please answer step by step i need to submit tonight thank you

these are the two questions u need to answer from

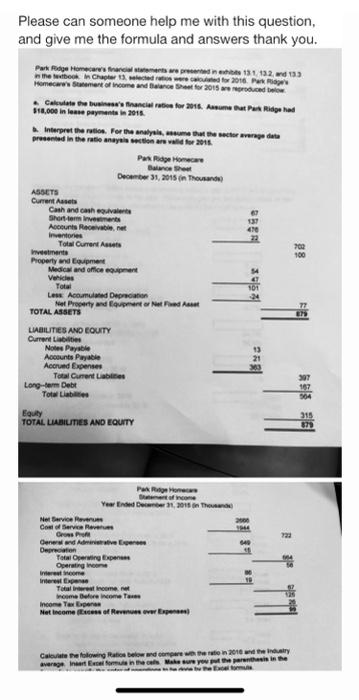

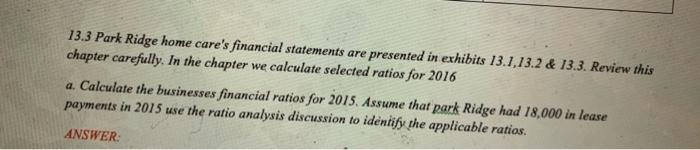

the previous images

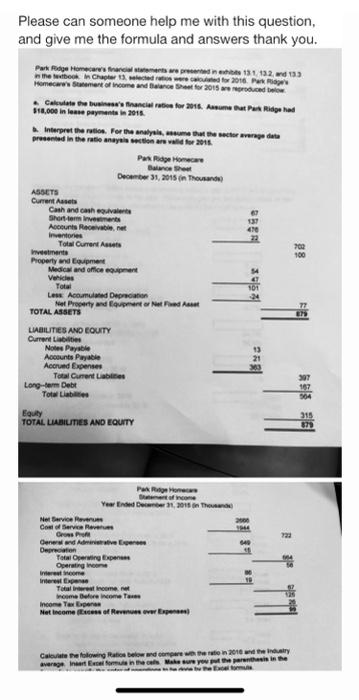

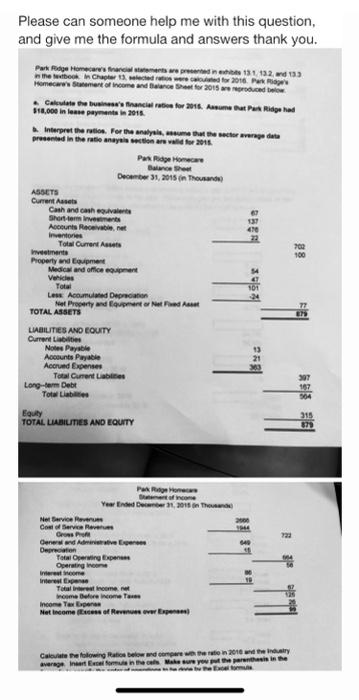

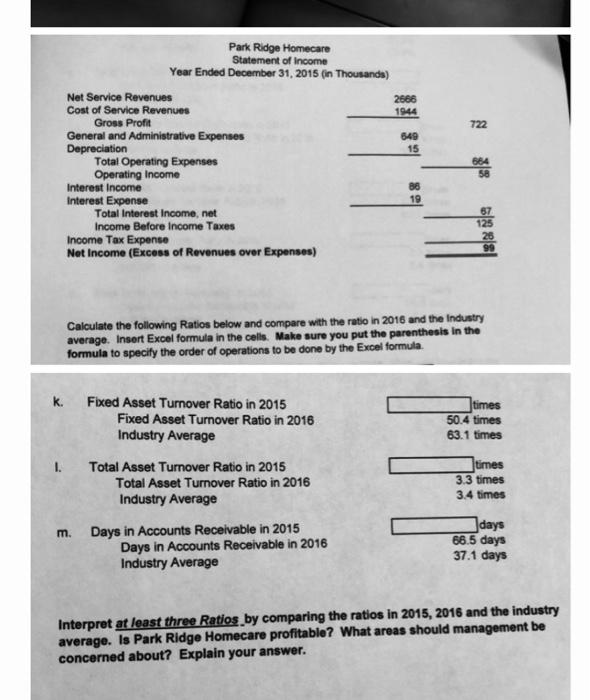

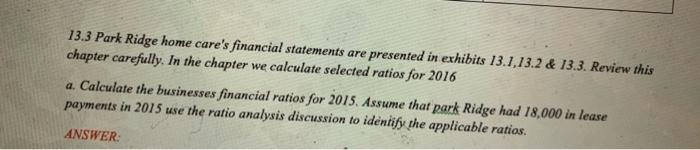

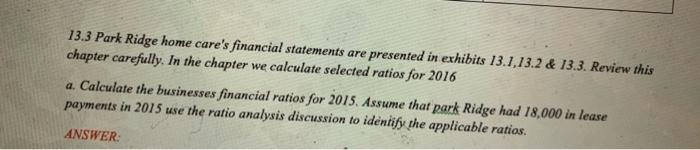

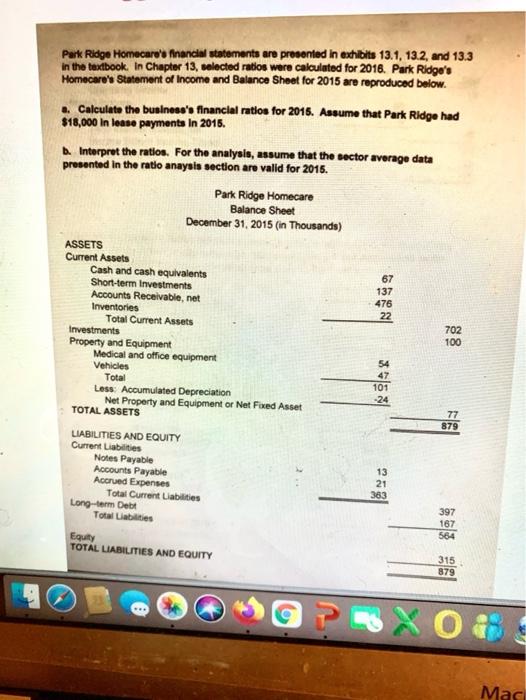

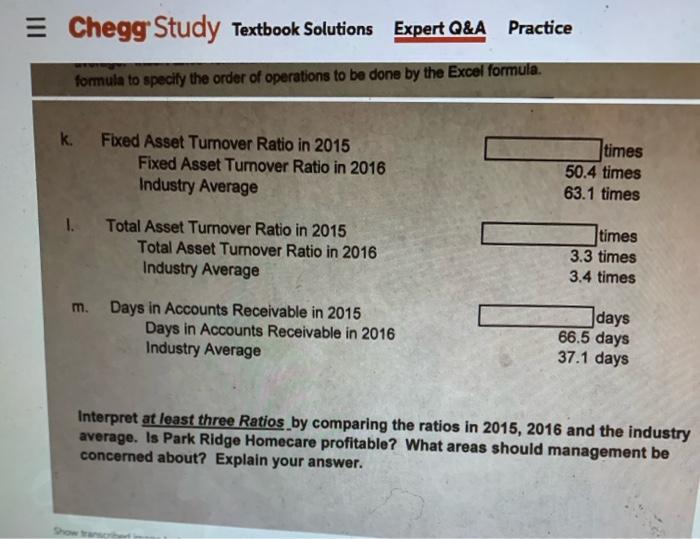

Please can someone help me with this question, and give me the formula and answers thank you. Pusage Homecars we were in 131 132 133 the Dock Chapter 13 lected for wed for 2016. Per a Home Statement of income and Garance produced to Calculate the user's financial for 2018. Asume a Persilige had $18.000 in lesse payment in 2015 Interpret the ration. For the analysis, aume that the sector warga presented in the rate anaysia section are valid for 2016 Per Roage Home Balance Sheet December 31, 2015 in Thousand ASSETS Current Assets Cash and chuivalente Short term investments Accounts Recent Inventores Total Current Asset investments 100 Property d bomen Medical and office open Video Total Les Acoume Depo Net Property and EquatorNet Fedt TOTAL ASSETS els 2 LIABILITIES AND EQUITY Current Notes Payable Accounts Payable Accrund Expenses Total Current Long-term Debe Tot Lab 197 504 315 Equity TOTAL LIABILITIES AND EQUITY 44 Par Regno to come Year End Dec 11, 2015 in The Net Service Power Cost of Service Revue Grow Gene and Admin Depron Tot Operving Expense Operating in me Interest Expense Totalrenomena nome Before comme Income Tax Expert Net Incomes of Revenue www Calcuteflowing to below and compete in 2016 heiny average Insert Emin Make sure this is the 722 Park Ridge Homecare Statement of Income Year Ended December 31, 2015 (in Thousands) Net Service Revenues 2688 Cost of Service Revenues 1944 Gross Profit General and Administrative Expenses 549 Depreciation 15 Total Operating Expenses Operating Income Interest Income 88 Interest Expense 19 Total Interest Income, net Income Before Income Taxes Income Tax Expense Net Income (Excess of Revenues over Expenses) 684 58 18a ale Calculate the following Ratios below and compare with the ratio in 2016 and the Industry average. Insert Excel formula in the cells. Make sure you put the parenthesis in the formula to specify the order of operations to be done by the Excel formula k Fixed Asset Turnover Ratio in 2015 Fixed Asset Turnover Ratio in 2016 Industry Average times 50.4 times 63.1 times 1. Total Asset Turnover Ratio in 2015 Total Asset Turnover Ratio in 2016 Industry Average times 3.3 times 3.4 times m. Days in Accounts Receivable in 2015 Days in Accounts Receivable in 2016 Industry Average days 66.5 days 37.1 days Interpret at least three Ratios by comparing the ratios in 2015, 2016 and the industry average. Is Park Ridge Homecare profitable? What areas should management be concerned about? Explain your answer. 13.3 Park Ridge home care's financial statements are presented in exhibits 13.1.13.2 & 13.3. Review this chapter carefully. In the chapter we calculate selected ratios for 2016 a. Calculate the businesses financial ratios for 2015. Assume that park Ridge had 18,000 in lease payments in 2015 use the ratio analysis discussion to identify the applicable ratios. ANSWER: b. Interpret the ratios. For the analysis assume that the sector average data presented in the ratio analysis selections are valid for 2015. ANSWER: Park Ridge Homecare's financial statements are presented in exhibits 13.1 13.2 and 13.3 in the textbook. In Chapter 13, selected ratios were calculated for 2016. Park Ridge's Homecare's Statement of Income and Balance Sheet for 2015 are reproduced below .. Calculate the business's financial ratios for 2016. Assume that Park Ridge had $18,000 in lease payments in 2016. Interpret the ration. For the analysis, assume that the sector average data presented in the ratio anaysia section are valid for 2015. Park Ridge Homecare Balance Sheet December 31, 2015 (in Thousands) 67 137 476 22 702 100 ASSETS Current Assets Cash and cash equivalents Short-term investments Accounts Receivable, net Inventories Total Current Assets Investments Property and Equipment Medical and office equipment Vehicles Total Loss: Accumulated Depreciation Net Property and Equipment or Net Foxed Asset TOTAL ASSETS LIABILITIES AND EQUITY Current Liabilities Notes Payable Accounts Payable Accrued Expenses Total Current Liabilities Long-term Debe Total abilities 54 47 101 -24 77 879 13 21 363 397 167 584 Equity TOTAL LIABILITIES AND EQUITY 315 879 XO Mac Chegg Study Textbook Solutions Expert Q&A Practice formula to specify the order of operations to be done by the Excel formula. k. Fixed Asset Turnover Ratio in 2015 Fixed Asset Turnover Ratio in 2016 Industry Average times 50.4 times 63.1 times Total Asset Turnover Ratio in 2015 Total Asset Turnover Ratio in 2016 Industry Average times 3.3 times 3.4 times m. Days in Accounts Receivable in 2015 Days in Accounts Receivable in 2016 Industry Average days 66.5 days 37.1 days Interpret at least three Ratios by comparing the ratios in 2015, 2016 and the industry average. Is Park Ridge Homecare profitable? What areas should management be concerned about? Explain your answer. Please can someone help me with this question, and give me the formula and answers thank you. Pusage Homecars we were in 131 132 133 the Dock Chapter 13 lected for wed for 2016. Per a Home Statement of income and Garance produced to Calculate the user's financial for 2018. Asume a Persilige had $18.000 in lesse payment in 2015 Interpret the ration. For the analysis, aume that the sector warga presented in the rate anaysia section are valid for 2016 Per Roage Home Balance Sheet December 31, 2015 in Thousand ASSETS Current Assets Cash and chuivalente Short term investments Accounts Recent Inventores Total Current Asset investments 100 Property d bomen Medical and office open Video Total Les Acoume Depo Net Property and EquatorNet Fedt TOTAL ASSETS els 2 LIABILITIES AND EQUITY Current Notes Payable Accounts Payable Accrund Expenses Total Current Long-term Debe Tot Lab 197 504 315 Equity TOTAL LIABILITIES AND EQUITY 44 Par Regno to come Year End Dec 11, 2015 in The Net Service Power Cost of Service Revue Grow Gene and Admin Depron Tot Operving Expense Operating in me Interest Expense Totalrenomena nome Before comme Income Tax Expert Net Incomes of Revenue www Calcuteflowing to below and compete in 2016 heiny average Insert Emin Make sure this is the 722 Park Ridge Homecare Statement of Income Year Ended December 31, 2015 (in Thousands) Net Service Revenues 2688 Cost of Service Revenues 1944 Gross Profit General and Administrative Expenses 549 Depreciation 15 Total Operating Expenses Operating Income Interest Income 88 Interest Expense 19 Total Interest Income, net Income Before Income Taxes Income Tax Expense Net Income (Excess of Revenues over Expenses) 684 58 18a ale Calculate the following Ratios below and compare with the ratio in 2016 and the Industry average. Insert Excel formula in the cells. Make sure you put the parenthesis in the formula to specify the order of operations to be done by the Excel formula k Fixed Asset Turnover Ratio in 2015 Fixed Asset Turnover Ratio in 2016 Industry Average times 50.4 times 63.1 times 1. Total Asset Turnover Ratio in 2015 Total Asset Turnover Ratio in 2016 Industry Average times 3.3 times 3.4 times m. Days in Accounts Receivable in 2015 Days in Accounts Receivable in 2016 Industry Average days 66.5 days 37.1 days Interpret at least three Ratios by comparing the ratios in 2015, 2016 and the industry average. Is Park Ridge Homecare profitable? What areas should management be concerned about? Explain your answer. 13.3 Park Ridge home care's financial statements are presented in exhibits 13.1.13.2 & 13.3. Review this chapter carefully. In the chapter we calculate selected ratios for 2016 a. Calculate the businesses financial ratios for 2015. Assume that park Ridge had 18,000 in lease payments in 2015 use the ratio analysis discussion to identify the applicable ratios. ANSWER: b. Interpret the ratios. For the analysis assume that the sector average data presented in the ratio analysis selections are valid for 2015. ANSWER: Park Ridge Homecare's financial statements are presented in exhibits 13.1 13.2 and 13.3 in the textbook. In Chapter 13, selected ratios were calculated for 2016. Park Ridge's Homecare's Statement of Income and Balance Sheet for 2015 are reproduced below .. Calculate the business's financial ratios for 2016. Assume that Park Ridge had $18,000 in lease payments in 2016. Interpret the ration. For the analysis, assume that the sector average data presented in the ratio anaysia section are valid for 2015. Park Ridge Homecare Balance Sheet December 31, 2015 (in Thousands) 67 137 476 22 702 100 ASSETS Current Assets Cash and cash equivalents Short-term investments Accounts Receivable, net Inventories Total Current Assets Investments Property and Equipment Medical and office equipment Vehicles Total Loss: Accumulated Depreciation Net Property and Equipment or Net Foxed Asset TOTAL ASSETS LIABILITIES AND EQUITY Current Liabilities Notes Payable Accounts Payable Accrued Expenses Total Current Liabilities Long-term Debe Total abilities 54 47 101 -24 77 879 13 21 363 397 167 584 Equity TOTAL LIABILITIES AND EQUITY 315 879 XO Mac Chegg Study Textbook Solutions Expert Q&A Practice formula to specify the order of operations to be done by the Excel formula. k. Fixed Asset Turnover Ratio in 2015 Fixed Asset Turnover Ratio in 2016 Industry Average times 50.4 times 63.1 times Total Asset Turnover Ratio in 2015 Total Asset Turnover Ratio in 2016 Industry Average times 3.3 times 3.4 times m. Days in Accounts Receivable in 2015 Days in Accounts Receivable in 2016 Industry Average days 66.5 days 37.1 days Interpret at least three Ratios by comparing the ratios in 2015, 2016 and the industry average. Is Park Ridge Homecare profitable? What areas should management be concerned about? Explain your