****PLEASE ANSWER QUESTIONS 10-16 ****

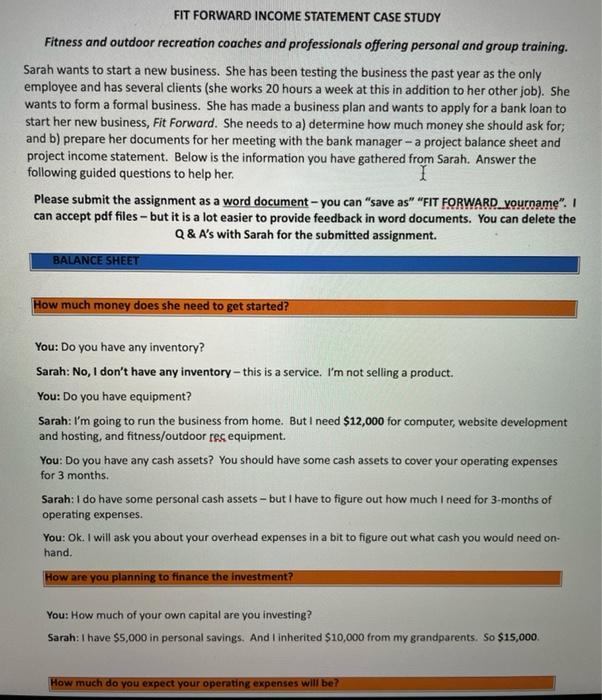

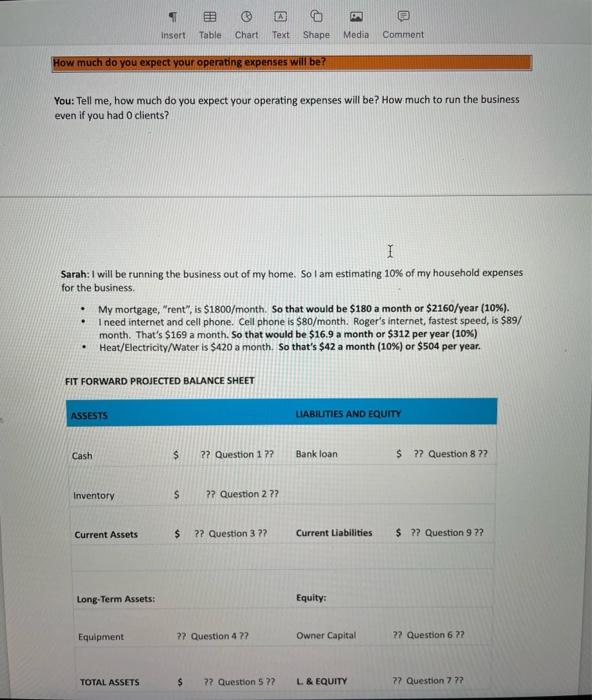

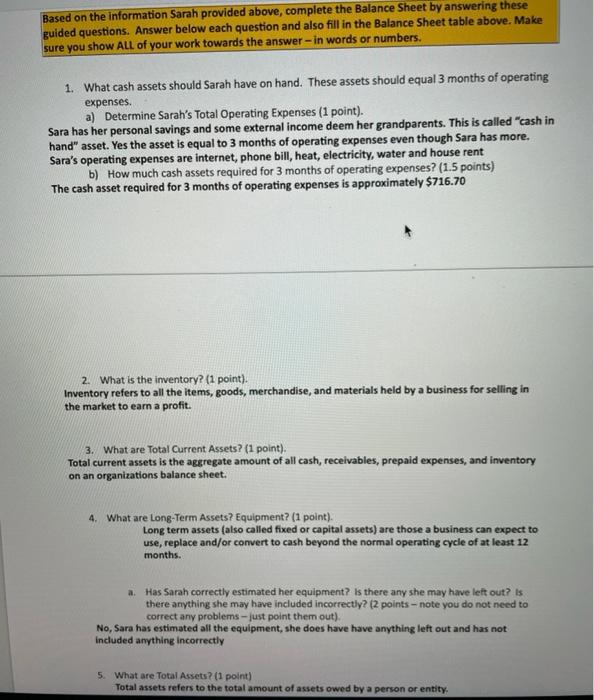

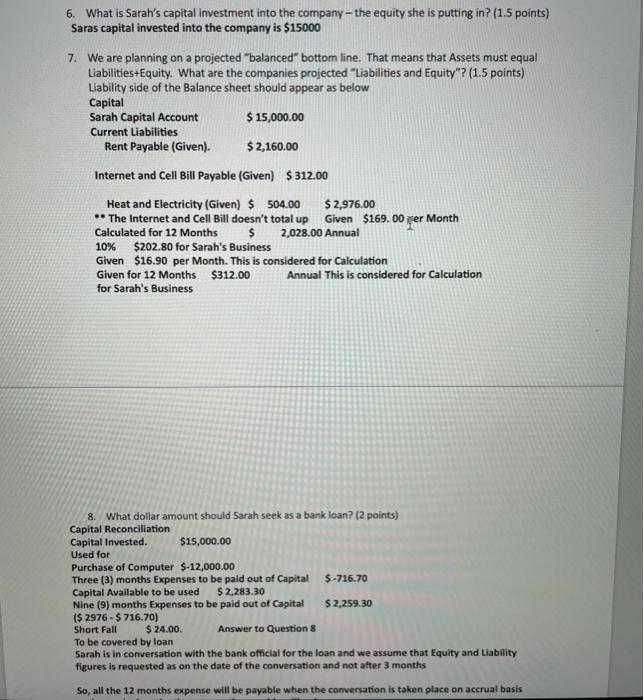

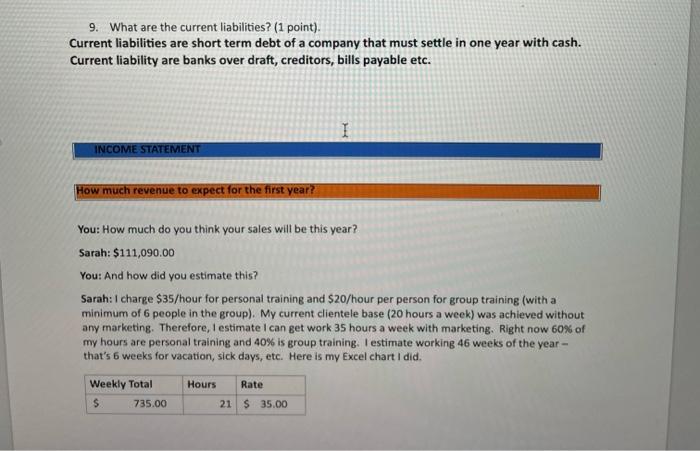

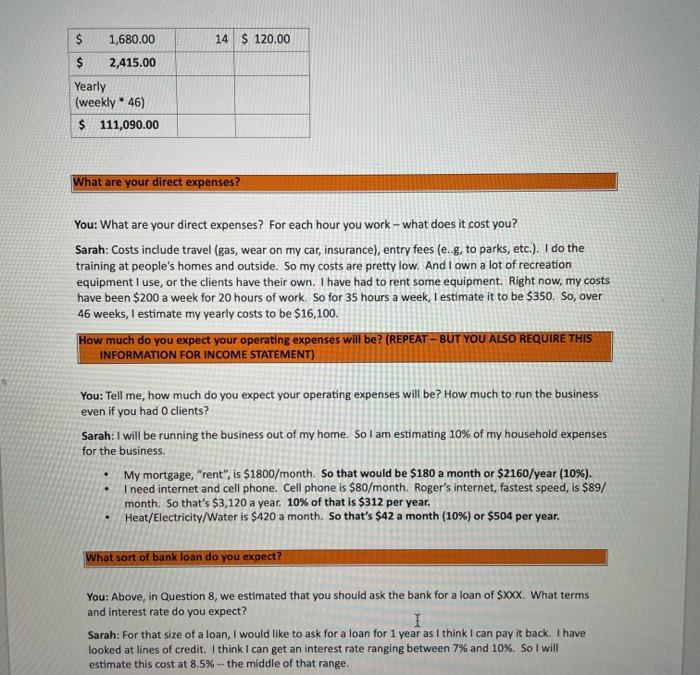

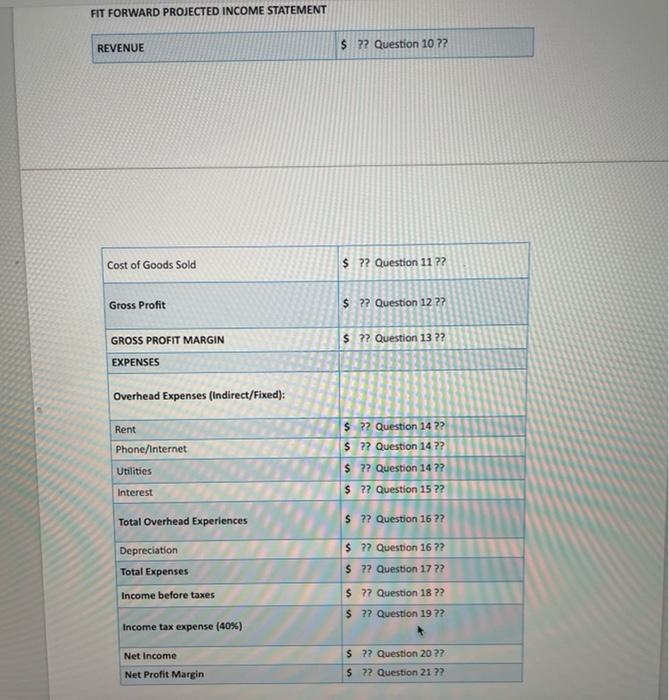

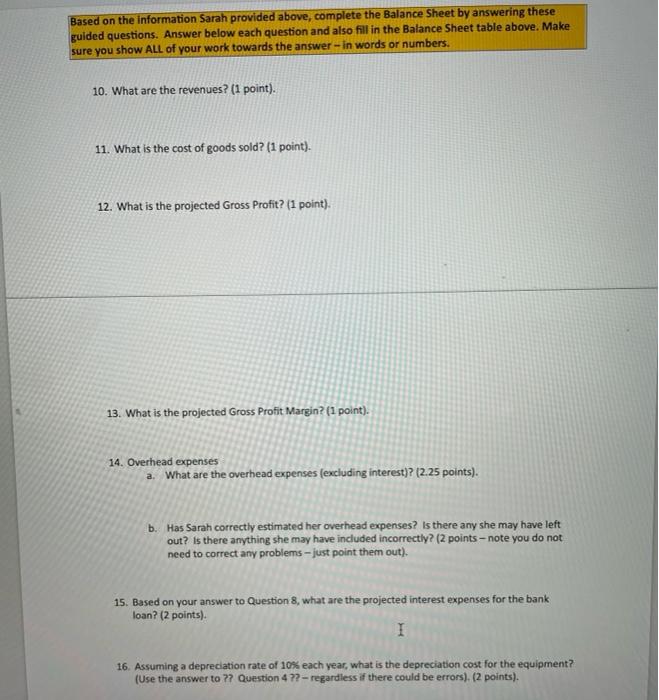

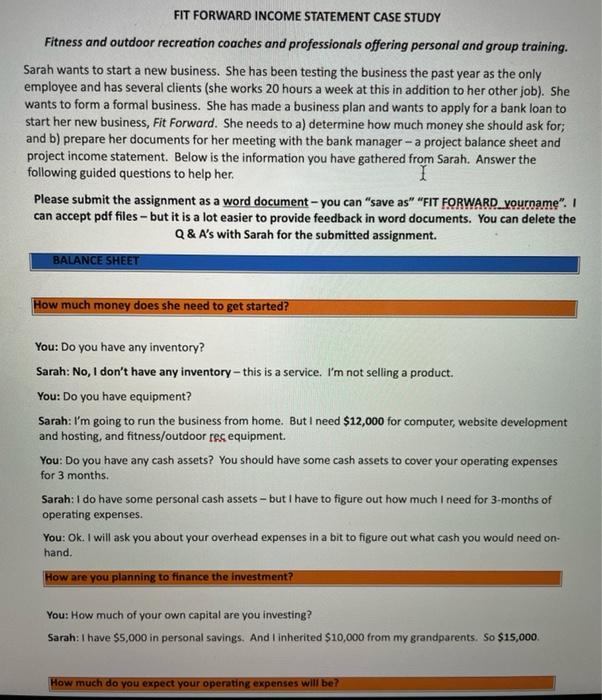

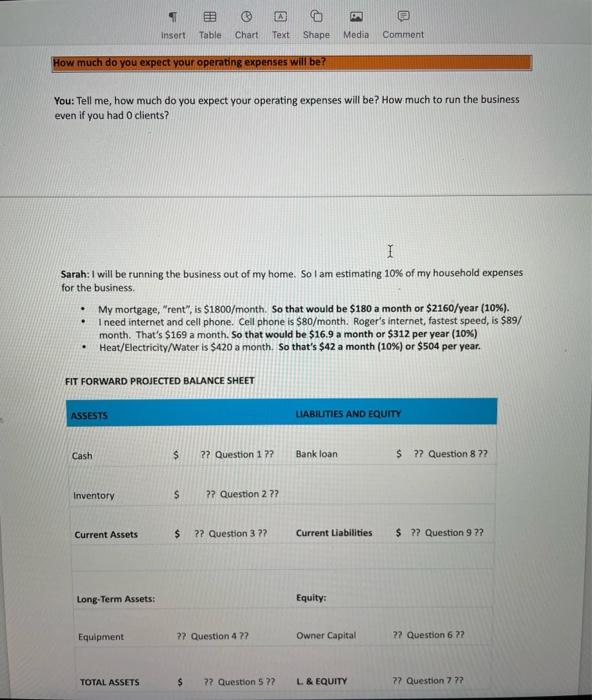

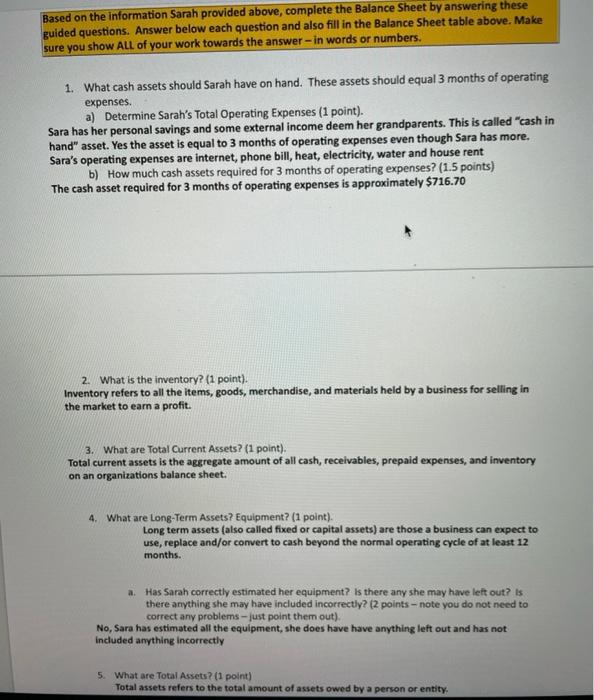

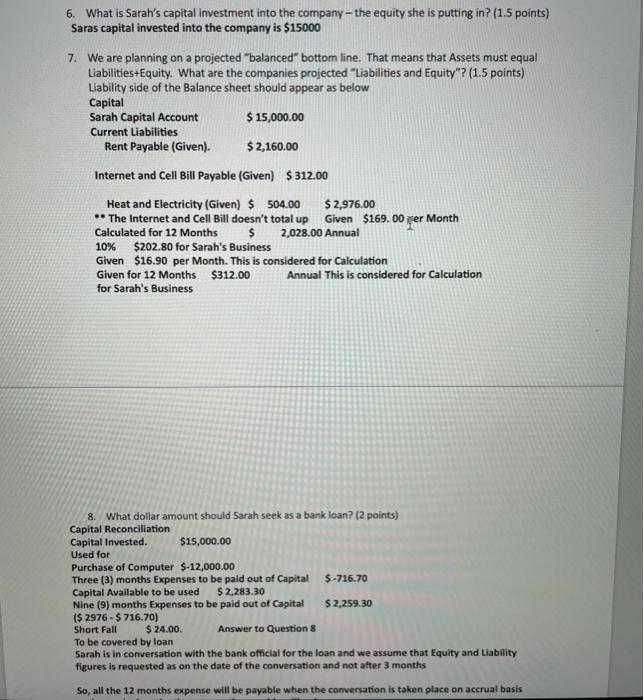

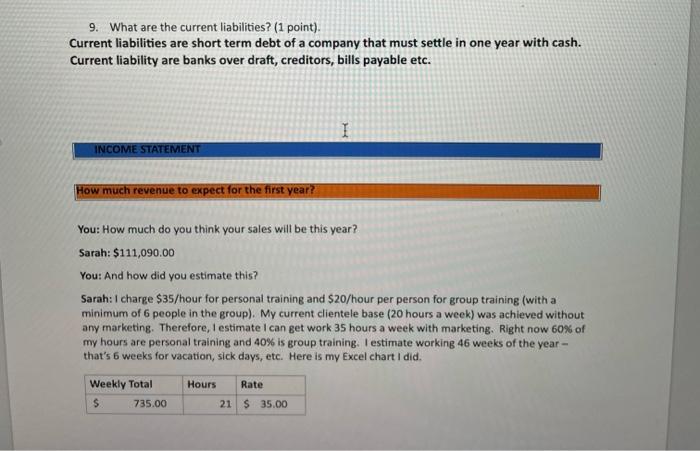

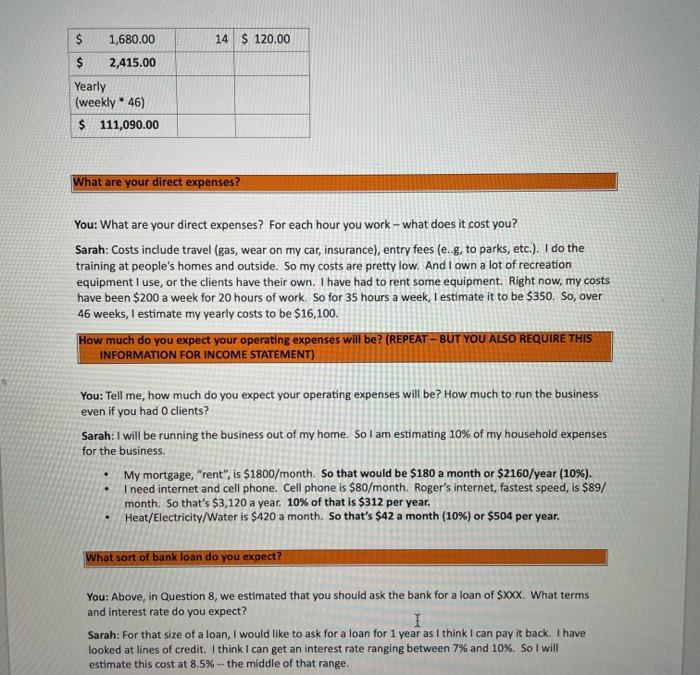

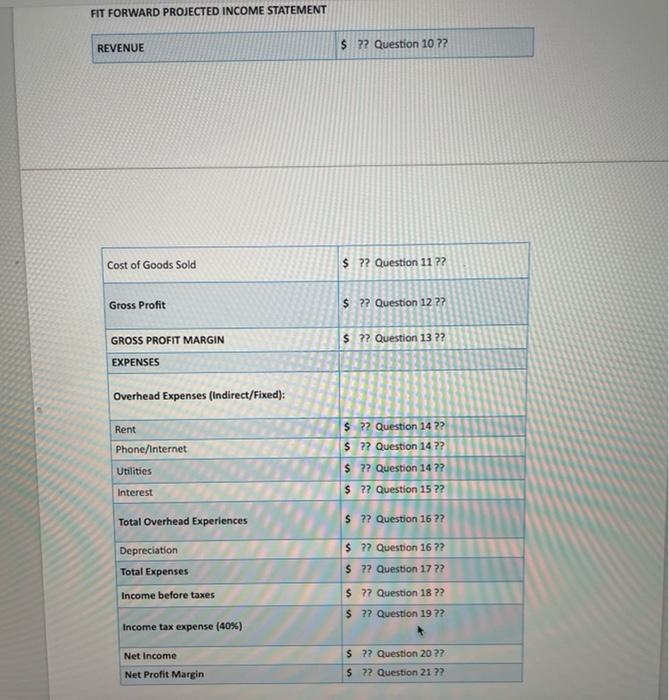

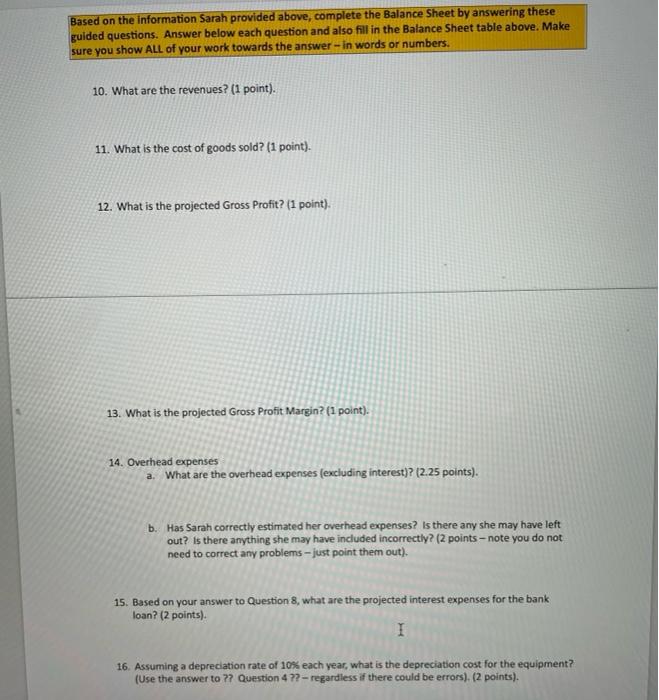

FIT FORWARD INCOME STATEMENT CASE STUDY Fitness and outdoor recreation coaches and professionals offering personal and group training. Sarah wants to start a new business. She has been testing the business the past year as the only employee and has several clients (she works 20 hours a week at this in addition to her other job). She wants to form a formal business. She has made a business plan and wants to apply for a bank loan to start her new business, Fit Forward. She needs to a) determine how much money she should ask for; and b) prepare her documents for her meeting with the bank manager - a project balance sheet and project income statement. Below is the information you have gathered from Sarah. Answer the following guided questions to help her. Please submit the assignment as a word document - you can save as" "FIT FORWARD yourname". I can accept pdf files - but it is a lot easier to provide feedback in word documents. You can delete the Q & A's with Sarah for the submitted assignment. BALANCE SHEET How much money does she need to get started? You: Do you have any inventory? Sarah: No, I don't have any inventory- this is a service. I'm not selling a product. You: Do you have equipment? Sarah: I'm going to run the business from home. But I need $12,000 for computer, website development and hosting, and fitness/outdoor res equipment. You: Do you have any cash assets? You should have some cash assets to cover your operating expenses for 3 months. Sarah: I do have some personal cash assets - but I have to figure out how much I need for 3-months of operating expenses. You: Ok. I will ask you about your overhead expenses in a bit to figure out what cash you would need on- hand. How are you planning to finance the investment? You: How much of your own capital are you investing? Sarah: I have $5,000 in personal savings. And I inherited $10,000 from my grandparents. So $15,000 How much do you expect your operating expenses will be? LAS . B insert Table Chart Text Shape Media Comment How much do you expect your operating expenses will be? You: Tell me, how much do you expect your operating expenses will be? How much to run the business even if you had O clients? 1 Sarah: I will be running the business out of my home. So I am estimating 10% of my household expenses for the business. My mortgage, "rent", is $1800/month. So that would be $180 a month or $2160/year (10%). I need internet and cell phone. Cell phone is $80/month. Roger's internet, fastest speed, is $89/ month. That's $169 a month. So that would be $16.9 a month or $312 per year (10%) Heat/Electricity/Water is $420 a month. So that's $42 a month (10%) or $504 per year. . . FIT FORWARD PROJECTED BALANCE SHEET ASSESTS LIABILITIES AND EQUITY Cash $ ?? Question 1 ?? Bank loan $ ?? Question 872 Inventory $ ?? Question 2 ?? Current Assets $ ?? Question 3 ?? Current Liabilities $ ?? Question 9 ?? Long-Term Assets: Equity: Equipment ?? Question 4 22 Owner Capital ?? Question 6.22 TOTAL ASSETS $ 7? Question 5 ?? L & EQUITY 7? Question 777 Based on the information Sarah provided above, complete the Balance Sheet by answering these guided questions. Answer below each question and also fill in the Balance Sheet table above. Make sure you show All of your work towards the answer - in words or numbers. 1. What cash assets should Sarah have on hand. These assets should equal 3 months of operating expenses. a) Determine Sarah's Total Operating Expenses (1 point). Sara has her personal savings and some external income deem her grandparents. This is called "cash in hand" asset. Yes the asset is equal to 3 months of operating expenses even though Sara has more. Sara's operating expenses are internet, phone bill, heat, electricity, water and house rent b) How much cash assets required for 3 months of operating expenses? (1.5 points) The cash asset required for 3 months of operating expenses is approximately $716.70 2. What is the inventory? (1 point). Inventory refers to all the items, goods, merchandise, and materials held by a business for selling in the market to earn a profit. 3. What are Total Current Assets? (1 point), Total current assets is the aggregate amount of all cash, receivables, prepaid expenses, and inventory on an organizations balance sheet. 4. What are Long-Term Assets? Equipment? (1 point). Long term assets (also called fixed or capital assets) are those a business can expect to use, replace and/or convert to cash beyond the normal operating cycle of at least 12 months. a. Has Sarah correctly estimated her equipment? Is there any she may have left out? Is there anything she may have included incorrectly? (2 points - note you do not need to correct any problems - just point them out). No, Sara has estimated all the equipment, she does have have anything left out and has not included anything Incorrectly 5. What are Total Assets? (1 point) Total assets refers to the total amount of assets owed by a person or entity 6. What is Sarah's capital investment into the company the equity she is putting in? (1.5 points) Saras capital invested into the company is $15000 7. We are planning on a projected "balanced" bottom line. That means that Assets must equal Liabilities+Equity. What are the companies projected "Liabilities and Equity"? (1.5 points) Liability side of the Balance sheet should appear as below Capital Sarah Capital Account $ 15,000.00 Current Liabilities Rent Payable (Given). $ 2,160.00 Internet and Cell Bill Payable (Given) $312.00 ser Heat and Electricity (Given) $ 504.00 $ 2,976.00 ** The Internet and Cell Bill doesn't total up Given $169.00 Month Calculated for 12 Months $ 2,028.00 Annual 10% $202.80 for Sarah's Business Given $16.90 per month. This is considered for Calculation Given for 12 Months $312.00 Annual This is considered for Calculation for Sarah's Business 8. What dollar amount should Sarah seek as a bank loan? (2 points) Capital Reconciliation Capital Invested. $15,000.00 Used for Purchase of Computer $-12,000.00 Three (3) months Expenses to be paid out of Capital $-716.70 Capital Available to be used $2,283.30 Nine (9) months Expenses to be paid out of Capital $ 2,259.30 ($ 2976 - $ 716.70) Short Fall $ 24.00 Answer to Question 8 To be covered by loan Sarah is in conversation with the bank official for the loan and we assume that Equity and Liability figures is requested as on the date of the conversation and not after 3 months So, all the 12 months expense will be payable when the conversation is taken place on accrual basis 9. What are the current liabilities? (1 point). Current liabilities are short term debt of a company that must settle in one year with cash. Current liability are banks over draft, creditors, bills payable etc. I INCOME STATEMENT How much revenue to expect for the first year? You: How much do you think your sales will be this year? Sarah: $111,090.00 You: And how did you estimate this? Sarah: I charge $35/hour for personal training and $20/hour per person for group training (with a minimum of 6 people in the group). My current clientele base (20 hours a week) was achieved without any marketing. Therefore, I estimate I can get work 35 hours a week with marketing. Right now 60% of my hours are personal training and 40% is group training. I estimate working 46 weeks of the year - that's 6 weeks for vacation, sick days, etc. Here is my Excel chart I did. Hours Rate Weekly Total $ 735.00 21 $ 35.00 14 $ 120.00 $ 1,680.00 $ 2,415.00 Yearly (weekly * 46) $ 111,090.00 What are your direct expenses? You: What are your direct expenses? For each hour you work - what does it cost you? Sarah: Costs include travel (gas, wear on my car, insurance), entry fees (eg, to parks, etc.). I do the training at people's homes and outside. So my costs are pretty low. And I own a lot of recreation equipment I use, or the clients have their own. I have had to rent some equipment. Right now, my costs have been $200 a week for 20 hours of work. So for 35 hours a week, I estimate it to be $350. So, over 46 weeks, l estimate my yearly costs to be $16,100. How much do you expect your operating expenses will be? (REPEAT - BUT YOU ALSO REQUIRE THIS INFORMATION FOR INCOME STATEMENT) You: Tell me, how much do you expect your operating expenses will be? How much to run the business even if you had clients? Sarah: I will be running the business out of my home. So I am estimating 10% of my household expenses for the business. . . My mortgage, "rent", is $1800/month. So that would be $180 a month or $2160/year (10%). I need internet and cell phone. Cell phone is $80/month. Roger's internet, fastest speed, is $89/ month. So that's $3,120 a year. 10% of that is $312 per year. Heat/Electricity/Water is $420 a month. So that's $42 a month (10%) or $504 per year. What sort of bank loan do you expect? You: Above, in Question 8, we estimated that you should ask the bank for a loan of $XXX. What terms and interest rate do you expect? I Sarah: For that size of a loan, I would like to ask for a loan for 1 year as I think I can pay it back. I have looked at lines of credit. I think I can get an interest rate ranging between 7% and 10%. So I will estimate this cost at 8,5% - the middle of that range. FIT FORWARD PROJECTED INCOME STATEMENT REVENUE $ 22 Question 1072 Cost of Goods Sold $ ?? Question 11 ?? Gross Profit $ ?? Question 12 ?? GROSS PROFIT MARGIN $ ?? Question 13 ?? EXPENSES Overhead Expenses (Indirect/Fixed): Rent $?? Question 14 2? $?? Question 14?? Phone/Internet Utilities $ ?? Question 14 ?? $ ?? Question 15 ?? Interest Total Overhead Experiences $ ?? Question 16 ?? Depreciation Total Expenses $?? Question 16 ?? $ ?? Question 1772 Income before taxes $ 77 Question 18 ?? $ ?? Question 1972 Income tax expense (40%) Net Income $ ?? Question 20?? $ 27 Question 21?? Net Profit Margin Based on the information Sarah provided above, complete the Balance Sheet by answering these guided questions. Answer below each question and also fill in the Balance Sheet table above. Make sure you show ALL of your work towards the answer -in words or numbers. 10. What are the revenues? (1 point). 11. What is the cost of goods sold? (1 point). 12. What is the projected Gross Profit? (1 point). 13. What is the projected Gross Profit Margin? (1 point). 14. Overhead expenses a. What are the overhead expenses (excluding interest)? (2.25 points). b. Has Sarah correctly estimated her overhead expenses? Is there any she may have left out? Is there anything she may have included incorrectly? (2 points - note you do not need to correct any problems - just point them out). 15. Based on your answer to Question 8, what are the projected interest expenses for the bank loan? (2 points) I 16. Assuming a depreciation rate of 10% each year, what is the depreciation cost for the equipment? (Use the answer to ?? Question 4 ??-regardless if there could be errors). (2 points). FIT FORWARD INCOME STATEMENT CASE STUDY Fitness and outdoor recreation coaches and professionals offering personal and group training. Sarah wants to start a new business. She has been testing the business the past year as the only employee and has several clients (she works 20 hours a week at this in addition to her other job). She wants to form a formal business. She has made a business plan and wants to apply for a bank loan to start her new business, Fit Forward. She needs to a) determine how much money she should ask for; and b) prepare her documents for her meeting with the bank manager - a project balance sheet and project income statement. Below is the information you have gathered from Sarah. Answer the following guided questions to help her. Please submit the assignment as a word document - you can save as" "FIT FORWARD yourname". I can accept pdf files - but it is a lot easier to provide feedback in word documents. You can delete the Q & A's with Sarah for the submitted assignment. BALANCE SHEET How much money does she need to get started? You: Do you have any inventory? Sarah: No, I don't have any inventory- this is a service. I'm not selling a product. You: Do you have equipment? Sarah: I'm going to run the business from home. But I need $12,000 for computer, website development and hosting, and fitness/outdoor res equipment. You: Do you have any cash assets? You should have some cash assets to cover your operating expenses for 3 months. Sarah: I do have some personal cash assets - but I have to figure out how much I need for 3-months of operating expenses. You: Ok. I will ask you about your overhead expenses in a bit to figure out what cash you would need on- hand. How are you planning to finance the investment? You: How much of your own capital are you investing? Sarah: I have $5,000 in personal savings. And I inherited $10,000 from my grandparents. So $15,000 How much do you expect your operating expenses will be? LAS . B insert Table Chart Text Shape Media Comment How much do you expect your operating expenses will be? You: Tell me, how much do you expect your operating expenses will be? How much to run the business even if you had O clients? 1 Sarah: I will be running the business out of my home. So I am estimating 10% of my household expenses for the business. My mortgage, "rent", is $1800/month. So that would be $180 a month or $2160/year (10%). I need internet and cell phone. Cell phone is $80/month. Roger's internet, fastest speed, is $89/ month. That's $169 a month. So that would be $16.9 a month or $312 per year (10%) Heat/Electricity/Water is $420 a month. So that's $42 a month (10%) or $504 per year. . . FIT FORWARD PROJECTED BALANCE SHEET ASSESTS LIABILITIES AND EQUITY Cash $ ?? Question 1 ?? Bank loan $ ?? Question 872 Inventory $ ?? Question 2 ?? Current Assets $ ?? Question 3 ?? Current Liabilities $ ?? Question 9 ?? Long-Term Assets: Equity: Equipment ?? Question 4 22 Owner Capital ?? Question 6.22 TOTAL ASSETS $ 7? Question 5 ?? L & EQUITY 7? Question 777 Based on the information Sarah provided above, complete the Balance Sheet by answering these guided questions. Answer below each question and also fill in the Balance Sheet table above. Make sure you show All of your work towards the answer - in words or numbers. 1. What cash assets should Sarah have on hand. These assets should equal 3 months of operating expenses. a) Determine Sarah's Total Operating Expenses (1 point). Sara has her personal savings and some external income deem her grandparents. This is called "cash in hand" asset. Yes the asset is equal to 3 months of operating expenses even though Sara has more. Sara's operating expenses are internet, phone bill, heat, electricity, water and house rent b) How much cash assets required for 3 months of operating expenses? (1.5 points) The cash asset required for 3 months of operating expenses is approximately $716.70 2. What is the inventory? (1 point). Inventory refers to all the items, goods, merchandise, and materials held by a business for selling in the market to earn a profit. 3. What are Total Current Assets? (1 point), Total current assets is the aggregate amount of all cash, receivables, prepaid expenses, and inventory on an organizations balance sheet. 4. What are Long-Term Assets? Equipment? (1 point). Long term assets (also called fixed or capital assets) are those a business can expect to use, replace and/or convert to cash beyond the normal operating cycle of at least 12 months. a. Has Sarah correctly estimated her equipment? Is there any she may have left out? Is there anything she may have included incorrectly? (2 points - note you do not need to correct any problems - just point them out). No, Sara has estimated all the equipment, she does have have anything left out and has not included anything Incorrectly 5. What are Total Assets? (1 point) Total assets refers to the total amount of assets owed by a person or entity 6. What is Sarah's capital investment into the company the equity she is putting in? (1.5 points) Saras capital invested into the company is $15000 7. We are planning on a projected "balanced" bottom line. That means that Assets must equal Liabilities+Equity. What are the companies projected "Liabilities and Equity"? (1.5 points) Liability side of the Balance sheet should appear as below Capital Sarah Capital Account $ 15,000.00 Current Liabilities Rent Payable (Given). $ 2,160.00 Internet and Cell Bill Payable (Given) $312.00 ser Heat and Electricity (Given) $ 504.00 $ 2,976.00 ** The Internet and Cell Bill doesn't total up Given $169.00 Month Calculated for 12 Months $ 2,028.00 Annual 10% $202.80 for Sarah's Business Given $16.90 per month. This is considered for Calculation Given for 12 Months $312.00 Annual This is considered for Calculation for Sarah's Business 8. What dollar amount should Sarah seek as a bank loan? (2 points) Capital Reconciliation Capital Invested. $15,000.00 Used for Purchase of Computer $-12,000.00 Three (3) months Expenses to be paid out of Capital $-716.70 Capital Available to be used $2,283.30 Nine (9) months Expenses to be paid out of Capital $ 2,259.30 ($ 2976 - $ 716.70) Short Fall $ 24.00 Answer to Question 8 To be covered by loan Sarah is in conversation with the bank official for the loan and we assume that Equity and Liability figures is requested as on the date of the conversation and not after 3 months So, all the 12 months expense will be payable when the conversation is taken place on accrual basis 9. What are the current liabilities? (1 point). Current liabilities are short term debt of a company that must settle in one year with cash. Current liability are banks over draft, creditors, bills payable etc. I INCOME STATEMENT How much revenue to expect for the first year? You: How much do you think your sales will be this year? Sarah: $111,090.00 You: And how did you estimate this? Sarah: I charge $35/hour for personal training and $20/hour per person for group training (with a minimum of 6 people in the group). My current clientele base (20 hours a week) was achieved without any marketing. Therefore, I estimate I can get work 35 hours a week with marketing. Right now 60% of my hours are personal training and 40% is group training. I estimate working 46 weeks of the year - that's 6 weeks for vacation, sick days, etc. Here is my Excel chart I did. Hours Rate Weekly Total $ 735.00 21 $ 35.00 14 $ 120.00 $ 1,680.00 $ 2,415.00 Yearly (weekly * 46) $ 111,090.00 What are your direct expenses? You: What are your direct expenses? For each hour you work - what does it cost you? Sarah: Costs include travel (gas, wear on my car, insurance), entry fees (eg, to parks, etc.). I do the training at people's homes and outside. So my costs are pretty low. And I own a lot of recreation equipment I use, or the clients have their own. I have had to rent some equipment. Right now, my costs have been $200 a week for 20 hours of work. So for 35 hours a week, I estimate it to be $350. So, over 46 weeks, l estimate my yearly costs to be $16,100. How much do you expect your operating expenses will be? (REPEAT - BUT YOU ALSO REQUIRE THIS INFORMATION FOR INCOME STATEMENT) You: Tell me, how much do you expect your operating expenses will be? How much to run the business even if you had clients? Sarah: I will be running the business out of my home. So I am estimating 10% of my household expenses for the business. . . My mortgage, "rent", is $1800/month. So that would be $180 a month or $2160/year (10%). I need internet and cell phone. Cell phone is $80/month. Roger's internet, fastest speed, is $89/ month. So that's $3,120 a year. 10% of that is $312 per year. Heat/Electricity/Water is $420 a month. So that's $42 a month (10%) or $504 per year. What sort of bank loan do you expect? You: Above, in Question 8, we estimated that you should ask the bank for a loan of $XXX. What terms and interest rate do you expect? I Sarah: For that size of a loan, I would like to ask for a loan for 1 year as I think I can pay it back. I have looked at lines of credit. I think I can get an interest rate ranging between 7% and 10%. So I will estimate this cost at 8,5% - the middle of that range. FIT FORWARD PROJECTED INCOME STATEMENT REVENUE $ 22 Question 1072 Cost of Goods Sold $ ?? Question 11 ?? Gross Profit $ ?? Question 12 ?? GROSS PROFIT MARGIN $ ?? Question 13 ?? EXPENSES Overhead Expenses (Indirect/Fixed): Rent $?? Question 14 2? $?? Question 14?? Phone/Internet Utilities $ ?? Question 14 ?? $ ?? Question 15 ?? Interest Total Overhead Experiences $ ?? Question 16 ?? Depreciation Total Expenses $?? Question 16 ?? $ ?? Question 1772 Income before taxes $ 77 Question 18 ?? $ ?? Question 1972 Income tax expense (40%) Net Income $ ?? Question 20?? $ 27 Question 21?? Net Profit Margin Based on the information Sarah provided above, complete the Balance Sheet by answering these guided questions. Answer below each question and also fill in the Balance Sheet table above. Make sure you show ALL of your work towards the answer -in words or numbers. 10. What are the revenues? (1 point). 11. What is the cost of goods sold? (1 point). 12. What is the projected Gross Profit? (1 point). 13. What is the projected Gross Profit Margin? (1 point). 14. Overhead expenses a. What are the overhead expenses (excluding interest)? (2.25 points). b. Has Sarah correctly estimated her overhead expenses? Is there any she may have left out? Is there anything she may have included incorrectly? (2 points - note you do not need to correct any problems - just point them out). 15. Based on your answer to Question 8, what are the projected interest expenses for the bank loan? (2 points) I 16. Assuming a depreciation rate of 10% each year, what is the depreciation cost for the equipment? (Use the answer to ?? Question 4 ??-regardless if there could be errors). (2 points)