Answered step by step

Verified Expert Solution

Question

1 Approved Answer

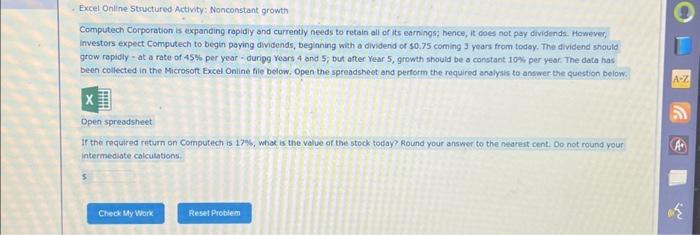

please answer question in firdt photo Computech Corporation is expanding rapldy and currently needs to retoin all of its earnings; hence, it does not pay

please answer question in firdt photo

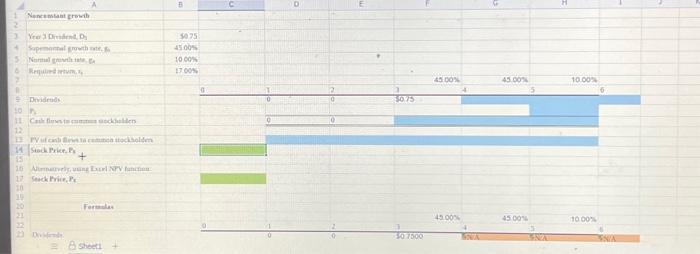

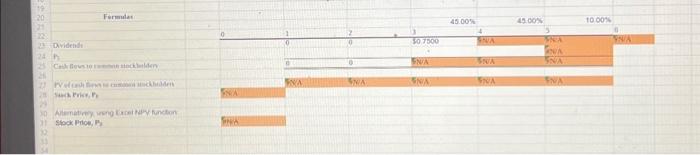

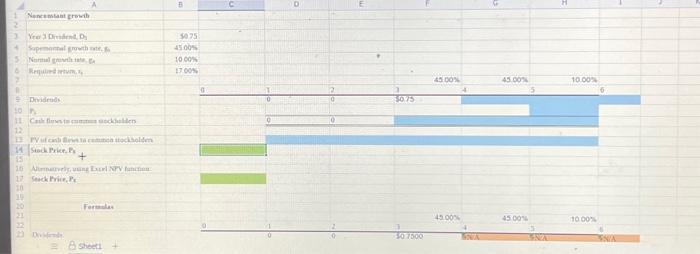

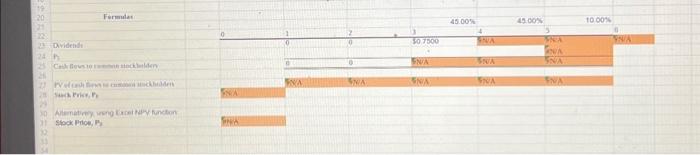

Computech Corporation is expanding rapldy and currently needs to retoin all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin poying dividends, beginning wath a dividend of 10.75 coming 3 years from today. The dividend should grow repidly - at a rate of 45% per year - duripg Years 4 ond 5; but after Year 5, growth should be 3 constant toN per year. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and pertorm the requirnd analysis to answer the question below. Ir the required return on Computech is 17%, whex is the value of the stock today? Round your answer to the neareit cent. Do not round your intermediate calcutations: Fertisias Fermulat Bividendi stock Mione, Ps

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started