please answer questions as detail as possible.

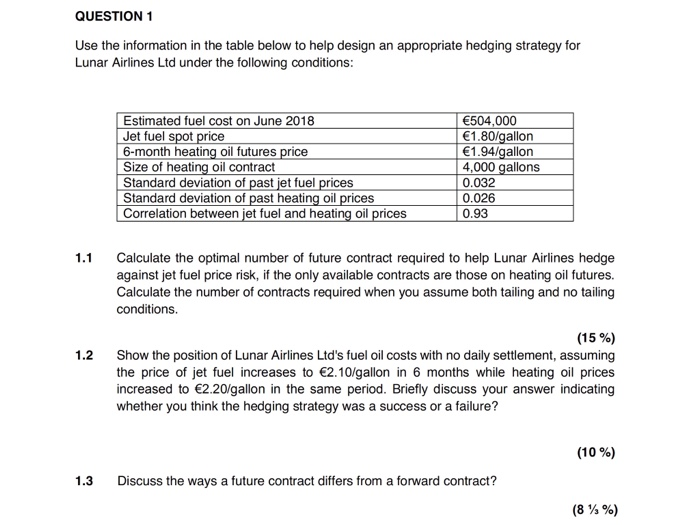

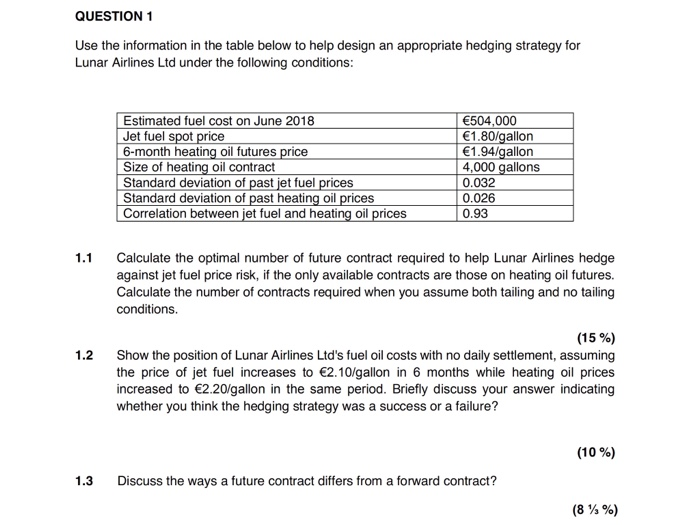

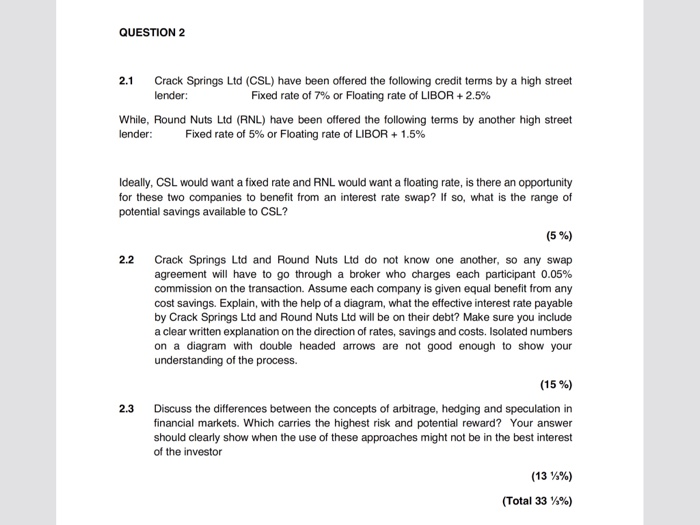

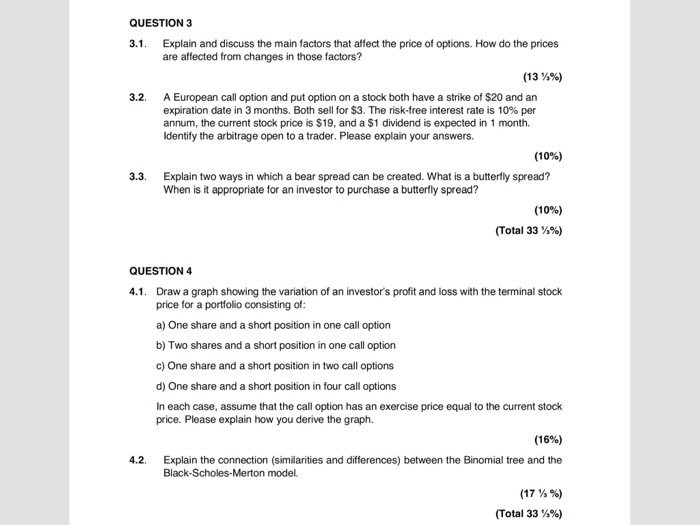

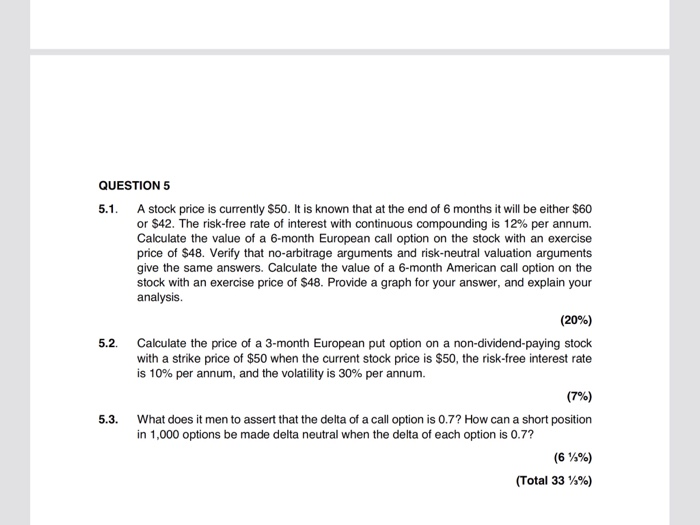

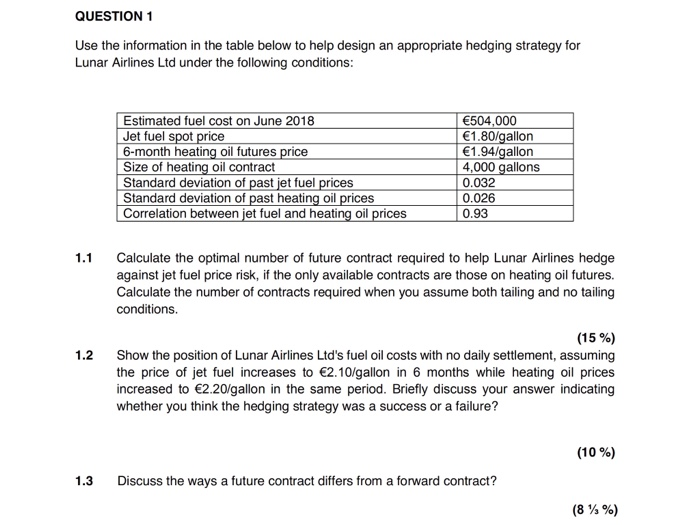

QUESTION 1 Use the information in the table below to help design an appropriate hedging strategy for Lunar Airlines Ltd under the following conditions Estimated fuel cost on June 2018 Jet fuel s 6-month heating oil futures p Size of heating oil contract Standard deviation of past jet fuel prices Standard deviation of past heating oil prices Correlation between jet fuel and heating oil prices 504,000 1.80/gallon 1.94/gallon 4,000 gallons 0.032 0.026 0.93 rice 1.1 Calculate the optimal number of future contract required to help Lunar Airlines hedge against jet fuel price risk, if the only available contracts are those on heating oil futures. Calculate the number of contracts required when you assume both tailing and no tailing conditions. (15 %) 1.2 Show the position of Lunar Airlines Ltd's fuel oil costs with no daily settlement, assuming the price of jet fuel increases to 2.10/gallon in 6 months while heating oil prices increased to 2.20/gallon in the same period. Briefly discuss your answer indicating whether you think the hedging strategy was a success or a failure? (10 %) 1.3 Discuss the ways a future contract differs from a forward contract? QUESTION 2 2.1 Crack Springs Ltd (CSL) have been offered the following credit terms by a high street lender: Fixed rate of 7% or Floating rate of LIBOR + 2.5% While, Round Nuts Ltd (RNL) have been offered the following terms by another high street lender: Fixed rate of 5% or Floating rate of LIBOR + 1.5% Ideally, CSL would want a fixed rate and RNL would want a floating rate, is there an opportunity for these two companies to benefit from an interest rate swap? If so, what is the range of potential savings available to CSL? (5%) 2.2 Crack Springs Ltd and Round Nuts Ltd do not know one another, so any swap agreement will have to go through a broker who charges each participant 0.05% commission on the transaction. Assume each company is given equal benefit from any cost savings. Explain, with the help of a diagram, what the effective interest rate payable by Crack Springs Ltd and Round Nuts Ltd will be on their debt? Make sure you include a clear written explanation on the direction of rates, savings and costs. Isolated numbers on a diagram with double headed arrows are not good enough to show your understanding of the process. (1596) 2.3 Discuss the differences between the concepts of arbitrage, hedging and speculation in financial markets. Which carries the highest risk and potential reward? Your answer should clearly show when the use of these approaches might not be in the best interest of the investor (13 %) (Total 33 %%) QUESTION 3 3.1. Explain and discuss the main factors that affect the price of options. How do the prices are affected from changes in those factors? (13 %%) 3.2. A European call option and put option on a stock both have a strike of $20 and an expiration date in 3 months. Both sell for $3. The risk-free interest rate is 10% per annum, the current stock price is $19, and a $1 dividend is expected in 1 month. Identify the arbitrage open to a trader. Please explain your answers. (10%) 3.3. Explain two ways in which a bear spread can be created. What is a butterfly spread? When is it appropriate for an investor to purchase a butterfly spread? (10%) (Total 33%%) QUESTION 4 4.1. Draw a graph showing the variation of an investor's profit and loss with the terminal stock price for a portfolio consisting of a) One share and a short position in one call option b) Two shares and a short position in one call option c) One share and a short position in two call options d) One share and a short position in four call options In each case, assume that the call option has an exercise price equal to the current stock price. Please explain how you derive the graph. (16%) 4.2. Explain the connection (similarities and differences) between the Binomial tree and the Black-Scholes-Merton model. (17 %) (Total 33%%) QUESTION 5 5.1. A stock price is currently $50. It is known that at the end of 6 months it will be either $60 or $42. The risk-free rate of interest with continuous compounding is 12% per annum. Calculate the value of a 6-month European call option on the stock with an exercise price of $48. Verify that no-arbitrage arguments and risk-neutral valuation arguments give the same answers. Calculate the value of a 6-month American call option on the stock with an exercise price of $48. Provide a graph for your answer, and explain your analysis. (20%) 5.2. Calculate the price of a 3-month European put option on a non-dividend-paying stock with a strike price of $50 when the current stock price is $50, the risk-free interest rate is 10% per annum, and the volatility is 30% per annum. (7%) 5.3. What does it men to assert that the delta of a call option is 0.7? How can a short position in 1,000 options be made delta neutral when the delta of each option is 0.7? (Total 33 %%) QUESTION 1 Use the information in the table below to help design an appropriate hedging strategy for Lunar Airlines Ltd under the following conditions Estimated fuel cost on June 2018 Jet fuel s 6-month heating oil futures p Size of heating oil contract Standard deviation of past jet fuel prices Standard deviation of past heating oil prices Correlation between jet fuel and heating oil prices 504,000 1.80/gallon 1.94/gallon 4,000 gallons 0.032 0.026 0.93 rice 1.1 Calculate the optimal number of future contract required to help Lunar Airlines hedge against jet fuel price risk, if the only available contracts are those on heating oil futures. Calculate the number of contracts required when you assume both tailing and no tailing conditions. (15 %) 1.2 Show the position of Lunar Airlines Ltd's fuel oil costs with no daily settlement, assuming the price of jet fuel increases to 2.10/gallon in 6 months while heating oil prices increased to 2.20/gallon in the same period. Briefly discuss your answer indicating whether you think the hedging strategy was a success or a failure? (10 %) 1.3 Discuss the ways a future contract differs from a forward contract? QUESTION 2 2.1 Crack Springs Ltd (CSL) have been offered the following credit terms by a high street lender: Fixed rate of 7% or Floating rate of LIBOR + 2.5% While, Round Nuts Ltd (RNL) have been offered the following terms by another high street lender: Fixed rate of 5% or Floating rate of LIBOR + 1.5% Ideally, CSL would want a fixed rate and RNL would want a floating rate, is there an opportunity for these two companies to benefit from an interest rate swap? If so, what is the range of potential savings available to CSL? (5%) 2.2 Crack Springs Ltd and Round Nuts Ltd do not know one another, so any swap agreement will have to go through a broker who charges each participant 0.05% commission on the transaction. Assume each company is given equal benefit from any cost savings. Explain, with the help of a diagram, what the effective interest rate payable by Crack Springs Ltd and Round Nuts Ltd will be on their debt? Make sure you include a clear written explanation on the direction of rates, savings and costs. Isolated numbers on a diagram with double headed arrows are not good enough to show your understanding of the process. (1596) 2.3 Discuss the differences between the concepts of arbitrage, hedging and speculation in financial markets. Which carries the highest risk and potential reward? Your answer should clearly show when the use of these approaches might not be in the best interest of the investor (13 %) (Total 33 %%) QUESTION 3 3.1. Explain and discuss the main factors that affect the price of options. How do the prices are affected from changes in those factors? (13 %%) 3.2. A European call option and put option on a stock both have a strike of $20 and an expiration date in 3 months. Both sell for $3. The risk-free interest rate is 10% per annum, the current stock price is $19, and a $1 dividend is expected in 1 month. Identify the arbitrage open to a trader. Please explain your answers. (10%) 3.3. Explain two ways in which a bear spread can be created. What is a butterfly spread? When is it appropriate for an investor to purchase a butterfly spread? (10%) (Total 33%%) QUESTION 4 4.1. Draw a graph showing the variation of an investor's profit and loss with the terminal stock price for a portfolio consisting of a) One share and a short position in one call option b) Two shares and a short position in one call option c) One share and a short position in two call options d) One share and a short position in four call options In each case, assume that the call option has an exercise price equal to the current stock price. Please explain how you derive the graph. (16%) 4.2. Explain the connection (similarities and differences) between the Binomial tree and the Black-Scholes-Merton model. (17 %) (Total 33%%) QUESTION 5 5.1. A stock price is currently $50. It is known that at the end of 6 months it will be either $60 or $42. The risk-free rate of interest with continuous compounding is 12% per annum. Calculate the value of a 6-month European call option on the stock with an exercise price of $48. Verify that no-arbitrage arguments and risk-neutral valuation arguments give the same answers. Calculate the value of a 6-month American call option on the stock with an exercise price of $48. Provide a graph for your answer, and explain your analysis. (20%) 5.2. Calculate the price of a 3-month European put option on a non-dividend-paying stock with a strike price of $50 when the current stock price is $50, the risk-free interest rate is 10% per annum, and the volatility is 30% per annum. (7%) 5.3. What does it men to assert that the delta of a call option is 0.7? How can a short position in 1,000 options be made delta neutral when the delta of each option is 0.7? (Total 33 %%)