Answered step by step

Verified Expert Solution

Question

1 Approved Answer

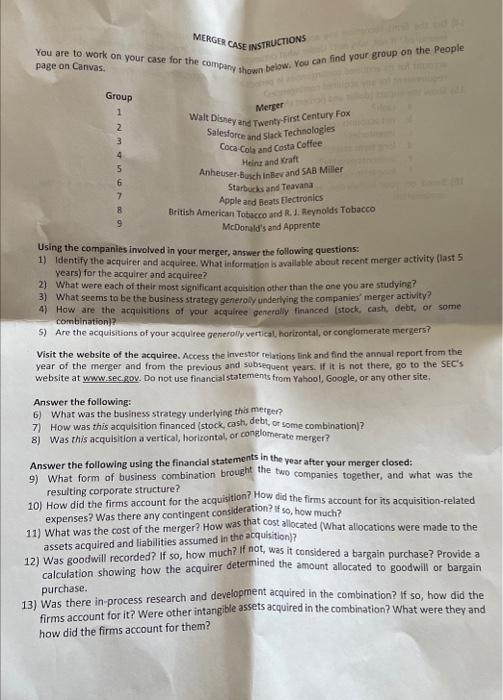

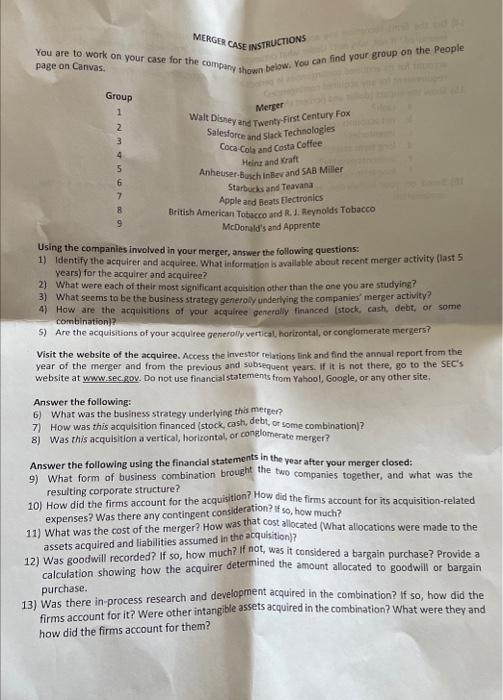

please answer questions 9,10,11 and 12, for group 1- Walt Disney and 21st century fox. MERGER CASE INTHUCTIONS You are to work on your case

please answer questions 9,10,11 and 12, for group 1- Walt Disney and 21st century fox.

MERGER CASE INTHUCTIONS You are to work on your case for the compary shown beiaw. You can find your group on the People page on Canvas. Using the companies involved in your merger, answer the following questions: 1) Identify the acquirer and acquiree. What infotration b avaliable about recent merger activity (last 5 . years) for the acquirer and acquiree? 2) What were each of the if most significant a cquaition other than the one you are studying? 3) What seems to be the business strategy generoly underlying the companies' merger activity? 4) How are the acqulsitions of your acaulfee generaliy fianced (stock, cash, debit, of some combination)? 5) Are the acquisitions of your acquiree generony vertical horizontal, or conglomerate mergers? Visit the website of the acquiree. Access the investor relations link and find the annual report from the year of the merger and from the previous and subsequent years. If it is not there, go to the SEC's website at www.secgov. Do not use financialstatements from Yahool, Google, or ary other site. Answer the following: 6) What was the business strategy undertying this merger? 7) How was this acquisition financed (stock, cast, debt, or some combination)? 8) Was this acquisition a vertical, horizontol, of conglomerate merger? Answer the following using the financial statements in the year after your merger closed: 9) What form of business combination brought the two companies together, and what was the resulting corporate structure? 10) How did the firms account for the acquistion? How did the firms account for its acquisition-related expenses? Was there any contingent consideration? if so, how much? 11) What was the cost of the merger? How was that cost allocated (What allocations were made to the assets acquired and liablities assumed in thn acquisition)? 12) Was goodwill recorded? If so, how much? If not, was it considered a bargain purchase? Provide a calculation showing how the acquiref determined the amount allocated to goodwill or bargain purchase. 13) Was there in-process research and development acquired in the combination? If 50 , how did the firms account for it? Were other intangible assets acquired in the combination? What were they and how did the firms account for them? MERGER CASE INTHUCTIONS You are to work on your case for the compary shown beiaw. You can find your group on the People page on Canvas. Using the companies involved in your merger, answer the following questions: 1) Identify the acquirer and acquiree. What infotration b avaliable about recent merger activity (last 5 . years) for the acquirer and acquiree? 2) What were each of the if most significant a cquaition other than the one you are studying? 3) What seems to be the business strategy generoly underlying the companies' merger activity? 4) How are the acqulsitions of your acaulfee generaliy fianced (stock, cash, debit, of some combination)? 5) Are the acquisitions of your acquiree generony vertical horizontal, or conglomerate mergers? Visit the website of the acquiree. Access the investor relations link and find the annual report from the year of the merger and from the previous and subsequent years. If it is not there, go to the SEC's website at www.secgov. Do not use financialstatements from Yahool, Google, or ary other site. Answer the following: 6) What was the business strategy undertying this merger? 7) How was this acquisition financed (stock, cast, debt, or some combination)? 8) Was this acquisition a vertical, horizontol, of conglomerate merger? Answer the following using the financial statements in the year after your merger closed: 9) What form of business combination brought the two companies together, and what was the resulting corporate structure? 10) How did the firms account for the acquistion? How did the firms account for its acquisition-related expenses? Was there any contingent consideration? if so, how much? 11) What was the cost of the merger? How was that cost allocated (What allocations were made to the assets acquired and liablities assumed in thn acquisition)? 12) Was goodwill recorded? If so, how much? If not, was it considered a bargain purchase? Provide a calculation showing how the acquiref determined the amount allocated to goodwill or bargain purchase. 13) Was there in-process research and development acquired in the combination? If 50 , how did the firms account for it? Were other intangible assets acquired in the combination? What were they and how did the firms account for them

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started