Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer questions 1 and 2 1. Assume the required return (R) is 10% . using R, dividend information, and growth rate (g) compute the

Please answer questions 1 and 2

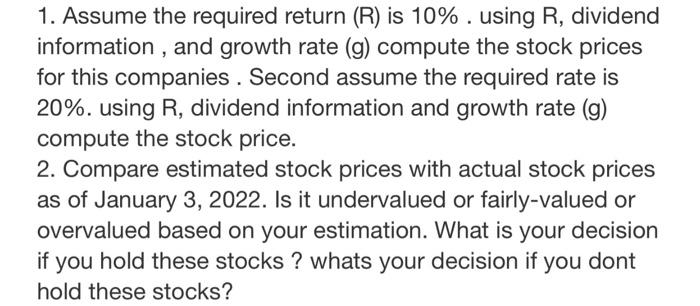

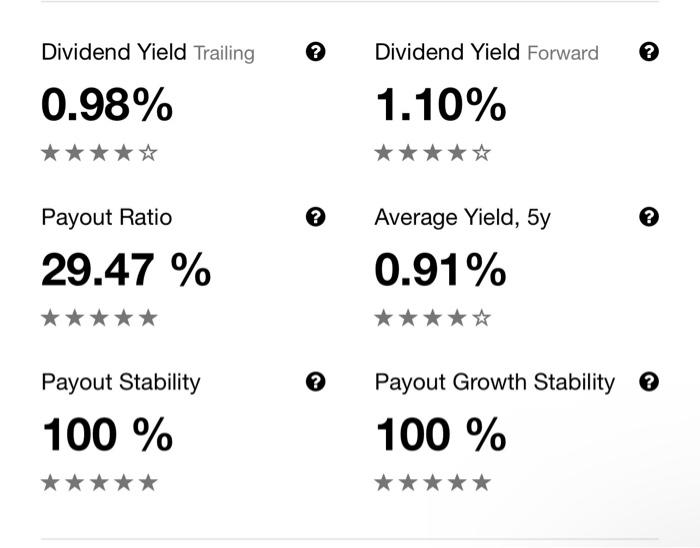

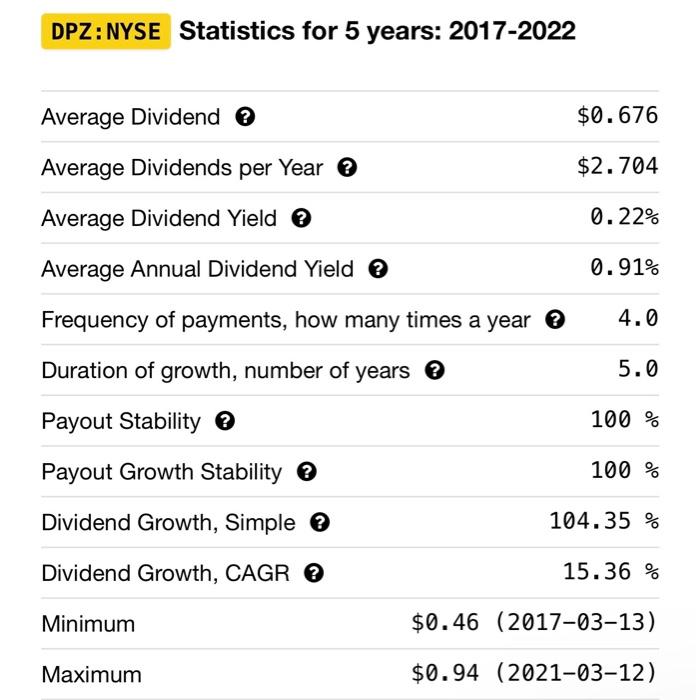

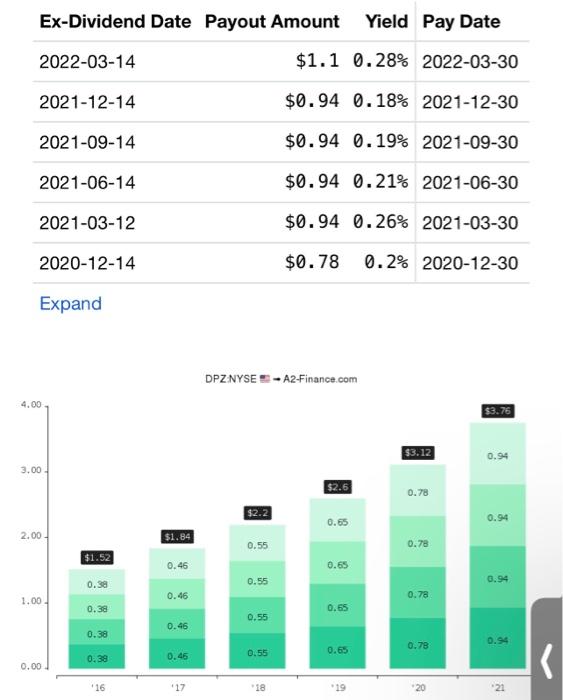

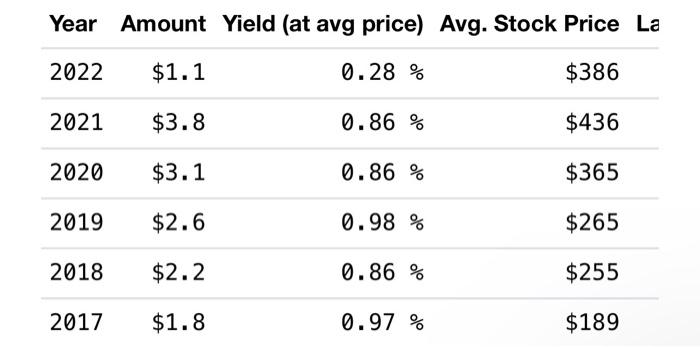

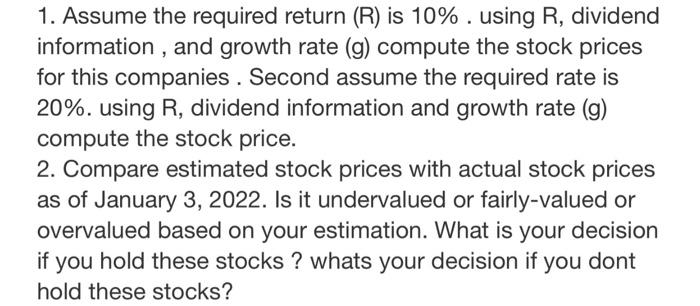

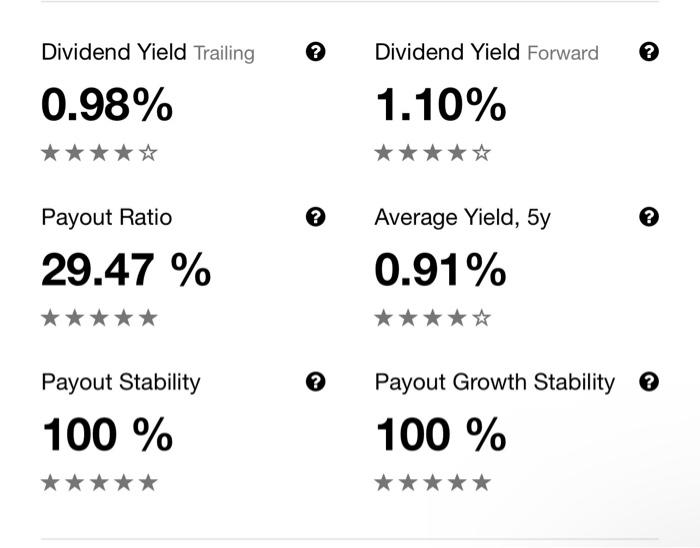

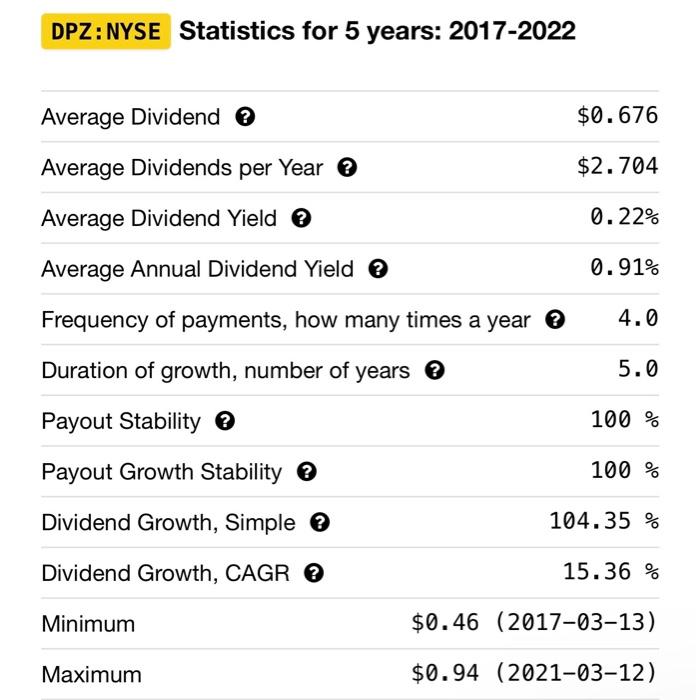

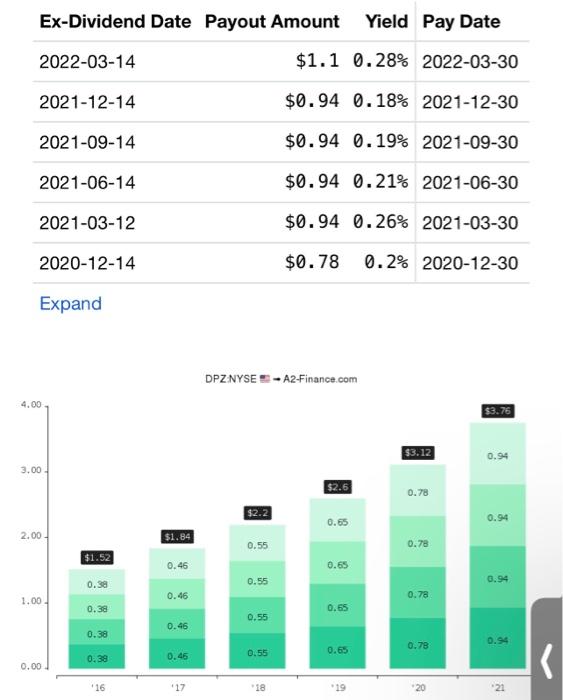

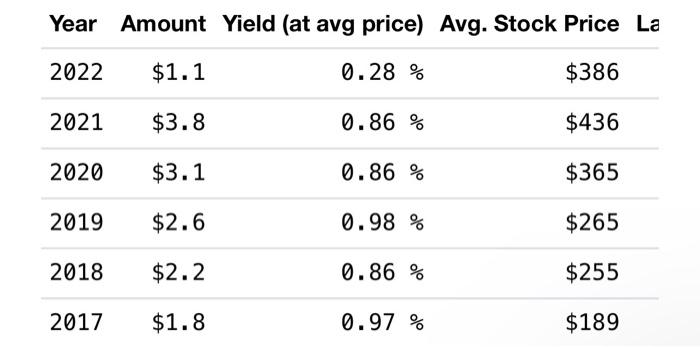

1. Assume the required return (R) is 10% . using R, dividend information, and growth rate (g) compute the stock prices for this companies. Second assume the required rate is 20%. using R, dividend information and growth rate (g) compute the stock price. 2. Compare estimated stock prices with actual stock prices as of January 3, 2022. Is it undervalued or fairly-valued or overvalued based on your estimation. What is your decision if you hold these stocks ? whats your decision if you dont hold these stocks? Dividend Yield Trailing ? Dividend Yield Forward ? 0.98% 1.10% **** Payout Ratio Average Yield, 5y 29.47 % 0.91% ***** * * * * Payout Stability 100 % Payout Growth Stability 100 % DPZ:NYSE Statistics for 5 years: 2017-2022 Average Dividend $0.676 Average Dividends per Year $2.704 Average Dividend Yield 0.22% Average Annual Dividend Yield 0.91% Frequency of payments, how many times a year 4.0 Duration of growth, number of years 5.0 Payout Stability 100 % Payout Growth Stability 100 % Dividend Growth, Simple 104.35 % Dividend Growth, CAGR 15.36 % Minimum $0.46 (2017-03-13) Maximum $0.94 (2021-03-12) Ex-Dividend Date Payout Amount Yield Pay Date 2022-03-14 $1.1 0.28% 2022-03-30 2021-12-14 $0.94 0.18% 2021-12-30 2021-09-14 $0.94 0.19% 2021-09-30 2021-06-14 $0.94 0.21% 2021-06-30 2021-03-12 $0.94 0.26% 2021-03-30 2020-12-14 $0.78 0.2% 2020-12-30 Expand DPZ NYSE - A2 Finance.com 4.00 $3.76 $3.12 0.94 3.00 $2.6 0.78 $2.2 0.65 0.94 2.00 51.84 0.55 0.78 $1.52 0.46 0.65 0.38 0.55 0.94 0.46 1.00 0.78 0.38 0.65 0.55 0.46 0.38 0.78 0.94 0.55 0.65 0.39 0.45 0.00 '16 '17 18 19 21 Year Amount Yield (at avg price) Avg. Stock Price La 2022 $1.1 0.28 % $386 2021 $3.8 0.86 % $436 2020 $3.1 0.86 % $365 2019 $2.6 0.98 % $265 2018 $2.2 0.86 % $255 2017 $1.8 0.97 % $189 1. Assume the required return (R) is 10% . using R, dividend information, and growth rate (g) compute the stock prices for this companies. Second assume the required rate is 20%. using R, dividend information and growth rate (g) compute the stock price. 2. Compare estimated stock prices with actual stock prices as of January 3, 2022. Is it undervalued or fairly-valued or overvalued based on your estimation. What is your decision if you hold these stocks ? whats your decision if you dont hold these stocks? Dividend Yield Trailing ? Dividend Yield Forward ? 0.98% 1.10% **** Payout Ratio Average Yield, 5y 29.47 % 0.91% ***** * * * * Payout Stability 100 % Payout Growth Stability 100 % DPZ:NYSE Statistics for 5 years: 2017-2022 Average Dividend $0.676 Average Dividends per Year $2.704 Average Dividend Yield 0.22% Average Annual Dividend Yield 0.91% Frequency of payments, how many times a year 4.0 Duration of growth, number of years 5.0 Payout Stability 100 % Payout Growth Stability 100 % Dividend Growth, Simple 104.35 % Dividend Growth, CAGR 15.36 % Minimum $0.46 (2017-03-13) Maximum $0.94 (2021-03-12) Ex-Dividend Date Payout Amount Yield Pay Date 2022-03-14 $1.1 0.28% 2022-03-30 2021-12-14 $0.94 0.18% 2021-12-30 2021-09-14 $0.94 0.19% 2021-09-30 2021-06-14 $0.94 0.21% 2021-06-30 2021-03-12 $0.94 0.26% 2021-03-30 2020-12-14 $0.78 0.2% 2020-12-30 Expand DPZ NYSE - A2 Finance.com 4.00 $3.76 $3.12 0.94 3.00 $2.6 0.78 $2.2 0.65 0.94 2.00 51.84 0.55 0.78 $1.52 0.46 0.65 0.38 0.55 0.94 0.46 1.00 0.78 0.38 0.65 0.55 0.46 0.38 0.78 0.94 0.55 0.65 0.39 0.45 0.00 '16 '17 18 19 21 Year Amount Yield (at avg price) Avg. Stock Price La 2022 $1.1 0.28 % $386 2021 $3.8 0.86 % $436 2020 $3.1 0.86 % $365 2019 $2.6 0.98 % $265 2018 $2.2 0.86 % $255 2017 $1.8 0.97 % $189

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started