Answered step by step

Verified Expert Solution

Question

1 Approved Answer

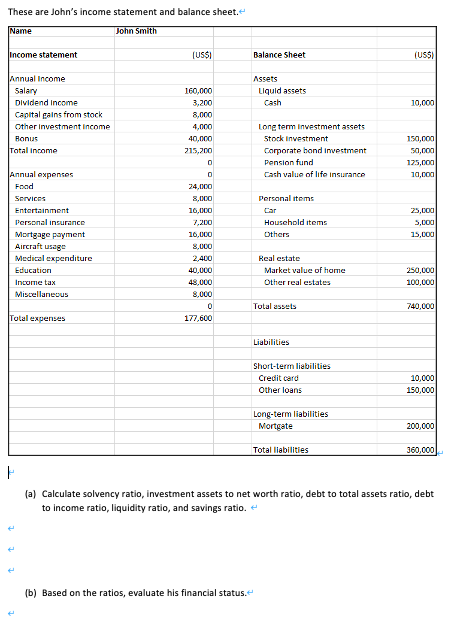

Please answer questions a and b with detailed steps. Thanks These are John's income statement and balance sheet. Name John Smith Income statement (US$1 Balance

Please answer questions a and b with detailed steps. Thanks

These are John's income statement and balance sheet. Name John Smith Income statement (US$1 Balance Sheet (US$) Assets Liquid assets Cash 10,000 Annual Income Salary Dividend Income Capital gains from stock Other investment income Bonus Total income 160,000 3,200 8.000 4,000 40,000 215,200 0 Lone term investment assets Stock investment Corporate bond investment Pension fund Cash value of life insurance 150,000 50,000 175,000 10,000 Annual expenses Foad Services Entertainment Personal insurance Mortgage payment Aircraft usage Medical expenditure Education Income tax Miscellaneous Personal items Car Household items Others 25,000 5,000 15,000 0 24.000 8,000 16,000 7,200 10.000 8,000 2.400 40.000 48.000 8,000 0 177,600 Real estate Market value of home Other real estates 250,000 100,000 Total assets 740,000 Total expenses Liabilities Short-term liabilities Credit card Other loans 10.000 150,000 Long-term liabilities Mortgate 200,000 Total liabilities 360,000 (a) Calculate solvency ratio, investment assets to net worth ratio, debt to total assets ratio, debt to income ratio, liquidity ratio, and savings ratio. (b) Based on the ratios, evaluate his financial status. These are John's income statement and balance sheet. Name John Smith Income statement (US$1 Balance Sheet (US$) Assets Liquid assets Cash 10,000 Annual Income Salary Dividend Income Capital gains from stock Other investment income Bonus Total income 160,000 3,200 8.000 4,000 40,000 215,200 0 Lone term investment assets Stock investment Corporate bond investment Pension fund Cash value of life insurance 150,000 50,000 175,000 10,000 Annual expenses Foad Services Entertainment Personal insurance Mortgage payment Aircraft usage Medical expenditure Education Income tax Miscellaneous Personal items Car Household items Others 25,000 5,000 15,000 0 24.000 8,000 16,000 7,200 10.000 8,000 2.400 40.000 48.000 8,000 0 177,600 Real estate Market value of home Other real estates 250,000 100,000 Total assets 740,000 Total expenses Liabilities Short-term liabilities Credit card Other loans 10.000 150,000 Long-term liabilities Mortgate 200,000 Total liabilities 360,000 (a) Calculate solvency ratio, investment assets to net worth ratio, debt to total assets ratio, debt to income ratio, liquidity ratio, and savings ratio. (b) Based on the ratios, evaluate his financial statusStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started