Answered step by step

Verified Expert Solution

Question

1 Approved Answer

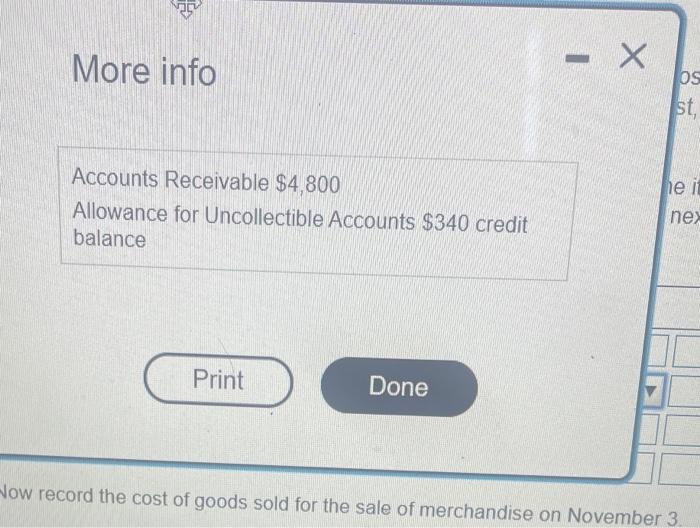

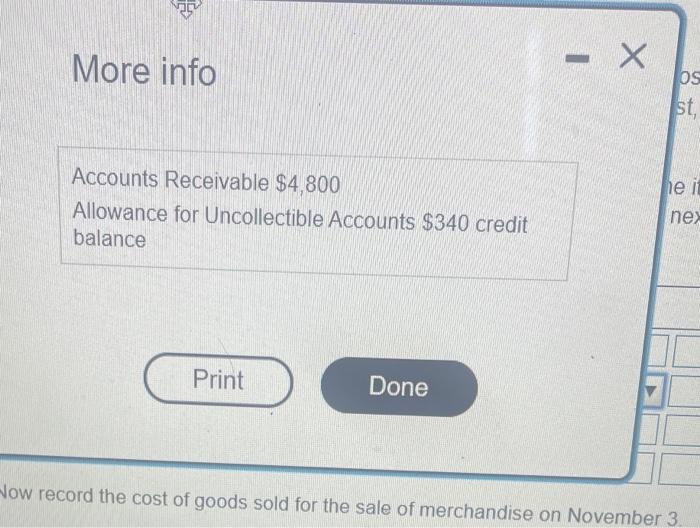

please answer quick requirements are attached. thanks More info Accounts Receivable $4,800 Allowance for Uncollectible Accounts $340 credit balance low record the cost of goods

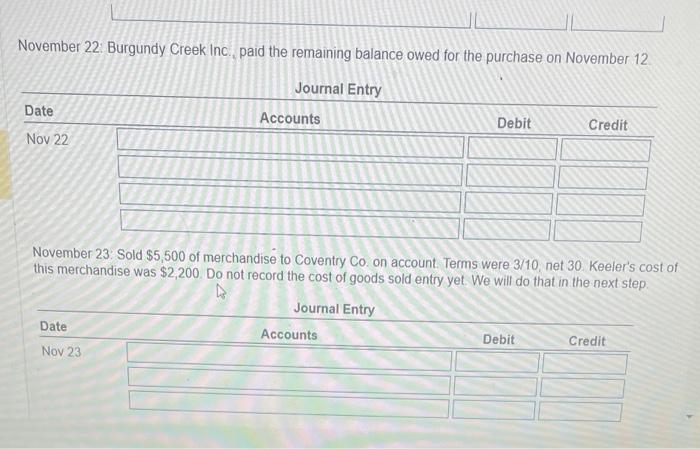

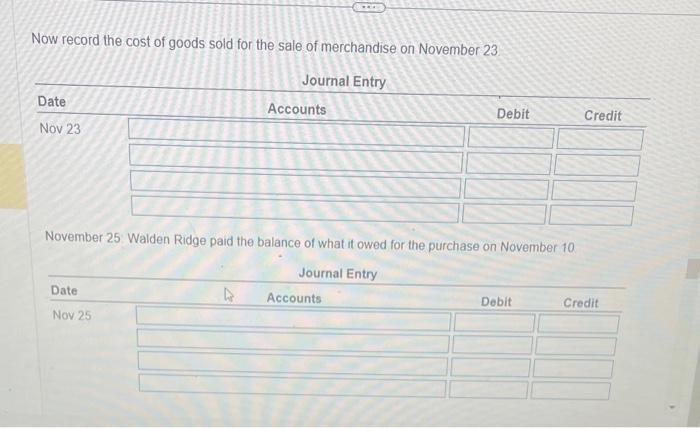

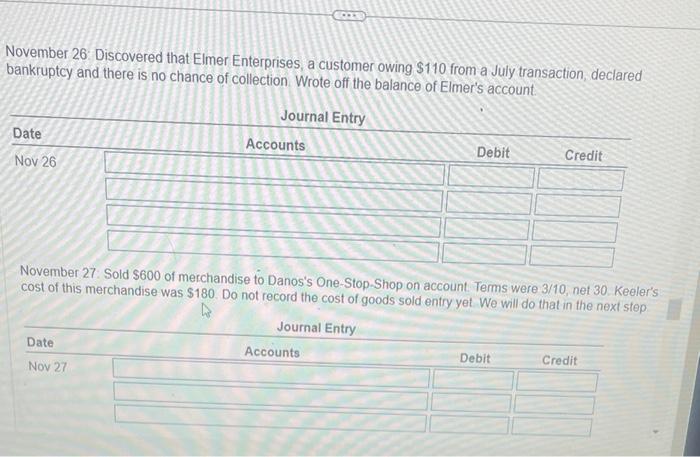

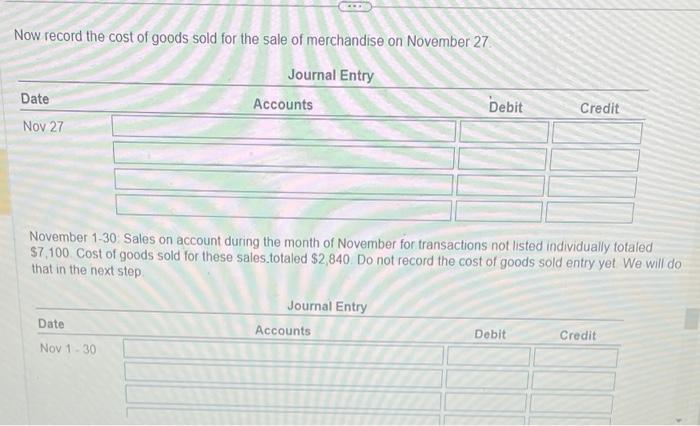

please answer quick requirements are attached. thanks

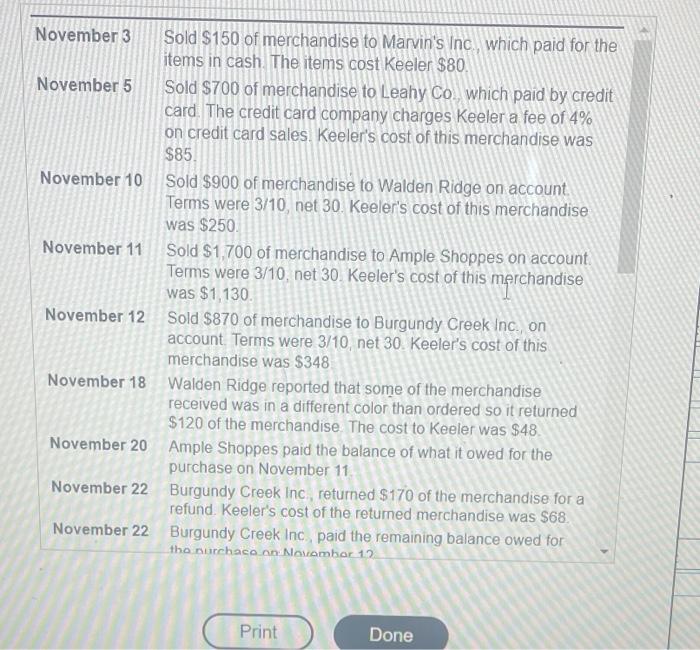

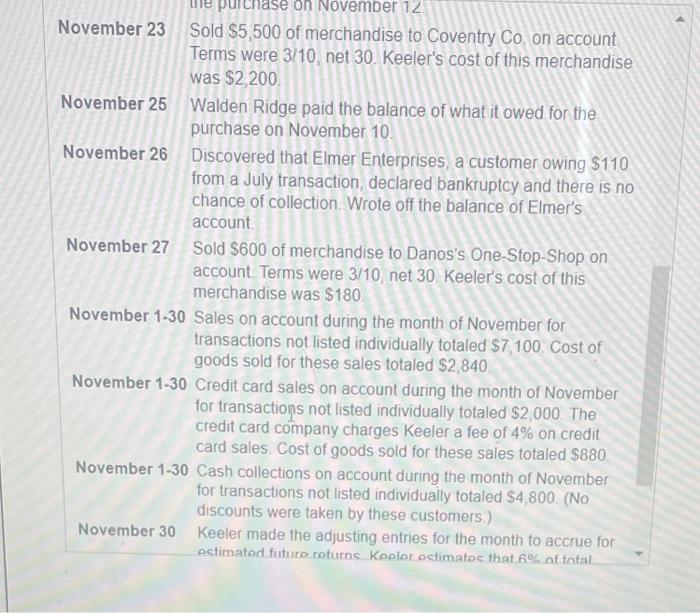

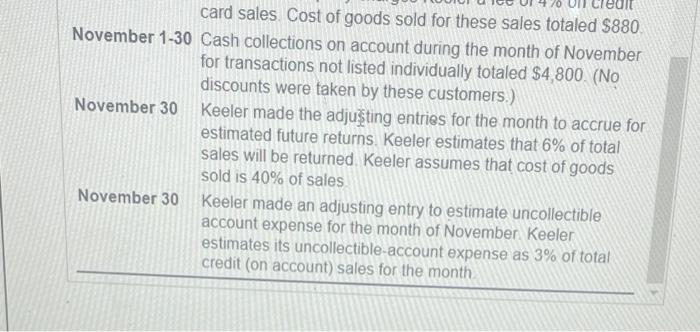

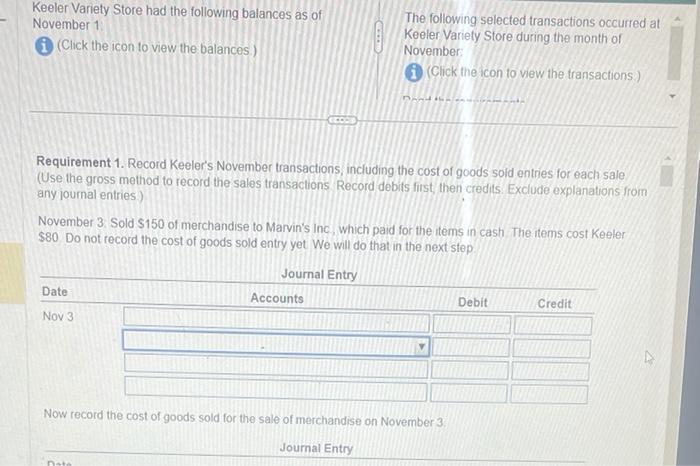

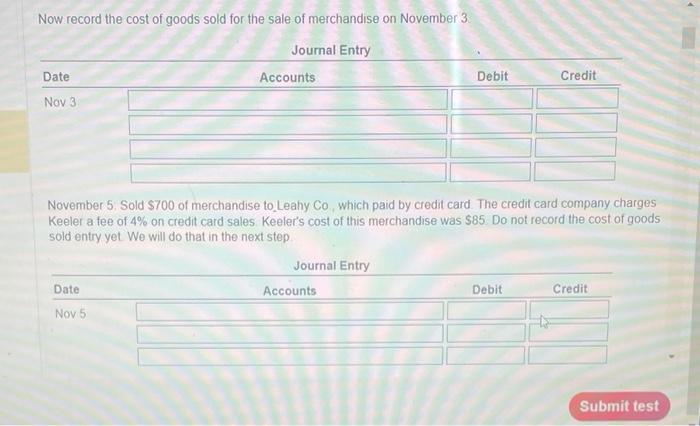

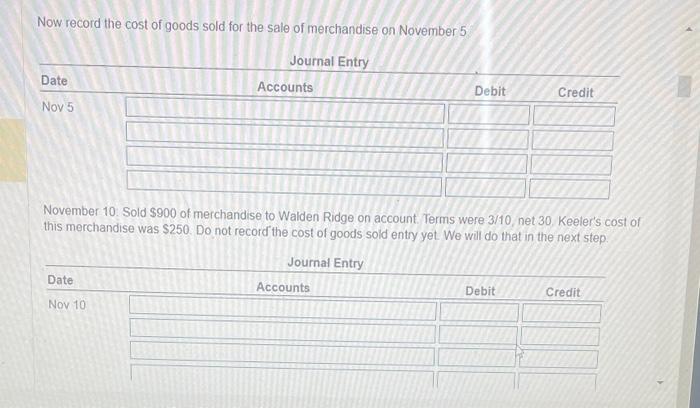

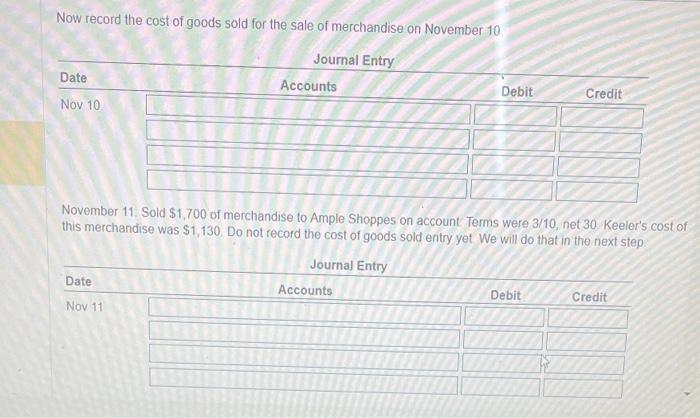

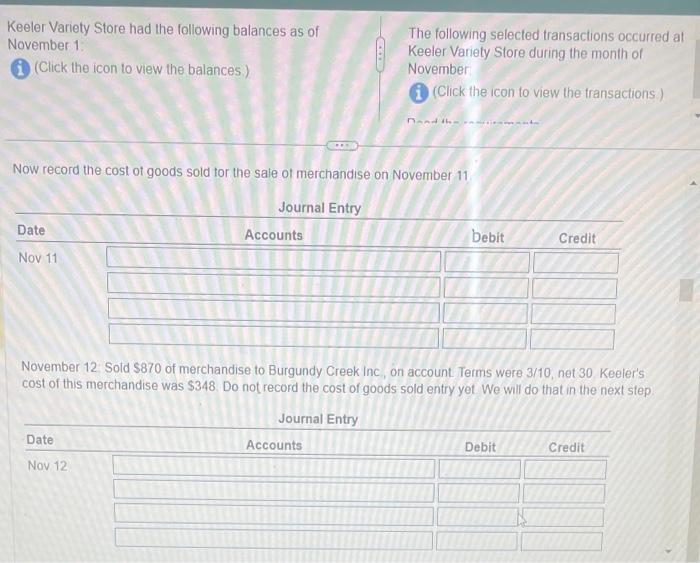

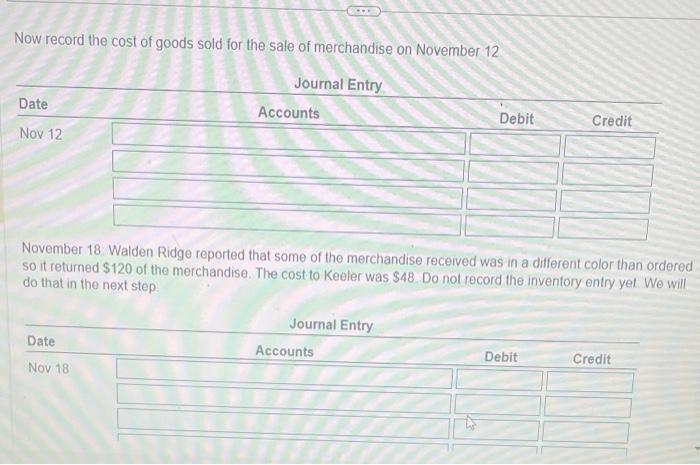

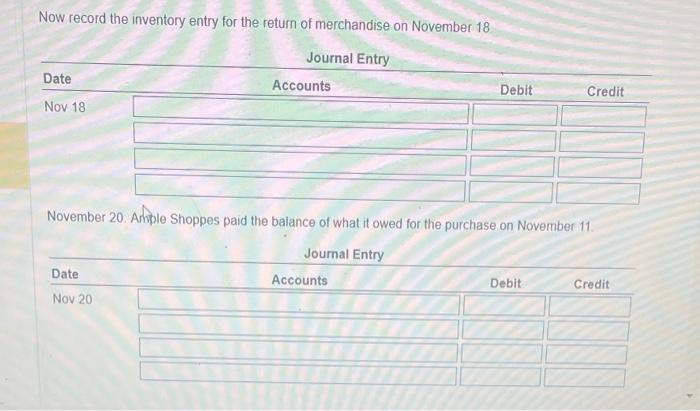

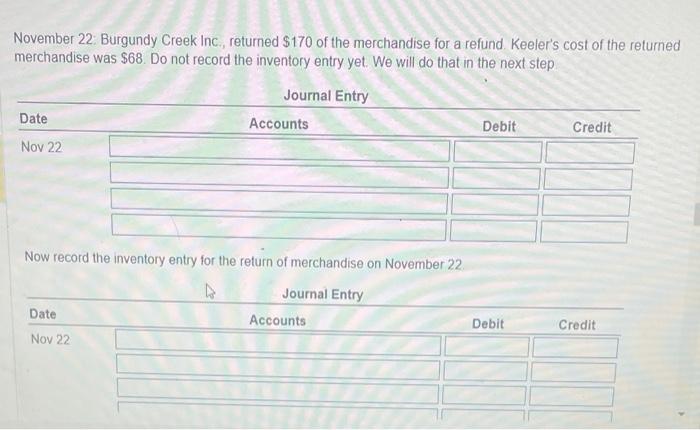

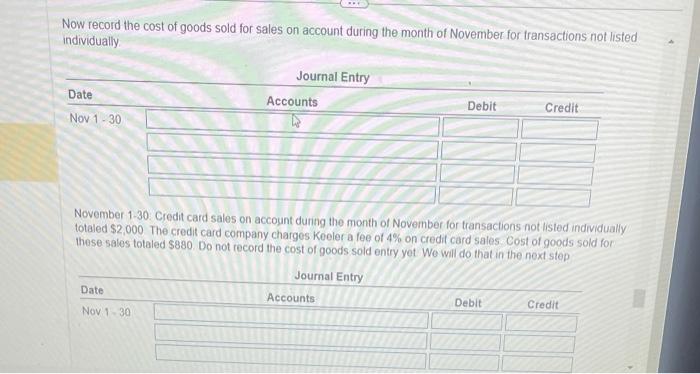

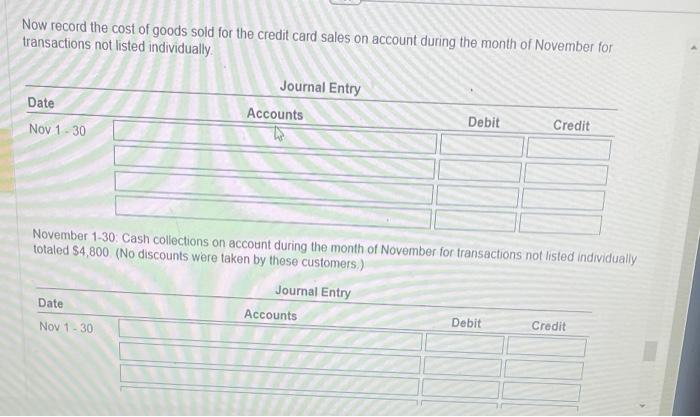

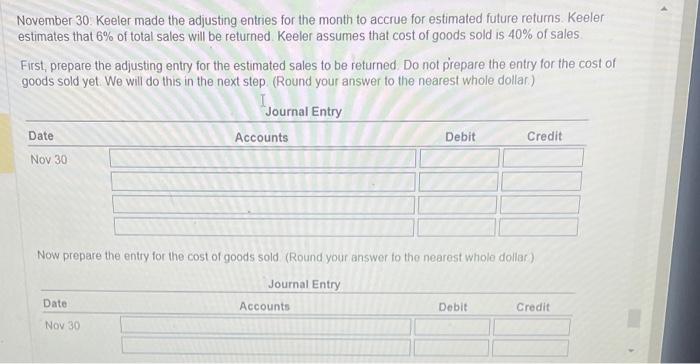

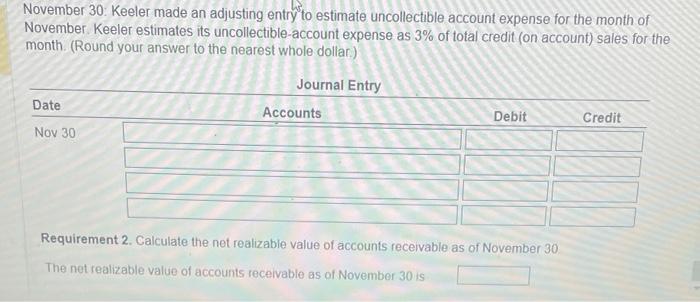

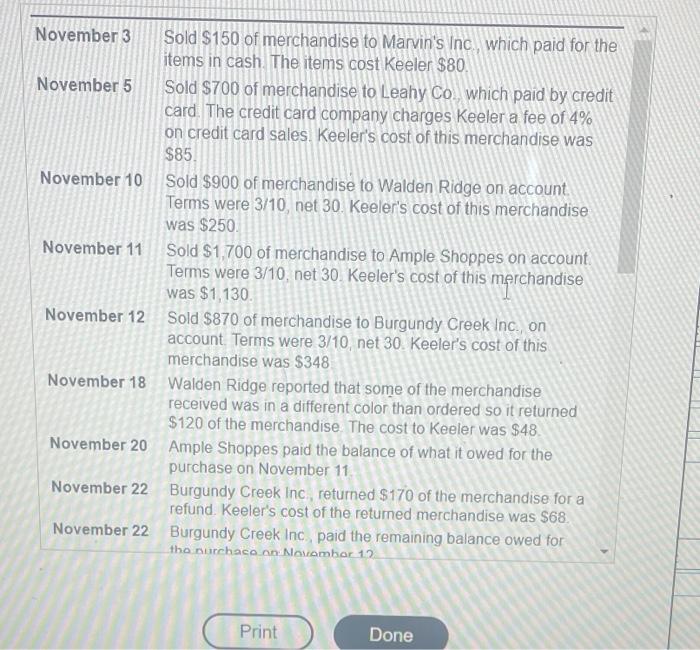

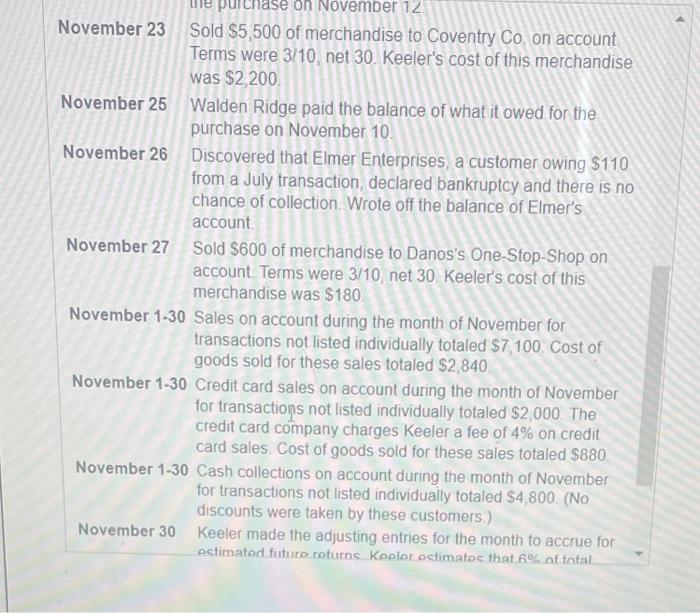

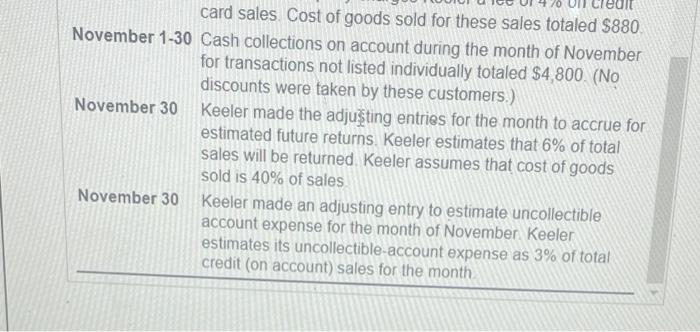

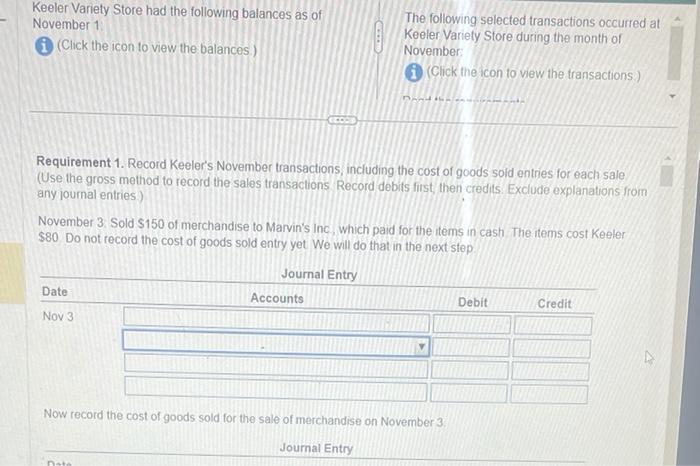

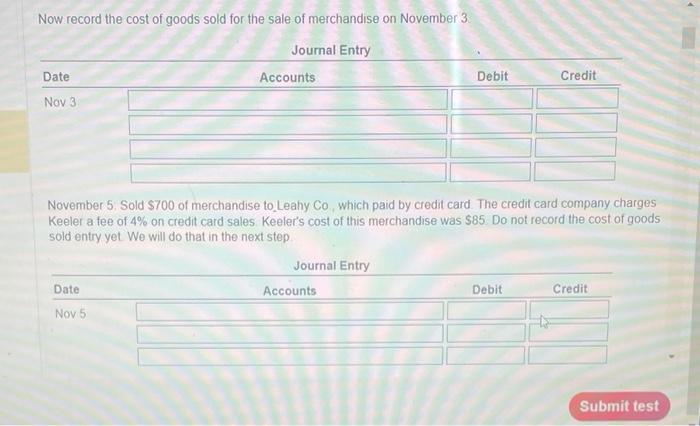

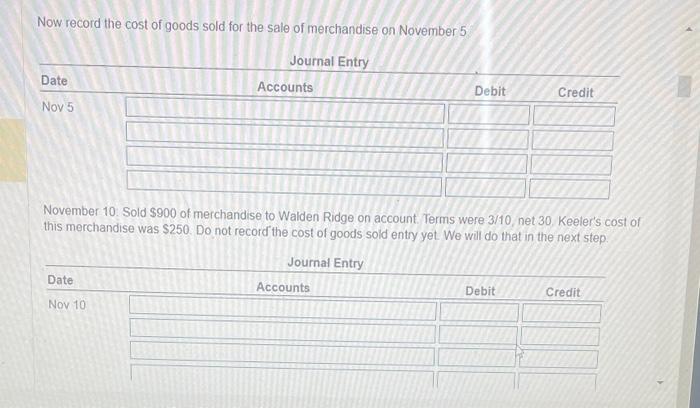

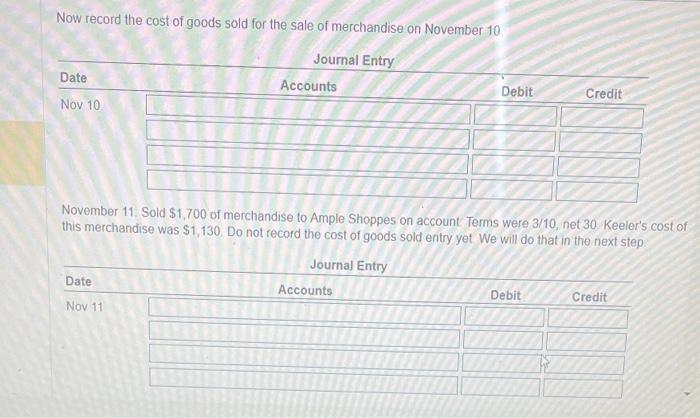

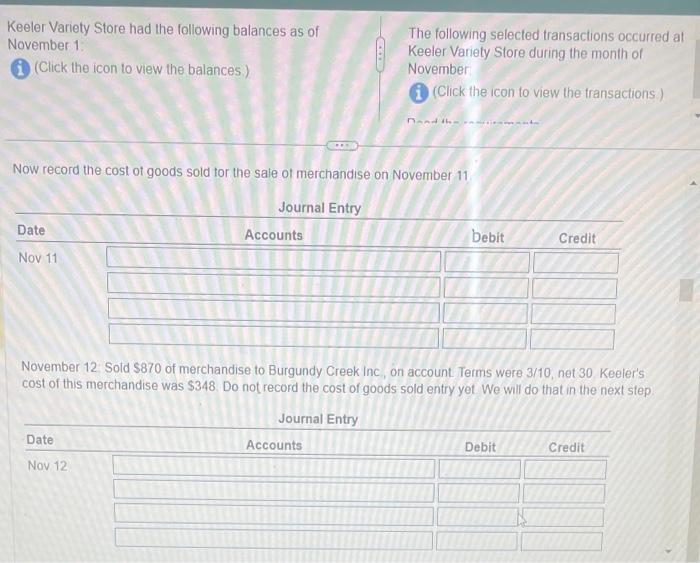

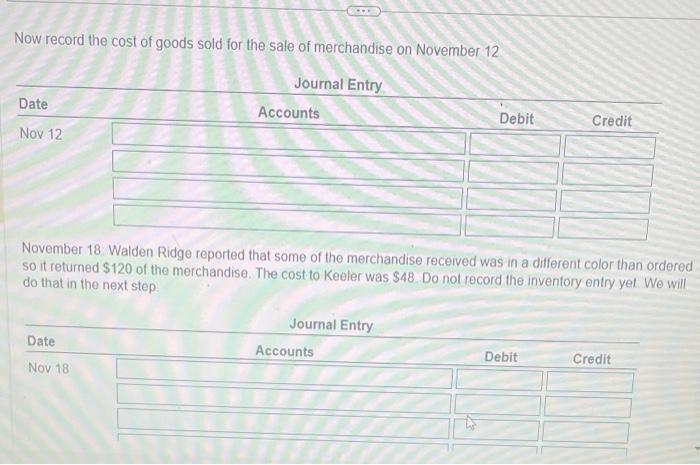

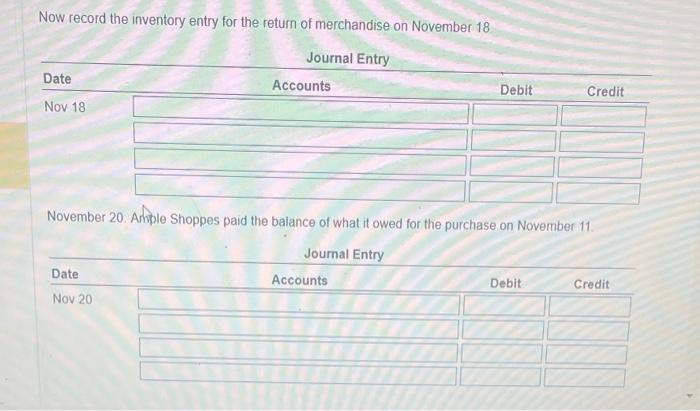

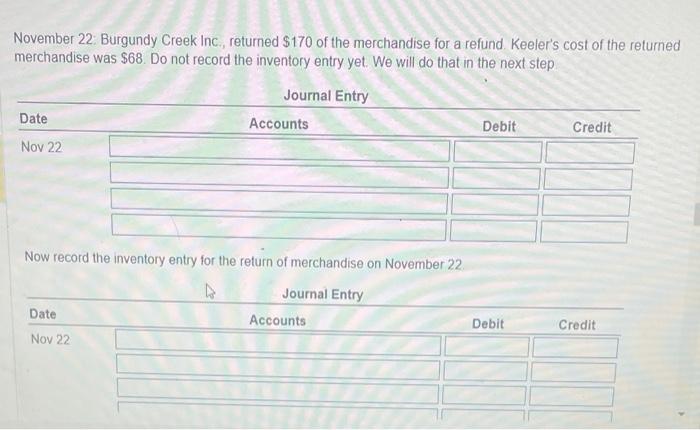

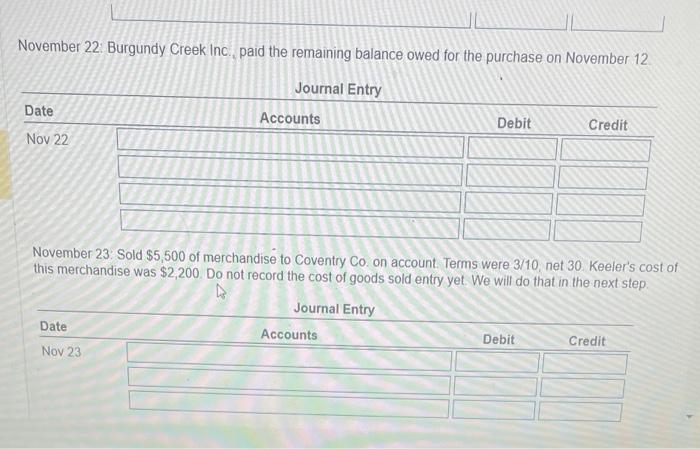

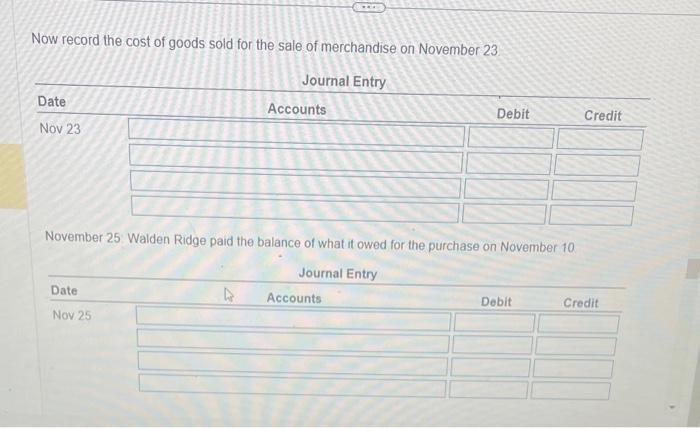

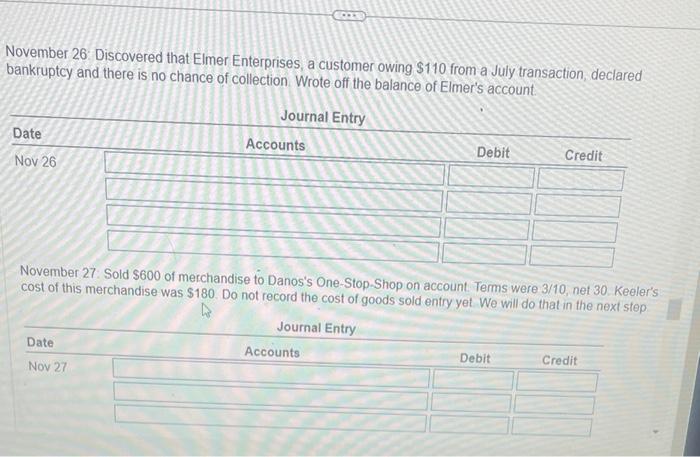

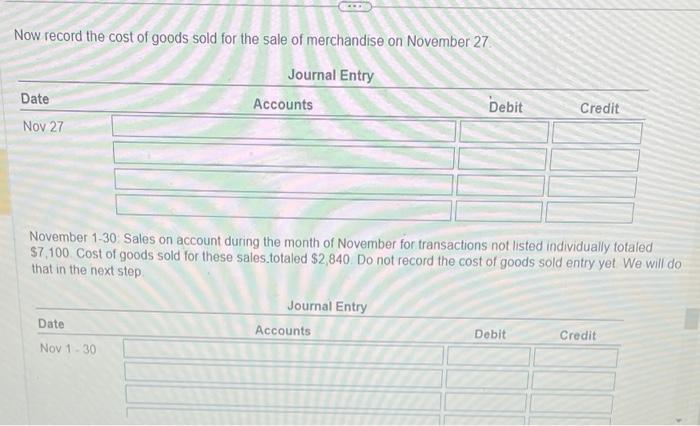

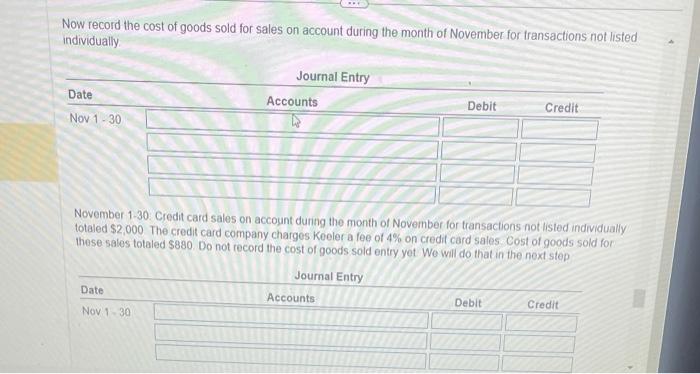

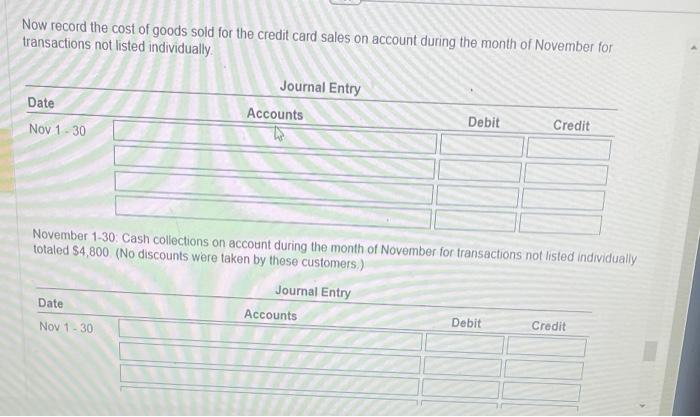

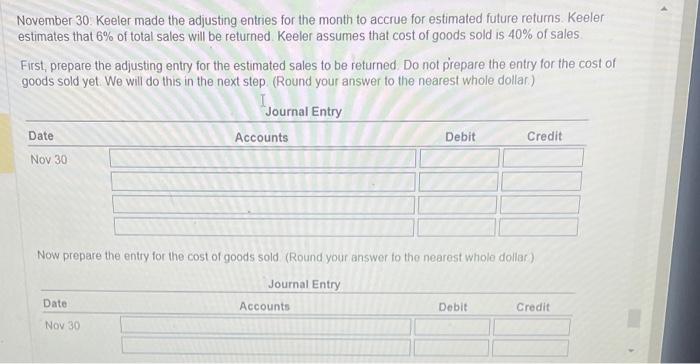

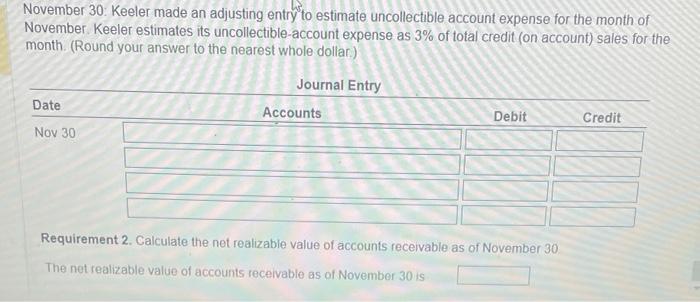

More info Accounts Receivable $4,800 Allowance for Uncollectible Accounts $340 credit balance low record the cost of goods sold for the sale of merchandise on November 3 November 3 Sold $150 of merchandise to Marvin's Inc. which paid for the items in cash. The items cost Keeler $80. November 5 Sold $700 of merchandise to Leahy Co. which paid by credit card The credit card company charges Keeler a fee of 4% on credit card sales. Keeler's cost of this merchandise was $85 November 10 Sold $900 of merchandise to Walden Ridge on account. Terms were 3/10, net 30 . Keeler's cost of this merchandise was $250. November 11 Sold $1,700 of merchandise to Ample Shoppes on account Terms were 3/10, net 30 . Keeler's cost of this merchandise was $1,130. November 12 Sold $870 of merchandise to Burgundy Creek Inc. on account. Terms were 3/10, net 30 . Keeler's cost of this merchandise was $348 November 18 Walden Ridge reported that some of the merchandise received was in a different color than ordered so it returned $120 of the merchandise. The cost to Keeler was $48. November 20 Ample Shoppes paid the balance of what it owed for the purchase on November 11 November 22 Burgundy Creek inc, returned $170 of the merchandise for a refund. Keeler's cost of the returned merchandise was $68. November 22 Burgundy Creek Inc, paid the remaining balance owed for tha nurchaco an Navambar 1 ? November 23 Sold $5,500 of merchandise to Coventry Co. on account Terms were 3/10, net 30 . Keeler's cost of this merchandise was $2,200. November 25 Walden Ridge paid the balance of what it owed for the purchase on November 10 November 26 Discovered that Elmer Enterprises, a customer owing $110 from a July transaction, declared bankruptcy and there is no chance of collection. Wrote off the balance of Elmer's account November 27 Sold \$600 of merchandise to Danos's One-Stop-Shop on account. Terms were 3/10, net 30 . Keeler's cost of this merchandise was $180. November 1-30 Sales on account during the month of November for transactions not listed individually totaled $7,100. Cost of goods sold for these sales totaled $2,840 November 1-30 Credit card sales on account during the month of November for transactions not listed individually totaled $2,000. The credit card company charges Keeler a fee of 4% on credit card sales. Cost of goods sold for these sales totaled $880 November 1-30 Cash collections on account during the month of November for transactions not listed individually totaled $4,800. (No discounts were taken by these customers.) November 30 Keeler made the adjusting entries for the month to accrue for octimated future roturne Koplor astimatoc that 6% inf thial card sales. Cost of goods sold for these sales totaled $880 November 1-30 Cash collections on account during the month of November for transactions not listed individually totaled $4,800. (No discounts were taken by these customers.) November 30 Keeler made the adjuting entries for the month to accrue for estimated future returns. Keeler estimates that 6% of total sales will be returned. Keeler assumes that cost of goods sold is 40% of sales. November 30 Keeler made an adjusting entry to estimate uncollectible account expense for the month of November. Keeler estimates its uncollectible-account expense as 3% of total credit (on account) sales for the month Keeler Variety Store had the following balances as of The following selected transactions occurred at November 1 . (Click the icon to view the balances.) Keeler Variety Store during the month of November: (Click the icon to view the transactions.) Requirement 1. Record Keeler's November transactions, including the cost of goods soid entries for each sale (Use the gross method to record the sales transactions. Record debits fiist, then credits. Exclude explanations from any journal entries.) November 3. Sold \$150 of merchandise to Marvin's inc, which paid for the items in cash The items cost Keeler $80 Do not record the cost of goods sold entry yet We will do that in the next step. Now record the cost of goods sold for the sale of merchandise on November 3 November 5 . Sold $700 of merchandise to Leahy Co, which paid by credit card The credit card company charges Keeler a fee of 4% on credit card sales. Keeler's cost of this merchandise was $85. Do not record the cost of goods sold entry yet We will do that in the next step Now record the cost of goods sold for the sale of merchandise on November 5 November 10. Sold $900 of merchandise to Walden Ridge on account. Terms were 3/10, net 30 ,Keeter's cost of this merchandise was $250. Do not record the cost of goods sold entry yet We will do that in the next step. Now record the cost of goods sold for the sale of merchandise on November 10 . November 11. Sold $1,700 of merchandise to Ample Shoppes on account. Terms were 3/10, net 30 . Keeler's cost o this merchandise was $1,130. Do not record the cost of goods sold entry yet We will do that in the next step. Keeler Variety Store had the following balances as of November 1 . (Click the icon to view the balances) The following selected transactions occurred at Keeler Variety Store during the month of November (Click the icon to view the fransactions) Now record the cost of goods sold tor the sale of merchandise on November 11 November 12 . Sold $870 of merchandise to Burgundy Creek Inc, on account. Terms were 3/10, net 30 Keeler's cost of this merchandise was $348. Do not record the cost of goods sold entry yet We will do that in the next slep Now record the cost of goods sold for the sale of merchandise on November 12 November 18 Walden Ridge reported that some of the merchandise received was in a different color than ordered so it returned $120 of the merchandise. The cost to Keeler was $48. Do not record the inventory entry yet. We will do that in the next step. Now record the inventory entry for the return of merchandise on November 18 November 20. Ample Shoppes paid the baiance of what it owed for the purchase on November 11 November 22: Burgundy Creek Inc., returned $170 of the merchandise for a refund. Keeler's cost of the returned merchandise was $68. Do not record the inventory entry yet. We will do that in the next step Now record the inventory entry for the return of merchandise on November 22 November 22: Burgundy Creek Inc., paid the remaining balance owed for the purchase on November 12 November 23. Sold $5,500 of merchandise to Coventry Co. on account. Terms were 3/10, net 30 .Keeler's cost this merchandise was $2,200. Do not record the cost of goods sold entry yet. We will do that in the next step. Now record the cost of goods sold for the sale of merchandise on November 23 November 25 Walden Ridge paid the balance of what it owed for the purchase on November 10 November 26: Discovered that Elmer Enterprises, a customer owing $110 from a July transaction, declared bankruptcy and there is no chance of collection. Wrote off the balance of Elmer's account. ND Lruvomuel 1. sora s6uv of merchandise to Danos's One-Stop. Shop on account. Terms were 3/10, net 30 . Keeler's cost of this merchandise was $180. Do not record the cost of goods sold entry yet We will do that in the next step Now record the cost of goods sold for the sale of merchandise on November 27 November 1-30: Sales on account during the month of November for transactions not listed individually totaled $7,100. Cost of goods sold for these sales.totaled $2,840. Do not record the cost of goods sold entry yet We will do that in the next step. Now record the cost of goods sold for sales on account during the month of November for transactions not listed individually. November 1-30. Credit card sales on account during the month of November for transactions not listed individually totaled \$2,000 The credit card company charges Keeler a fee of 4% on credil card sales. Cost of goods sold for these sales totaled \$880. Do not record the cost of goods sold entry yot We will do that in the noxt step Now record the cost of goods sold for the credit card sales on account during the month of November for transactions not listed individually. totaled \$4, 800 (No discoints wen on account during the month of November for transactions not listed individually totaled $4,800 (No discounts were taken by these customers. November 30 . Keeler made the adjusting entries for the month to accrue for estimated future returns. Keeler estimates that 6% of total sales will be returned. Keeler assumes that cost of goods sold is 40% of sales. First, prepare the adjusting entry for the estimated sales to be returned. Do not prepare the entry for the cost of goods sold yet We will do this in the next step. (Round your answer to the nearest whole dollar.) Now prepare the entry for the cost of goods sold (Round your answer to the nearest whole dollar) November 30: Keeler made an adjusting entry to estimate uncollectible account expense for the month of November. Keeler estimates its uncollectible-account expense as 3% of total credit (on account) sales for the month. (Round your answer to the nearest whole dollar.) requirement 2. Calculate the net realizable value of accounts receivable as of November 30 The not realizable value of accounts receivable as of November 30 is

More info Accounts Receivable $4,800 Allowance for Uncollectible Accounts $340 credit balance low record the cost of goods sold for the sale of merchandise on November 3 November 3 Sold $150 of merchandise to Marvin's Inc. which paid for the items in cash. The items cost Keeler $80. November 5 Sold $700 of merchandise to Leahy Co. which paid by credit card The credit card company charges Keeler a fee of 4% on credit card sales. Keeler's cost of this merchandise was $85 November 10 Sold $900 of merchandise to Walden Ridge on account. Terms were 3/10, net 30 . Keeler's cost of this merchandise was $250. November 11 Sold $1,700 of merchandise to Ample Shoppes on account Terms were 3/10, net 30 . Keeler's cost of this merchandise was $1,130. November 12 Sold $870 of merchandise to Burgundy Creek Inc. on account. Terms were 3/10, net 30 . Keeler's cost of this merchandise was $348 November 18 Walden Ridge reported that some of the merchandise received was in a different color than ordered so it returned $120 of the merchandise. The cost to Keeler was $48. November 20 Ample Shoppes paid the balance of what it owed for the purchase on November 11 November 22 Burgundy Creek inc, returned $170 of the merchandise for a refund. Keeler's cost of the returned merchandise was $68. November 22 Burgundy Creek Inc, paid the remaining balance owed for tha nurchaco an Navambar 1 ? November 23 Sold $5,500 of merchandise to Coventry Co. on account Terms were 3/10, net 30 . Keeler's cost of this merchandise was $2,200. November 25 Walden Ridge paid the balance of what it owed for the purchase on November 10 November 26 Discovered that Elmer Enterprises, a customer owing $110 from a July transaction, declared bankruptcy and there is no chance of collection. Wrote off the balance of Elmer's account November 27 Sold \$600 of merchandise to Danos's One-Stop-Shop on account. Terms were 3/10, net 30 . Keeler's cost of this merchandise was $180. November 1-30 Sales on account during the month of November for transactions not listed individually totaled $7,100. Cost of goods sold for these sales totaled $2,840 November 1-30 Credit card sales on account during the month of November for transactions not listed individually totaled $2,000. The credit card company charges Keeler a fee of 4% on credit card sales. Cost of goods sold for these sales totaled $880 November 1-30 Cash collections on account during the month of November for transactions not listed individually totaled $4,800. (No discounts were taken by these customers.) November 30 Keeler made the adjusting entries for the month to accrue for octimated future roturne Koplor astimatoc that 6% inf thial card sales. Cost of goods sold for these sales totaled $880 November 1-30 Cash collections on account during the month of November for transactions not listed individually totaled $4,800. (No discounts were taken by these customers.) November 30 Keeler made the adjuting entries for the month to accrue for estimated future returns. Keeler estimates that 6% of total sales will be returned. Keeler assumes that cost of goods sold is 40% of sales. November 30 Keeler made an adjusting entry to estimate uncollectible account expense for the month of November. Keeler estimates its uncollectible-account expense as 3% of total credit (on account) sales for the month Keeler Variety Store had the following balances as of The following selected transactions occurred at November 1 . (Click the icon to view the balances.) Keeler Variety Store during the month of November: (Click the icon to view the transactions.) Requirement 1. Record Keeler's November transactions, including the cost of goods soid entries for each sale (Use the gross method to record the sales transactions. Record debits fiist, then credits. Exclude explanations from any journal entries.) November 3. Sold \$150 of merchandise to Marvin's inc, which paid for the items in cash The items cost Keeler $80 Do not record the cost of goods sold entry yet We will do that in the next step. Now record the cost of goods sold for the sale of merchandise on November 3 November 5 . Sold $700 of merchandise to Leahy Co, which paid by credit card The credit card company charges Keeler a fee of 4% on credit card sales. Keeler's cost of this merchandise was $85. Do not record the cost of goods sold entry yet We will do that in the next step Now record the cost of goods sold for the sale of merchandise on November 5 November 10. Sold $900 of merchandise to Walden Ridge on account. Terms were 3/10, net 30 ,Keeter's cost of this merchandise was $250. Do not record the cost of goods sold entry yet We will do that in the next step. Now record the cost of goods sold for the sale of merchandise on November 10 . November 11. Sold $1,700 of merchandise to Ample Shoppes on account. Terms were 3/10, net 30 . Keeler's cost o this merchandise was $1,130. Do not record the cost of goods sold entry yet We will do that in the next step. Keeler Variety Store had the following balances as of November 1 . (Click the icon to view the balances) The following selected transactions occurred at Keeler Variety Store during the month of November (Click the icon to view the fransactions) Now record the cost of goods sold tor the sale of merchandise on November 11 November 12 . Sold $870 of merchandise to Burgundy Creek Inc, on account. Terms were 3/10, net 30 Keeler's cost of this merchandise was $348. Do not record the cost of goods sold entry yet We will do that in the next slep Now record the cost of goods sold for the sale of merchandise on November 12 November 18 Walden Ridge reported that some of the merchandise received was in a different color than ordered so it returned $120 of the merchandise. The cost to Keeler was $48. Do not record the inventory entry yet. We will do that in the next step. Now record the inventory entry for the return of merchandise on November 18 November 20. Ample Shoppes paid the baiance of what it owed for the purchase on November 11 November 22: Burgundy Creek Inc., returned $170 of the merchandise for a refund. Keeler's cost of the returned merchandise was $68. Do not record the inventory entry yet. We will do that in the next step Now record the inventory entry for the return of merchandise on November 22 November 22: Burgundy Creek Inc., paid the remaining balance owed for the purchase on November 12 November 23. Sold $5,500 of merchandise to Coventry Co. on account. Terms were 3/10, net 30 .Keeler's cost this merchandise was $2,200. Do not record the cost of goods sold entry yet. We will do that in the next step. Now record the cost of goods sold for the sale of merchandise on November 23 November 25 Walden Ridge paid the balance of what it owed for the purchase on November 10 November 26: Discovered that Elmer Enterprises, a customer owing $110 from a July transaction, declared bankruptcy and there is no chance of collection. Wrote off the balance of Elmer's account. ND Lruvomuel 1. sora s6uv of merchandise to Danos's One-Stop. Shop on account. Terms were 3/10, net 30 . Keeler's cost of this merchandise was $180. Do not record the cost of goods sold entry yet We will do that in the next step Now record the cost of goods sold for the sale of merchandise on November 27 November 1-30: Sales on account during the month of November for transactions not listed individually totaled $7,100. Cost of goods sold for these sales.totaled $2,840. Do not record the cost of goods sold entry yet We will do that in the next step. Now record the cost of goods sold for sales on account during the month of November for transactions not listed individually. November 1-30. Credit card sales on account during the month of November for transactions not listed individually totaled \$2,000 The credit card company charges Keeler a fee of 4% on credil card sales. Cost of goods sold for these sales totaled \$880. Do not record the cost of goods sold entry yot We will do that in the noxt step Now record the cost of goods sold for the credit card sales on account during the month of November for transactions not listed individually. totaled \$4, 800 (No discoints wen on account during the month of November for transactions not listed individually totaled $4,800 (No discounts were taken by these customers. November 30 . Keeler made the adjusting entries for the month to accrue for estimated future returns. Keeler estimates that 6% of total sales will be returned. Keeler assumes that cost of goods sold is 40% of sales. First, prepare the adjusting entry for the estimated sales to be returned. Do not prepare the entry for the cost of goods sold yet We will do this in the next step. (Round your answer to the nearest whole dollar.) Now prepare the entry for the cost of goods sold (Round your answer to the nearest whole dollar) November 30: Keeler made an adjusting entry to estimate uncollectible account expense for the month of November. Keeler estimates its uncollectible-account expense as 3% of total credit (on account) sales for the month. (Round your answer to the nearest whole dollar.) requirement 2. Calculate the net realizable value of accounts receivable as of November 30 The not realizable value of accounts receivable as of November 30 is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started