Please answer required A,B

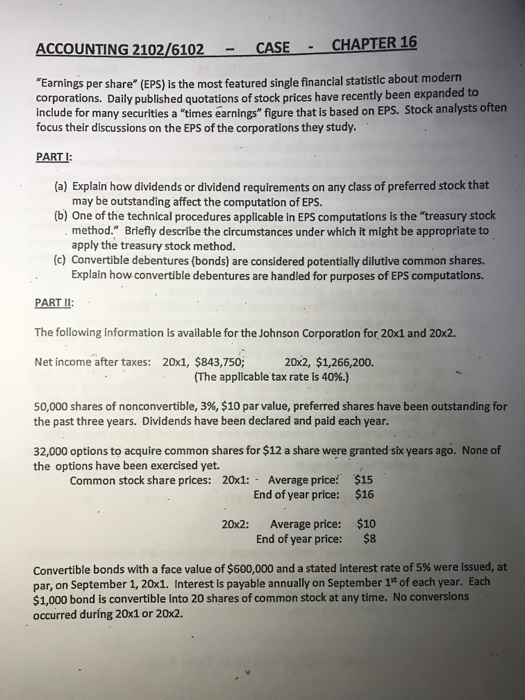

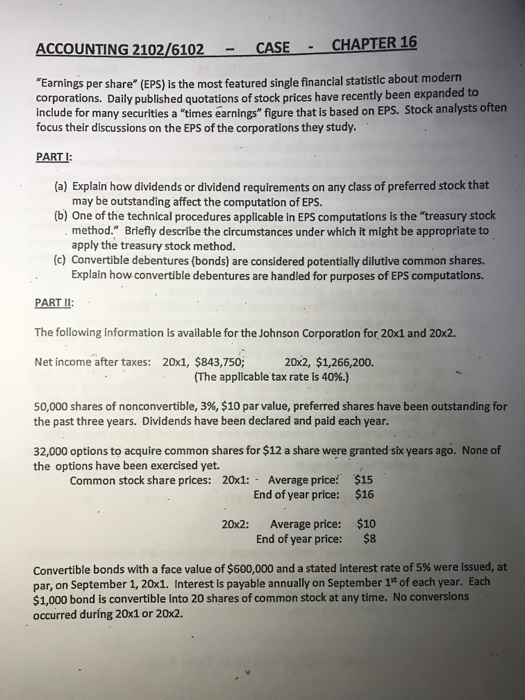

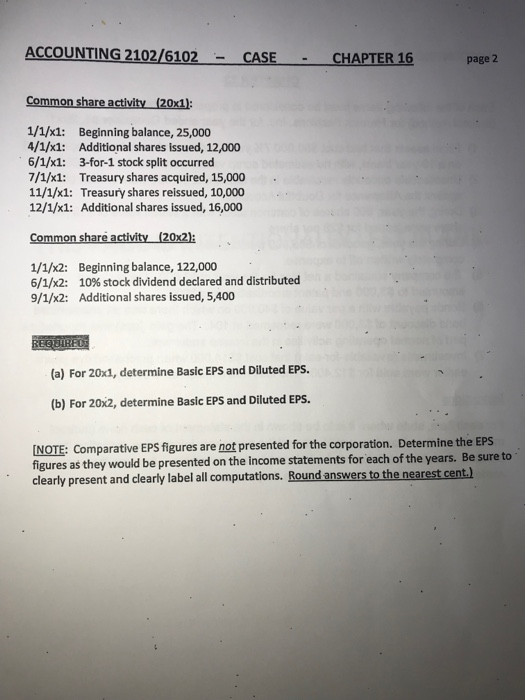

ACCOUNTING 2102/6102- CASE CHAPTER 16 - "Earnings per share (EPS) is the most featured single financial statistic about modern corporations. Daily published quotations of stock prices have recently been expanded to include for many securities a "times earnings" figure that is based on EPS. Stock analysts often focus their discussions on the EPS of the corporations they study PARTI (a) Explain how dividends or dividend requirements on any class of preferred stock that (b) One of the technical procedures applicable in EPS computations is the "treasury stock (c) Convertible debentures (bonds) are considered potentially dilutive common shares. may be outstanding affect the computation of EPS. method." Briefly describe the circumstances under which it might be appropriate to apply the treasury stock method. Explain how convertible debentures are handled for purposes of EPS computations. PART 11: The following information is available for the Johnson Corporation for 20xi and 20x2. Net income after taxes: 20x1, $843,750; 20x2, $1,266,200. e applicable tax rate is 40%.) 50,000 shares of nonconvertible, 3%, $10 par value, preferred shares have been outstanding for the past three years. Dividends have been declared and paid each year. 32,000 options to acquire common shares for $12 a share were granted six years ago. None of the options have been exercised yet. Common stock share prices: 20x1: Average price: $15 End of year price: $16 20x2: Average price: End of year price: $10 $8 Convertible bonds with a face value of $600,000 and a stated interest rate of 5% were issued, at par, on September 1, 20x1. Interest is payable annually on September 1t of each year. Each $1,000 bond is convertible into 20 shares of common stock at any time. No conversions occurred during 20x1 or 20x2. ACCOUNTING 2102/6102-CASE CHAPTER 16 page 2 Common share activity (20x1 1/1/x1: Beginning balance, 25,000 4/1/x1: Additional shares issued, 12,000 6/1/x1: 3-for-1 stock split occurred 7/1/x1: Treasury shares acquired, 15,000 11/1/x1: Treasury shares reissued, 10,000 12/1/x1: Additional shares issued, 16,000 1/1/x2: Beginning balance, 122,000 6/1/2: 10% stock dividend declared and distributed 9/1/x2: Additional shares issued, 5,400 (a) For 20x1, determine Basic EPS and Diluted EPS. (b) For 20x2, determine Basic EPS and Diluted EPS NOTE: Comparative EPS figures are not presented for the corporation. Determine the EP figures as they would be presented on the income statements for each of the years. Be sure to clearly present and clearly label all computations. Round answers to the nearest cent.) ACCOUNTING 2102/6102- CASE CHAPTER 16 - "Earnings per share (EPS) is the most featured single financial statistic about modern corporations. Daily published quotations of stock prices have recently been expanded to include for many securities a "times earnings" figure that is based on EPS. Stock analysts often focus their discussions on the EPS of the corporations they study PARTI (a) Explain how dividends or dividend requirements on any class of preferred stock that (b) One of the technical procedures applicable in EPS computations is the "treasury stock (c) Convertible debentures (bonds) are considered potentially dilutive common shares. may be outstanding affect the computation of EPS. method." Briefly describe the circumstances under which it might be appropriate to apply the treasury stock method. Explain how convertible debentures are handled for purposes of EPS computations. PART 11: The following information is available for the Johnson Corporation for 20xi and 20x2. Net income after taxes: 20x1, $843,750; 20x2, $1,266,200. e applicable tax rate is 40%.) 50,000 shares of nonconvertible, 3%, $10 par value, preferred shares have been outstanding for the past three years. Dividends have been declared and paid each year. 32,000 options to acquire common shares for $12 a share were granted six years ago. None of the options have been exercised yet. Common stock share prices: 20x1: Average price: $15 End of year price: $16 20x2: Average price: End of year price: $10 $8 Convertible bonds with a face value of $600,000 and a stated interest rate of 5% were issued, at par, on September 1, 20x1. Interest is payable annually on September 1t of each year. Each $1,000 bond is convertible into 20 shares of common stock at any time. No conversions occurred during 20x1 or 20x2. ACCOUNTING 2102/6102-CASE CHAPTER 16 page 2 Common share activity (20x1 1/1/x1: Beginning balance, 25,000 4/1/x1: Additional shares issued, 12,000 6/1/x1: 3-for-1 stock split occurred 7/1/x1: Treasury shares acquired, 15,000 11/1/x1: Treasury shares reissued, 10,000 12/1/x1: Additional shares issued, 16,000 1/1/x2: Beginning balance, 122,000 6/1/2: 10% stock dividend declared and distributed 9/1/x2: Additional shares issued, 5,400 (a) For 20x1, determine Basic EPS and Diluted EPS. (b) For 20x2, determine Basic EPS and Diluted EPS NOTE: Comparative EPS figures are not presented for the corporation. Determine the EP figures as they would be presented on the income statements for each of the years. Be sure to clearly present and clearly label all computations. Round answers to the nearest cent.)