Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer soon! You are considering investing in a project that requires an up front investment of $2,300,000 and is expected to produce NOI for

please answer soon!

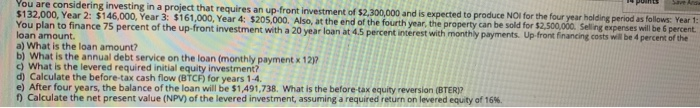

You are considering investing in a project that requires an up front investment of $2,300,000 and is expected to produce NOI for the four year holding period as follows: Year 1: $132,000, Year 2: $146,000, Year 3: $161,000, Year 4: $205,000. Also, at the end of the fourth year, the property can be sold for $2,500,000. Selling expenses will be 6 percent You plan to finance 75 percent of the up-front investment with a 20 year loan at 4.5 percent interest with monthly payments. Up-front financing costs will be 4 percent of the loan amount. a) What is the loan amount? b) What is the annual debt service on the loan (monthly payment x 12)? What is the levered required initial equity investment? d) Calculate the before-tax cash flow (BTCF) for years 1-4. e) After four years, the balance of the loan will be $1,491,738. What is the before tax equity reversion (BTER? 1) Calculate the net present value (NPV) of the levered investment, assuming a required return on levered equity of 16% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started