Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer question / E13-18 (similar to) 18 of 25 (22 complete) HW Score: 65.05%, 170.42 Curran Associates prepares architectural drawings to conform to local

please answer question

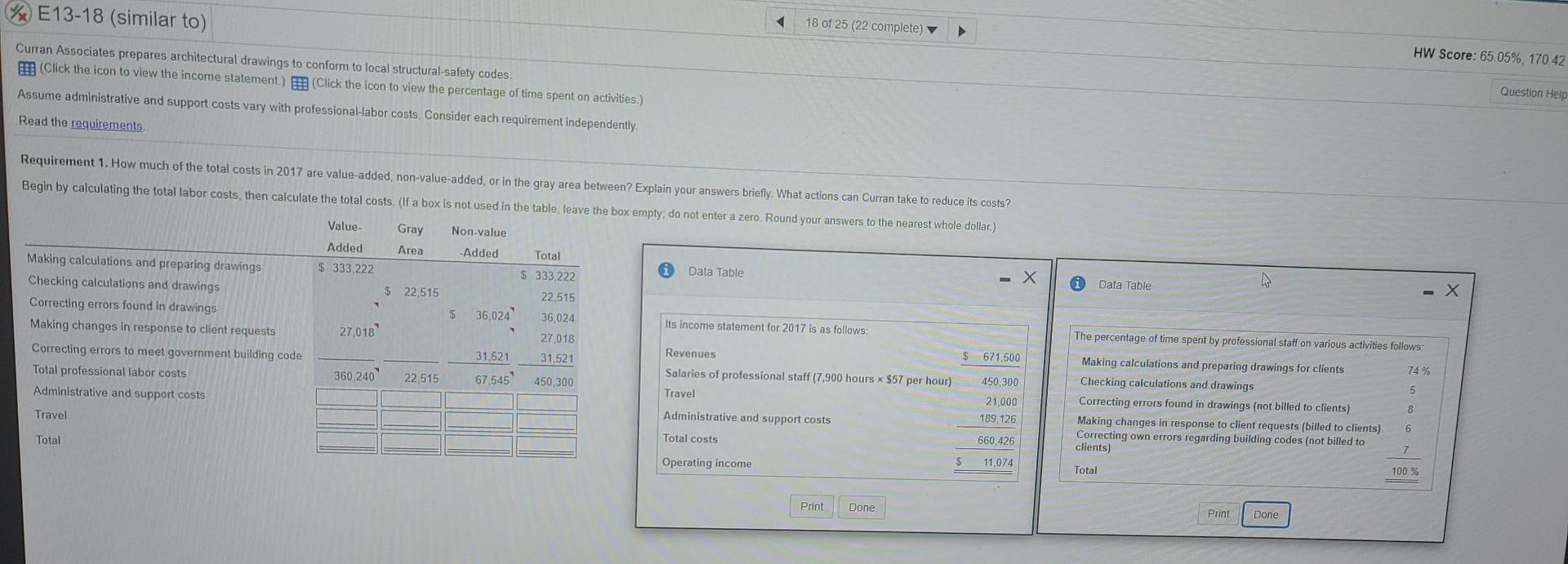

/ E13-18 (similar to) 18 of 25 (22 complete) HW Score: 65.05%, 170.42 Curran Associates prepares architectural drawings to conform to local structural-safety codes BE (Click the icon to view the income statement.) B (Click the icon to view the percentage of time spent on activities.) Assume administrative and support costs vary with professional-labor costs. Consider each requirement independently Read the requirements Question Help Data Table - X Requirement 1. How much of the total costs in 2017 are value-added, non-value-added, or in the gray area between? Explain your answers briefly. What actions can Curran take to reduce its costs? Begin by calculating the total labor costs, then calculate the total costs. (If a box is not used in the table, leave the box empty: do not enter a zero. Round your answers to the nearest whole dollar.) Value Gray Non-value Added Area -Added Total Making calculations and preparing drawings Data Table $ 333,222 $ 333,222 Checking calculations and drawings $ 22,515 22,515 Correcting errors found in drawings S 36,024 36,024 Its income statement for 2017 is as follows: Making changes in response to client requests 27,018 27,018 Revenues $ 671,500 Correcting errors to meet government building code 31,521 31,521 Salaries of professional staff (7,900 hours x $57 per hour) 450,300 Total professional labor costs 360 240 22,515 67,545 450.300 Travel 21,000 Administrative and support costs Administrative and support costs 189,126 Travel Total costs 660,426 Total $ 11,074 Operating income The percentage of time spent by professional staff on various activities follows: Making calculations and preparing drawings for clients 74 % Checking calculations and drawings 5 Correcting errors found in drawings (not billed to clients) 8 Making changes in response to client requests (billed to clients) 6 Correcting own errors regarding building codes (not billed to clients) 7 Total 100 % Print Done Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started