please answer questions 12,14,16

these are the notes:

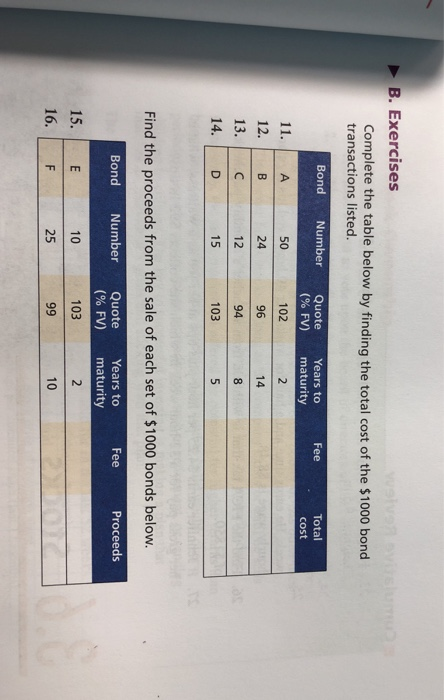

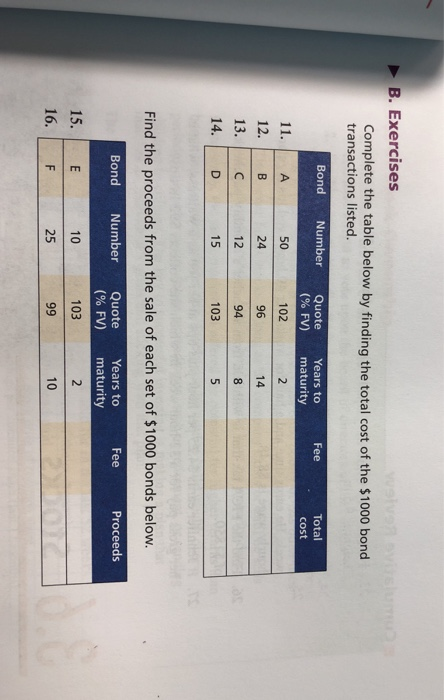

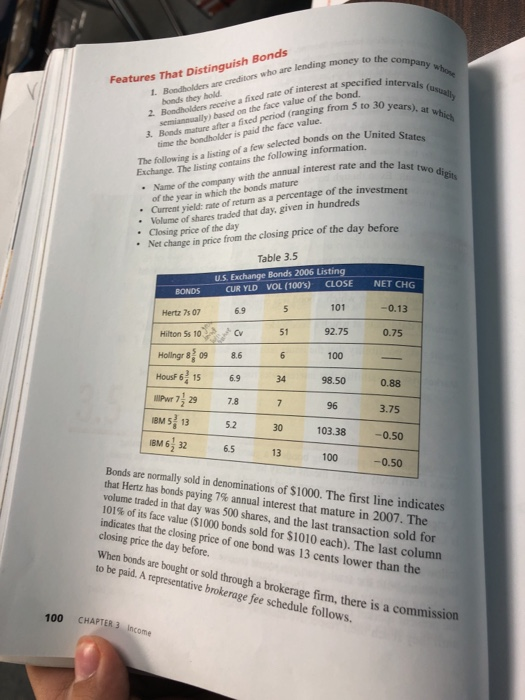

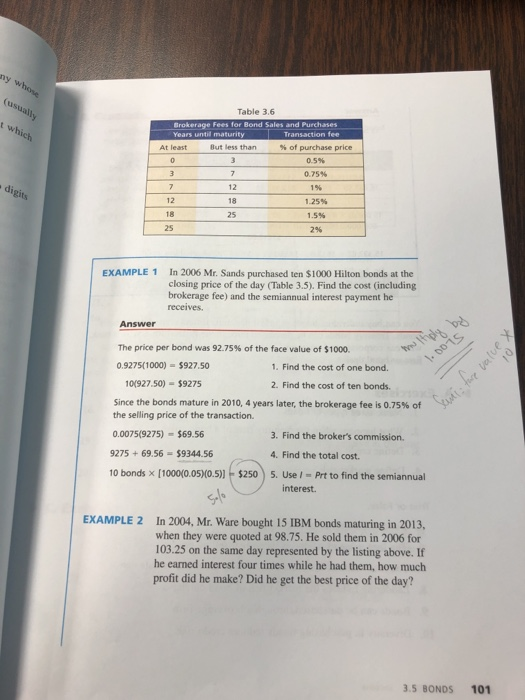

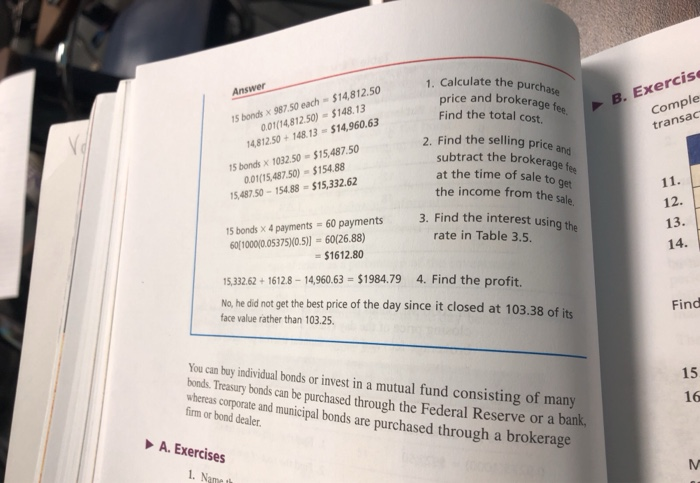

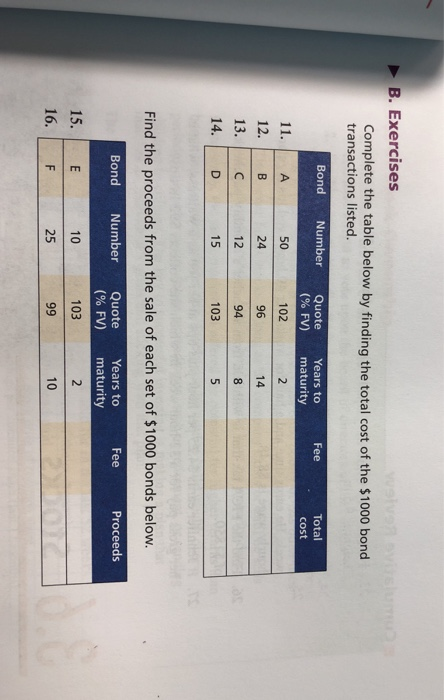

B. Exercises Complete the table below by finding the total cost of the $1000 bond transactions listed. Bond Number Fee Total cost 11. IA 50 12. B 24 13. C 12 D 15 Quote Years to (% FV) maturity 1022 9 6 D 14 94 8 103 5 14. Find the proceeds from the sale of each set of $1000 bonds below. Bond Fee Proceeds 15.E 16. F Number Quote (% FV) 10103 25 99 Years to maturity 2 10 ey to the company w intervals (usually 30 years), at which Features That Distinguish Bonds 1. Bandholders are creditors who are lending money to bonds they hold 2. Bondholders receive a niced e rate of interest at specified inter semuay) based on the face value of the bond 3. Bands mature after a fed period ranging from 5 to 30 time the bondholder is paid the face value last two digits selected bonds on the United St The following is a listing of a few sele Exchange. The listing contains the following information Name of the company wil with the annual interest rate and the las of the year in which the bonds mature Current yield rate of return as a percentage of the investmen Volume of shares traded that day, given in hundreds Closing price of the day Ner change in price from the closing price of the day before Table 3.5 U.S. Exchange Bonds 2006 Listing CUR YLD VOL (100's) CLOSE NET CHG BONDS 5 101 -0.13 51 92.75 0.75 69 C V 8.6 6.9 100 Hertz 7s07 Hilton Ss 10 Holingr 809 HousF 6 15 Pr7 2 IBM 513 98.50 0.88 96 78 52 3.75 103.38 -0.50 IBM 6 32 6.5 13 100 -0.50 Bonds are normally sold in denominations of $1000. The first line indicates that Hertz has bonds paying 7% annual interest that mature in 2007. The volume traded in that day was 500 shares, and the last transaction sold for 101% of its face value (51000 bonds sold for $1010 each). The last column indicates that the closing price of one bond was 13 cents lower than the closing price the day before. When bonds are bought or sold through a brokerage firm, there is a commission to be paid. A representative brokerage fee schedule follows. 100 CHAPTER 3 Income my whose I which Table 3.6 Brokerage Fees for Bond Sales and Purchases Years until maturity Transaction fee At least but less than % of purchase price 3 0.5% 0 digits 12 18 18 25 1.25% 1.5% EXAMPLE 1 in 2006 Mr. Sands purchased ten $1000 Hilton bonds at the closing price of the day (Table 3.5). Find the cost (including brokerage fee) and the semiannual interest payment he receives. Answer wirdy 1.oots 01 The price per bond was 92.75% of the face value of $1000. 0.9275(1000) = $927.50 1. Find the cost of one bond. 10(927.50) - $9275 2. Find the cost of ten bonds. Since the bonds mature in 2010, 4 years later, the brokerage fee is 0.75% of the selling price of the transaction. 0.0075(9275) = $69.56 3. Find the broker's commission. 9275 + 69.56 = 59344.56 4. Find the total cost. 10 bonds x (1000(0.05)(0.5) -- $250 5. Use / -Prt to find the semiannual interest EXAMPLE 2 In 2004, Mr. Ware bought 15 IBM bonds maturing in 2013, when they were quoted at 98.75. He sold them in 2006 for 103.25 on the same day represented by the listing above. If he earned interest four times while he had them, how much profit did he make? Did he get the best price of the day? 3.5 BONDS 101 Answer 1. Calculate the purchase price and brokerage to Find the total cost. B. Exercise Comple transac 15 bonds x 987.50 each - 514,812.50 0.01/14,812.50) - 5148.13 14,812.50 + 148.13 $14,960.63 15 bonds x 1032.50 - $15.487.50 0.01(15,487.50) - $154.88 2. Find the selling price an subtract the brokerage fee at the time of sale to get the income from the sale 15,487.50 - 154.88 - 515,332.62 15 bonds x 4 payments = 60 payments 60[100010.05375)(0.5)) - 60(26.88) 3. Find the interest using the rate in Table 3.5. = $1612.80 15,332.62 + 1612,8 - 14,960.63 = $1984.79 4. Find the profit. No, he did not get the best price of the day since it closed at 103.38 of its face value rather than 103.25. Find 15 You can buy individual bonds or invest in a mutual fund consisting of many bonds. Treasury bonds can be purchased through the Federal Reserve or a bank, whereas corporate and municipal bonds are purchased through a brokerage firm or bond dealer. 16 A. Exercises 1. Name the