Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer question i, ii, iii, iv and v thank you very much (a) You launch a start-up in California, USA, offering remote consulting services

please answer question i, ii, iii, iv and v

thank you very much

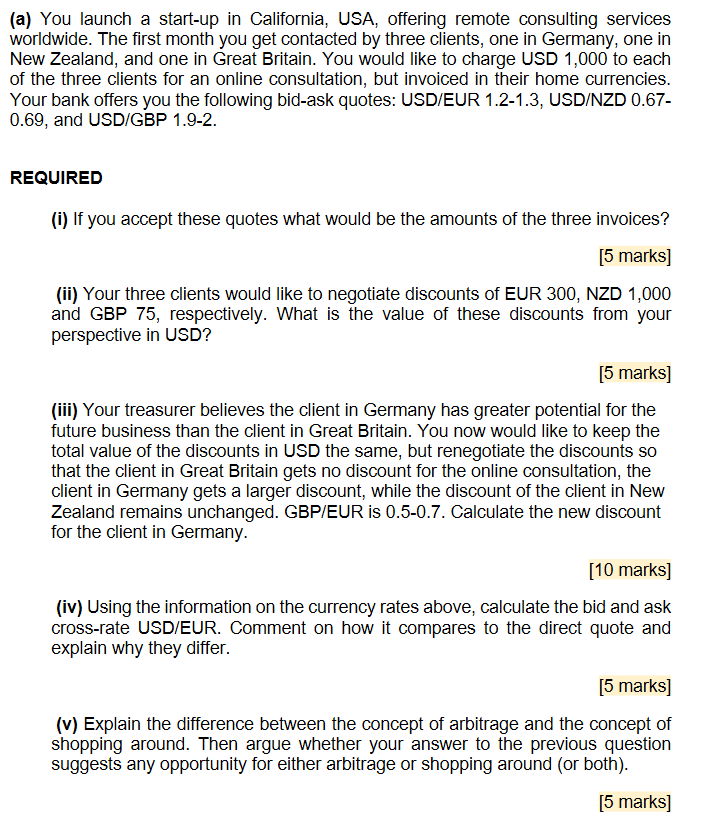

(a) You launch a start-up in California, USA, offering remote consulting services worldwide. The first month you get contacted by three clients, one in Germany, one in New Zealand, and one in Great Britain. You would like to charge USD 1,000 to each of the three clients for an online consultation, but invoiced in their home currencies. Your bank offers you the following bid-ask quotes: USD/EUR 1.2-1.3, USD/NZD 0.67- 0.69, and USD/GBP 1.9-2. REQUIRED (i) If you accept these quotes what would be the amounts of the three invoices? [5 marks] (ii) Your three clients would like to negotiate discounts of EUR 300, NZD 1,000 and GBP 75, respectively. What is the value of these discounts from your perspective in USD? [5 marks] (iii) Your treasurer believes the client in Germany has greater potential for the future business than the client in Great Britain. You now would like to keep the total value of the discounts in USD the same, but renegotiate the discounts so that the client in Great Britain gets no discount for the online consultation, the client in Germany gets a larger discount, while the discount of the client in New Zealand remains unchanged. GBP/EUR is 0.5-0.7. Calculate the new discount for the client in Germany. [10 marks] (iv) Using the information on the currency rates above, calculate the bid and ask cross-rate USD/EUR. Comment on how it compares to the direct quote and explain why they differ. [5 marks] (v) Explain the difference between the concept of arbitrage and the concept of shopping around. Then argue whether your answer to the previous question suggests any opportunity for either arbitrage or shopping around (or both). [5 marks] (a) You launch a start-up in California, USA, offering remote consulting services worldwide. The first month you get contacted by three clients, one in Germany, one in New Zealand, and one in Great Britain. You would like to charge USD 1,000 to each of the three clients for an online consultation, but invoiced in their home currencies. Your bank offers you the following bid-ask quotes: USD/EUR 1.2-1.3, USD/NZD 0.67- 0.69, and USD/GBP 1.9-2. REQUIRED (i) If you accept these quotes what would be the amounts of the three invoices? [5 marks] (ii) Your three clients would like to negotiate discounts of EUR 300, NZD 1,000 and GBP 75, respectively. What is the value of these discounts from your perspective in USD? [5 marks] (iii) Your treasurer believes the client in Germany has greater potential for the future business than the client in Great Britain. You now would like to keep the total value of the discounts in USD the same, but renegotiate the discounts so that the client in Great Britain gets no discount for the online consultation, the client in Germany gets a larger discount, while the discount of the client in New Zealand remains unchanged. GBP/EUR is 0.5-0.7. Calculate the new discount for the client in Germany. [10 marks] (iv) Using the information on the currency rates above, calculate the bid and ask cross-rate USD/EUR. Comment on how it compares to the direct quote and explain why they differ. [5 marks] (v) Explain the difference between the concept of arbitrage and the concept of shopping around. Then argue whether your answer to the previous question suggests any opportunity for either arbitrage or shopping around (or both). [5 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started