Answered step by step

Verified Expert Solution

Question

1 Approved Answer

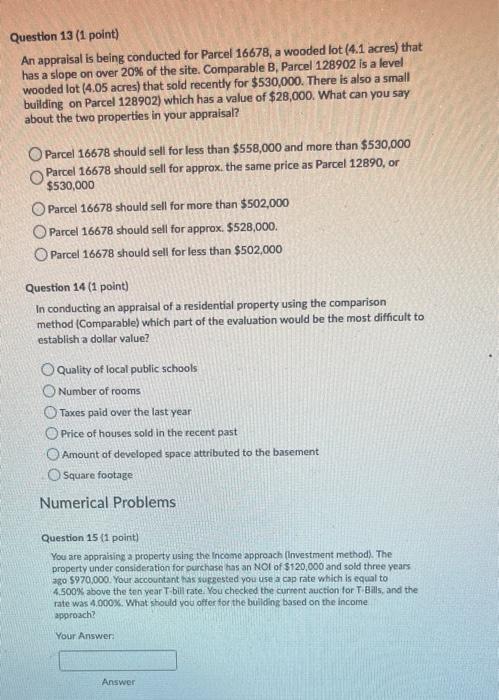

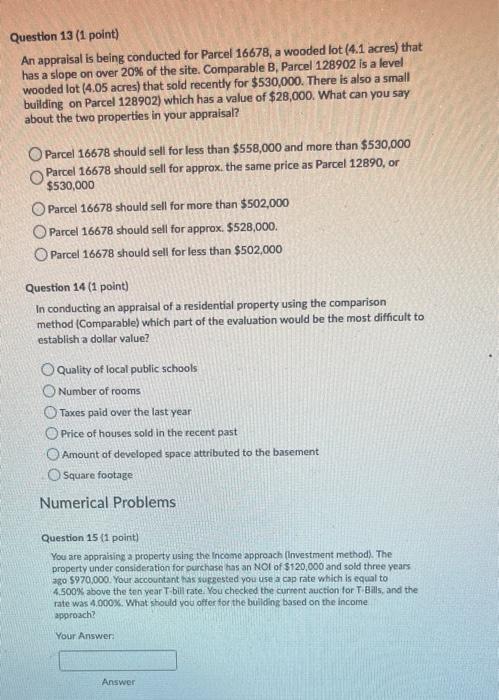

please answer questions #13-15 thanks Question 13 (1 point) An appraisal is being conducted for Parcel 16678, a wooded lot (4.1 acres) that has a

please answer questions #13-15 thanks

Question 13 (1 point) An appraisal is being conducted for Parcel 16678, a wooded lot (4.1 acres) that has a slope on over 20% of the site. Comparable B. Parcel 128902 is a level wooded lot (4.05 acres) that sold recently for $530,000. There is also a small building on Parcel 128902) which has a value of $28,000. What can you say about the two properties in your appraisal? O Parcel 16678 should sell for less than $558,000 and more than $530,000 Parcel 16678 should sell for approx. the same price as Parcel 12890, or $530,000 Parcel 16678 should sell for more than $502,000 O Parcel 16678 should sell for approx. $528,000. O Parcel 16678 should sell for less than $502,000 Question 14 (1 point) In conducting an appraisal of a residential property using the comparison method (Comparable) which part of the evaluation would be the most difficult to establish a dollar value? Quality of local public schools Number of rooms Taxes paid over the last year Price of houses sold in the recent past Amount of developed space attributed to the basement Square footage Numerical Problems Question 15 (1 point) You are appraising a property using the Income approach (Investment method). The property under consideration for purchase has an NOI of $120,000 and sold three years ago $970.000. Your accountant has suggested you use a cap rate which is equal to 4.500% above the ten year T-bill rate. You checked the current auction for Bills, and the rate was 4.000%. What should you offer for the building based on the income approach Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started