Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER QUICK SCF Ltd . is evaluating the following projects. Past practice has been to accept all projects with IRRs greater than the firm's

PLEASE ANSWER QUICK

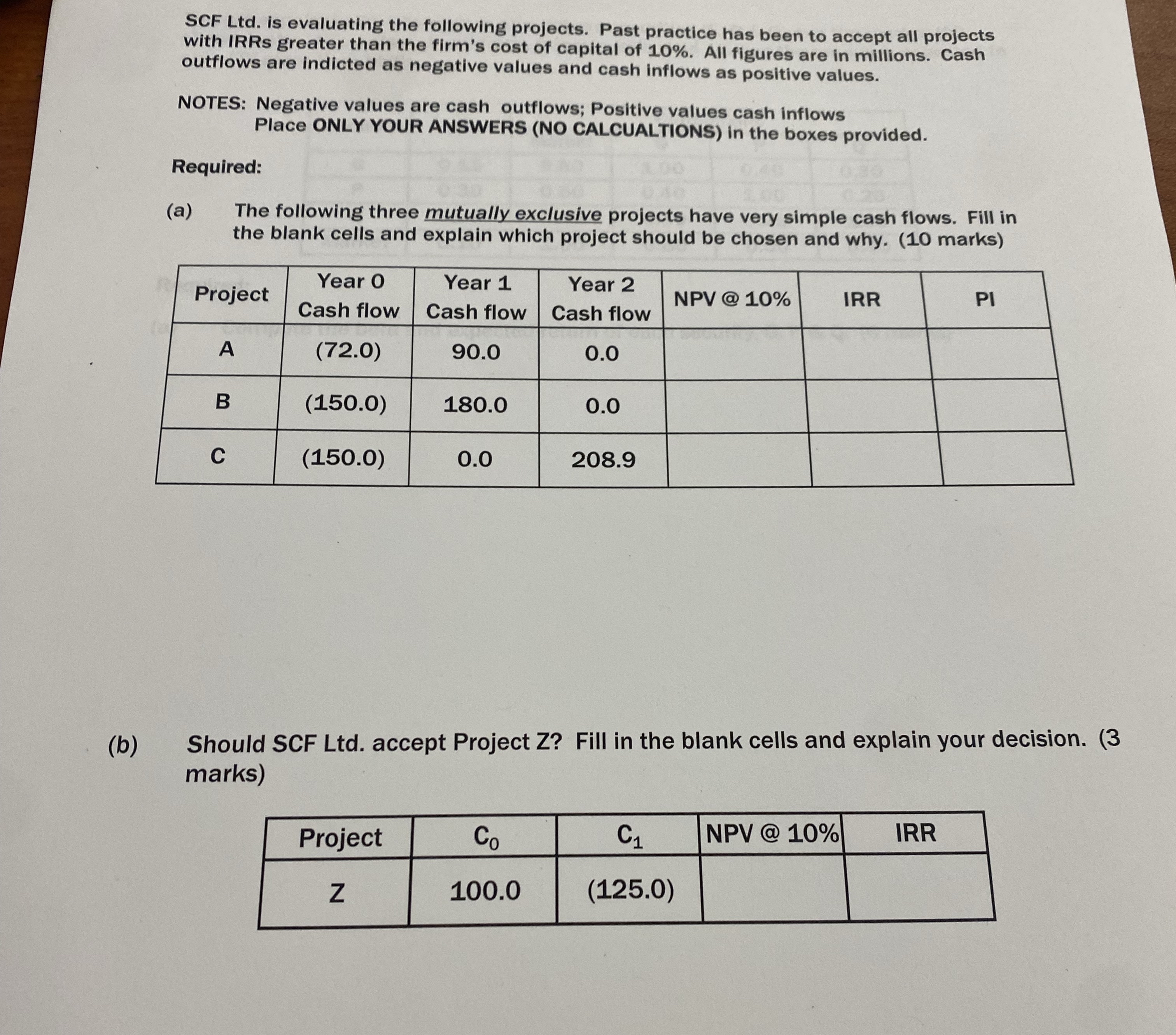

SCF Ltd is evaluating the following projects. Past practice has been to accept all projects with IRRs greater than the firm's cost of capital of All figures are in millions. Cash outflows are indicted as negative values and cash inflows as positive values.

NOTES: Negative values are cash outflows; Positive values cash inflows Place ONLY YOUR ANSWERS NO CALCUALTIONS in the boxes provided.

Required:

a The following three mutually exclusive projects have very simple cash flows. Fill in the blank cells and explain which project should be chosen and why. marks

tableProjecttableYear Cash flowtableYear Cash flowtableYear Cash flowNPV @ IRR,PIABC

b Should SCF Ltd accept Project Z Fill in the blank cells and explain your decision. marks

tableProjectNPV @ IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started