Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer questions B, C, D Thank you! QUESTION 1 [15 Marks] Suppose today is June 2020 and you are analyzing Arbitrage-Before-Cash (ABC) Inc. which

Please answer questions B, C, D

Thank you!

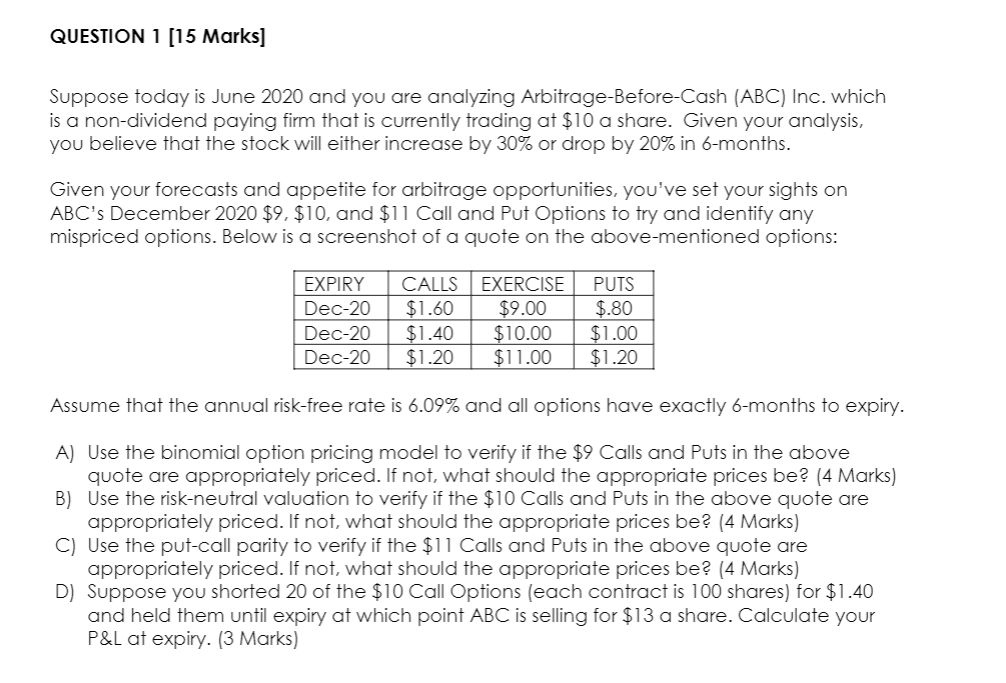

QUESTION 1 [15 Marks] Suppose today is June 2020 and you are analyzing Arbitrage-Before-Cash (ABC) Inc. which is a non-dividend paying firm that is currently trading at $10 a share. Given your analysis, you believe that the stock will either increase by 30% or drop by 20% in 6-months. Given your forecasts and appetite for arbitrage opportunities, you've set your sights on ABC's December 2020 $9, $10, and $11 Call and Put Options to try and identify any mispriced options. Below is a screenshot of a quote on the above-mentioned options: EXPIRY Dec-20 Dec-20 Dec-20 CALLS EXERCISE $1.60 $9.00 $1.40 $10.00 $1.20 $11.00 PUTS $.80 $1.00 $1.20 Assume that the annual risk-free rate is 6.09% and all options have exactly 6-months to expiry. A) Use the binomial option pricing model to verify if the $9 Calls and Puts in the above quote are appropriately priced. If not, what should the appropriate prices be? (4 Marks) B) Use the risk-neutral valuation to verify if the $10 Calls and Puts in the above quote are appropriately priced. If not, what should the appropriate prices be? (4 Marks) C) Use the put-call parity to verify if the $11 Calls and Puts in the above quote are appropriately priced. If not, what should the appropriate prices be? (4 Marks) D) Suppose you shorted 20 of the $10 Call Options (each contract is 100 shares) for $1.40 and held them until expiry at which point ABC is selling for $13 a share. Calculate your P&L at expiry. (3 Marks) QUESTION 1 [15 Marks] Suppose today is June 2020 and you are analyzing Arbitrage-Before-Cash (ABC) Inc. which is a non-dividend paying firm that is currently trading at $10 a share. Given your analysis, you believe that the stock will either increase by 30% or drop by 20% in 6-months. Given your forecasts and appetite for arbitrage opportunities, you've set your sights on ABC's December 2020 $9, $10, and $11 Call and Put Options to try and identify any mispriced options. Below is a screenshot of a quote on the above-mentioned options: EXPIRY Dec-20 Dec-20 Dec-20 CALLS EXERCISE $1.60 $9.00 $1.40 $10.00 $1.20 $11.00 PUTS $.80 $1.00 $1.20 Assume that the annual risk-free rate is 6.09% and all options have exactly 6-months to expiry. A) Use the binomial option pricing model to verify if the $9 Calls and Puts in the above quote are appropriately priced. If not, what should the appropriate prices be? (4 Marks) B) Use the risk-neutral valuation to verify if the $10 Calls and Puts in the above quote are appropriately priced. If not, what should the appropriate prices be? (4 Marks) C) Use the put-call parity to verify if the $11 Calls and Puts in the above quote are appropriately priced. If not, what should the appropriate prices be? (4 Marks) D) Suppose you shorted 20 of the $10 Call Options (each contract is 100 shares) for $1.40 and held them until expiry at which point ABC is selling for $13 a share. Calculate your P&L at expiryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started