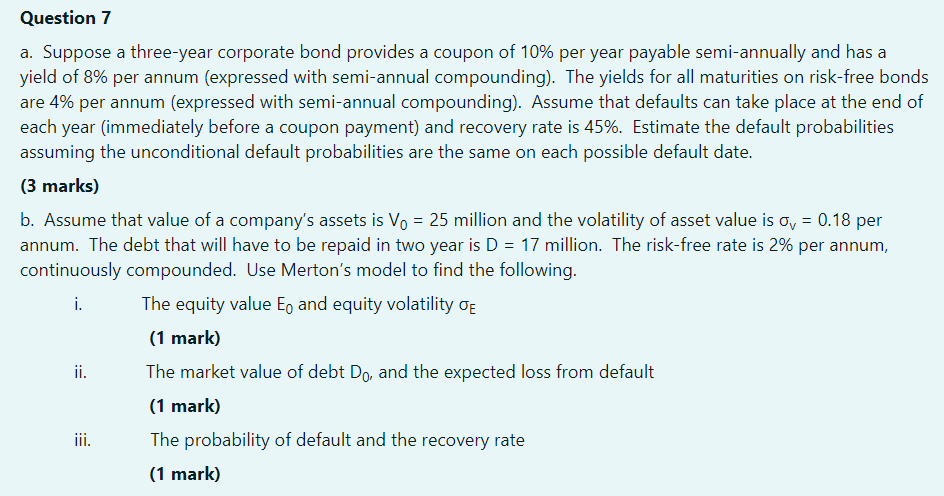

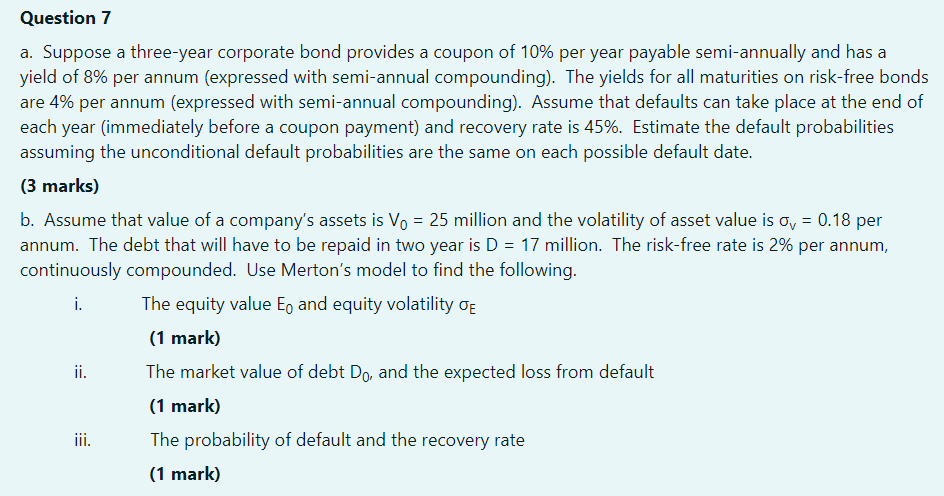

Question 7 = a. Suppose a three-year corporate bond provides a coupon of 10% per year payable semi-annually and has a yield of 8% per annum (expressed with semi-annual compounding). The yields for all maturities on risk-free bonds are 4% per annum (expressed with semi-annual compounding). Assume that defaults can take place at the end of each year (immediately before a coupon payment) and recovery rate is 45%. Estimate the default probabilities assuming the unconditional default probabilities are the same on each possible default date. (3 marks) b. Assume that value of a company's assets is Vo = 25 million and the volatility of asset value is Ov = 0.18 per annum. The debt that will have to be repaid in two year is D = 17 million. The risk-free rate is 2% per annum, continuously compounded. Use Merton's model to find the following. i. The equity value Eo and equity volatility OE (1 mark) ii. The market value of debt Do, and the expected loss from default (1 mark) iii. The probability of default and the recovery rate (1 mark) Question 7 = a. Suppose a three-year corporate bond provides a coupon of 10% per year payable semi-annually and has a yield of 8% per annum (expressed with semi-annual compounding). The yields for all maturities on risk-free bonds are 4% per annum (expressed with semi-annual compounding). Assume that defaults can take place at the end of each year (immediately before a coupon payment) and recovery rate is 45%. Estimate the default probabilities assuming the unconditional default probabilities are the same on each possible default date. (3 marks) b. Assume that value of a company's assets is Vo = 25 million and the volatility of asset value is Ov = 0.18 per annum. The debt that will have to be repaid in two year is D = 17 million. The risk-free rate is 2% per annum, continuously compounded. Use Merton's model to find the following. i. The equity value Eo and equity volatility OE (1 mark) ii. The market value of debt Do, and the expected loss from default (1 mark) iii. The probability of default and the recovery rate (1 mark)