Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer quickly running out of time During February, the last month of the fiscal year, Be My Valentine Ltd, sells $21.500 of gift cards.

Please answer quickly running out of time

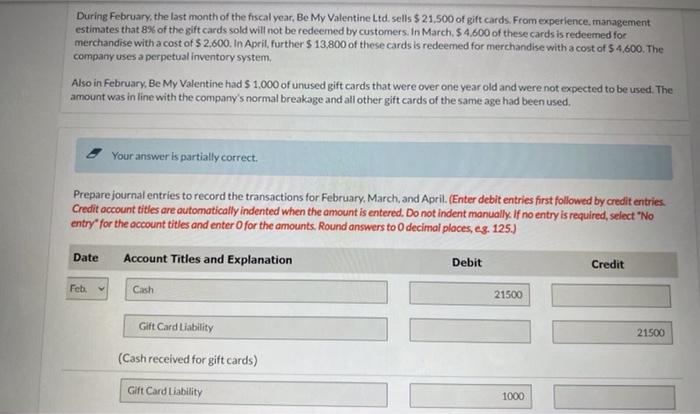

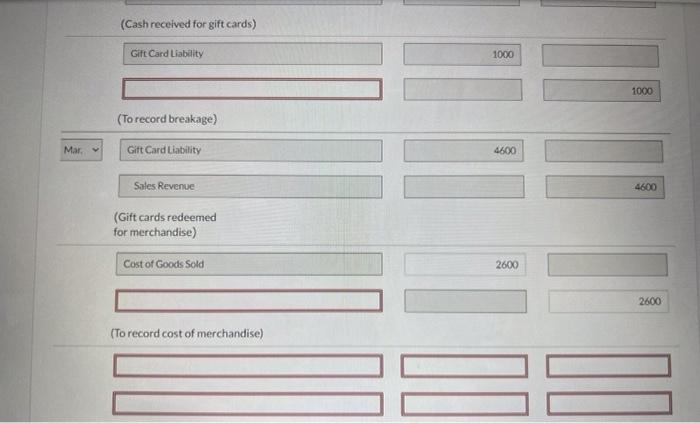

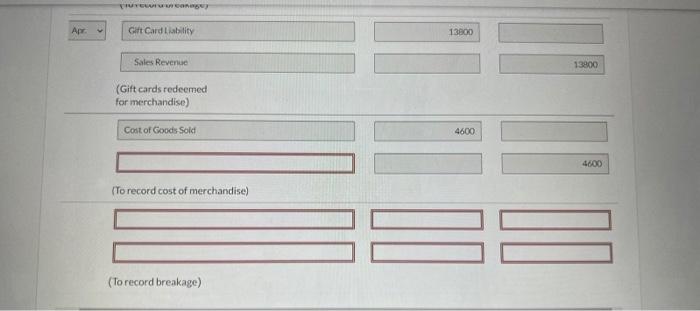

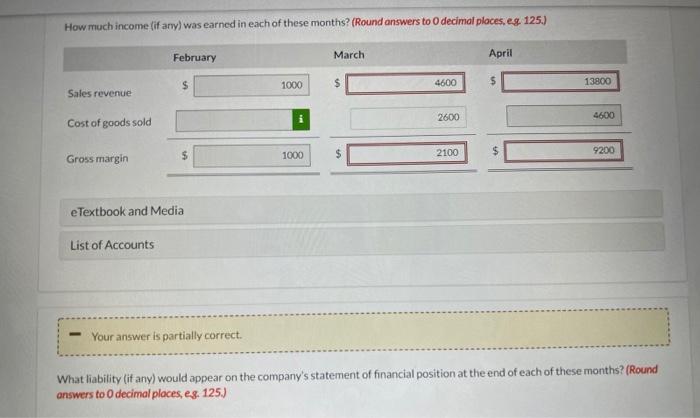

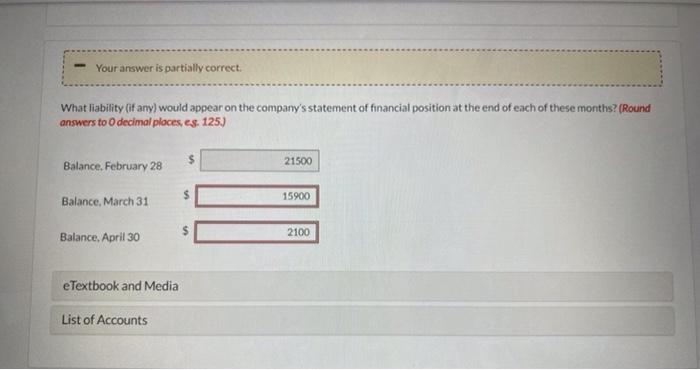

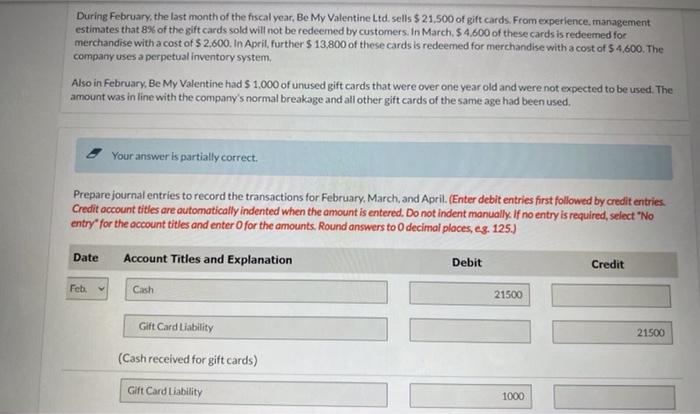

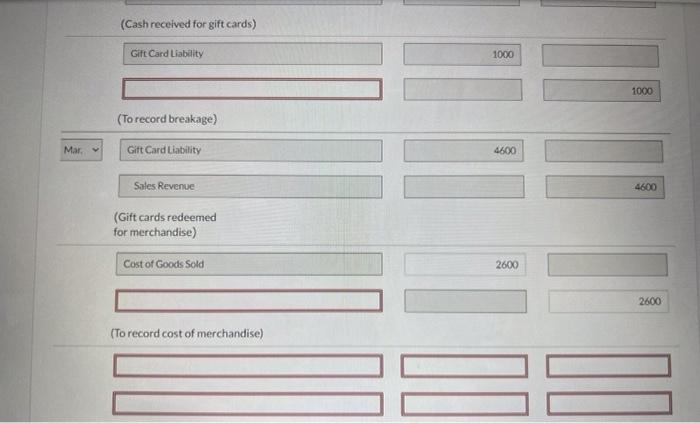

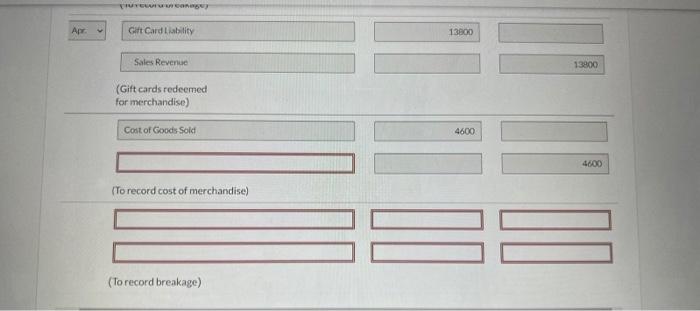

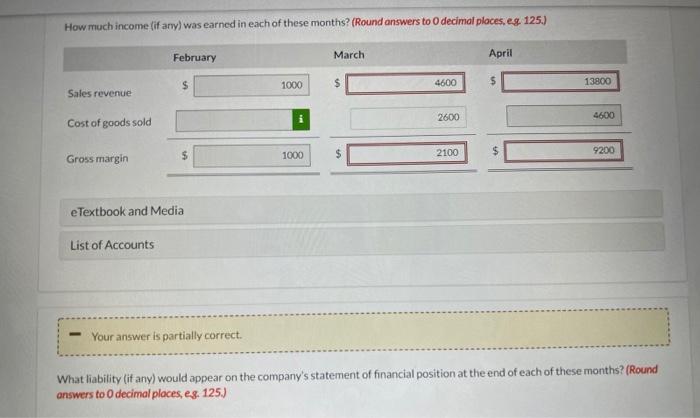

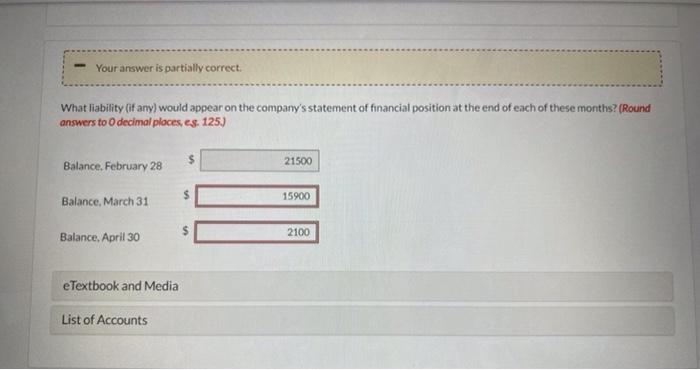

During February, the last month of the fiscal year, Be My Valentine Ltd, sells $21.500 of gift cards. From experience management estimates that 8% of the gift cards sold will not be redeemed by customers. In March, $4,600 of these cards is redeemed for merchandise with a cost of $ 2,600. In April, further $13,800 of these cards is redeemed for merchandise with a cost of $4,600. The company uses a perpetual inventory system, Also in February, Be My Valentine had $ 1.000 of unused gift cards that were over one year old and were not expected to be used. The amount was in line with the company's normal breakage and all other gift cards of the same age had been used. Your answer is partially correct. Prepare journal entries to record the transactions for February March, and April (Enter debit entries first followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter O for the amounts. Round answers to decimal places, eg. 125.) Date Account Titles and Explanation Debit Credit Feb Cash 21500 Gift Card Liability 21500 (Cash received for gift cards) Gift Card Liability 1000 (Cash received for gift cards) Gift Card Liability 1000 1000 (To record breakage) Mar, Gift Card Liability 4600 Sales Revenue 4600 (Gift cards redeemed for merchandise) TATTI Cost of Goods Sold 2600 2600 (To record cost of merchandise) PUTERS . Gift Card Liability 13800 Sales Revenue 13800 (Gift cards redeemed for merchandise) Cost of Goods Sold 4600 TUTO 4600 (To record cost of merchandise) IN (To record breakage) How much income (if any) was earned in each of these months? (Round answers to decimal places, es 125.) February March April $ $ 1000 4600 $ 13800 Sales revenue 2600 4600 Cost of goods sold $ $ 2100 1000 Gross margin 9200 e Textbook and Media List of Accounts Your answer is partially correct. What liability (if any) would appear on the company's statement of financial position at the end of each of these months? (Round answers to decimal places, c.8. 125) Your answer is partially correct. What liability (if any) would appear on the company's statement of financial position at the end of each of these months? (Round answers to decimal places, es. 125.) Balance. February 28 21500 $ Balance, March 31 15900 $ 2100 Balance, April 30 eTextbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started