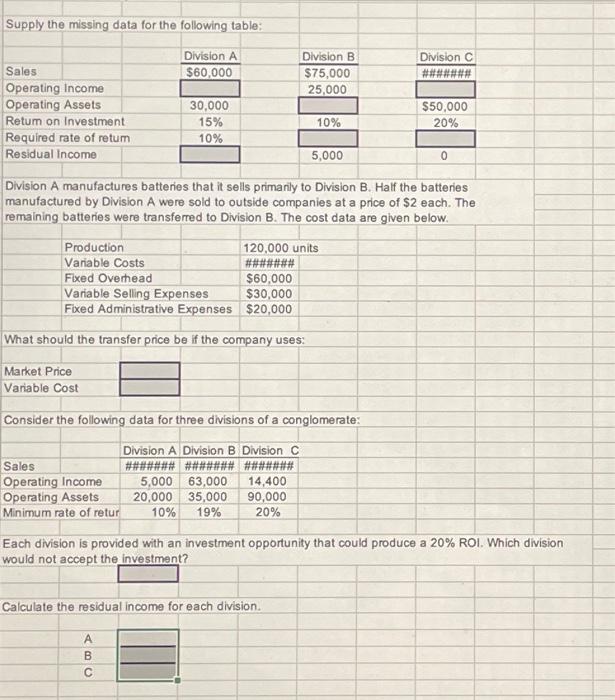

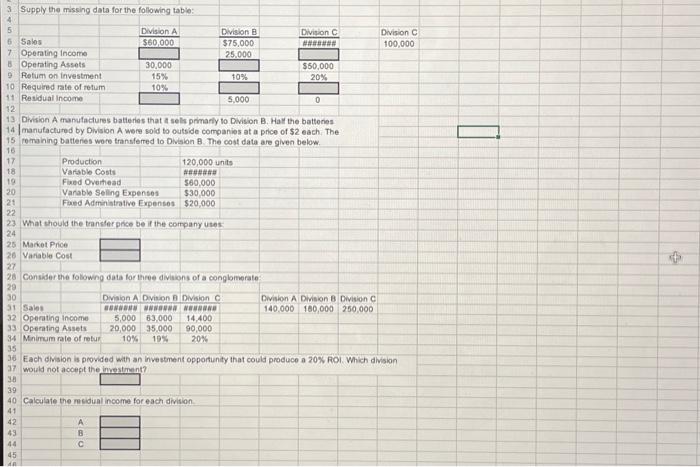

Supply the missing data for the following table: Division A manufactures batteries that it sells primarily to Division B. Half the batteries manufactured by Division \\( A \\) were sold to outside companies at a price of \\( \\$ 2 \\) each. The remaining batteries were transferred to Division B. The cost data are given below. Each division is provided with an investment opportunity that could produce a \20 ROI. Which division would not accept the investment? Calculate the residual income for each division. 3. Drision A cranufactures batteries that at sels prinarly to Division B. Hall the battones 4 Imanufactured by Dwision A were soid to outside companies at a price of \\( \\$ 2 \\) each. The remaing batteries wore transferred to Division B. The cost data are given below. What should the transterpece be if the corpany uses: Consider the folowing data for three divicons of a conglomerate Division A Division B Division C \\begin{tabular}{l|l|l|l} 140,000 & 100,000 & 250,000 \\end{tabular} Each elvision is provided with an investment opportunity that could produce a \20 ROI. Which division would not accept the investmant? Calculate the mesidual income for each division Supply the missing data for the following table: Division A manufactures batteries that it sells primarily to Division B. Half the batteries manufactured by Division \\( A \\) were sold to outside companies at a price of \\( \\$ 2 \\) each. The remaining batteries were transferred to Division B. The cost data are given below. Each division is provided with an investment opportunity that could produce a \20 ROI. Which division would not accept the investment? Calculate the residual income for each division. 3. Drision A cranufactures batteries that at sels prinarly to Division B. Hall the battones 4 Imanufactured by Dwision A were soid to outside companies at a price of \\( \\$ 2 \\) each. The remaing batteries wore transferred to Division B. The cost data are given below. What should the transterpece be if the corpany uses: Consider the folowing data for three divicons of a conglomerate Division A Division B Division C \\begin{tabular}{l|l|l|l} 140,000 & 100,000 & 250,000 \\end{tabular} Each elvision is provided with an investment opportunity that could produce a \20 ROI. Which division would not accept the investmant? Calculate the mesidual income for each division