Please answer question E only. i attach prior work for reference. Thank you so much

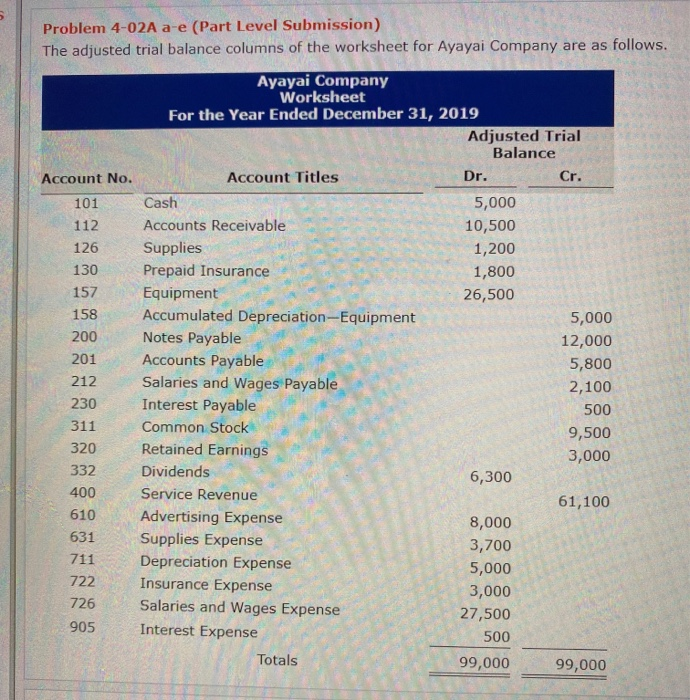

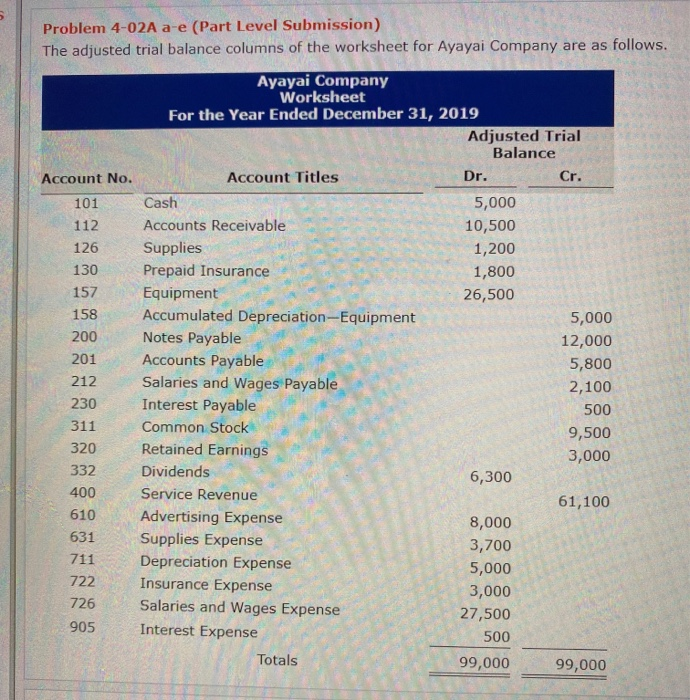

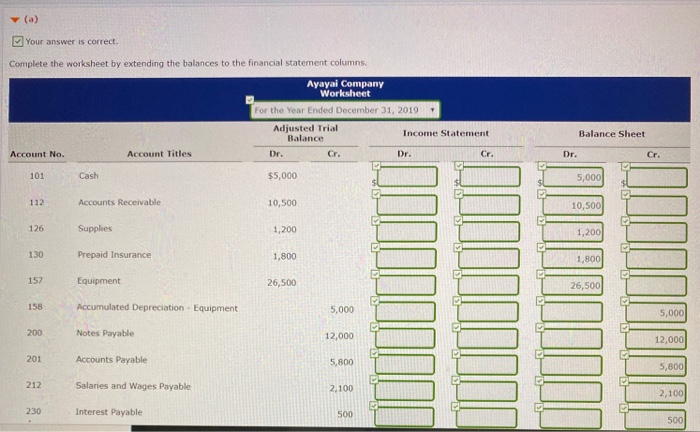

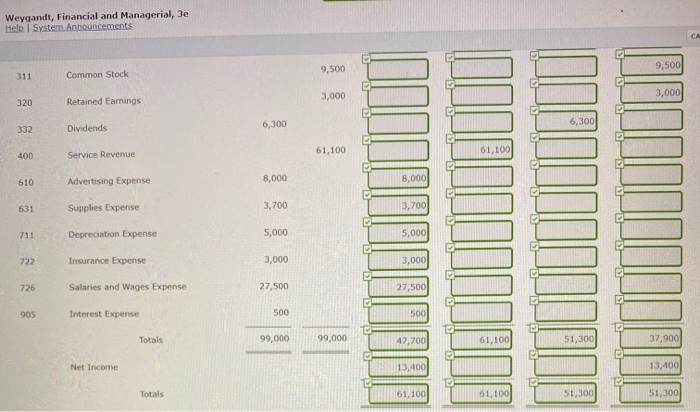

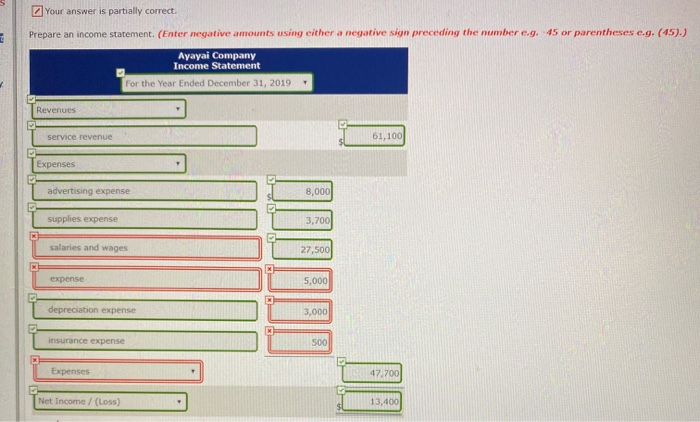

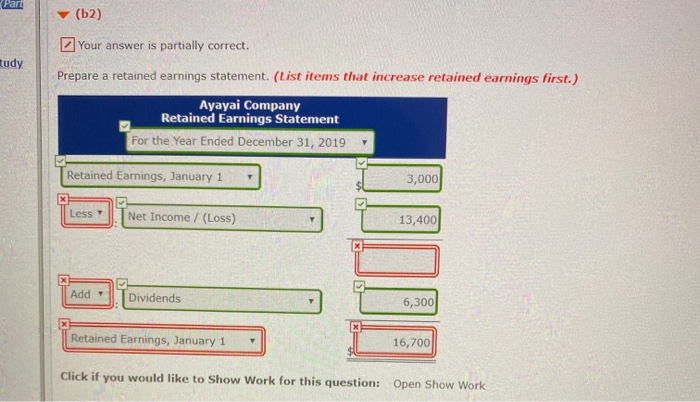

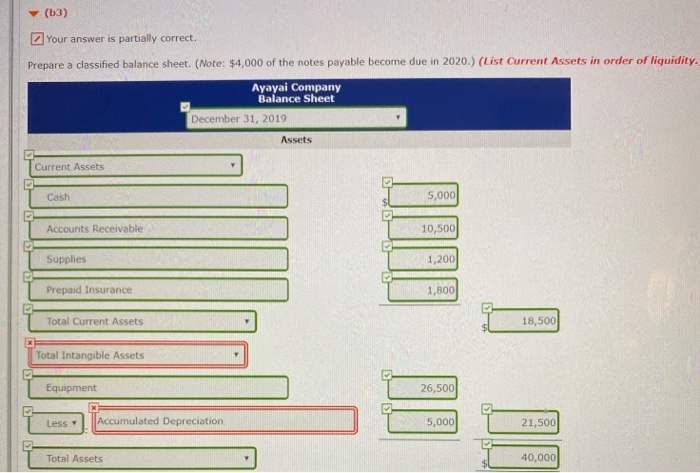

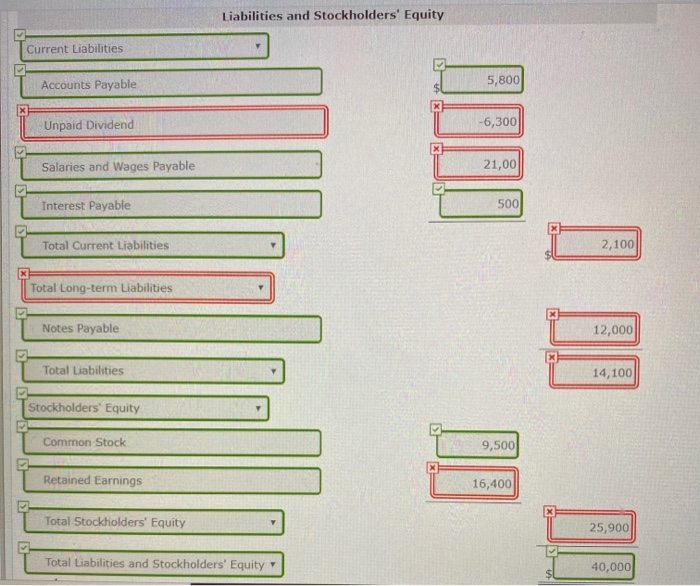

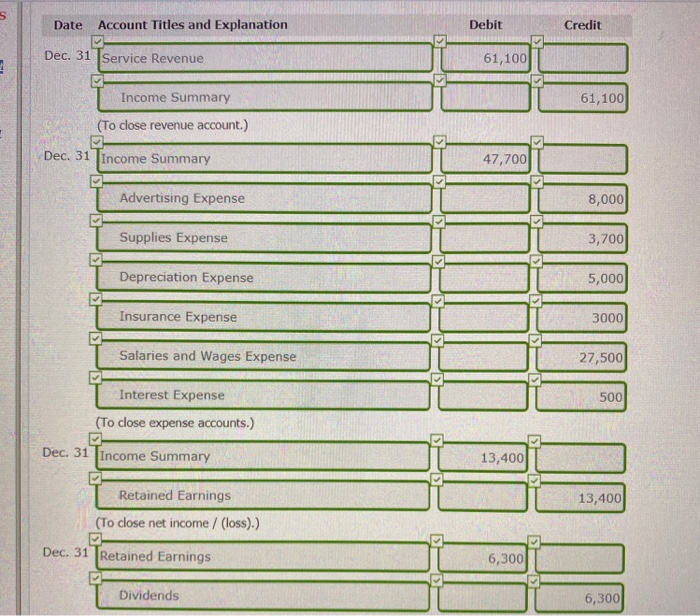

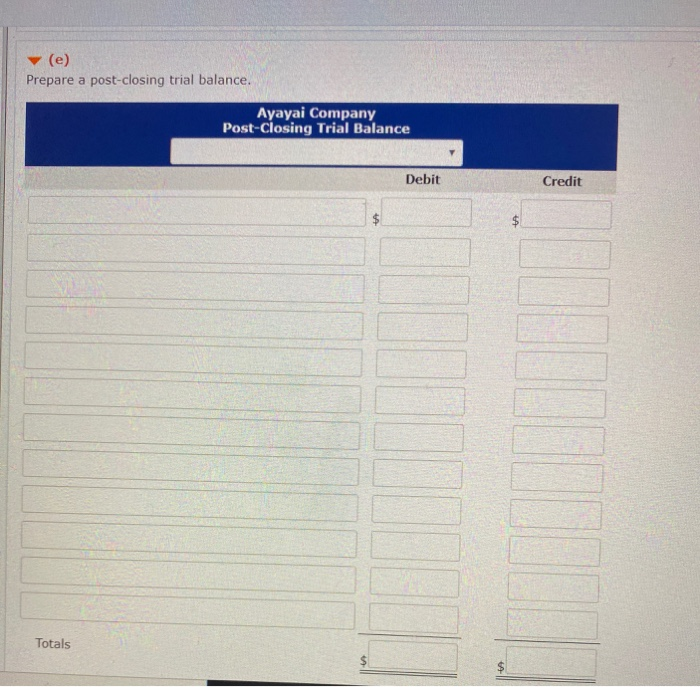

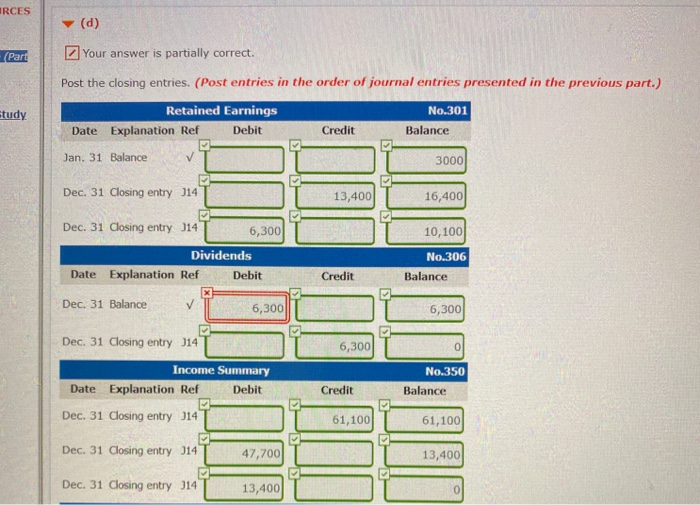

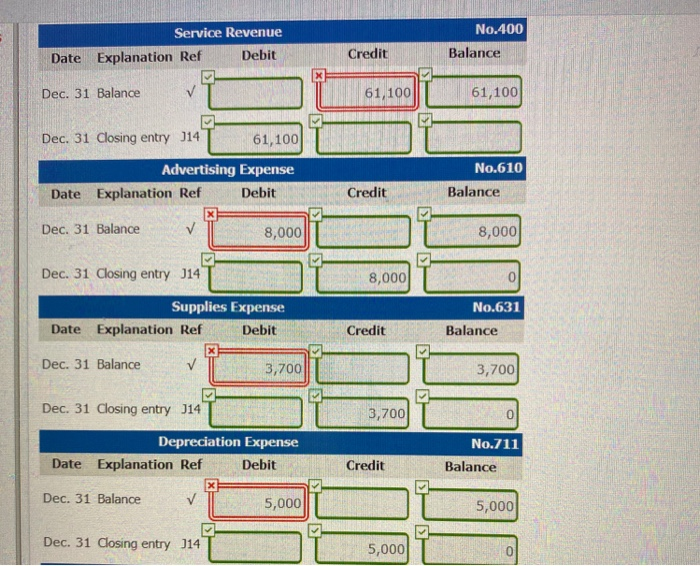

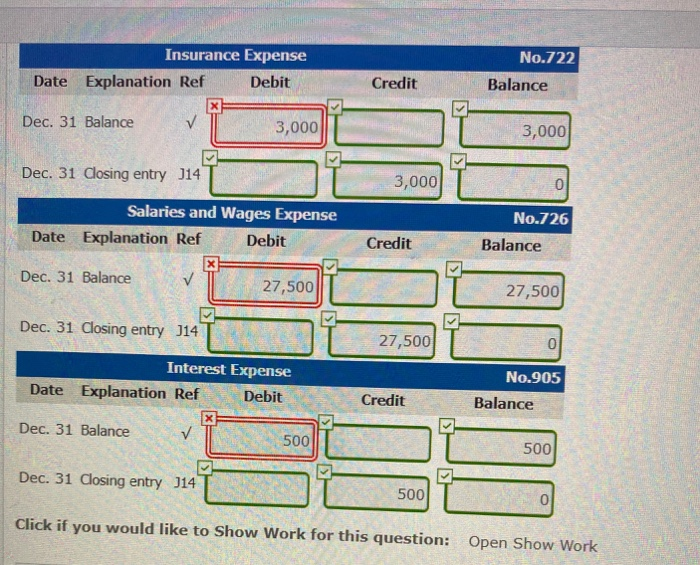

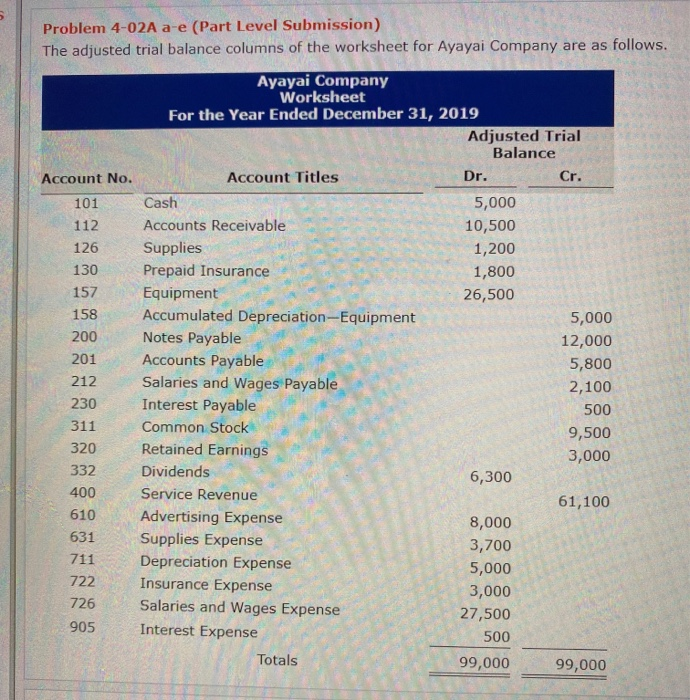

Problem 4-02A a-e (Part Level Submission) The adjusted trial balance columns of the worksheet for Ayayai Company are as follows. . 130 157 Ayayai Company Worksheet For the Year Ended December 31, 2019 Adjusted Trial Balance Account No. Account Titles Dr. Cr. 101 Cash 5,000 112 Accounts Receivable 10,500 126 Supplies 1,200 Prepaid Insurance 1,800 Equipment 26,500 158 Accumulated Depreciation-Equipment 5,000 200 Notes Payable 12,000 201 Accounts Payable 5,800 212 Salaries and Wages Payable 2,100 Interest Payable 500 311 Common Stock 9,500 320 Retained Earnings 3,000 Dividends 6,300 400 Service Revenue 61,100 610 Advertising Expense 8,000 631 Supplies Expense 3,700 Depreciation Expense 5,000 Insurance Expense 3,000 726 Salaries and Wages Expense 27,500 Interest Expense 500 Totals 99,000 99,000 230 332 711 722 Your answer is correct. Complete the worksheet by extending the balances to the financial statement columns Ayayal Company Worksheet For the Year Ended December 31, 2019 Adjusted Trial Income Statement Balance Balance Sheet Account No. Account Titles Dr. CE 101 Cash $5,000 5,000 Accounts Receivable 10,500 1 Supplies 1,200 Prepaid Insurance 1,800 Equipment 26,500 JUDDDDDDT: 26,500 Accumulated Depreciation Equipment 5,000 Notes Payable 12,000 12,000 Accounts Payable 5.800 Salaries and Wages Payable 2.100 1 230 Interest Payable Weygandt, Financial and Managerial, 3e Help System Announcements Common Stock 9,500 9,500 Retained Earings 3,000 Dividends 6,300 Service Revenue 61.100 Advertising Expense 8.000 Supplies Expense 3,700 Depreciation Expense 5,000 HDVIDULTEUIL Insurance Expense 3,000 Salaries and Wages Expense 27,500 905 Interest Expense 500 Totals 99,000 90.000 Net Income Totals 61,100 T 51,300 51,300 Your answer is partially correct. Prepare an income statement. (Enter negative amounts using either a negative sign preceding the number ... 45 or parentheses e.g. (45).) Ayayai Company Income Statement For the Year Ended December 31, 2019 Revenues T service revenue Texpenses T advertising expense | supplies expense salaries and wages 27,500 expense 5,000 depreciation expense insurance expense 500 Expenses Net Income / (Loss) Part (62) Your answer is partially correct. tudy. Prepare a retained earnings statement. (List items that increase retained earnings first.) Ayayai Company Retained Earnings Statement For the Year Ended December 31, 2019 TRetained Earnings, January 1 3,000 Less 1 Net Income / (Loss) 13,400 Add Dividends 6,300 Retained Earnings, January 1 16,700 Click if you would like to Show Work for this question: Open Show Work (13) Your answer is partially correct. Prepare a classified balance sheet. (Note: $4,000 of the notes payable become due in 2020.) (List Current Assets in order of liquidity. Ayayai Company Balance Sheet December 31, 2019 Assets Current Assets | Cash T 5,000 Accounts Receivable 10,500 Supplies 1,200 | Prepaid Insurance - 1,800 T Total Current Assets 18,500 Total Intangible Assets Equipment 26,500 Accumulated Depreciation 5,000 21,500 Total Assets 40,000 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable 5,800 * Unpaid Dividend -6,300 * T Salaries and Wages Payable 21,00 T Interest Payable 500 T Total Current Liabilities 2,100 Total Long-term Liabilities Notes Payable 12,000 Total Liabilities 14,100 Stockholders' Equity Common Stock 9,500 Retained Earnings 16,400 Total Stockholders' Equity 25,900 Total Liabilities and Stockholders' Equity 40,000 Date Account Titles and Explanation Debit Credit Dec. 31 Service Revenue 61,100 61,100 | Income Summary (To close revenue account.) Dec. 31 Income Summary : 47,700| | Advertising Expense 8,000 T Supplies Expense IT 3,700 1 Depreciation Expense T 5 ,000 Insurance Expense IT 3000 T Salaries and Wages Expense IT 27,500 500 | Interest Expense (To close expense accounts.) Dec. 31 Income Summary 13,400 | L 13,400 Retained Earnings (To close net income / (loss).) Dec. 31 Retained Earnings 6,300 1 Dividends IL 6,300 (e) Prepare a post-closing trial balance. Ayayai Company Post-Closing Trial Balance Debit Credit Totals RCES (d) (Part Your answer is partially correct. Post the closing entries. (Post entries in the order of journal entries presented in the previous part.) tudy Retained Earnings Date Explanation Ref Debit Jan. 31 Balance VT No.301 Balance Credit 3000 Dec. 31 Closing entry314 T 13,400 T 16,400 T Dec. 31 Closing entry 314 Dividends Date Explanation Ref Debit 10,100 No.306 Balance Credit Dec. 31 Balance VT 6,300 | 6,300 L 6,300 Dec. 31 Closing entry J14T I Income Summary Date Explanation Ref Debit Dec. 31 Closing entry 314 T No.350 Balance Credit 61,100 61,100 Dec. 31 Closing entry 014 T 13,400 Dec. 31 Closing entry 014 T 13,400 T LO Service Revenue Date Explanation Ref Debit No.400 Balance Credit Dec. 31 Balance VT 61,100 61,100 IL L Dec. 31 Closing entry J14 61,100 No.610 Advertising Expense Explanation Ref Debit Date Credit Balance Dec. 31 Balance Balance 1 8,000 8,000 8,000 8,000 Dec. 31 Closing entry J14 8,000 Supplies Expense Date Explanation Ref Debit No.631 Balance Credit Dec. 31 Balance vi 3,700 3,700 3,700 Dec. 31 Closing entry J14T 3,700 Depreciation Expense Date Explanation Ref Debit No.711 Balance Credit Dec. 31 Balance 5,000 5,000 Dec. 31 Closing entry J14T 5,000 No.722 Insurance Expense Date Explanation Ref Debit XF Dec. 31 Balance V 3,000 Credit Balance 3,000 LE Dec. 31 Closing entry J14T 3,000 Salaries and Wages Expense Date Explanation Ref Debit No.726 Balance Credit T 27,500 Dec. 31 Balance vi 27,500 Dec. 31 Closing entry J14 Dec. 31 dosing entry J14T Interest Expense Date Explanation Ref Debit Dec. 31 Balance VT 5 00 27,500 T 27,500 Credit No.905 Balance 500) Dec. 31 Closing entry J14T 500 Click if you would like to Show Work for this question: Open Show Work