Answered step by step

Verified Expert Solution

Question

1 Approved Answer

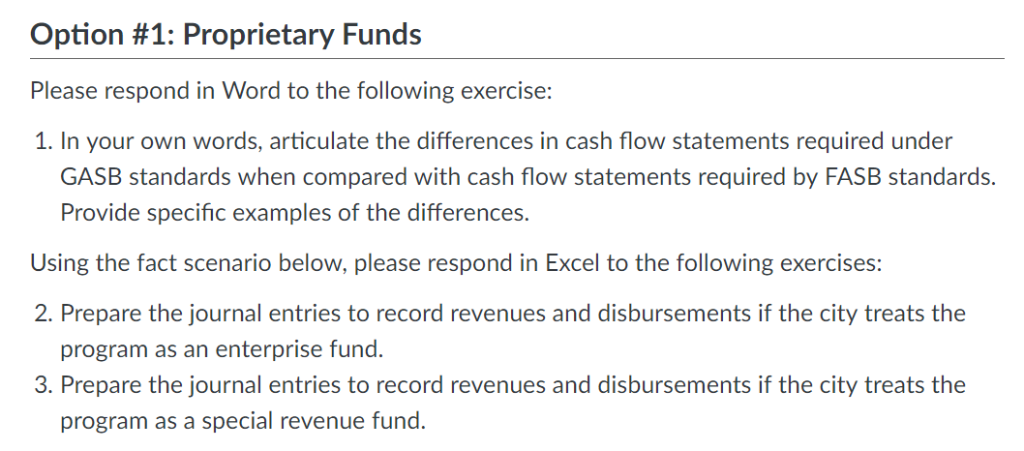

Please answer questions 2 & 3 (journal entries). Thanks. Option #1: Proprietary Funds Please respond in Word to the following exercise: 1. In your own

Please answer questions 2 & 3 (journal entries). Thanks.

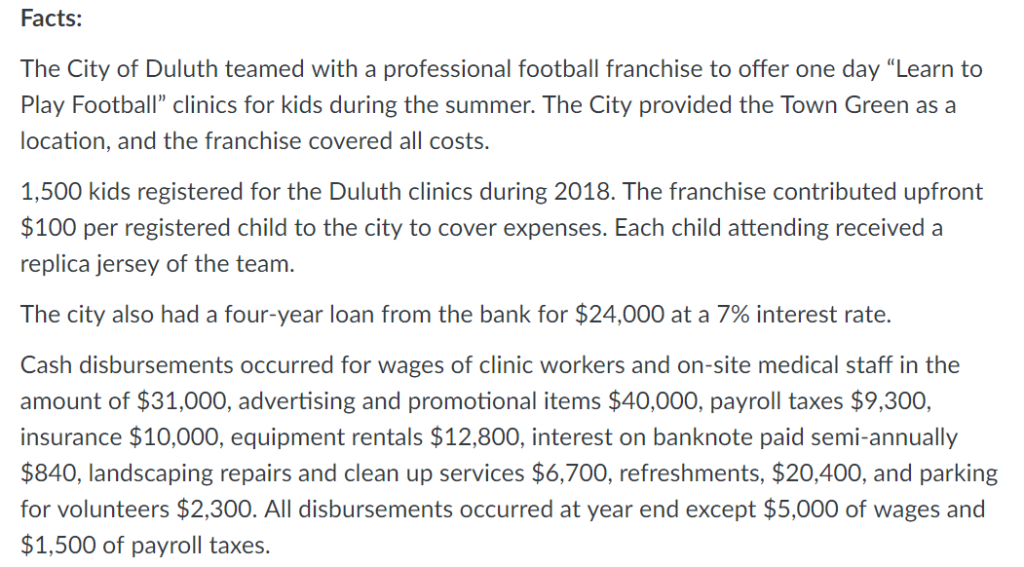

Option #1: Proprietary Funds Please respond in Word to the following exercise: 1. In your own words, articulate the differences in cash flow statements required under GASB standards when compared with cash flow statements required by FASB standards Provide specific examples of the differences. Using the fact scenario below, please respond in Excel to the following exercises: 2. Prepare the journal entries to record revenues and disbursements if the city treats the 3. Prepare the journal entries to record revenues and disbursements if the city treats the program as an enterprise fund. program as a special revenue fund. Facts: The City of Duluth teamed with a professional football franchise to offer one day "Learn to Play Football" clinics for kids during the summer. The City provided the Town Green as a location, and the franchise covered all costs. 1,500 kids registered for the Duluth clinics during 2018. The franchise contributed upfront $100 per registered child to the city to cover expenses. Each child attending received a replica jersey of the team The city also had a four-year loan from the bank for $24,000 at a 7% interest rate. Cash disbursements occurred for wages of clinic workers and on-site medical staff in the amount of $31,000, advertising and promotional items $40,000, payroll taxes $9,300, insurance $10,000, equipment rentals $12,800, interest on banknote paid semi-annually $840, landscaping repairs and clean up services $6,700, refreshments, $20,400, and parking for volunteers $2,300. All disbursements occurred at year end except $5,000 of wages and $1,500 of payroll taxes. Option #1: Proprietary Funds Please respond in Word to the following exercise: 1. In your own words, articulate the differences in cash flow statements required under GASB standards when compared with cash flow statements required by FASB standards Provide specific examples of the differences. Using the fact scenario below, please respond in Excel to the following exercises: 2. Prepare the journal entries to record revenues and disbursements if the city treats the 3. Prepare the journal entries to record revenues and disbursements if the city treats the program as an enterprise fund. program as a special revenue fund. Facts: The City of Duluth teamed with a professional football franchise to offer one day "Learn to Play Football" clinics for kids during the summer. The City provided the Town Green as a location, and the franchise covered all costs. 1,500 kids registered for the Duluth clinics during 2018. The franchise contributed upfront $100 per registered child to the city to cover expenses. Each child attending received a replica jersey of the team The city also had a four-year loan from the bank for $24,000 at a 7% interest rate. Cash disbursements occurred for wages of clinic workers and on-site medical staff in the amount of $31,000, advertising and promotional items $40,000, payroll taxes $9,300, insurance $10,000, equipment rentals $12,800, interest on banknote paid semi-annually $840, landscaping repairs and clean up services $6,700, refreshments, $20,400, and parking for volunteers $2,300. All disbursements occurred at year end except $5,000 of wages and $1,500 of payroll taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started