Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER REQUIREMENTS 1-7 Kurt & Theresa is an advertising agency. The firm uses a job cost system in which each client is a different

PLEASE ANSWER REQUIREMENTS 1-7

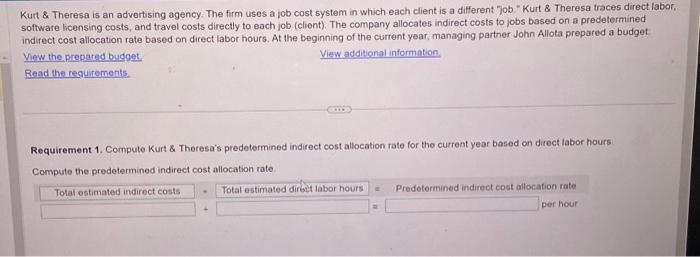

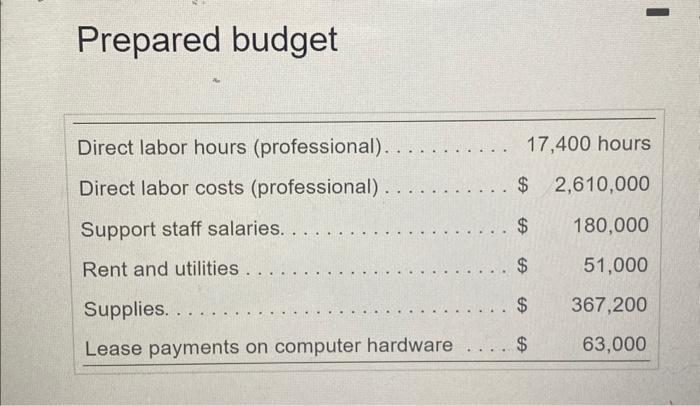

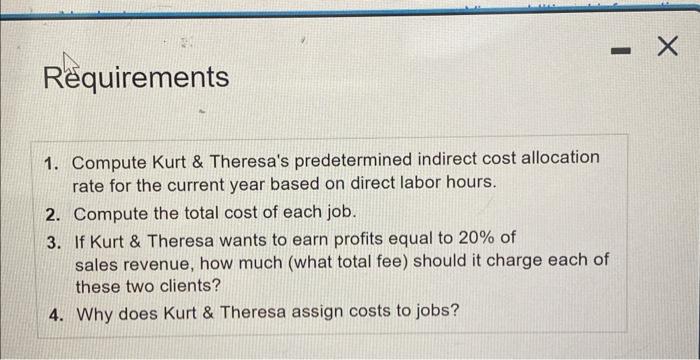

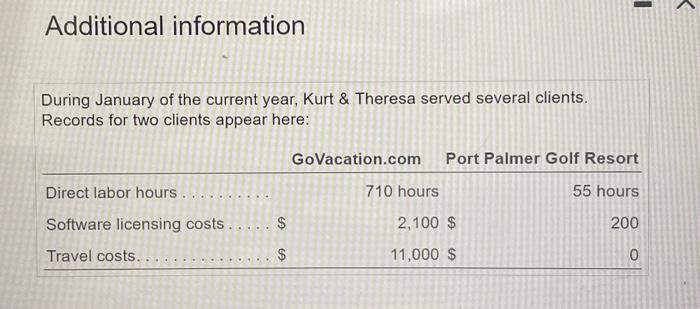

Kurt & Theresa is an advertising agency. The firm uses a job cost system in which each client is a different "job." Kurt & Theresa traces direct labor, software licensing costs, and travel costs directly to each job (client). The company allocates indirect costs to jobs based on a predetermined indirect cost allocation rate based on direct labor hours. At the beginning of the current year, managing partner John Allota prepared a budget: View the prepared budget. View additional information. Read the requirements. Requirement 1. Compute Kurt & Theresa's predetermined indirect cost allocation rate for the current year based on direct labor hours. Compute the predetermined indirect cost allocation rate. Total estimated indirect costs Total estimated direct labor hours + + = = Predetermined indirect cost allocation rate per hour

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started