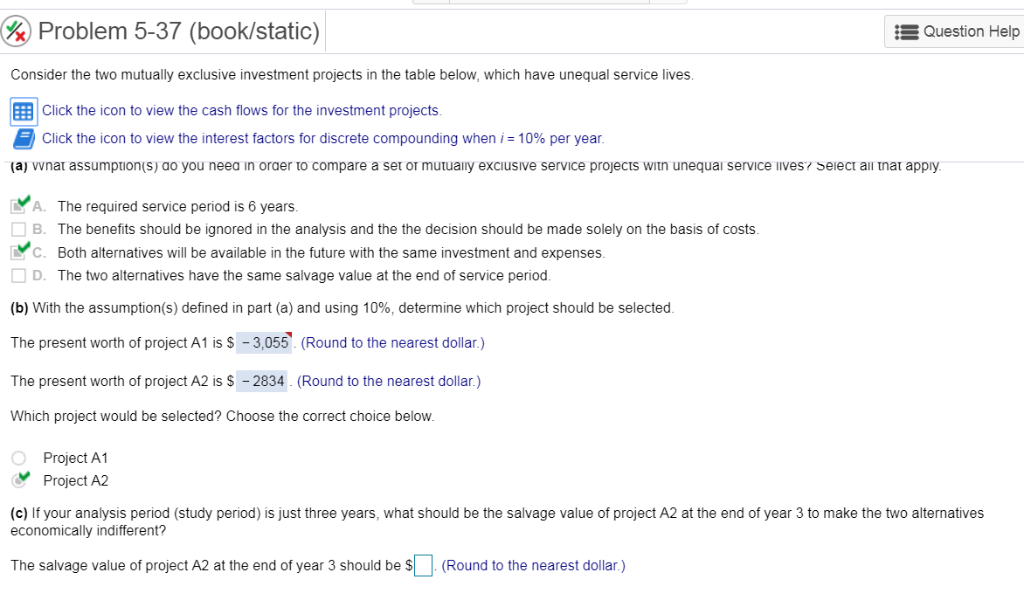

Question

Please answer question c thanks! ANSWER: B) I = 10% PW = Cash flow in year 0 + cash flow in year 1(p/f,i,n) + cash

Please answer question c thanks!

ANSWER:

B) I = 10%

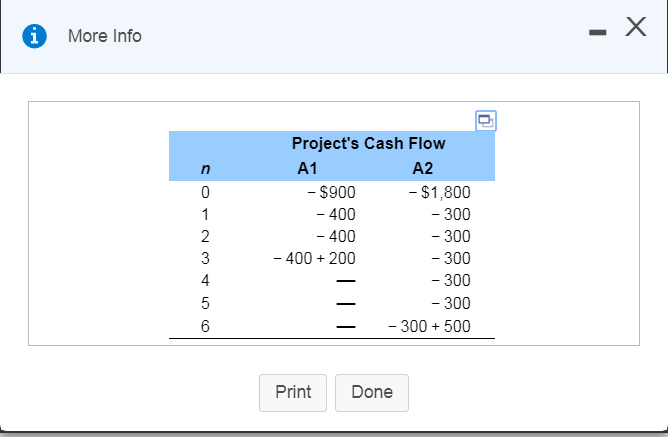

PW = Cash flow in year 0 + cash flow in year 1(p/f,i,n) + cash flow in year 2(p/f,i,n) + cash flow in year 3(p/f,i,n)

Pw = -900 - 400(p/f,10%,1) - 400(p/f,10%,2) + (-400 + 200)(p/f,10%,3)

pw = -900 - 400 * 0.9091 - 400 * 0.8264 - 200 * 0.7513

pw = -900 - 363.64 - 330.56 - 150.26

pw = -1744.46

pw = -1744 (rounded off to the nearest dollar)(this is wrong answer)

C) I = 10%

PW = Cash flow in year 0 + cash flow in year 1(p/f,i,n) + cash flow in year 2(p/f,i,n) + cash flow in year 3(p/f,i,n) + cash flow in year 4(p/f,i,n) + cash flow in year 5(p/f,i,n) + cash flow in year 6(p/f,i,n)

Pw = -1,800 - 300(p/f,10%,1) - 300(p/f,10%,2) - 300(p/f,10%,3) - 300(p/f,10%,4) - 300(p/f,10%,5) + (-300+500)(p/f,10%,6) -

pw = -1,800 - 300 * 0.9091 - 300 * 0.8264 - 300 * 0.7513 - 300 * 0.683 - 300 * 0.6209 + 200 * 0.5645

pw = -1,800 - 272.73 - 247.92 - 225.39 - 204.9 - 186.27 + 112.9

pw = -2,824.31

pw = -2,824 (rounded off to the nearest dollar)

&Problem 5-37 (book/static) Question Help Consider the two mutually exclusive investment projects in the table below, which have unequal service lives. EE Click the icon to view the cash flows for the investment projects Click the icon to view the interest factors for discrete compounding when i: 10% per year. (a) vvna assumpuon(s) ao you neea in oraero compare a ser or mutually exclusive service projects win unequal service ives? select all apply A. The required service period is 6 years. B. The benefits should be ignored in the analysis and the the decision should be made solely on the basis of costs. C. Both alternatives will be available in the future with the same investment and expenses. D. The two alternatives have the same salvage value at the end of service period. (b) With the assumption(s) defined in part (a) and using 10%, determine which project should be selected. The present worth of project A1 is S -3,055 (Round to the nearest dollar.) The present worth of project A2 is S -2834 (Round to the nearest dollar) Which project would be selected? Choose the correct choice below. Project A1 Project A2 (c) If your analysis period (study period) is just three years, what should be the salvage value of project A2 at the end of year 3 to make the two alternatives economically indifferent? The salvage value of project A2 at the end of year 3 should be s(Round to the nearest dollar) More Info Project's Cash Flow A1 A2 $900 400 400 400 +200 - $1,800 300 300 300 300 300 300500 4 PrintDoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started