Answered step by step

Verified Expert Solution

Question

1 Approved Answer

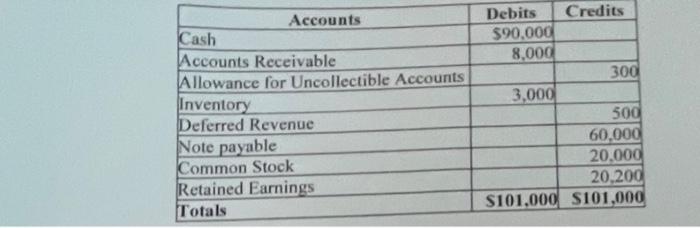

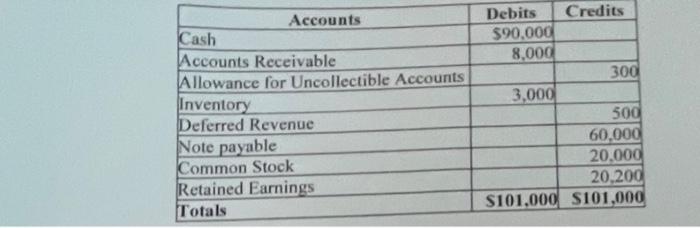

please answer quickly and completely begin{tabular}{|l|r|r|} hline multicolumn{1}{|c|}{ Accounts } & multicolumn{1}{c|}{ Debits } & Credits hline Cash & 590,000 & hline Accounts

please answer quickly and completely

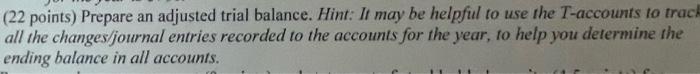

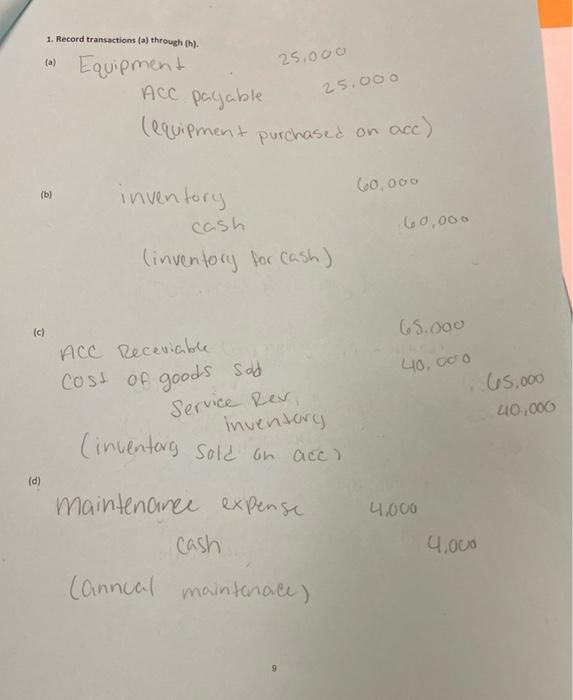

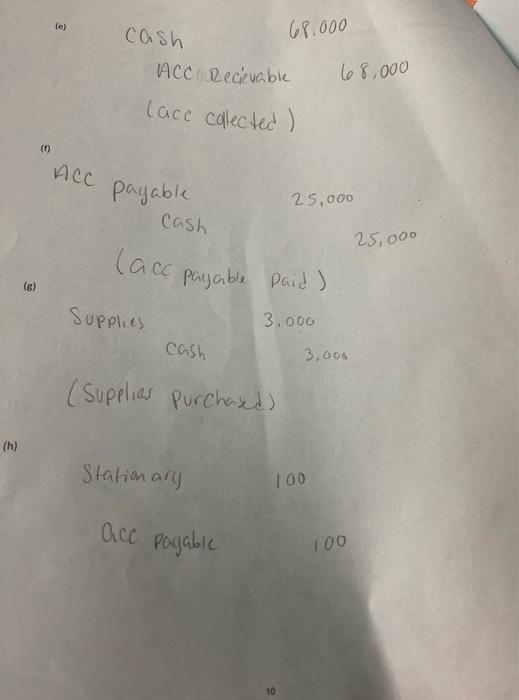

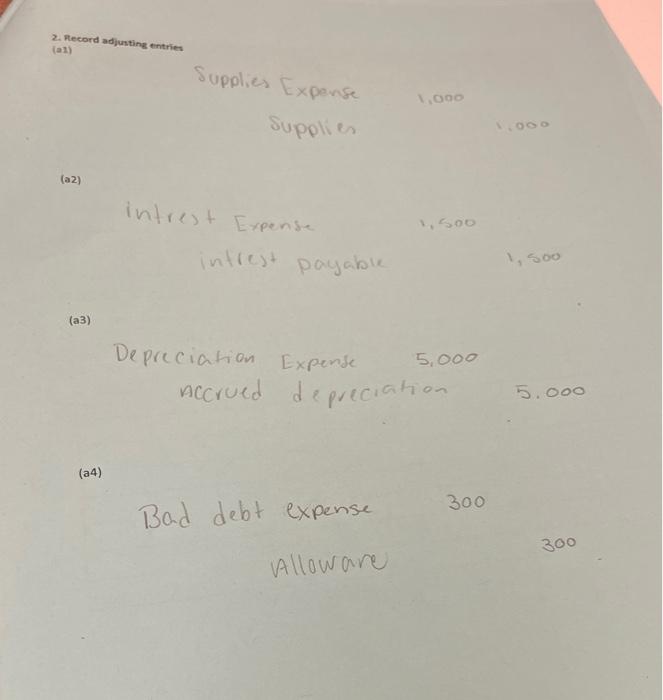

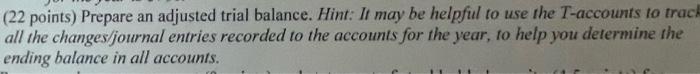

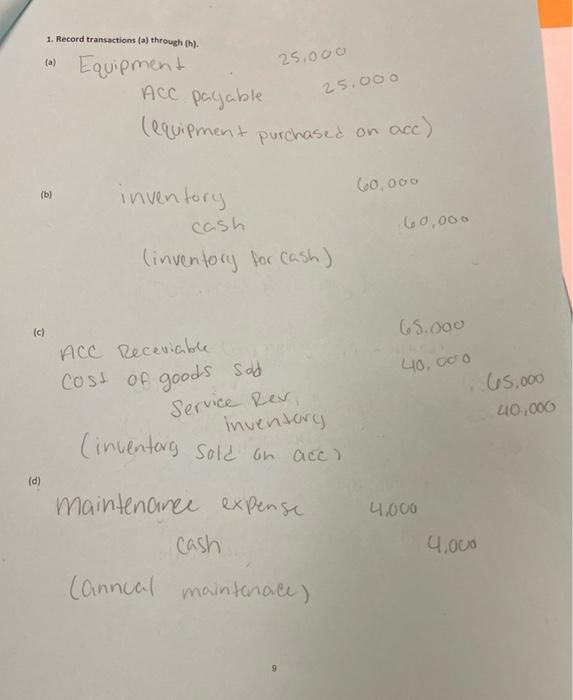

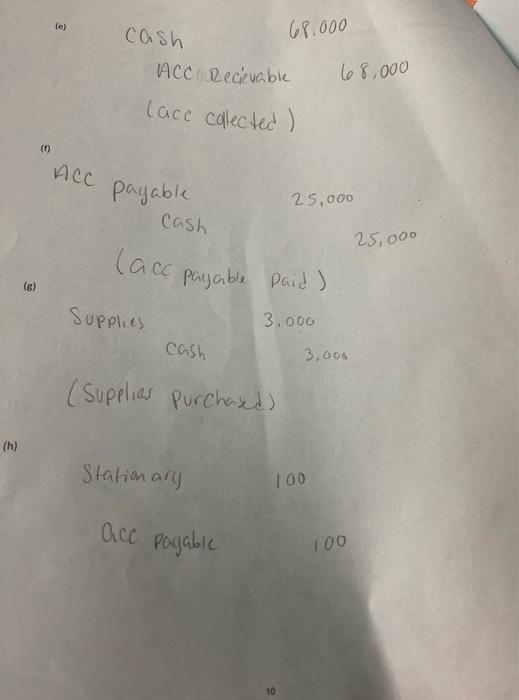

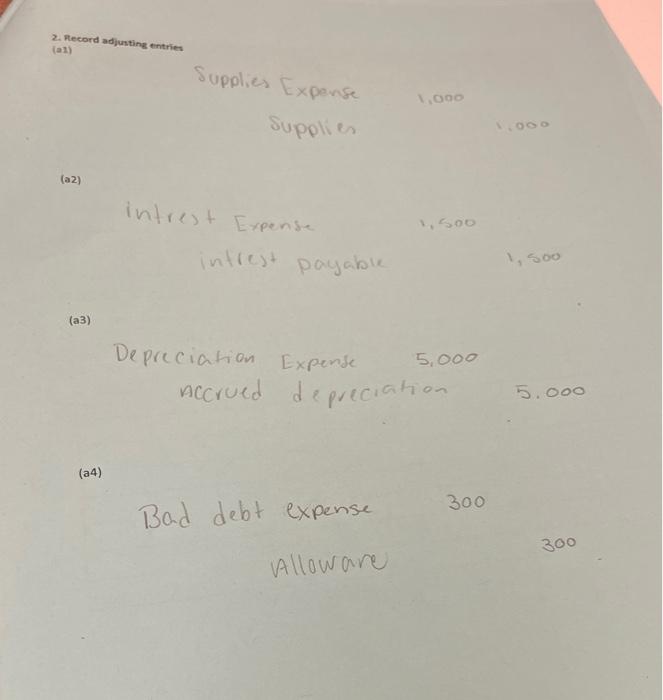

\begin{tabular}{|l|r|r|} \hline \multicolumn{1}{|c|}{ Accounts } & \multicolumn{1}{c|}{ Debits } & Credits \\ \hline Cash & 590,000 & \\ \hline Accounts Receivable & 8,000 & \\ \hline Allowance for Uncollectible Accounts & & 300 \\ \hline Inventory & 3,000 & \\ \hline Deferred Revenue & & 500 \\ \hline Note payable & & 60,000 \\ \hline Common Stock & & 20,000 \\ \hline Retained Earnings & & 20,200 \\ \hline Totals & S101,000 & S101,000 \\ \hline \end{tabular} (22 points) Prepare an adjusted trial balance. Hint: It may be helpful to use the T-accounts to trac) all the changes/journal entries recorded to the accounts for the year, to help you determine the ending balance in all accounts. 1. Record transactions (a) through (h). (a) Equipment 25,000 Ace payable 25.000 (equipment purchased on acc) (b) inventory 60,000 cash 60,000 (inventory for (ash) (c) ACC Receviable Cost of goods sod 40,000 \begin{tabular}{lr} Service Rev & 65,000 \\ \hline & 40,000 \end{tabular} (incentarg sold on ace) (d) maintenaree expense 4.000 cash 4,000 (annual maintenace) (6) cash 68.000 ACC Recievable 68,000 (ace colected) (7) ACCpayableCash25,00025,000 (acc payable paid) Supplies 3,000 \begin{tabular}{c} cash 3,000 \\ \hline 05000 \end{tabular} (Supplias purchased) (h) Stationary 100 ace pagable 100 2. Ptecord adjusting tintrien (avi) (a1) Supplies Expense 1,000 Supplies (a2) intrest Expense 1500 intrest payable 1,500 (a3) Depreciation Expense 5,000 accrued depreciation 5.000 (a4) Bad debt expense 300 Alloware 300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started