Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer quickly - whatever u can. HollyRock Golf Course You are the new bookkeeper for the HollyRock Golf Course. The owner has hired you

Please answer quickly - whatever u can.

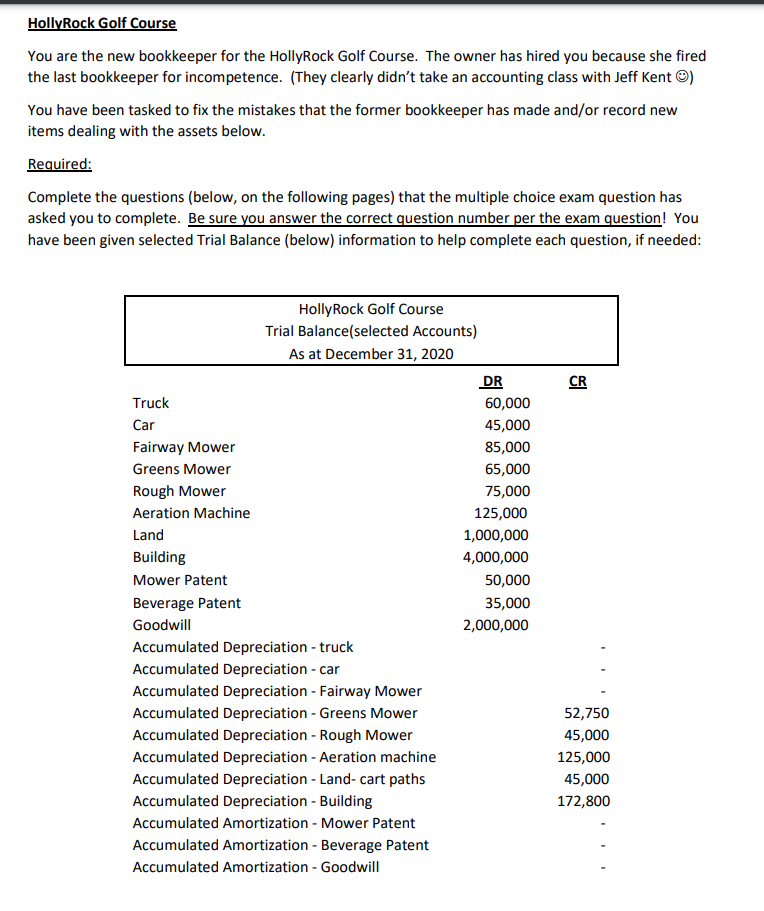

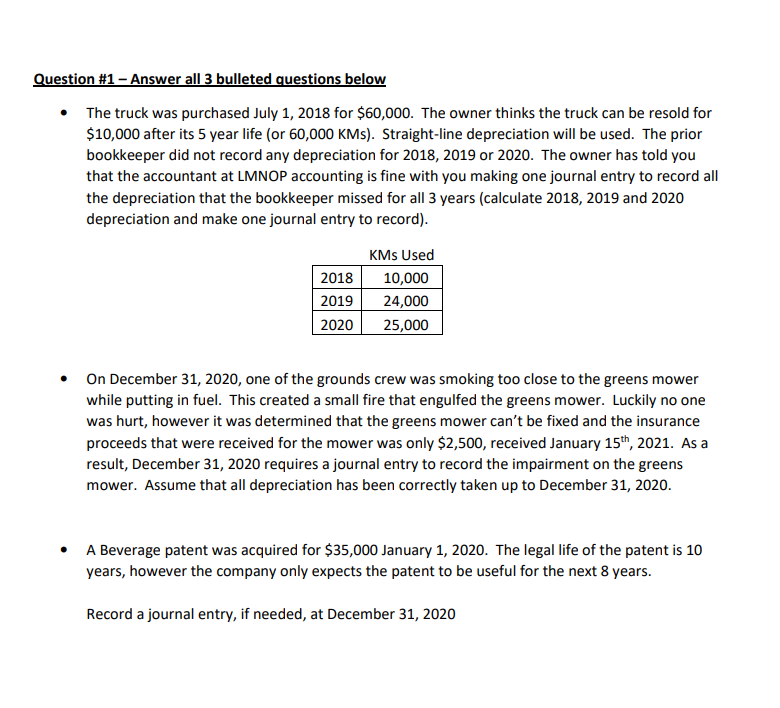

HollyRock Golf Course You are the new bookkeeper for the HollyRock Golf Course. The owner has hired you because she fired the last bookkeeper for incompetence. (They clearly didn't take an accounting class with Jeff Kent) You have been tasked to fix the mistakes that the former bookkeeper has made and/or record new items dealing with the assets below. Required: Complete the questions (below, on the following pages) that the multiple choice exam question has asked you to complete. Be sure you answer the correct question number per the exam question! You have been given selected Trial Balance (below) information to help complete each question, if needed: HollyRock Golf Course Trial Balance(selected Accounts) As at December 31, 2020 DR CR 60,000 45,000 85,000 65,000 75,000 125,000 1,000,000 4,000,000 50,000 35,000 2,000,000 Truck Car Fairway Mower Greens Mower Rough Mower Aeration Machine Land Building Mower Patent Beverage Patent Goodwill Accumulated Depreciation - truck Accumulated Depreciation - car Accumulated Depreciation - Fairway Mower Accumulated Depreciation - Greens Mower Accumulated Depreciation - Rough Mower Accumulated Depreciation - Aeration machine Accumulated Depreciation - Land-cart paths Accumulated Depreciation - Building Accumulated Amortization - Mower Patent Accumulated Amortization - Beverage Patent Accumulated Amortization - Goodwill 52,750 45,000 125,000 45,000 172,800 Question #1 - Answer all 3 bulleted questions below The truck was purchased July 1, 2018 for $60,000. The owner thinks the truck can be resold for $10,000 after its 5 year life (or 60,000 KMs). Straight-line depreciation will be used. The prior bookkeeper did not record any depreciation for 2018, 2019 or 2020. The owner has told you that the accountant at LMNOP accounting is fine with you making one journal entry to record all the depreciation that the bookkeeper missed for all 3 years (calculate 2018, 2019 and 2020 depreciation and make one journal entry to record). KMs Used 2018 10,000 2019 24,000 2020 25,000 On December 31, 2020, one of the grounds crew was smoking too close to the greens mower while putting in fuel. This created a small fire that engulfed the greens mower. Luckily no one was hurt, however it was determined that the greens mower can't be fixed and the insurance proceeds that were received for the mower was only $2,500, received January 15th, 2021. As a result, December 31, 2020 requires a journal entry to record the impairment on the greens mower. Assume that all depreciation has been correctly taken up to December 31, 2020. A Beverage patent was acquired for $35,000 January 1, 2020. The legal life of the patent is 10 years, however the company only expects the patent to be useful for the next 8 years. Record a journal entry, if needed, at December 31, 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started