Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer quickly ill thumbs up!!! Cracks of Dawns a clothing resale store, employs one salesperson, Daisy Hardy, Hardy's straight-time wage is $40 per hour,

please answer quickly ill thumbs up!!!

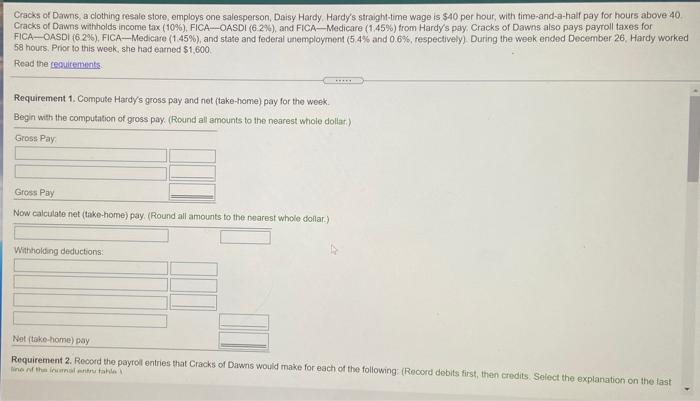

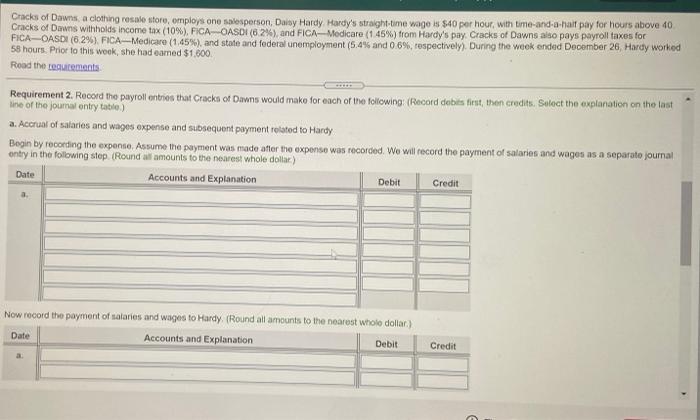

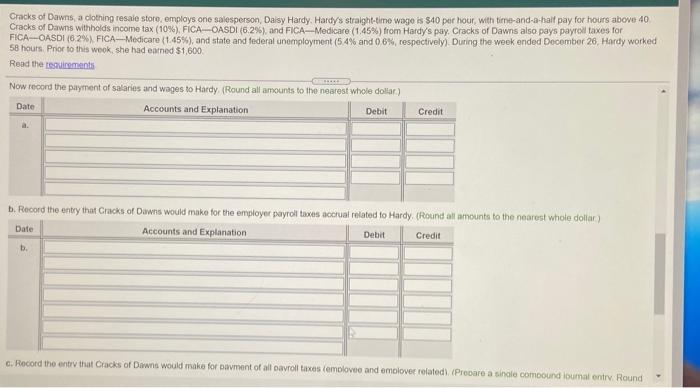

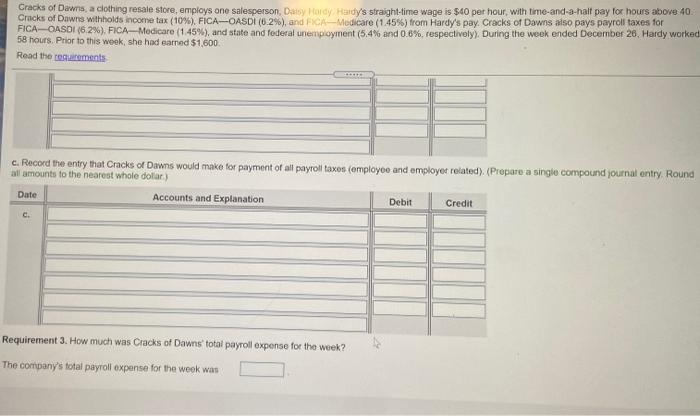

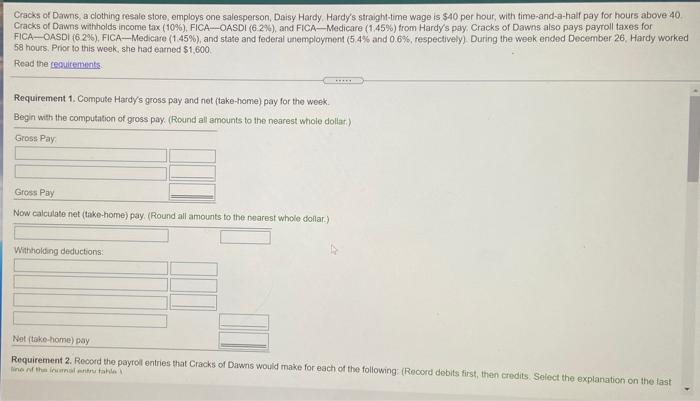

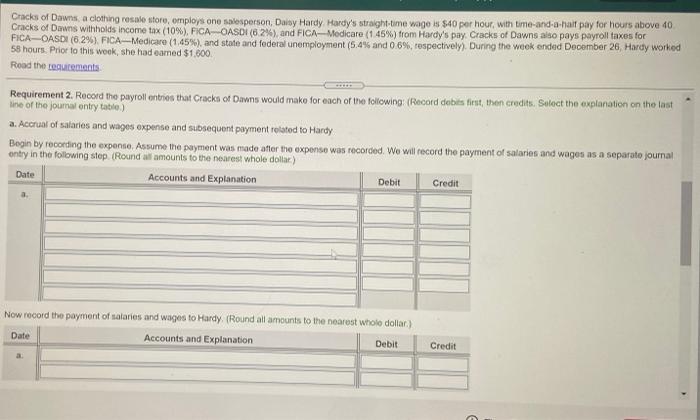

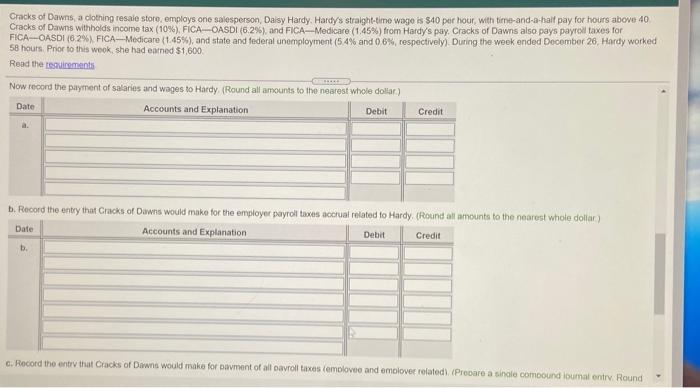

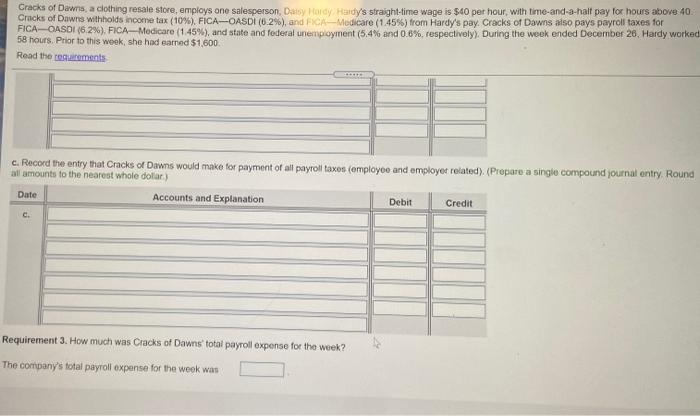

Cracks of Dawns a clothing resale store, employs one salesperson, Daisy Hardy, Hardy's straight-time wage is $40 per hour, with time-and-a-half pay for hours above 40 Cracks of Dawns withholds income tax (10%), FICA--OASDI (62%), and FICA--Medicare (1.45%) from Hardy's pay. Cracks of Dawns also pays payroll taxes for FICA-CASDI (626), FICA--Medicare (145%), and state and federal unemployment (5,4% and 0.6%, respectively) During the week ended December 26, Hardy worked 58 hours. Prior to this week, she had eamed $1.600 Read the requirements Requirement 1. Compute Hardy's gross pay and not take home) pay for the week Begin with the computation of gross pay. (Round all amounts to the nearest whole dollar) Gross Pay Gross Pay Now calculate net (take-home) pay. (Round all amounts to the nearest whole dollar) Withholding deductions: Not take-home) pay Requirement 2. Record the payroll entries that Cracks of Dawns would make for each of the following: (Record debits first, then credits Select the explanation on the last in the mouth - Cracks of Dawns a clothing rosale store, employs one salesperson, Davay Hardy Hardy's straight-time wage is $40 per hour, with time-and-a-half pay for hours above 40 Cracks of Dawns withholds income tax (10%), FICA OASDI (62%), and FICA-Medicare (145) from Hardy's pay Cracks of Dawns also pays payroll taxes for FICA-CASDI (62%) FICA---Medicare (1,45%), and state and federal unemployment (5.4% and 6%, respectively). During the week ended December 26, Hardy worked 58 hours. Prior to this week, she had eamed $1.600 Read the requirements Requirement 2. Record the payroll entries that Cracks of Dawns would make for each of the following: (Record debts first, then credits. Select the explanation on the last ne of the journal entry table) a. Accrual of salaries and wages expense and subsequent payment related to Hardy Begin by recording the expense. Assume the payment was made after the expense was recorded. We will record the payment of salaries and wages as a separatojournal entry in the following step (Round all amounts to the nearest whole dollar) Date Accounts and Explanation Debit Credit Now record the payment of salaries and wages to Hardy (Round all amounts to the nearest whole dollar) Date Accounts and Explanation Debit Credit Cracks of Dawns, a clothing resale store, employs one salesperson, Daisy Hardy, Hardy straight-time wage is $40 per hour, with time-and-a-half pay for hours above 10 Cracks of Dawns withholds income tax (10%), FICA-OASDI (6.2%)and FICA--Medicare (1.45%) from Hardy's pay. Cracks of Dawns also pays payroll taxes for FICA--OASDI (62%) FICA--Medicare (1.456), and state and federal unemployment (5.4% and 0.6%respectively). During the wook ended December 26, Hardy worked 58 hours. Prior to this weok, she had earned $1,600 Read the requirements Now record the payment of salaries and wages to Hardy (Round all amounts to the nearest whole dollar) Date Accounts and Explanation Debit Credit b. Record the entry that Cracks of Dawns would make for the employer payrols taxes socrual related to Hardy, (Round al amounts to the nearest whole dollar) Accounts and Explanation Date Debit Credit b. c. Record the entry that Cracks of Dawns would make for savment of all avroll taxes temolove and emolover related. (Procare a single compound loumal entry Round Cracks of Dawn, a clothing resale store, employs one salesperson, Daisy Hardy Haidy's straight-time wage is $40 per hour, with time-and-a-half pay for hours above 40. Cracks of Dawns withholds income tax (10%), FICA-OASDI(0.2%), and FICA-Medicare (1.45%) from Hardy's pay. Cracks of Dawns also pays payroll taxes for FICA-OASDI (62%), FICA-Medicare (145%), and state and federal unemployment (5,4% and 0.6%, respectively). During the week ended December 26, Hardy worked 58 hours. Prior to this week, she had earned $1,600 Read the regrements c. Record the entry that Cracks of Dawns would make for payment of all payroll taxes (employee and employer related). (Prepare a single compound journal entry Round all amounts to the nearest whole dolar) Date Accounts and Explanation Debit Credit C. Requirement 3. How much was Cracks of Dawns total payroll expense for the week? The company's total payroll expense for the week was

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started