Answered step by step

Verified Expert Solution

Question

1 Approved Answer

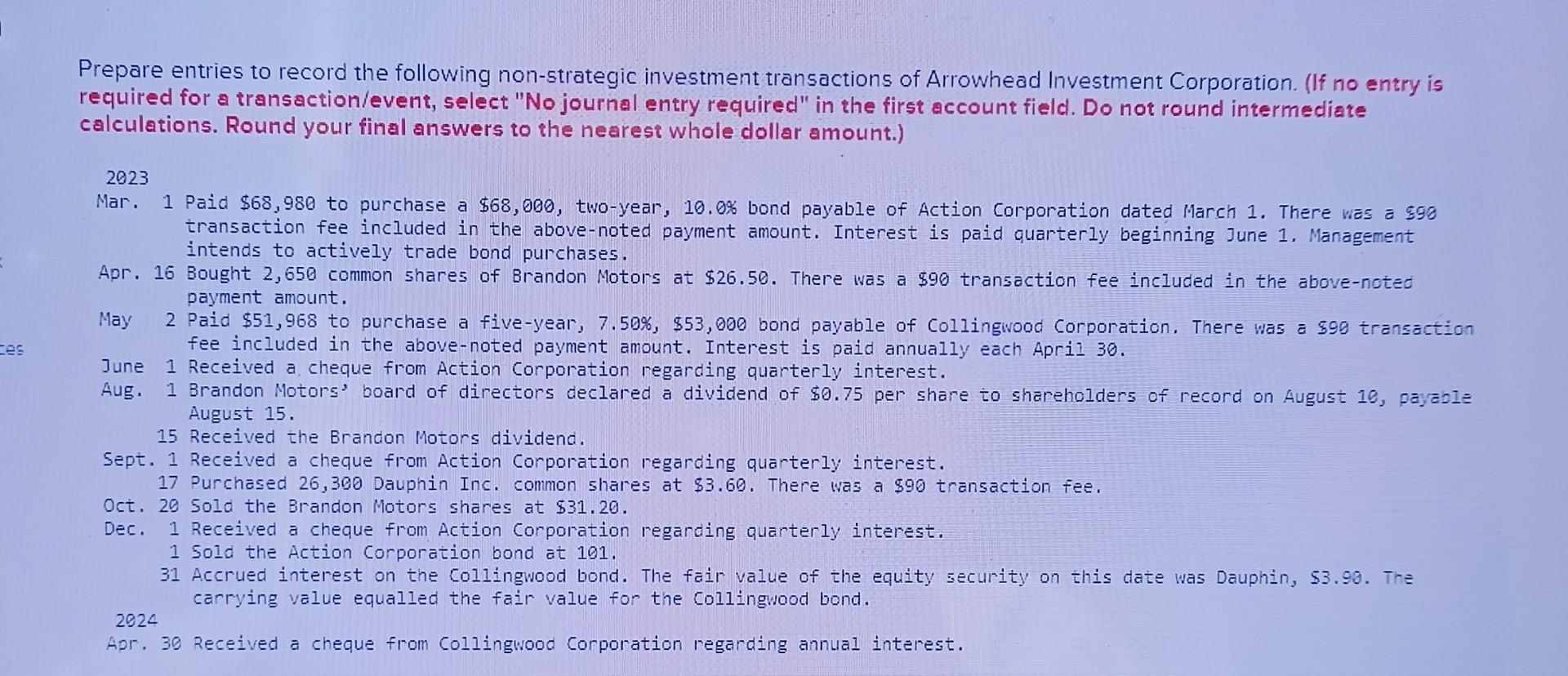

Please answer question no. 10 Prepare entries to record the following non-strategic investment transactions of Arrowhead Investment Corporation. (If no entry is required for a

Please answer question no. 10

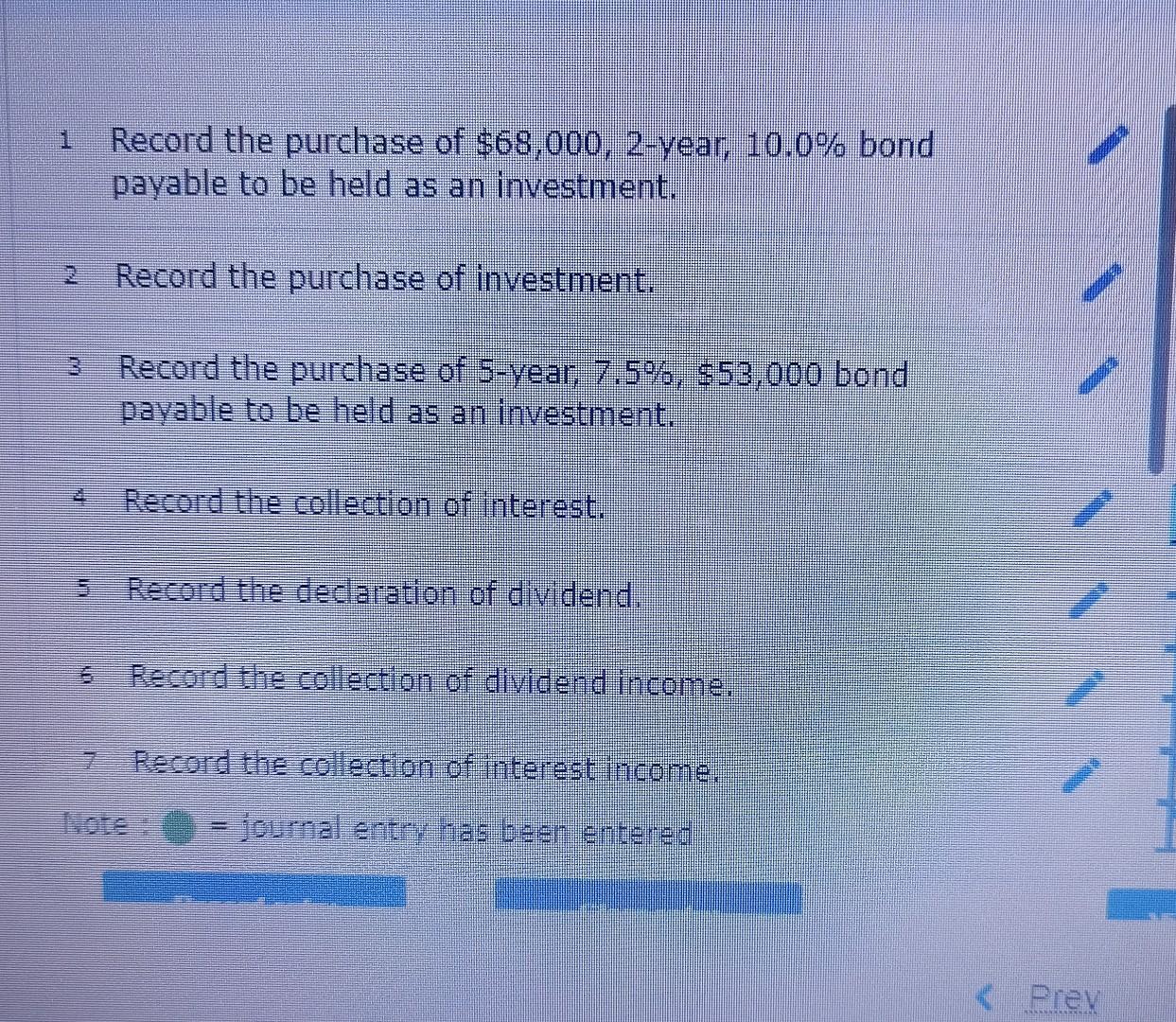

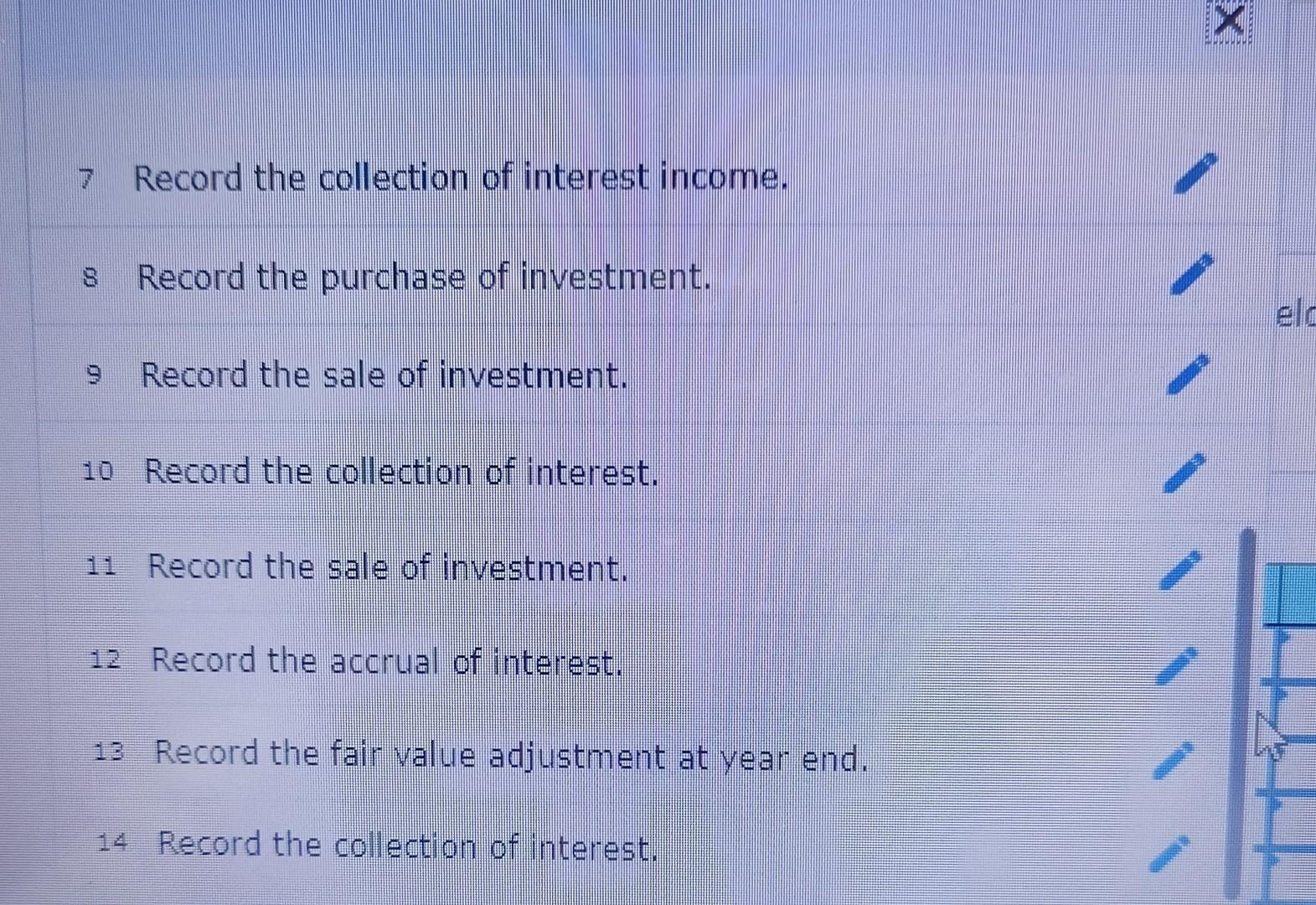

Prepare entries to record the following non-strategic investment transactions of Arrowhead Investment Corporation. (If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) 2023 Mar. 1 Paid \\( \\$ 68,980 \\) to purchase a \\( \\$ 68,000 \\), two-year, \10.0 bond payable of Action Corporation dated March 1 . There was a \\( \\$ 90 \\) transaction fee included in the above-noted payment amount. Interest is paid quarterly beginning June 1 . Management intends to actively trade bond purchases. Apr. 16 Bought 2,650 common shares of Brandon Motors at \\( \\$ 26.50 \\). There was a \\( \\$ 90 \\) transaction fee included in the above-noted payment amount. May 2 Paid \\( \\$ 51,968 \\) to purchase a five-year, \7.50, \\( \\$ 53,000 \\) bond payable of Collingwood Corporation. There was a \\( \\$ 90 \\) transaction fee included in the above-noted payment amount. Interest is paid annually each April 30. June 1 Received a cheque from Action Corporation regarding quarterly interest. Aug. 1 Brandon Motors' board of directors declared a dividend of \\( \\$ 0.75 \\) per share to shareholders of record on August 10 , payable August 15. 15 Received the Brandion Motors dividend. Sept. 1 Received a cheque from Action Corporation regarding quarterly interest. 17 Purchased 26,300 Dauphin Inc. Common shares at \\( \\$ 3.60 \\). There was a \\( \\$ 90 \\) transaction fee. Oct. 20 Sold the Brandon Motors shares at \\$31.20. Dec. 1 Received a cheque from Action Corporation regarding quarterly interest. 1 Sold the Action Corporation bond at 101. 31 Accrued interest on the Collingwood bond. The fair value of the equity security on this date was Dauphin, 53.90 . The carrying value equalled the fair value for the collingwood bond. 2024 Apr. 30 Received a cheque from Collingwood Corporation regarding annual interest. Record the collection of interest income. Record the purchase of investment. 9 Record the sale of investment. 10 Record the collection of interest. 11 Record the sale of investment. 12 Record the accrual of interest. 13 Record the fair value adjustment at year end. 14 Record the collection of interest. 1 Record the purchase of \\( \\$ 68,000,2 \\)-year, \10.0 bond payable to be held as an investment. 2 Record the purchase of investment. 3 Record the purchase of 5 -year, \7.5 bond payable to be held as an investment. 4 Record the collection of interest. 5 Record the declaration of dividend. 6 Record the collection of dividend income. 7 Record the collection of interest income. Note : \\( ( \\) ) = joumal entry has been entered Analysis Component: If the fair value adjusting entry on December 31, 2023, were not recorded, what would the effect be on the income statement and balance sheet? Based on your understanding of GAAP, would it be better or worse to omit an investment loss than investment income? Better WorseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started