Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer QUESTION ONE (a) Ochengo a trading company, currently has negligible cash holdings but expects to make a series of cash payments totaling Sh.152

please answer

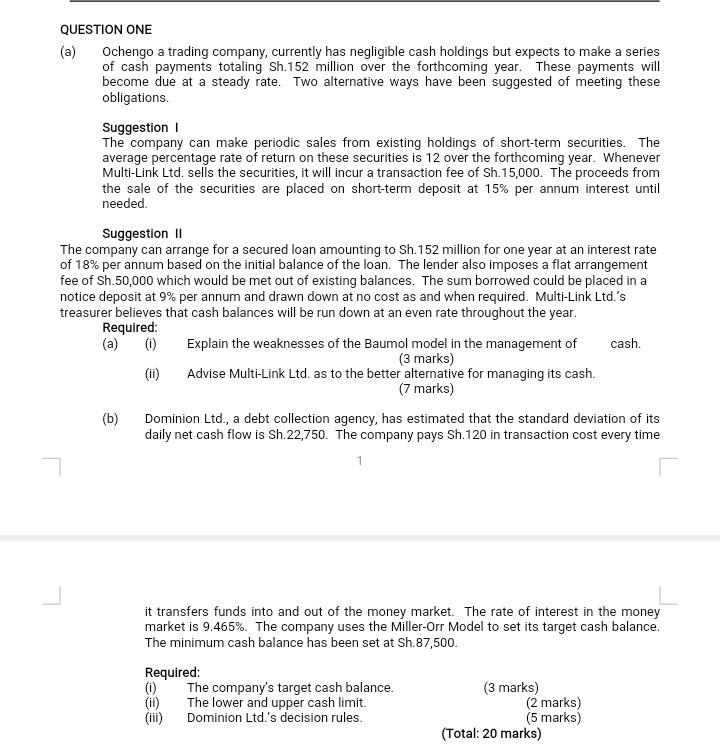

QUESTION ONE (a) Ochengo a trading company, currently has negligible cash holdings but expects to make a series of cash payments totaling Sh.152 million over the forthcoming year. These payments will become due at a steady rate. Two alternative ways have been suggested of meeting these obligations. Suggestion The company can make periodic sales from existing holdings of short-term securities. The average percentage rate of return on these securities is 12 over the forthcoming year. Whenever Multi-Link Ltd. sells the securities, it will incur a transaction fee of Sh.15,000. The proceeds from the sale of the securities are placed on short-term deposit at 15% per annum interest until needed Suggestion 11 The company can arrange for a secured loan amounting to Sh.152 million for one year at an interest rate of 18% per annum based on the initial balance of the loan. The lender also imposes a flat arrangement fee of Sh.50,000 which would be met out of existing balances. The sum borrowed could be placed in a notice deposit at 9% per annum and drawn down at no cost as and when required. Multi-Link Ltd.'s treasurer believes that cash balances will be run down at an even rate throughout the year. Required: (a) (0) Explain the weaknesses of the Baumol model in the management of cash. (3 marks) Advise Multi-Link Ltd. as to the better alternative for managing its cash. (7 marks) (b) Dominion Ltd., a debt collection agency, has estimated that the standard deviation of its daily net cash flow is Sh.22,750. The company pays Sh.120 in transaction cost every time 1 it transfers funds into and out of the money market. The rate of interest in the money market is 9.465%. The company uses the Miller-Orr Model to set its target cash balance. The minimum cash balance has been set at Sh.87,500. Required: (0) The company's target cash balance. (ii) The lower and upper cash limit. Dominion Ltd.'s decision rules. (3 marks) (2 marks) (5 marks) (Total: 20 marks) QUESTION ONE (a) Ochengo a trading company, currently has negligible cash holdings but expects to make a series of cash payments totaling Sh.152 million over the forthcoming year. These payments will become due at a steady rate. Two alternative ways have been suggested of meeting these obligations. Suggestion The company can make periodic sales from existing holdings of short-term securities. The average percentage rate of return on these securities is 12 over the forthcoming year. Whenever Multi-Link Ltd. sells the securities, it will incur a transaction fee of Sh.15,000. The proceeds from the sale of the securities are placed on short-term deposit at 15% per annum interest until needed Suggestion 11 The company can arrange for a secured loan amounting to Sh.152 million for one year at an interest rate of 18% per annum based on the initial balance of the loan. The lender also imposes a flat arrangement fee of Sh.50,000 which would be met out of existing balances. The sum borrowed could be placed in a notice deposit at 9% per annum and drawn down at no cost as and when required. Multi-Link Ltd.'s treasurer believes that cash balances will be run down at an even rate throughout the year. Required: (a) (0) Explain the weaknesses of the Baumol model in the management of cash. (3 marks) Advise Multi-Link Ltd. as to the better alternative for managing its cash. (7 marks) (b) Dominion Ltd., a debt collection agency, has estimated that the standard deviation of its daily net cash flow is Sh.22,750. The company pays Sh.120 in transaction cost every time 1 it transfers funds into and out of the money market. The rate of interest in the money market is 9.465%. The company uses the Miller-Orr Model to set its target cash balance. The minimum cash balance has been set at Sh.87,500. Required: (0) The company's target cash balance. (ii) The lower and upper cash limit. Dominion Ltd.'s decision rules. (3 marks) (2 marks) (5 marks) (Total: 20 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started