Please answer questions 1-4. Thank you

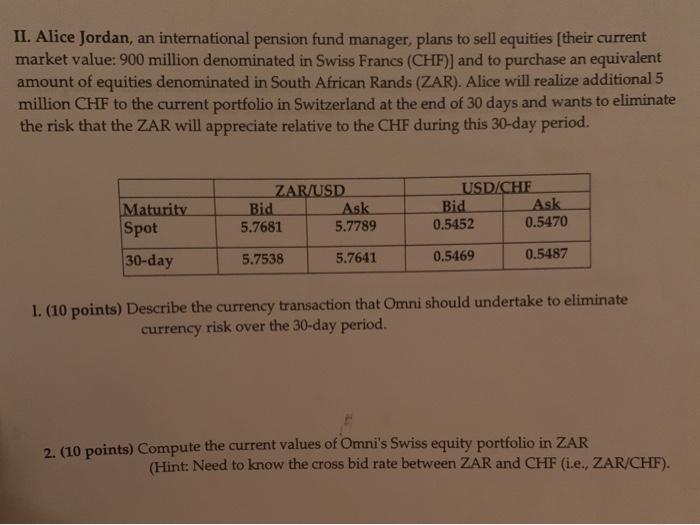

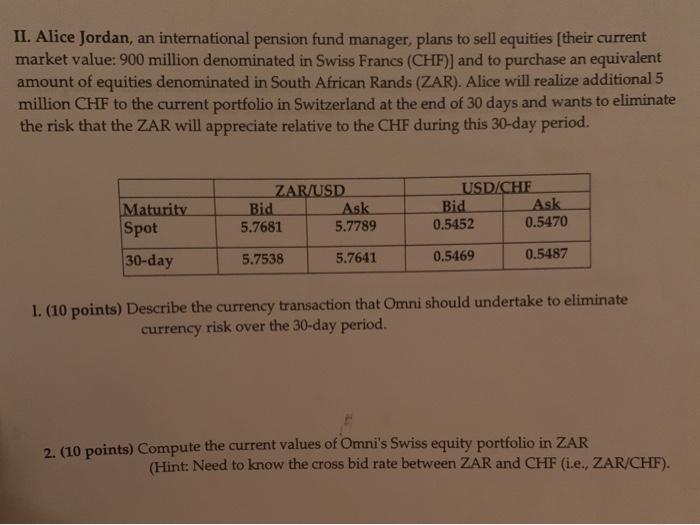

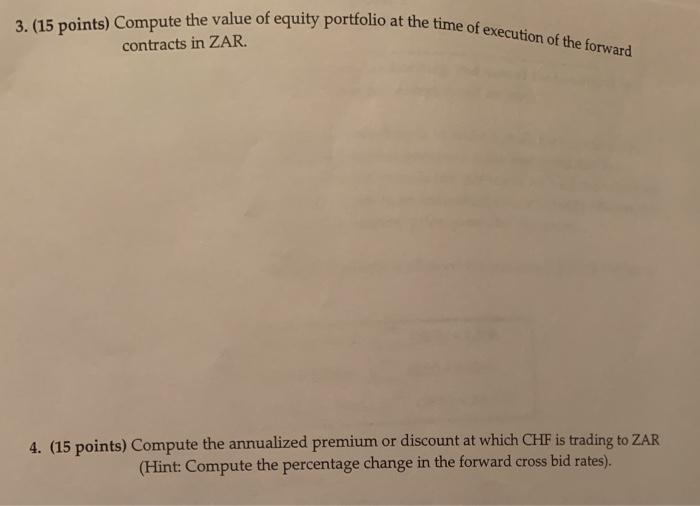

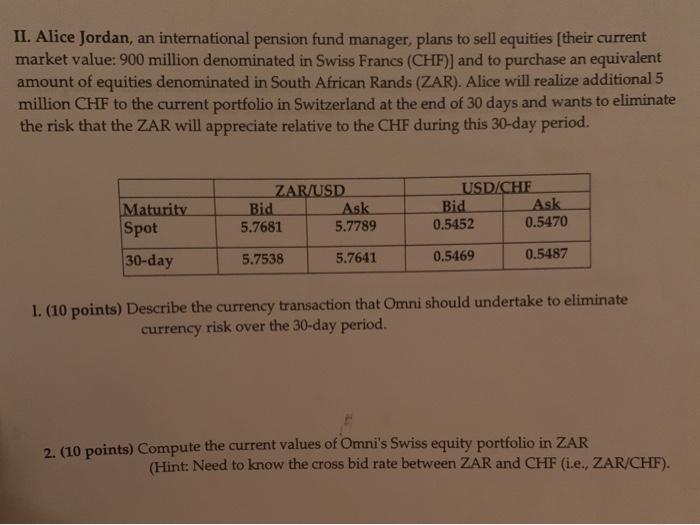

II. Alice Jordan, an international pension fund manager, plans to sell equities (their current market value: 900 million denominated in Swiss Franc (CHF)] and to purchase an equivalent amount of equities denominated in South African Rand (ZAR). Alice will realize additional 5 million CHF to the current portfolio in Switzerland at the end of 30 days and wants to eliminate the risk that the ZAR will appreciate relative to the CHF during this 30-day period. Maturity Spot ZAR/USD Bid Ask 5.7681 5.7789 USD CHE Bid Ask 0.5452 0.5470 30-day 5.7538 5.7641 0.5469 0.5487 1. (10 points) Describe the currency transaction that Omni should undertake to eliminate currency risk over the 30-day period. 2. (10 points) Compute the current values of Omni's Swiss equity portfolio in ZAR (Hint: Need to know the cross bid rate between ZAR and CHF (i.e., ZAR/CHF). 3. (15 points) Compute the value of equity portfolio at the time of execution of the forward contracts in ZAR. 4. (15 points) Compute the annualized premium or discount at which CHF is trading to ZAR (Hint: Compute the percentage change in the forward cross bid rates). II. Alice Jordan, an international pension fund manager, plans to sell equities (their current market value: 900 million denominated in Swiss Franc (CHF)] and to purchase an equivalent amount of equities denominated in South African Rand (ZAR). Alice will realize additional 5 million CHF to the current portfolio in Switzerland at the end of 30 days and wants to eliminate the risk that the ZAR will appreciate relative to the CHF during this 30-day period. Maturity Spot ZAR/USD Bid Ask 5.7681 5.7789 USD CHE Bid Ask 0.5452 0.5470 30-day 5.7538 5.7641 0.5469 0.5487 1. (10 points) Describe the currency transaction that Omni should undertake to eliminate currency risk over the 30-day period. 2. (10 points) Compute the current values of Omni's Swiss equity portfolio in ZAR (Hint: Need to know the cross bid rate between ZAR and CHF (i.e., ZAR/CHF). 3. (15 points) Compute the value of equity portfolio at the time of execution of the forward contracts in ZAR. 4. (15 points) Compute the annualized premium or discount at which CHF is trading to ZAR (Hint: Compute the percentage change in the forward cross bid rates)