Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer question four and use the information provided. thank you. 4. What is your assessment of Wil's Grill's financial performance over the 2014 -

please answer question four and use the information provided. thank you.

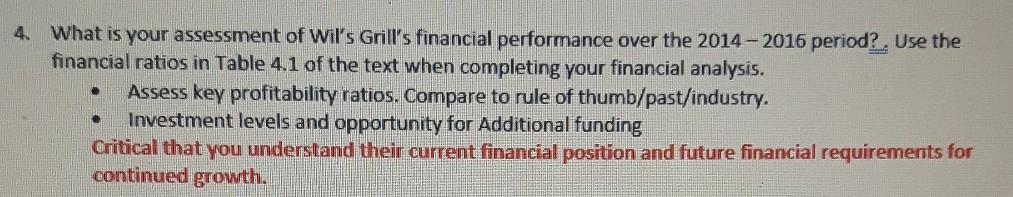

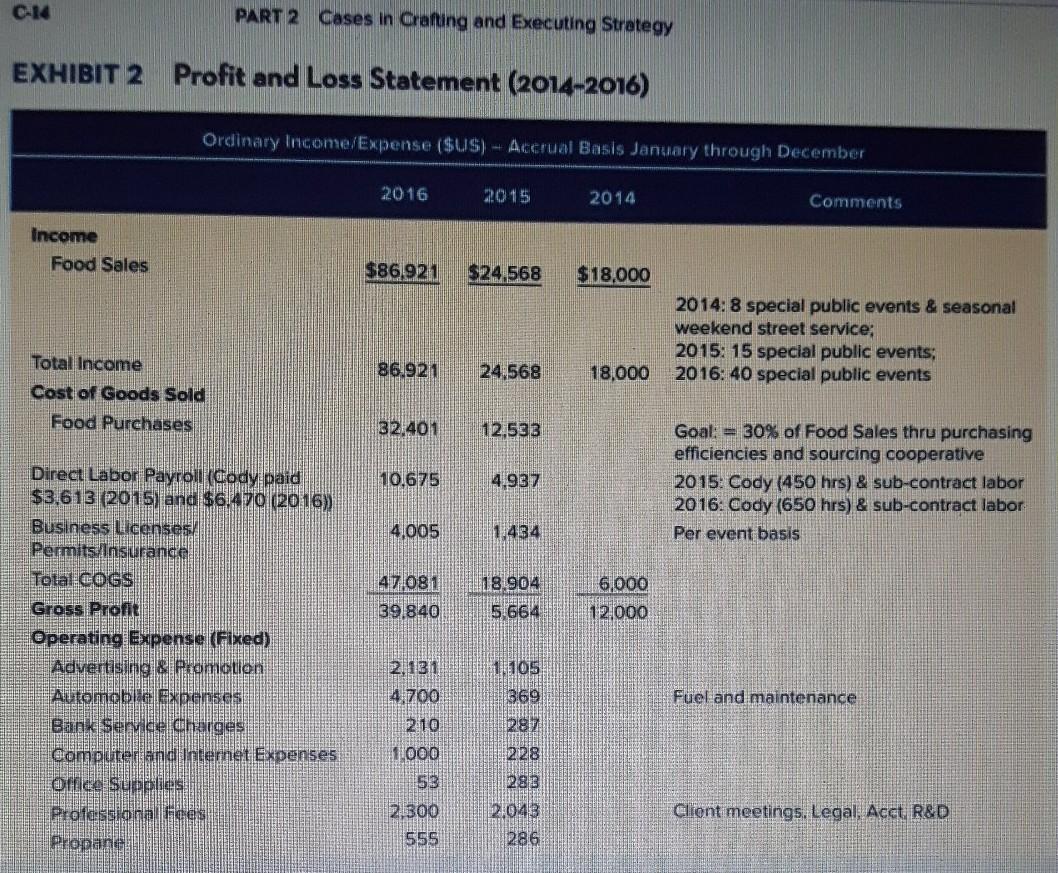

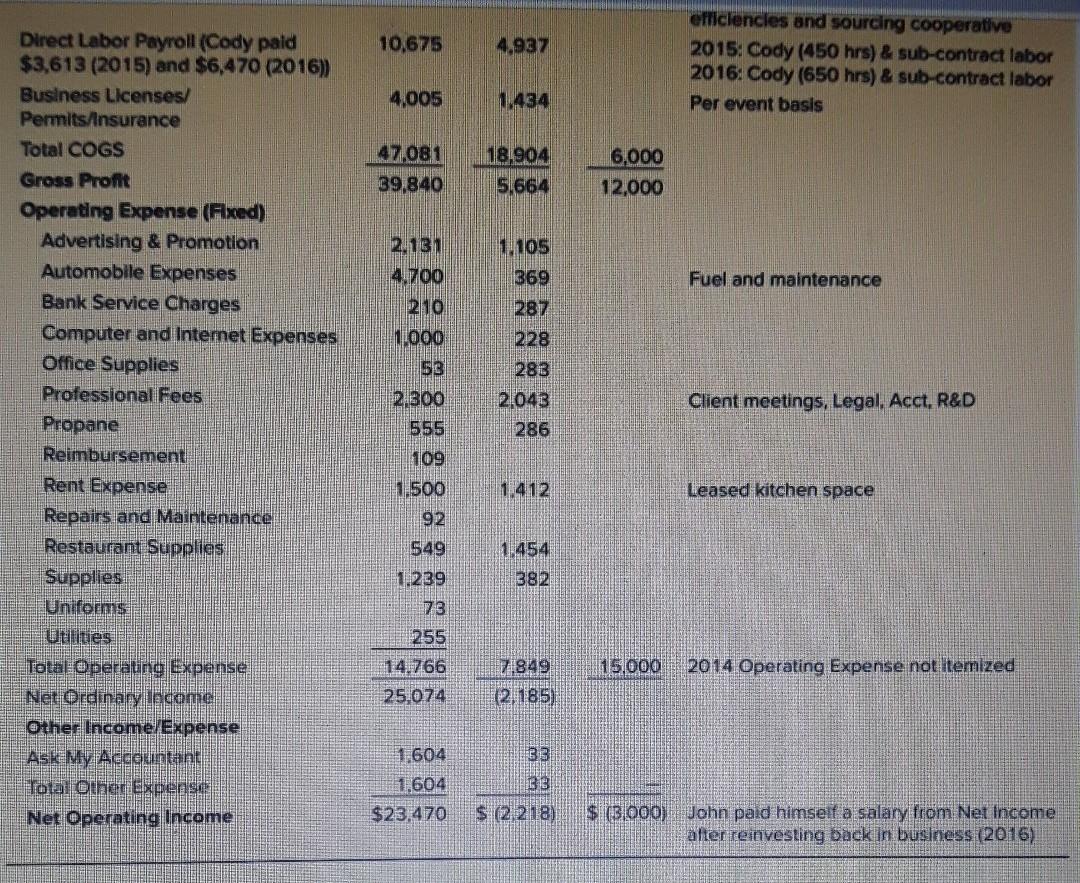

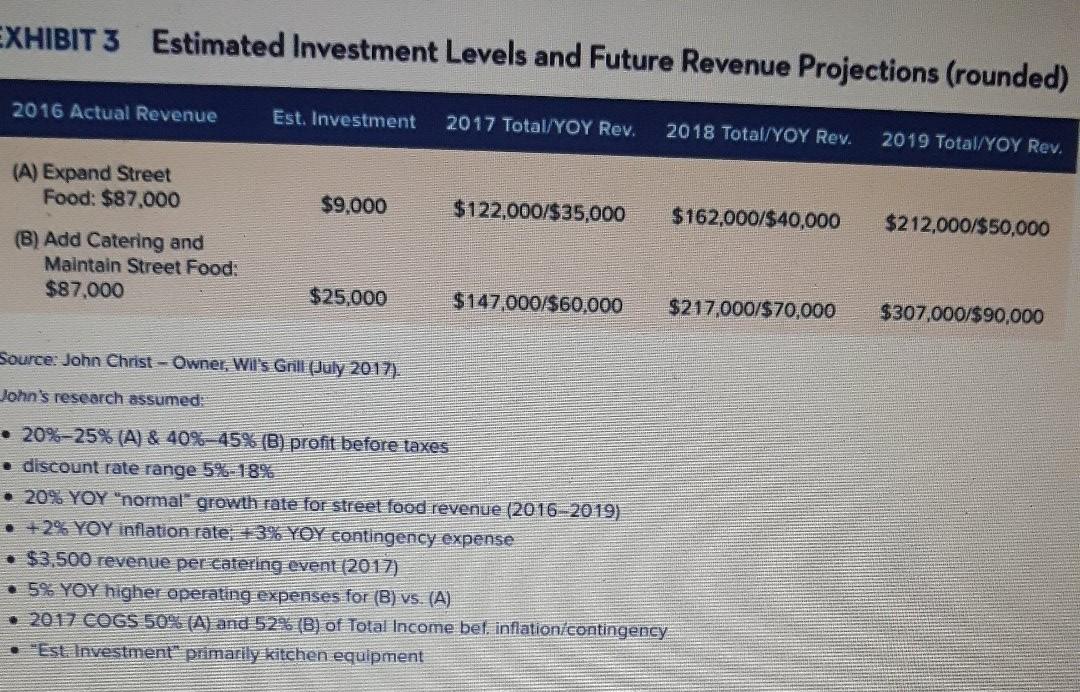

4. What is your assessment of Wil's Grill's financial performance over the 2014 - 2016 period?. Use the financial ratios in Table 4.1 of the text when completing your financial analysis. Assess key profitability ratios. Compare to rule of thumb/past/industry. Investment levels and opportunity for Additional funding Critical that you understand their current financial position and future financial requirements for continued growth. . C-14 PART 2 Cases in Crafting and Executing Strategy EXHIBIT 2 Profit and Loss Statement (2014-2016) Ordinary Income/Expense ($US) - Accrual Basis January through December 2016 2015 2014 Comments Income Food Sales $86.921 524,568 $18,000 2014: 8 special public events & seasonal weekend street service: 2015: 15 special public events; 2016: 40 special public events 86.921 24,568 18,000 Total Income Cost of Goods Sold Food Purchases 32.401 12.533 10.675 4,937 Goal: = 30% of Food Sales thru purchasing efficiencies and sourcing cooperative 2015: Cody (450 hrs) & sub-contract labor 2016: Cody (650 hrs) & sub-contract labor Per event basis 4,005 1.434 A7.081 39.840 18.904 5 664 6,000 12.000 Direct Labor Payroll (Cody paid $3,613 (2015) and $6.470 (2016)) Business Licenses/ Permits Insurance Total COGS Gross Pront Operating Expense (Fixed) Advertising & Promoulon Automoba Expenses Bank service charges Computer and Internet Expenses Once Supplies Professionales Propane Fuel and maintenance 2,131 4.700 210 11000 53 2.300 555 1105 369 287 228 293 Client meetings. Legal, Acct R&D 2043 286 10.675 4.937 efficiencies and sourcing cooperative 2015: Cody (450 hrs) & sub-contract labor 2016: Cody (650 hrs) & sub-contract labor Per event basis 4.005 134 47 081 39,840 18.904 5.664 6.000 12,000 2.131 Fuel and maintenance Direct Labor Payroll (Cody paid $3,613 (2015) and $6,470 (2016)) Business Licenses/ Permits/insurance Total COGS Gross Pront Operating Expense (Fixed) Advertising & Promotion Automobile Expenses Bank Service Charges Computer and Internet Expenses Office Supplies Professional Fees Propane Reimbursement Rent Expense Repairs and Maintenance Restaurant Supplies Supplies Uniforms Uulites Total Operating expense Net Ordinary Lecome Other Income Expense Ask My Accountant Total Other Expense Net Operating Income 4.700 210 1.000 53 2.300 555 109 1.500 92 105 369 287 228 283 2,043 286 Client meetings, Legal. Acct, R&D 1 412 Leased kitchen space 549 1.454 382 1.239 73 255 14.766 25,074 15.000 2014 Operating Expense not itemized 7,849 12.185) 33 1.604 1,604 $23,470 EB $ (2218) $ (B000)John paid himself a salary from Net Income after reinvesting back in business (2016) EXHIBIT 3 Estimated Investment Levels and Future Revenue Projections (rounded) 2016 Actual Revenue Est. Investment 2017 Total/YOY Rev. 2018 Total/YOY Rev. 2019 Total/YOY Rev. (A) Expand Street Food: $87,000 $9.000 $122,000/$35,000 $162,000/$40,000 $212,000/$50,000 (B) Add Catering and Maintain Street Food: $87,000 $25,000 $147,000/$60,000 $217,000/$70,000 $307,000/$90,000 Source: John Christ -- Owner, Wi's Grill (July 2017). John's research assumed: 20%-25% (A) & 40%-45% (B) profit before taxes discount rate range 5%-18% 20% YOY "normal" growth rate for street food revenue (2016-2019) +29. YOY inflation rate 33% YOY contingency expense $3,500 revenue per catering event (2017) 5% YOY higher operating expenses for (B) vs. (A) 2017 COGS 50% (A) and 52% (B) of Total Income bef. inflation contingency "Est Investment primarily kitchen equipment 4. What is your assessment of Wil's Grill's financial performance over the 2014 - 2016 period?. Use the financial ratios in Table 4.1 of the text when completing your financial analysis. Assess key profitability ratios. Compare to rule of thumb/past/industry. Investment levels and opportunity for Additional funding Critical that you understand their current financial position and future financial requirements for continued growth. . C-14 PART 2 Cases in Crafting and Executing Strategy EXHIBIT 2 Profit and Loss Statement (2014-2016) Ordinary Income/Expense ($US) - Accrual Basis January through December 2016 2015 2014 Comments Income Food Sales $86.921 524,568 $18,000 2014: 8 special public events & seasonal weekend street service: 2015: 15 special public events; 2016: 40 special public events 86.921 24,568 18,000 Total Income Cost of Goods Sold Food Purchases 32.401 12.533 10.675 4,937 Goal: = 30% of Food Sales thru purchasing efficiencies and sourcing cooperative 2015: Cody (450 hrs) & sub-contract labor 2016: Cody (650 hrs) & sub-contract labor Per event basis 4,005 1.434 A7.081 39.840 18.904 5 664 6,000 12.000 Direct Labor Payroll (Cody paid $3,613 (2015) and $6.470 (2016)) Business Licenses/ Permits Insurance Total COGS Gross Pront Operating Expense (Fixed) Advertising & Promoulon Automoba Expenses Bank service charges Computer and Internet Expenses Once Supplies Professionales Propane Fuel and maintenance 2,131 4.700 210 11000 53 2.300 555 1105 369 287 228 293 Client meetings. Legal, Acct R&D 2043 286 10.675 4.937 efficiencies and sourcing cooperative 2015: Cody (450 hrs) & sub-contract labor 2016: Cody (650 hrs) & sub-contract labor Per event basis 4.005 134 47 081 39,840 18.904 5.664 6.000 12,000 2.131 Fuel and maintenance Direct Labor Payroll (Cody paid $3,613 (2015) and $6,470 (2016)) Business Licenses/ Permits/insurance Total COGS Gross Pront Operating Expense (Fixed) Advertising & Promotion Automobile Expenses Bank Service Charges Computer and Internet Expenses Office Supplies Professional Fees Propane Reimbursement Rent Expense Repairs and Maintenance Restaurant Supplies Supplies Uniforms Uulites Total Operating expense Net Ordinary Lecome Other Income Expense Ask My Accountant Total Other Expense Net Operating Income 4.700 210 1.000 53 2.300 555 109 1.500 92 105 369 287 228 283 2,043 286 Client meetings, Legal. Acct, R&D 1 412 Leased kitchen space 549 1.454 382 1.239 73 255 14.766 25,074 15.000 2014 Operating Expense not itemized 7,849 12.185) 33 1.604 1,604 $23,470 EB $ (2218) $ (B000)John paid himself a salary from Net Income after reinvesting back in business (2016) EXHIBIT 3 Estimated Investment Levels and Future Revenue Projections (rounded) 2016 Actual Revenue Est. Investment 2017 Total/YOY Rev. 2018 Total/YOY Rev. 2019 Total/YOY Rev. (A) Expand Street Food: $87,000 $9.000 $122,000/$35,000 $162,000/$40,000 $212,000/$50,000 (B) Add Catering and Maintain Street Food: $87,000 $25,000 $147,000/$60,000 $217,000/$70,000 $307,000/$90,000 Source: John Christ -- Owner, Wi's Grill (July 2017). John's research assumed: 20%-25% (A) & 40%-45% (B) profit before taxes discount rate range 5%-18% 20% YOY "normal" growth rate for street food revenue (2016-2019) +29. YOY inflation rate 33% YOY contingency expense $3,500 revenue per catering event (2017) 5% YOY higher operating expenses for (B) vs. (A) 2017 COGS 50% (A) and 52% (B) of Total Income bef. inflation contingency "Est Investment primarily kitchen equipmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started