PLEASE ANSWER STEP BY STEP SO THAT I CAN UNDERSTAND HOW TO DO IT. thank you

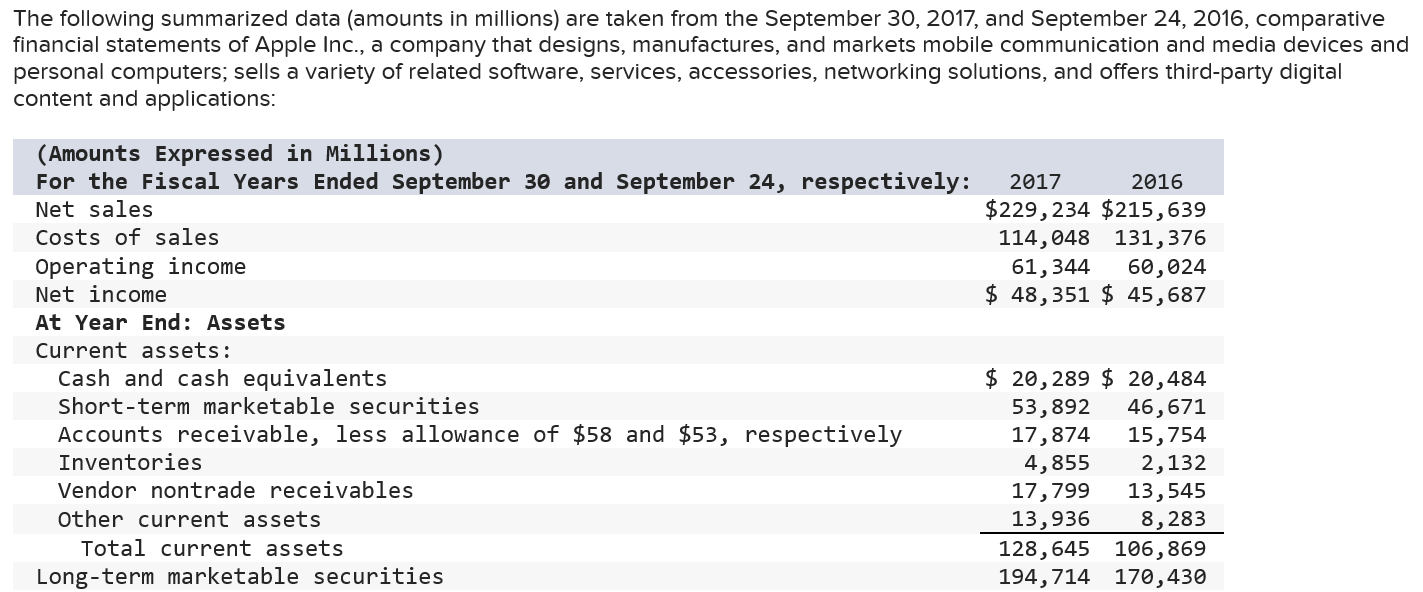

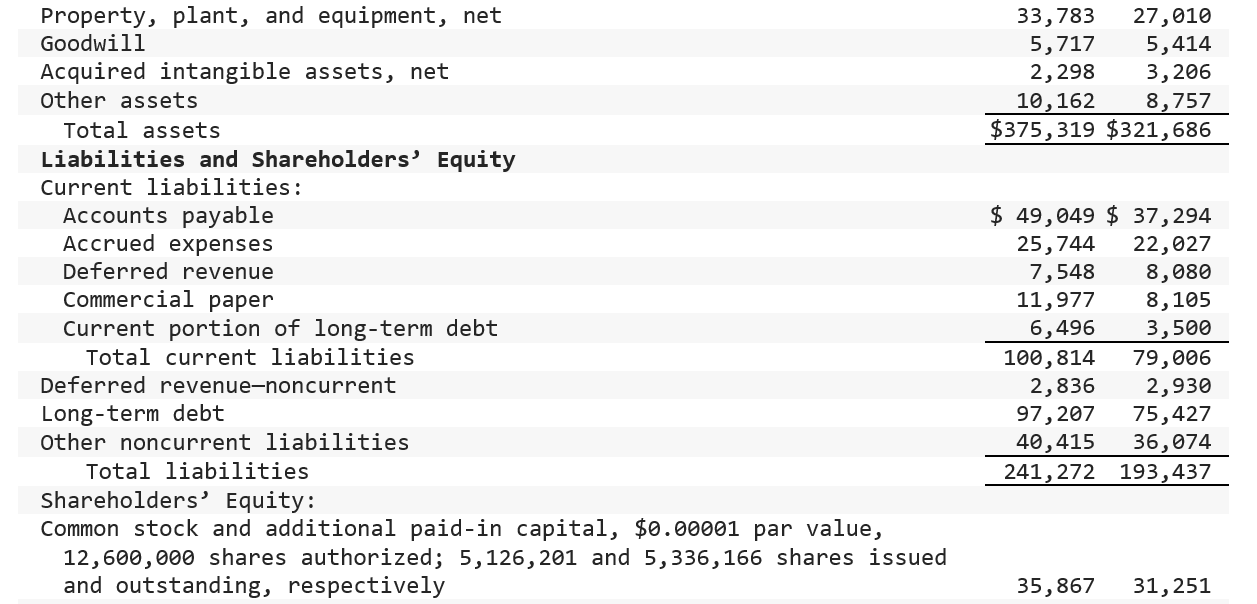

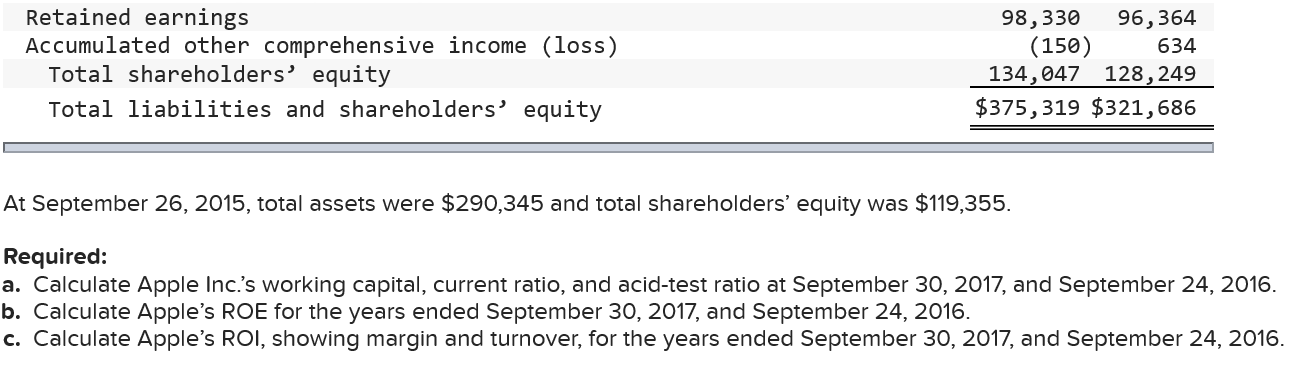

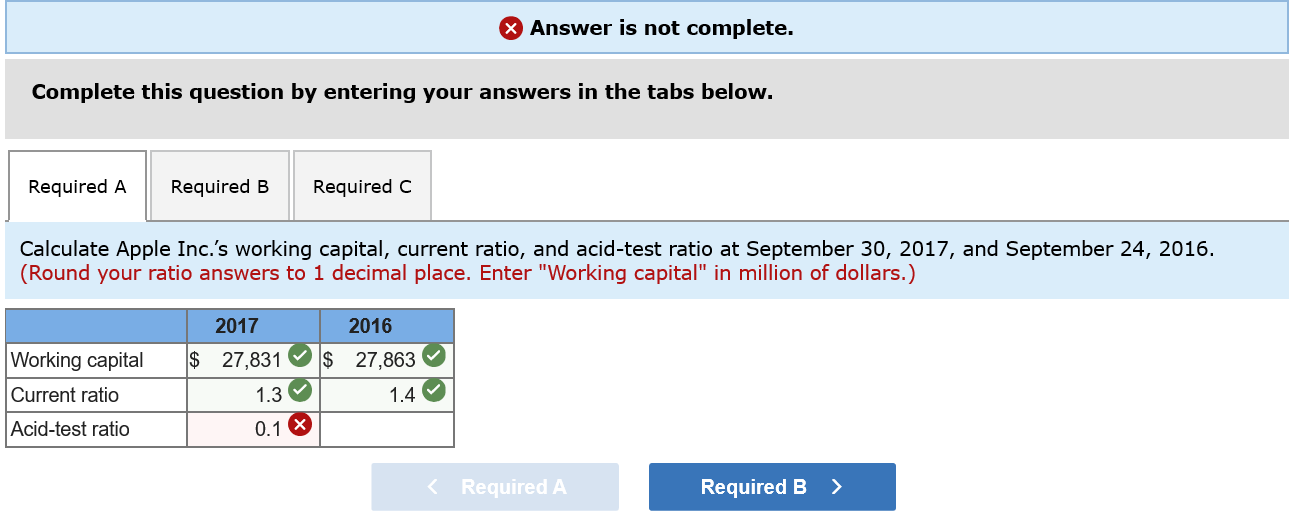

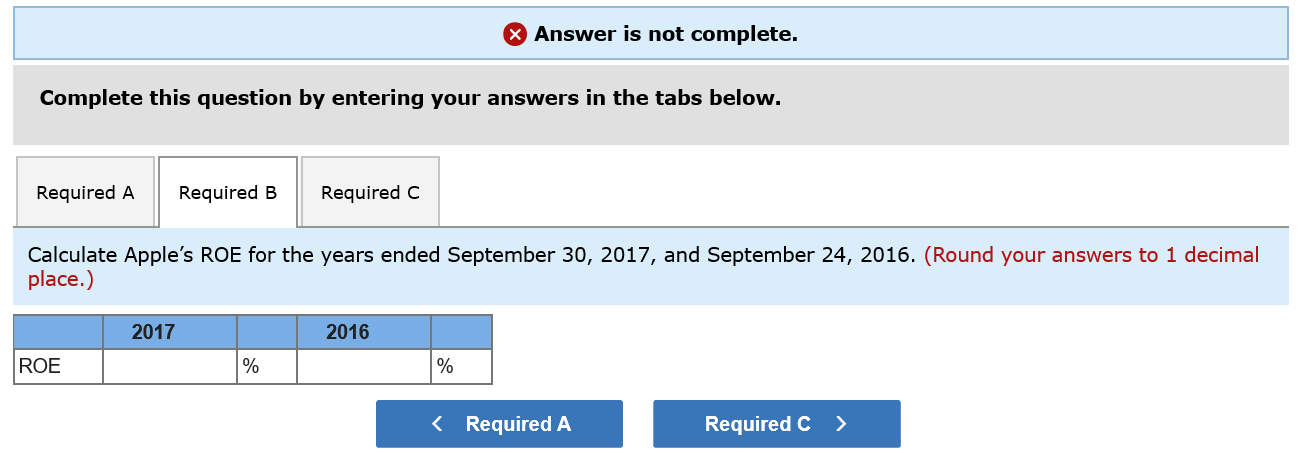

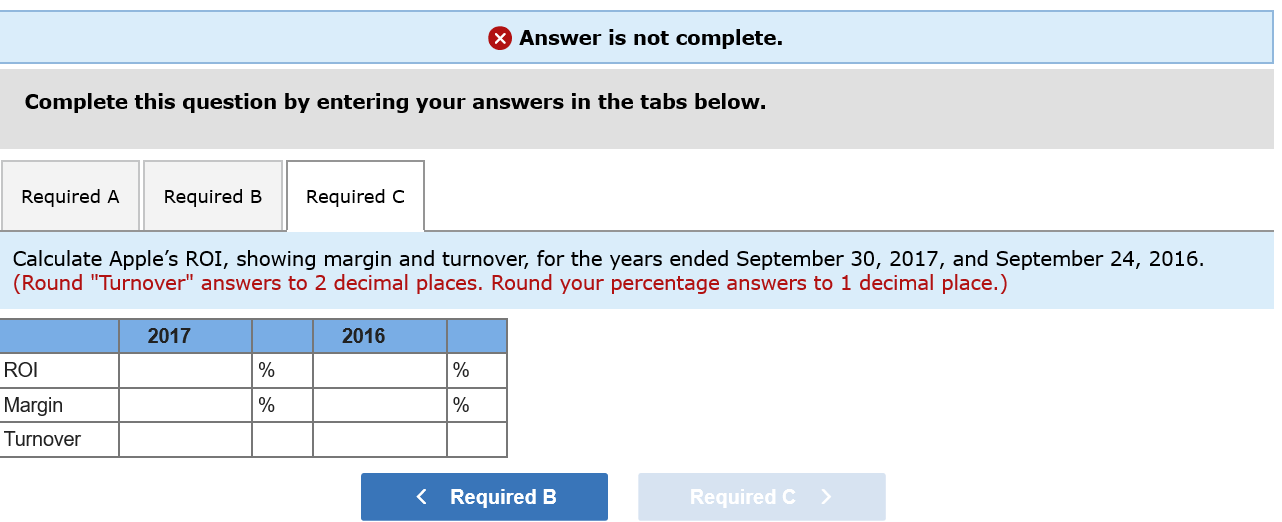

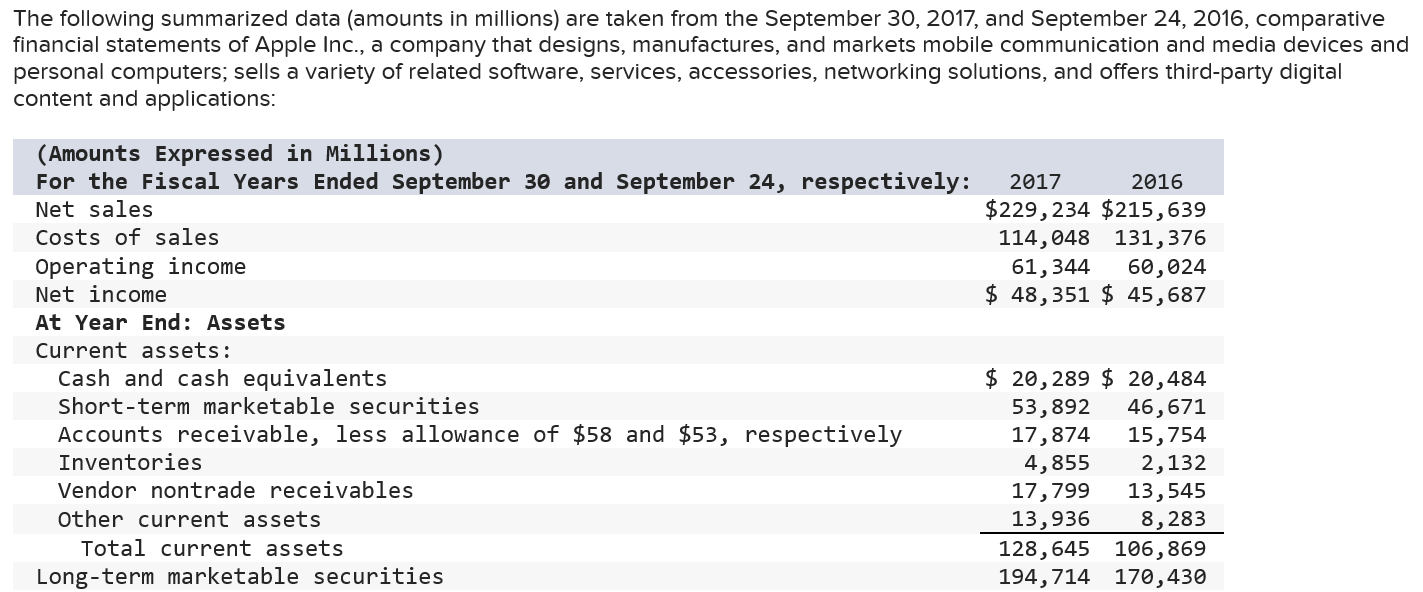

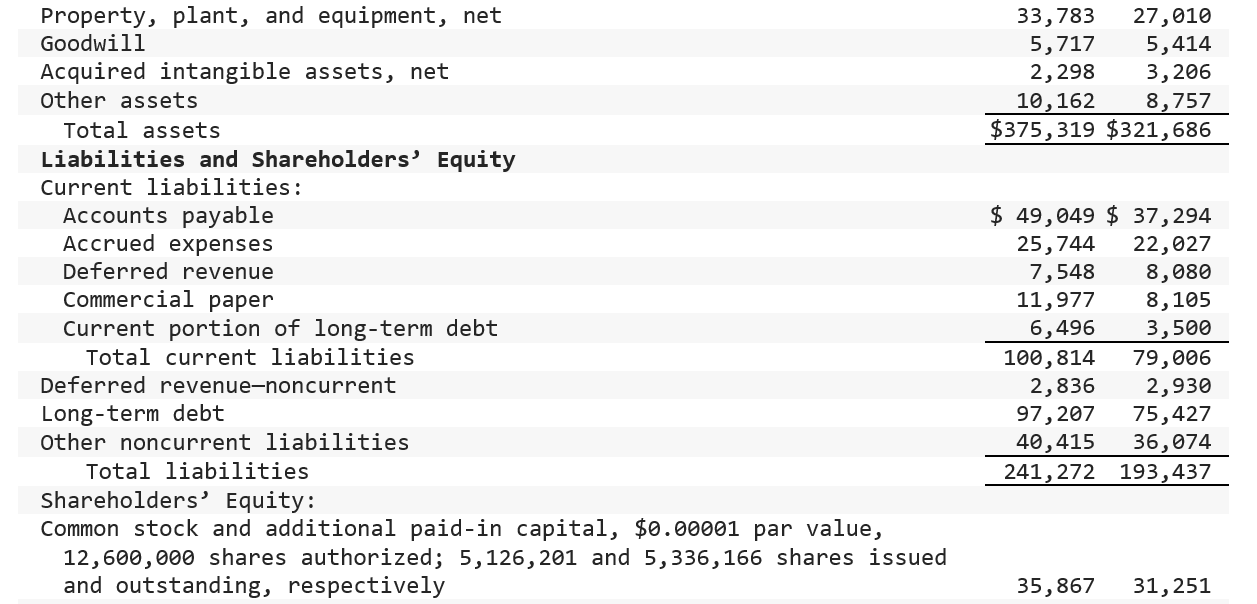

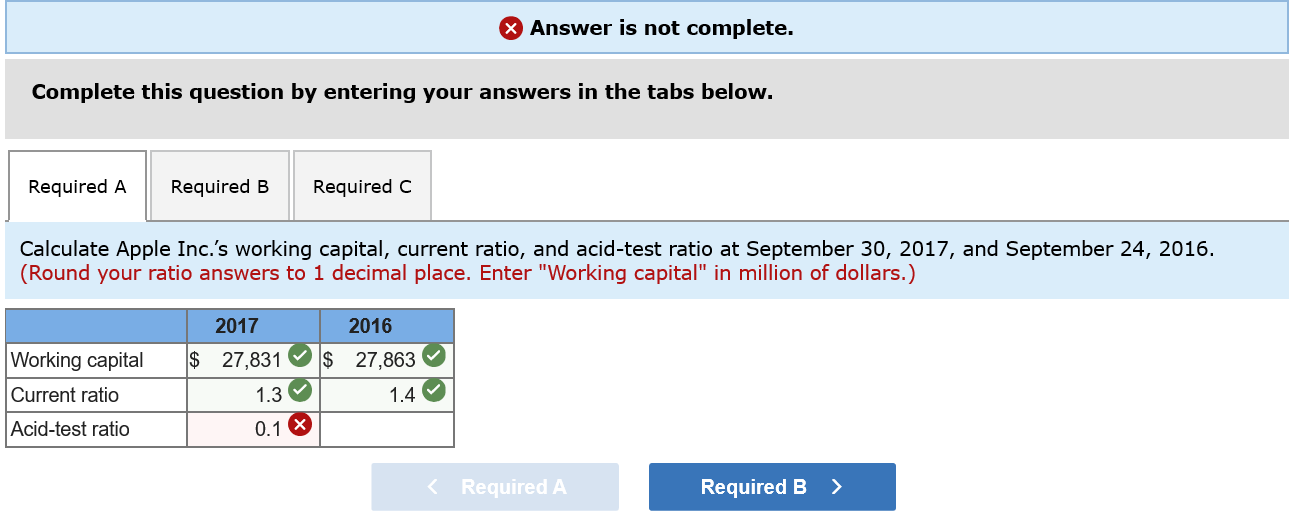

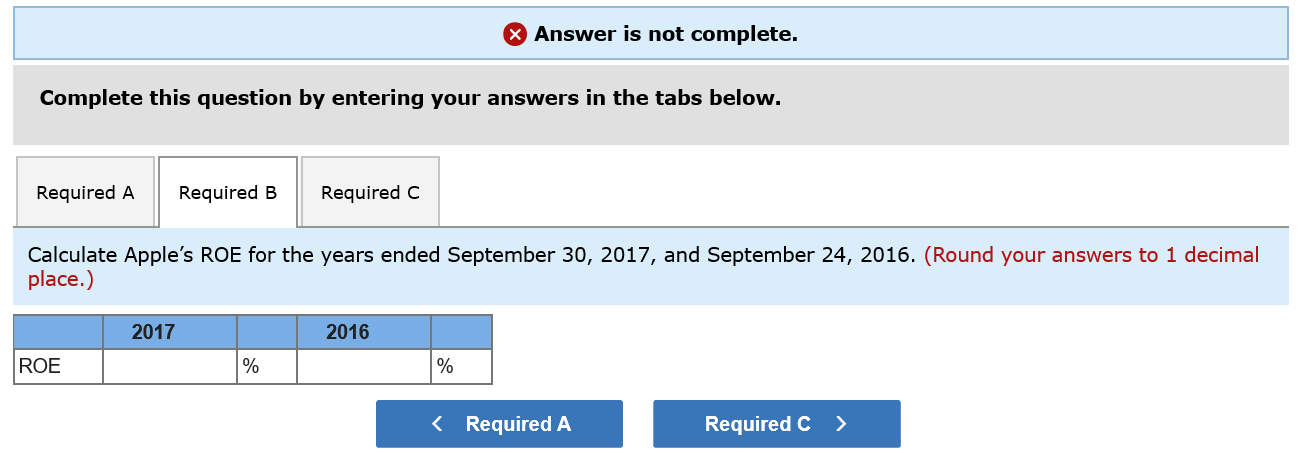

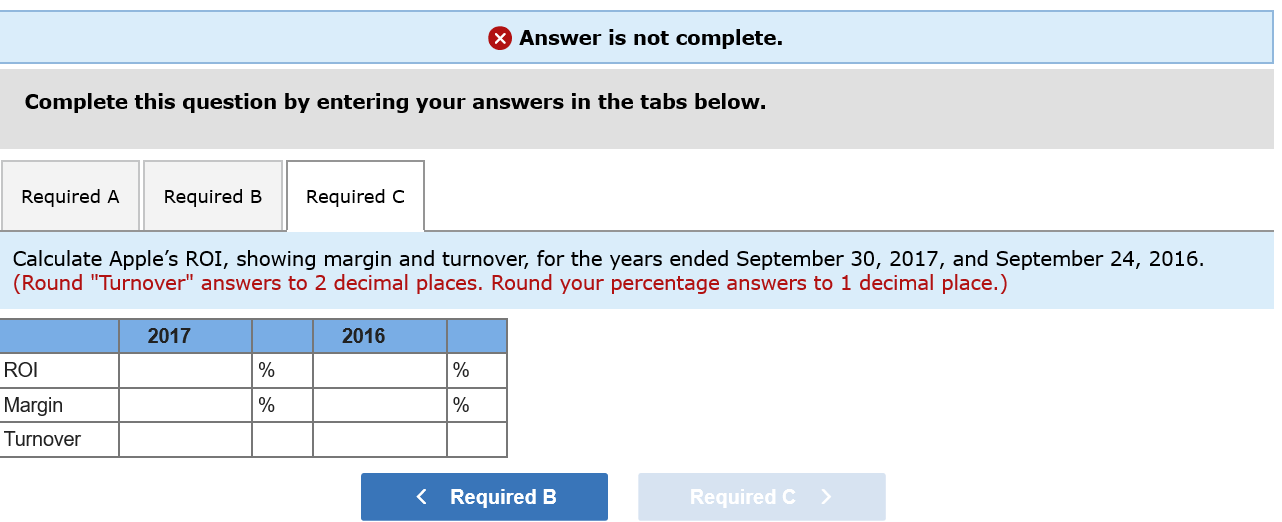

The following summarized data (amounts in millions) are taken from the September 30, 2017, and September 24, 2016, comparative financial statements of Apple Inc., a company that designs, manufactures, and markets mobile communication and media devices and personal computers; sells a variety of related software, services, accessories, networking solutions, and offers third-party digital content and applications: 2017 2016 $229,234 $215,639 114,048 131,376 61,344 60,024 $ 48,351 $ 45,687 (Amounts Expressed in Millions) For the Fiscal Years Ended September 30 and September 24, respectively: Net sales Costs of sales Operating income Net income At Year End: Assets Current assets: Cash and cash equivalents Short-term marketable securities Accounts receivable, less allowance of $58 and $53, respectively Inventories Vendor nontrade receivables other current assets Total current assets Long-term marketable securities $ 20,289 $ 20,484 53,892 46,671 17,874 15,754 4,855 2,132 17,799 13,545 13,936 8,283 128,645 106,869 194,714 170,430 33,783 27,010 5,717 5,414 2,298 3, 206 10,162 8,757 $375,319 $321,686 Property, plant, and equipment, net Goodwill Acquired intangible assets, net Other assets Total assets Liabilities and shareholders' Equity Current liabilities: Accounts payable Accrued expenses Deferred revenue Commercial paper Current portion of long-term debt Total current liabilities Deferred revenue-noncurrent Long-term debt Other noncurrent liabilities Total liabilities Shareholders' Equity: Common stock and additional paid-in capital, $0.00001 par value, 12,600,000 shares authorized; 5,126,201 and 5,336,166 shares issued and outstanding, respectively $ 49,049 $ 37,294 25, 744 22,027 7,548 8,080 11,977 8,105 6,496 3,500 100,814 79,006 2,836 2,930 97,207 75,427 40,415 36,074 241, 272 193,437 35,867 31, 251 Retained earnings Accumulated other comprehensive income (loss) Total shareholders' equity Total liabilities and shareholders' equity 98,330 96,364 (150) 634 134,047 128, 249 $375, 319 $321,686 At September 26, 2015, total assets were $290,345 and total shareholders' equity was $119,355. Required: a. Calculate Apple Inc.'s working capital, current ratio, and acid-test ratio at September 30, 2017, and September 24, 2016. b. Calculate Apple's ROE for the years ended September 30, 2017, and September 24, 2016. c. Calculate Apple's ROI, showing margin and turnover, for the years ended September 30, 2017, and September 24, 2016. Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required c Calculate Apple Inc.'s working capital, current ratio, and acid-test ratio at September 30, 2017, and September 24, 2016. (Round your ratio answers to 1 decimal place. Enter "Working capital" in million of dollars.) 2017 2016 $ 27,831 $ 27,863 Working capital Current ratio 1.3 1.4 Acid-test ratio 0.1 X Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate Apple's ROE for the years ended September 30, 2017, and September 24, 2016. (Round your answers to 1 decimal place.) 2017 2016 ROE % % X Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate Apple's ROI, showing margin and turnover, for the years ended September 30, 2017, and September 24, 2016. (Round "Turnover" answers to 2 decimal places. Round your percentage answers to 1 decimal place.) 2017 2016 ROI % % % % Margin Turnover