Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer question specifically Instructions On November 1, the firm of Sails, Welch, and Greenberg decided to liquidate their actesho. The partners have capital balances

Please answer question specifically

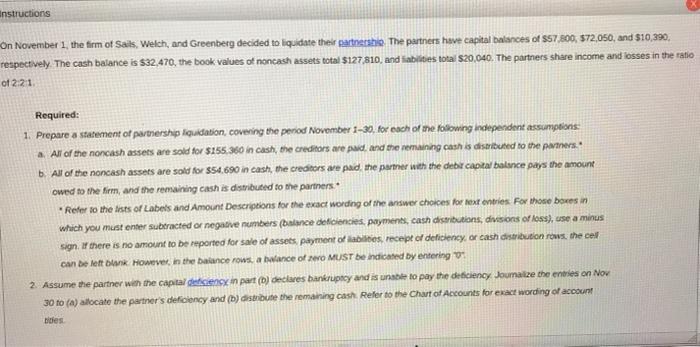

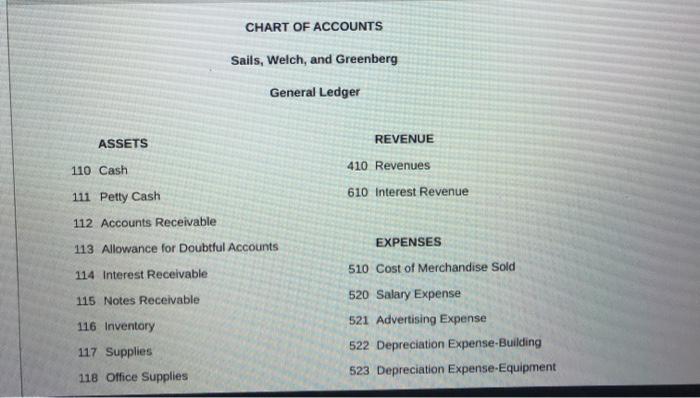

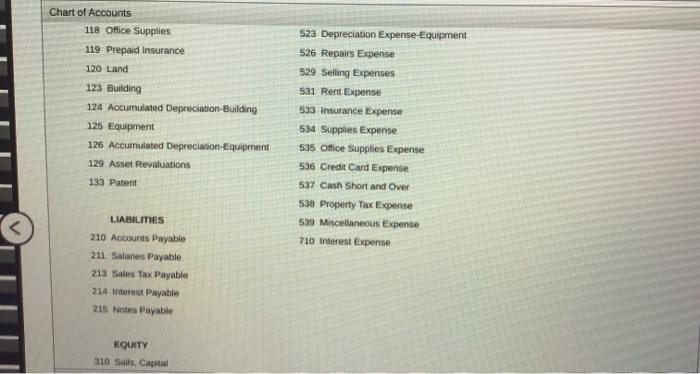

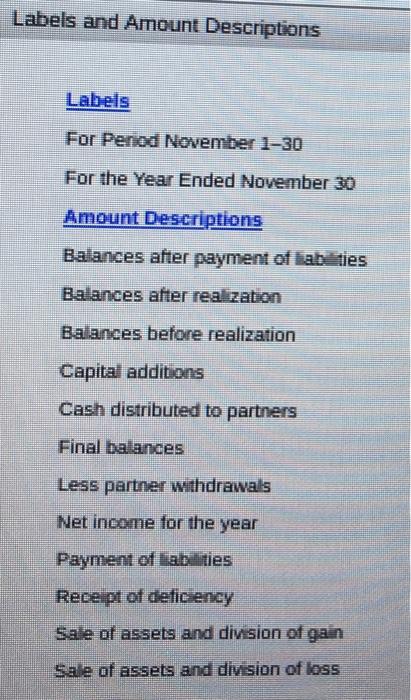

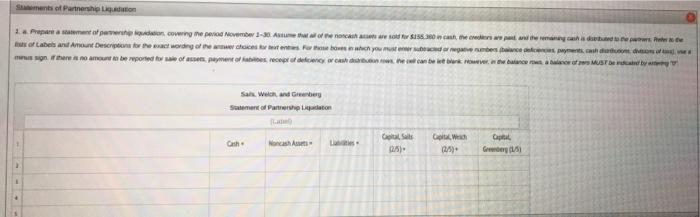

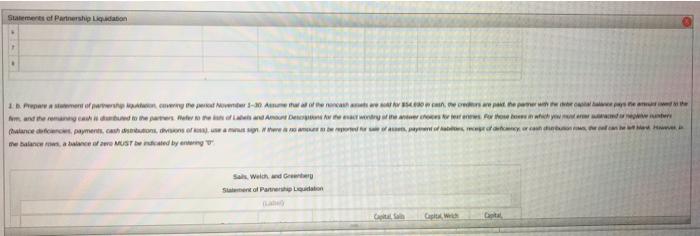

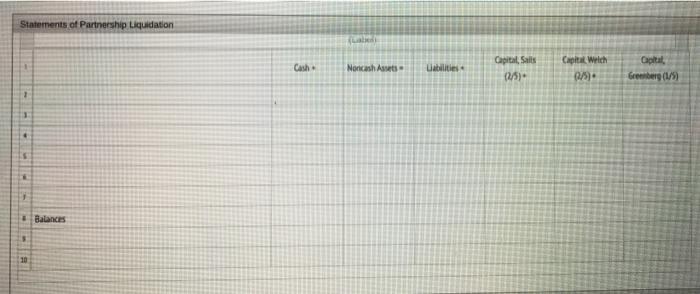

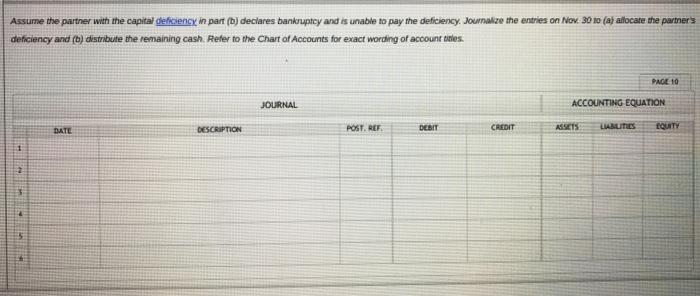

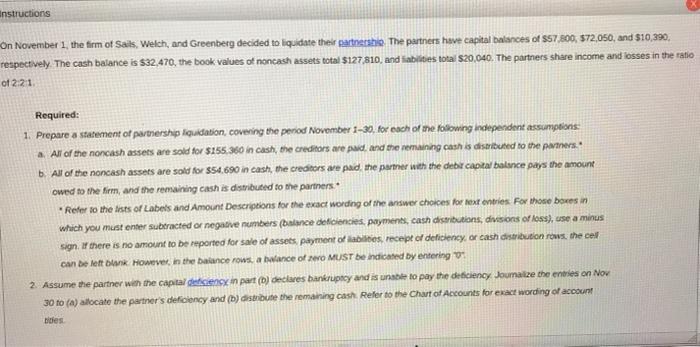

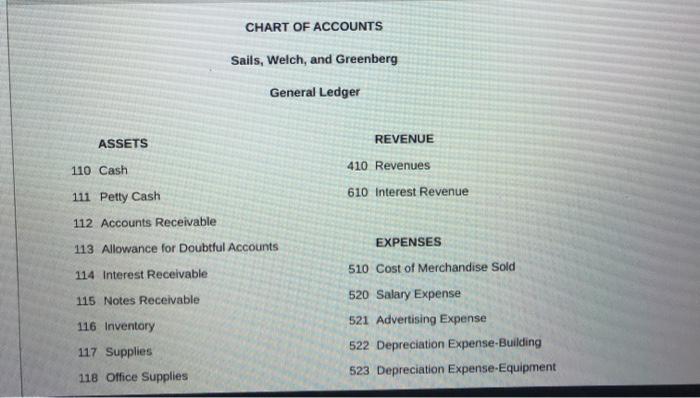

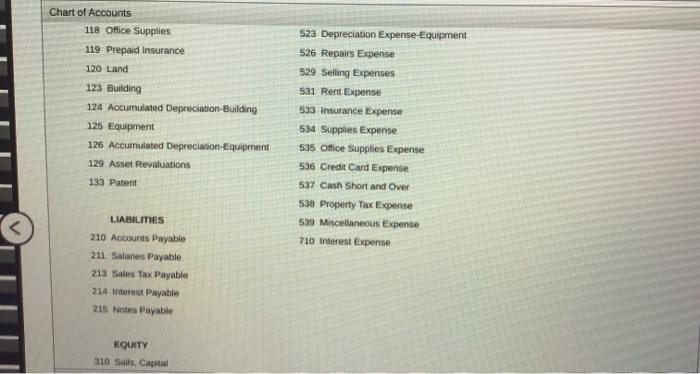

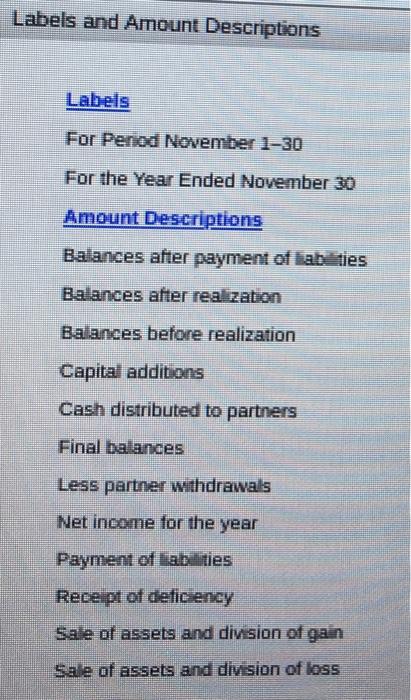

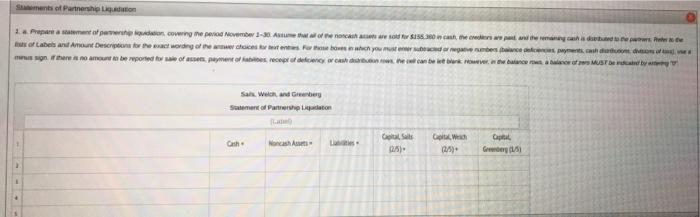

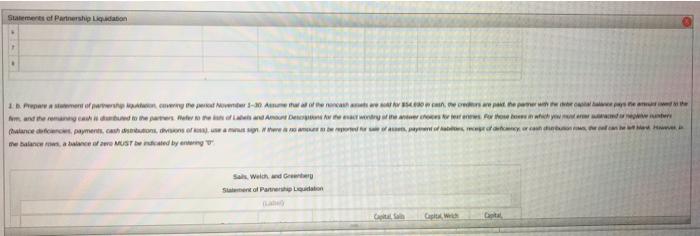

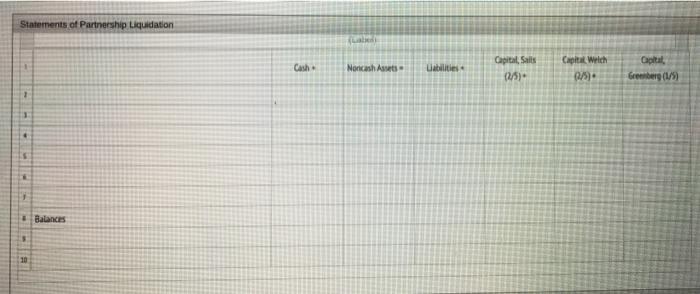

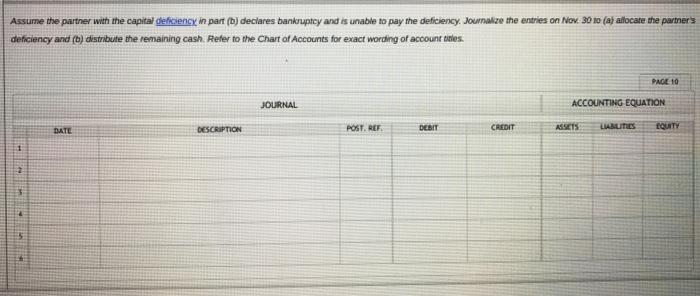

Instructions On November 1, the firm of Sails, Welch, and Greenberg decided to liquidate their actesho. The partners have capital balances of SS7 800, 372,050, and $10,390, respectively. The cash balance is $32,470, the book values of noncash assets total $127,810, and inities total $20,040. The partners share income and losses in the ratio of 2:21 Required: 1. Prepare a statement of partnership liquidation, covering the period Novomber 1-30, for each of the following independent assumptions a. All of the noncash assets are sold for $155.360 in cash, the creditors are paid, and the remaining cash is distributed to the partners." 6. All of the noncash assets are sold for $54.690 in cash, the creditors are paid the partner with the debt capital balance pays the amount owed to the firm, and the remaining cash is distributed to the partners *Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for rent entries. For those boxes in which you must enter subtracted or negative numbers (binlance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of receipt of deficiency, or cash distribution rous, the cel can be left. However, in the balance rows a bwance of O MUST be indicated by entering 2. Assume the partner with the capital detect part (D) declares bankruptcy and is unable to pay the deficiency Joumaize the entries on Nov 30 to (a) allocate the partner's deficiency and (b) distribute the remaining cash. Refer to the Chart of Accounts for exact wording of account titles CHART OF ACCOUNTS Sails, Welch, and Greenberg General Ledger ASSETS REVENUE 110 Cash 410 Revenues 610 Interest Revenue 111 Petty Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 114 Interest Receivable 115 Notes Receivable 116 Inventory 117 Supplies 118 Office Supplies EXPENSES 510 Cost of Merchandise Sold 520 Salary Expense 521 Advertising Expense 522 Depreciation Expense-Building 523 Depreciation Expense-Equipment Chart of Accounts 118 Office Supplies 119 Prepaid Insurance 120 Land 123 Building 124 Accumulated Depreciation Building 125 Equipment 126 Accumulated Depreciation Equipment 129 Asset Revaluations 133 Patent S2a Depreciation Expense-Equipment 526 Repairs Expense 529 Selling Expenses 531 Rent Expense 533 Insurance Expense 534 Supplies Expense 535 Office Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 538 Property Tax Expense 539 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Sals, Capital Labels and Amount Descriptions Labels For Perod November 1-30 For the Year Ended November 30 Amount Descriptions Balances after payment of liabilities Balances after realization Balances before realization Capital additions Cash distributed to partners Final balances Less partner withdrawals Net income for the year Payment of liabilities Receipt of deficiency Sale of assets and division of gain Sale of assets and division of loss Suments of Partnership 2. a marcar cowring med Member 1-36. Alumner 5.0 inch, the crackers and we of Label and Amount Description for reading of the west church.com mwin. There is no amount to be reported of sepamos recoprofen can be www.weblicer MUST DE Sal Welchand Granberg Simen Parton Gash Wanash Golls ) CW 2/5) Capital Gerber y Statement of Partnership Liquidation wwwwwwwwwww over to the per tomated to retro e Arsene for the umar , the balance MUST Wed by any Sal Welch, and Gren Sofa Loudon Statements of Partnership Liquidation Cach Noncash abilities: Capital Sails (25) Capital Welch 02/5) Greenberg (1/5) Balances Assume the partner with the capital deficiency in part (1) declares bankruptcy and is unable to pay the deficiency. Journalize the entries on Nov. 30 so (a} allocate the partners deficiency and (b) distribute the remaining cash. Refer to the Chart of Accounts for exact wording of account ones. PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS EQUITY LIABUITIES 2 HE

Instructions On November 1, the firm of Sails, Welch, and Greenberg decided to liquidate their actesho. The partners have capital balances of SS7 800, 372,050, and $10,390, respectively. The cash balance is $32,470, the book values of noncash assets total $127,810, and inities total $20,040. The partners share income and losses in the ratio of 2:21 Required: 1. Prepare a statement of partnership liquidation, covering the period Novomber 1-30, for each of the following independent assumptions a. All of the noncash assets are sold for $155.360 in cash, the creditors are paid, and the remaining cash is distributed to the partners." 6. All of the noncash assets are sold for $54.690 in cash, the creditors are paid the partner with the debt capital balance pays the amount owed to the firm, and the remaining cash is distributed to the partners *Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for rent entries. For those boxes in which you must enter subtracted or negative numbers (binlance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of receipt of deficiency, or cash distribution rous, the cel can be left. However, in the balance rows a bwance of O MUST be indicated by entering 2. Assume the partner with the capital detect part (D) declares bankruptcy and is unable to pay the deficiency Joumaize the entries on Nov 30 to (a) allocate the partner's deficiency and (b) distribute the remaining cash. Refer to the Chart of Accounts for exact wording of account titles CHART OF ACCOUNTS Sails, Welch, and Greenberg General Ledger ASSETS REVENUE 110 Cash 410 Revenues 610 Interest Revenue 111 Petty Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 114 Interest Receivable 115 Notes Receivable 116 Inventory 117 Supplies 118 Office Supplies EXPENSES 510 Cost of Merchandise Sold 520 Salary Expense 521 Advertising Expense 522 Depreciation Expense-Building 523 Depreciation Expense-Equipment Chart of Accounts 118 Office Supplies 119 Prepaid Insurance 120 Land 123 Building 124 Accumulated Depreciation Building 125 Equipment 126 Accumulated Depreciation Equipment 129 Asset Revaluations 133 Patent S2a Depreciation Expense-Equipment 526 Repairs Expense 529 Selling Expenses 531 Rent Expense 533 Insurance Expense 534 Supplies Expense 535 Office Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 538 Property Tax Expense 539 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Sals, Capital Labels and Amount Descriptions Labels For Perod November 1-30 For the Year Ended November 30 Amount Descriptions Balances after payment of liabilities Balances after realization Balances before realization Capital additions Cash distributed to partners Final balances Less partner withdrawals Net income for the year Payment of liabilities Receipt of deficiency Sale of assets and division of gain Sale of assets and division of loss Suments of Partnership 2. a marcar cowring med Member 1-36. Alumner 5.0 inch, the crackers and we of Label and Amount Description for reading of the west church.com mwin. There is no amount to be reported of sepamos recoprofen can be www.weblicer MUST DE Sal Welchand Granberg Simen Parton Gash Wanash Golls ) CW 2/5) Capital Gerber y Statement of Partnership Liquidation wwwwwwwwwww over to the per tomated to retro e Arsene for the umar , the balance MUST Wed by any Sal Welch, and Gren Sofa Loudon Statements of Partnership Liquidation Cach Noncash abilities: Capital Sails (25) Capital Welch 02/5) Greenberg (1/5) Balances Assume the partner with the capital deficiency in part (1) declares bankruptcy and is unable to pay the deficiency. Journalize the entries on Nov. 30 so (a} allocate the partners deficiency and (b) distribute the remaining cash. Refer to the Chart of Accounts for exact wording of account ones. PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS EQUITY LIABUITIES 2 HE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started