Question

PLEASE ANSWER REQUIRED C & D Jordan Company is a retail company that specializes in selling outdoor camping equipment. The company is considering opening a

PLEASE ANSWER REQUIRED C & D

Jordan Company is a retail company that specializes in selling outdoor camping equipment. The company is considering opening a new store on October 1, year 1. The company president formed a planning committee to prepare a master budget for the first three months of operation. As budget coordinator, you have been assigned the following tasks.

Required

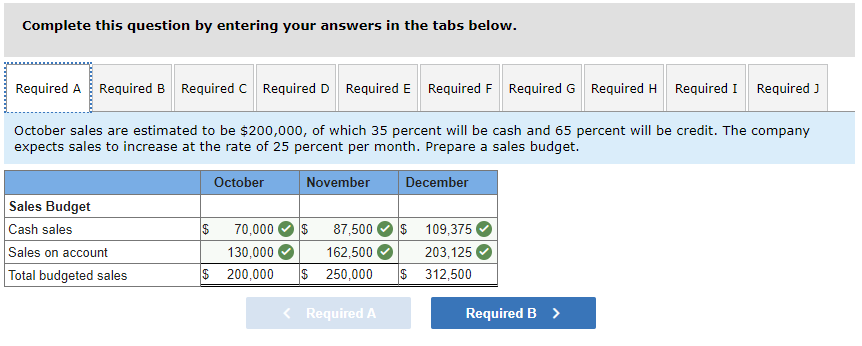

a. October sales are estimated to be $200,000, of which 35 percent will be cash and 65 percent will be credit. The company expects sales to increase at the rate of 25 percent per month. Prepare a sales budget.

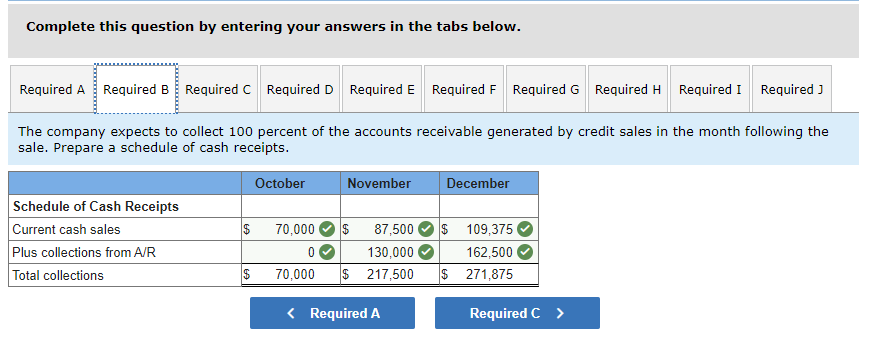

b. The company expects to collect 100 percent of the accounts receivable generated by credit sales in the month following the sale. Prepare a schedule of cash receipts.

Required

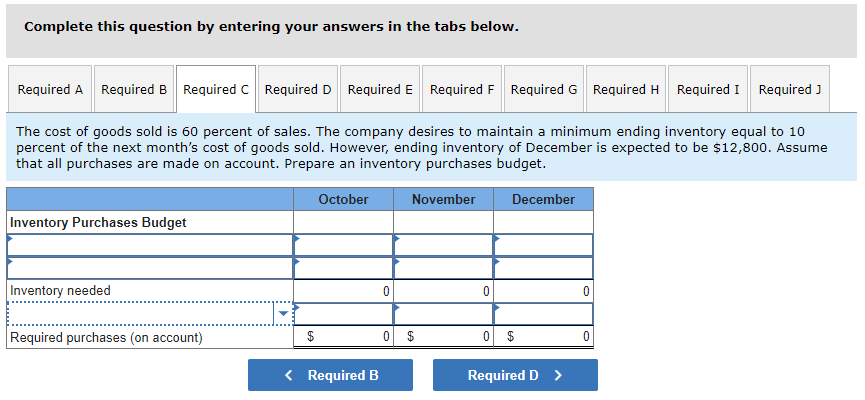

c. The cost of goods sold is 60 percent of sales. The company desires to maintain a minimum ending inventory equal to 10 percent of the next months cost of goods sold. However, ending inventory of December is expected to be $12,800. Assume that all purchases are made on account. Prepare an inventory purchases budget.

FAR LEFT COLUMN ROW 2 ANSWER OPTIONS:

- Budgeted cost of goods sold

- Purchases

- Sales

- Sales return

- Selling and administrative expenses

FAR LEFT COLUMN ROWS 3 & 5 ANSWER OPTIONS:

- Plus: Desired ending inventory

- Less: Desired ending inventory

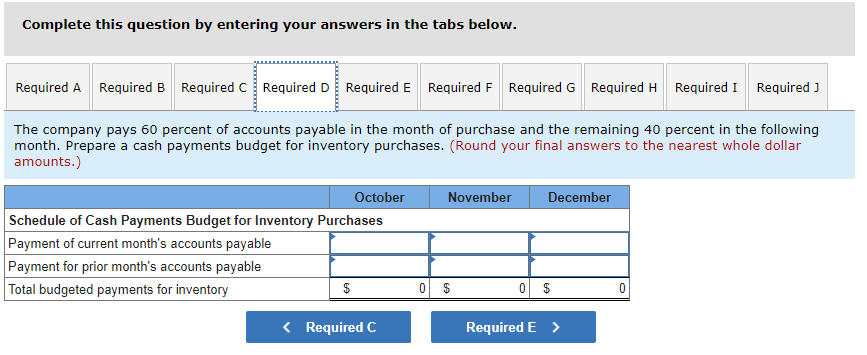

d. The company pays 60 percent of accounts payable in the month of purchase and the remaining 40 percent in the following month. Prepare a cash payments budget for inventory purchases.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started