Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer quickly i rate good! 13) 14) Complete the problems using the information provided in pictures and this is the part of accounting that

Please answer quickly i rate good!

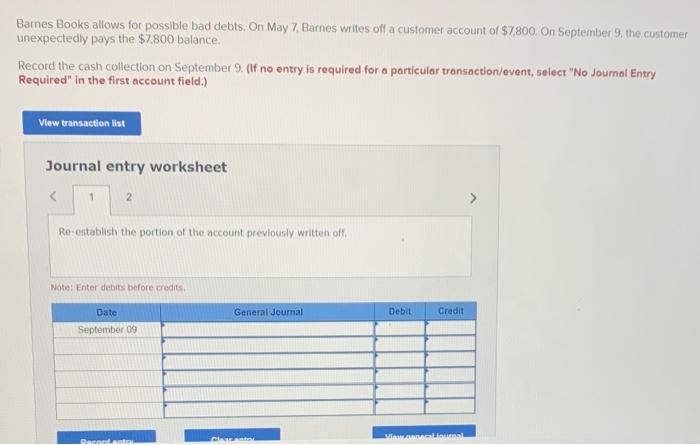

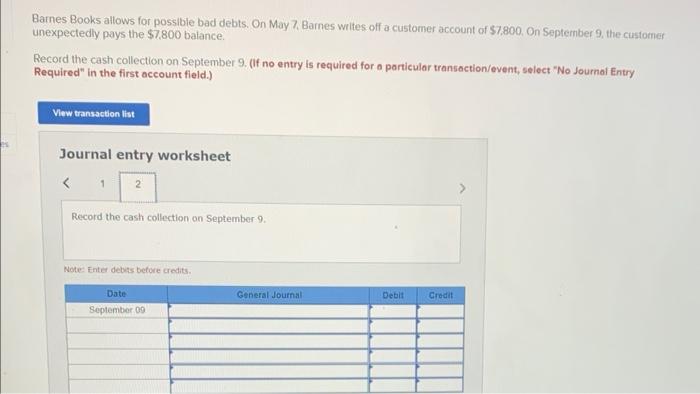

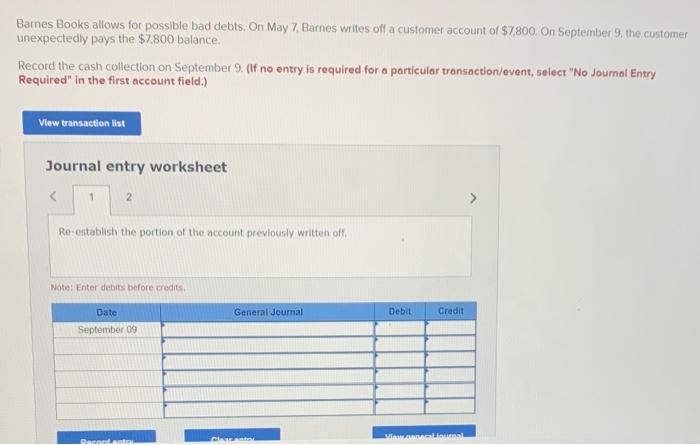

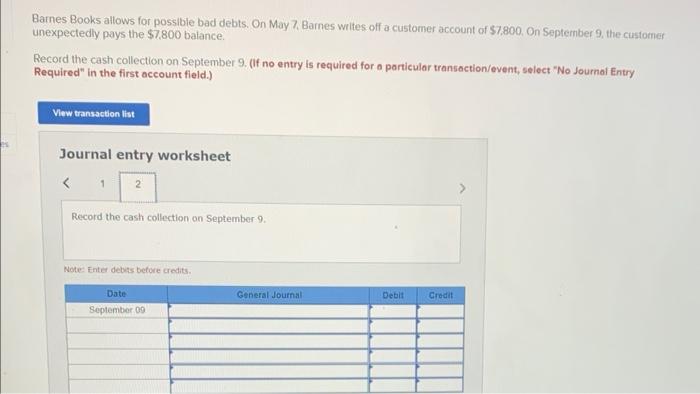

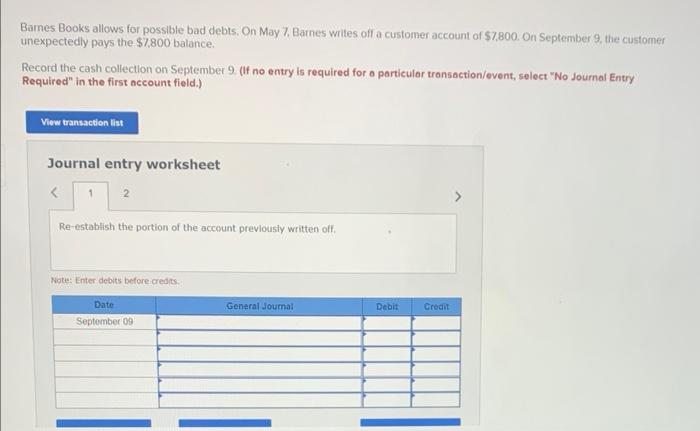

13)

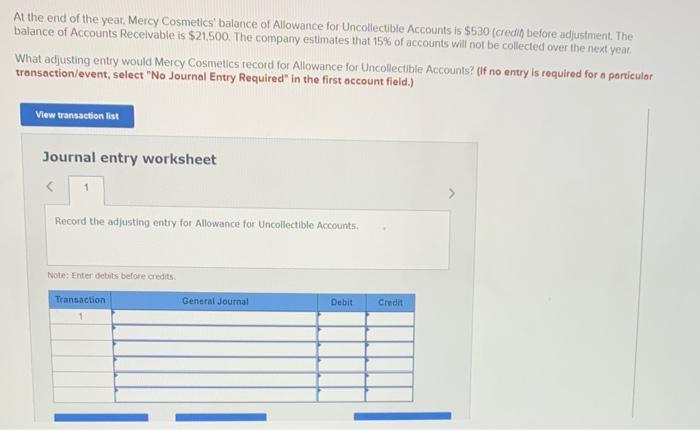

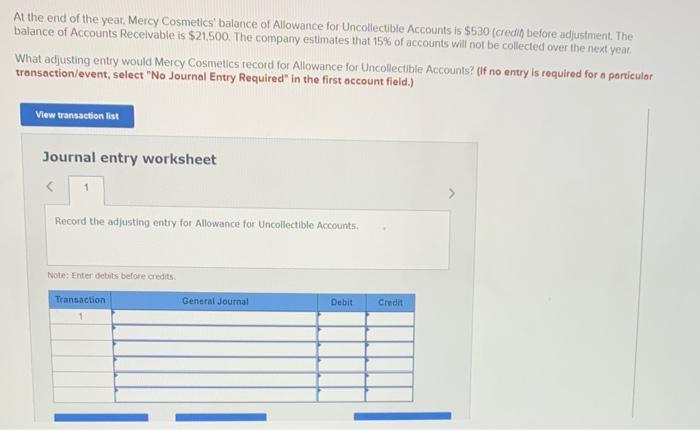

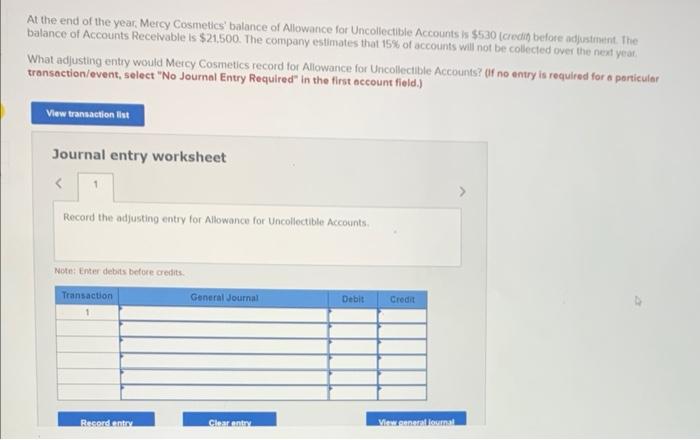

14)

Complete the problems using the information provided in pictures and this is the part of accounting that is being used\/

(internal Controls, Cash, Accounts receivable)(calculatong net sales, caluation of accounts receivable, recognizing bad debt expense through the "allowance method")

first problem

second problem

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started