Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer QUESTIONS 8,10,12 AND 14 ONLY thank u A corporate bond is priced at $959.25. It has a coupon rate of 3.5%, matures in

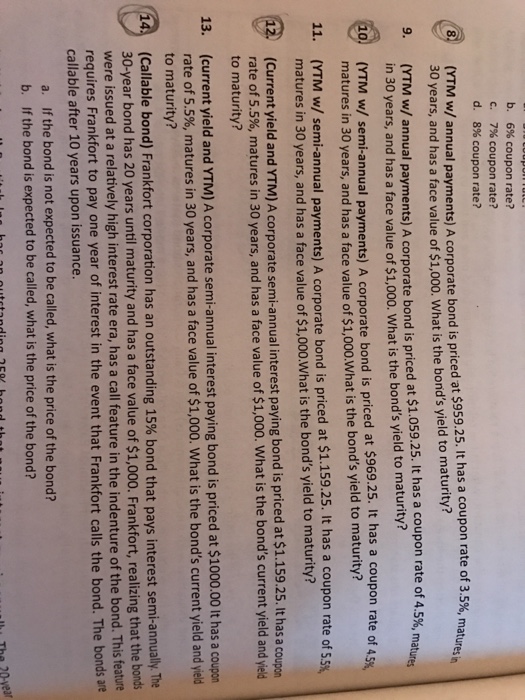

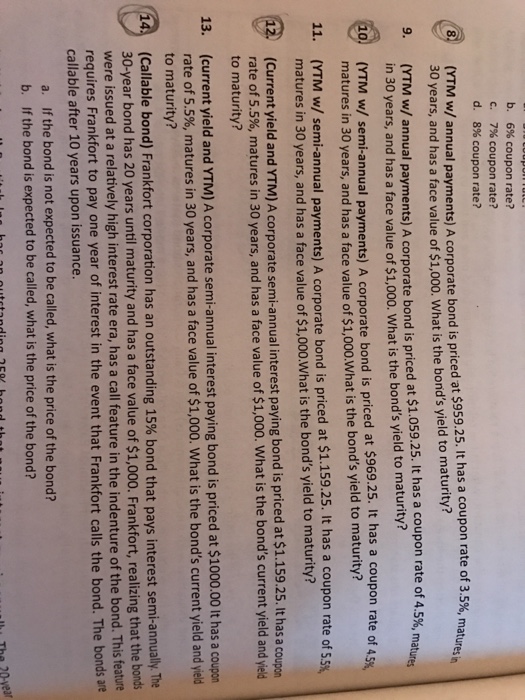

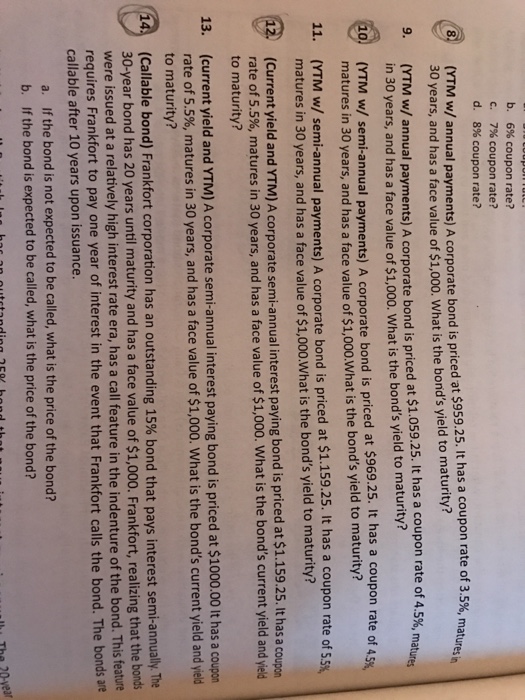

Please answer QUESTIONS 8,10,12 AND 14 ONLY thank u  A corporate bond is priced at $959.25. It has a coupon rate of 3.5%, matures in 30 years, and has a face value of $1,000. What is the bond's yield to maturity? A corporate bond is priced at $1,059.25. It has a coupon rate of 4.5%, matures in 30 years, and has a face value of $1,000. What is the bond's yield to maturity? A corporate bond is priced at $969.25. It has a coupon rate of 4.5% matures in 30 years, and has a face value of $1,000. What is the bond's yield to maturity? A corporate bond is priced at $1, 159.25. It has a coupon rate of 5.5% matures in 30 years, and has a face value of $1,000. What is the bond's yield to maturity? A corporate semi-annual interest paying bond is priced at $1, 159.25. It has a coupon rate of 5.5%, matures in 30 years, and has a face value of $1,000. What is the bond's current yield and yield to maturity? A corporate semi-annual interest paying bond is priced at $1000.00. It has a coupon rate of 5.5%, matures in 30 years, and has a face value of $1,000. What is the bond's current yield and yield to maturity? Frankfort corporation has an outstanding 15% bond that pays interest semi-annually. The 30-year bond has 20 years until maturity and has a face value of $1,000. Frankfort, realizing that the bonds were issued at a relatively high interest rate era, has a call feature in the indenture of the bond. This feature requires Frankfort to pay one year of interest in the event that Frankfort calls the bond. The bonds are callable after 10 years upon issuance. a. If the bond is not expected to be called, what is the price of the bond? b. If the bond is expected to be called, what is the price of the bond

A corporate bond is priced at $959.25. It has a coupon rate of 3.5%, matures in 30 years, and has a face value of $1,000. What is the bond's yield to maturity? A corporate bond is priced at $1,059.25. It has a coupon rate of 4.5%, matures in 30 years, and has a face value of $1,000. What is the bond's yield to maturity? A corporate bond is priced at $969.25. It has a coupon rate of 4.5% matures in 30 years, and has a face value of $1,000. What is the bond's yield to maturity? A corporate bond is priced at $1, 159.25. It has a coupon rate of 5.5% matures in 30 years, and has a face value of $1,000. What is the bond's yield to maturity? A corporate semi-annual interest paying bond is priced at $1, 159.25. It has a coupon rate of 5.5%, matures in 30 years, and has a face value of $1,000. What is the bond's current yield and yield to maturity? A corporate semi-annual interest paying bond is priced at $1000.00. It has a coupon rate of 5.5%, matures in 30 years, and has a face value of $1,000. What is the bond's current yield and yield to maturity? Frankfort corporation has an outstanding 15% bond that pays interest semi-annually. The 30-year bond has 20 years until maturity and has a face value of $1,000. Frankfort, realizing that the bonds were issued at a relatively high interest rate era, has a call feature in the indenture of the bond. This feature requires Frankfort to pay one year of interest in the event that Frankfort calls the bond. The bonds are callable after 10 years upon issuance. a. If the bond is not expected to be called, what is the price of the bond? b. If the bond is expected to be called, what is the price of the bond

Please answer QUESTIONS 8,10,12 AND 14 ONLY thank u

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started