Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer questions number 18,19,20 ason is 60 years old. His wife, Anna, died on March 1 2017. Jason has not remarried. His deceased spouse

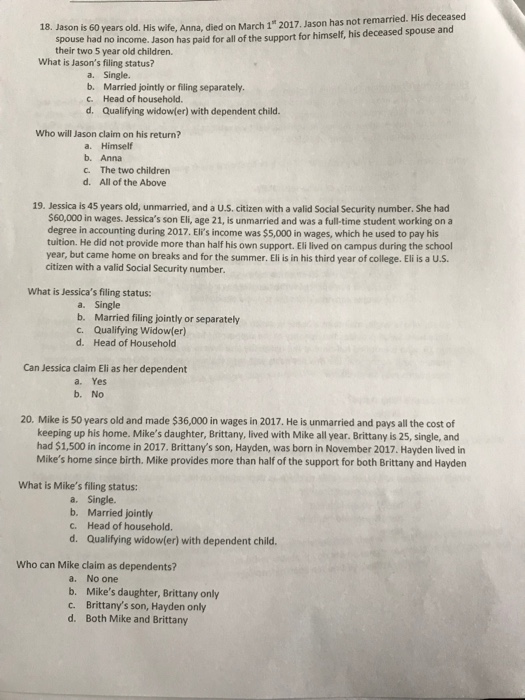

Please answer questions number 18,19,20  ason is 60 years old. His wife, Anna, died on March 1" 2017. Jason has not remarried. His deceased spouse had no incom 18. J e. Jason has paid for all of the support for himself, his deceased spouse and their two 5 year old children. What is Jason's filing status? Single. Married jointly or filing separately. Head of household. Qualifying widowler) with dependent child. a. b. c. d. Who will Jason claim on his return? a. Himself b. Anna c. The two children d. All of the Above 19. Jessica is 45 years old, unmarried, and a U.S. citizen with a valid Social Security number. She had $60,000 in wages. Jessica's son Eli, age 21, is unmarried and was a full-time student working on a degree in accounting during 2017. Eli's income was $5,000 in wages, which he used to pay his tultion. He did not provide more than half his own support. Eli lived on campus during the school year, but came home on breaks and for the summer. Eli is in his third year of college. Eli is a U.S. citizen with a valid Social Security number. What is Jessica's filing status: a. b. c. d. Single Married filing jointly or separatehy Qualifying Widow(er) Head of Household Can Jessica claim Eli as her dependent a. Yes b. No 20. Mike is 50 years old and made $36,000 in wages in 2017. He is unmarried and pays all the cost of keeping up his home. Mike's daughter, Brittany, lived with Mike all year. Brittany is 25, single, and had $1,500 in income in 2017. Brittany's son, Hayden, was born in November 2017. Hayden lived in Mike's home since birth. Mike provides more than half of the support for both Brittany and Hayden What is Mike's filing status: a. Single. b. Married jointly c. Head of household. d. Qualifying widow(er) with dependent child. Who can Mike claim as dependents? a. No one b. Mike's daughter, Brittany only c. Brittany's son, Hayden only d. Both Mike and Brittany

ason is 60 years old. His wife, Anna, died on March 1" 2017. Jason has not remarried. His deceased spouse had no incom 18. J e. Jason has paid for all of the support for himself, his deceased spouse and their two 5 year old children. What is Jason's filing status? Single. Married jointly or filing separately. Head of household. Qualifying widowler) with dependent child. a. b. c. d. Who will Jason claim on his return? a. Himself b. Anna c. The two children d. All of the Above 19. Jessica is 45 years old, unmarried, and a U.S. citizen with a valid Social Security number. She had $60,000 in wages. Jessica's son Eli, age 21, is unmarried and was a full-time student working on a degree in accounting during 2017. Eli's income was $5,000 in wages, which he used to pay his tultion. He did not provide more than half his own support. Eli lived on campus during the school year, but came home on breaks and for the summer. Eli is in his third year of college. Eli is a U.S. citizen with a valid Social Security number. What is Jessica's filing status: a. b. c. d. Single Married filing jointly or separatehy Qualifying Widow(er) Head of Household Can Jessica claim Eli as her dependent a. Yes b. No 20. Mike is 50 years old and made $36,000 in wages in 2017. He is unmarried and pays all the cost of keeping up his home. Mike's daughter, Brittany, lived with Mike all year. Brittany is 25, single, and had $1,500 in income in 2017. Brittany's son, Hayden, was born in November 2017. Hayden lived in Mike's home since birth. Mike provides more than half of the support for both Brittany and Hayden What is Mike's filing status: a. Single. b. Married jointly c. Head of household. d. Qualifying widow(er) with dependent child. Who can Mike claim as dependents? a. No one b. Mike's daughter, Brittany only c. Brittany's son, Hayden only d. Both Mike and Brittany

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started