Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER QUESTION SHOWING ALL WORK AND CORRECT ANSWER COMPLETELY!!! QUESTIONS 3 THROUGH 6!!! Question 3 Beesly Co, owned all of the voting common stock

PLEASE ANSWER QUESTION SHOWING ALL WORK AND CORRECT ANSWER COMPLETELY!!!

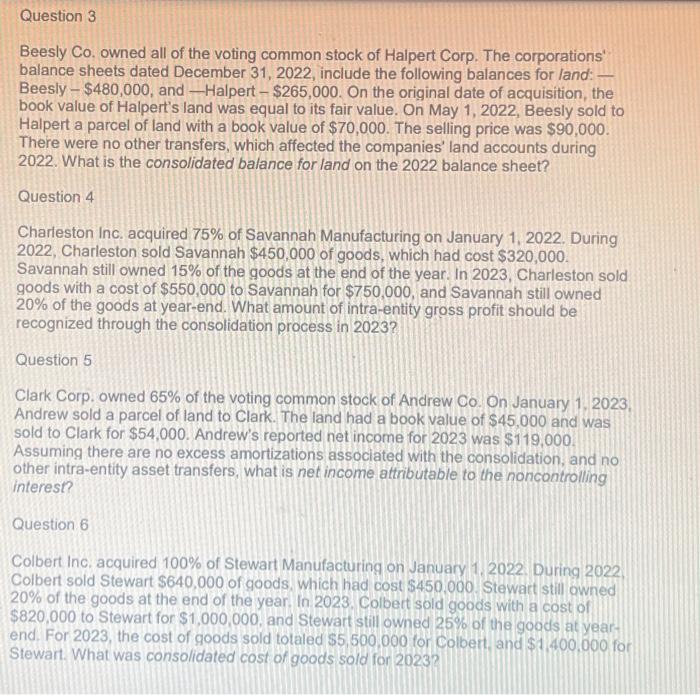

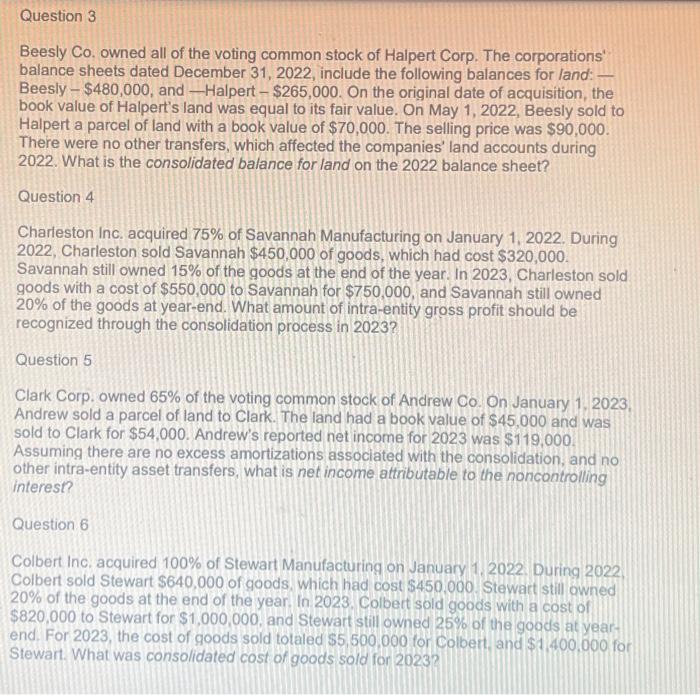

Question 3 Beesly Co, owned all of the voting common stock of Halpert Corp. The corporations' balance sheets dated December 31, 2022, include the following balances for land: Beesly - $480,000, and - Halpert - $265,000. On the original date of acquisition, the book value of Halpert's land was equal to its fair value. On May 1, 2022, Beesly sold to Halpert a parcel of land with a book value of $70,000. The selling price was $90,000. There were no other transfers, which affected the companies' land accounts during 2022. What is the consolidated balance for land on the 2022 balance sheet? Question 4 Charleston Inc. acquired 75% of Savannah Manufacturing on January 1, 2022. During 2022, Charleston sold Savannah $450,000 of goods, which had cost $320,000. Savannah still owned 15\% of the goods at the end of the year. In 2023, Charleston sold goods with a cost of $550,000 to Savannah for $750,000, and Savannah still owned 20% of the goods at year-end. What amount of intra-entity gross profit should be recognized through the consolidation process in 2023? Question 5 Clark Corp. owned 65% of the voting common stock of Andrew Co. On January 1,2023, Andrew sold a parcel of land to Clark. The land had a book value of $45,000 and was sold to Clark for $54,000. Andrew's reported net income for 2023 was $119,000. Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, what is net income attributable to the noncontrolling interest? Question 6 Colbert Inc. acquired 100\% of Stewart Manufacturing on January 1, 2022. During 2022. Colbert sold Stewart $640,000 of goods. which had cost $450,000. Stewart still owned 20% of the goods at the end of the year. In 2023. Colbert sold goods with a cost of $820,000 to Stewart for $1,000,000, and Stewart still owned 25% of the goods at yearend. For 2023, the cost of goods sold totaled $5,500,000 for Colbert, and $1,400,000 for Stewart. What was consolidated cost of goods sold for 2023 QUESTIONS 3 THROUGH 6!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started