please answer thank you

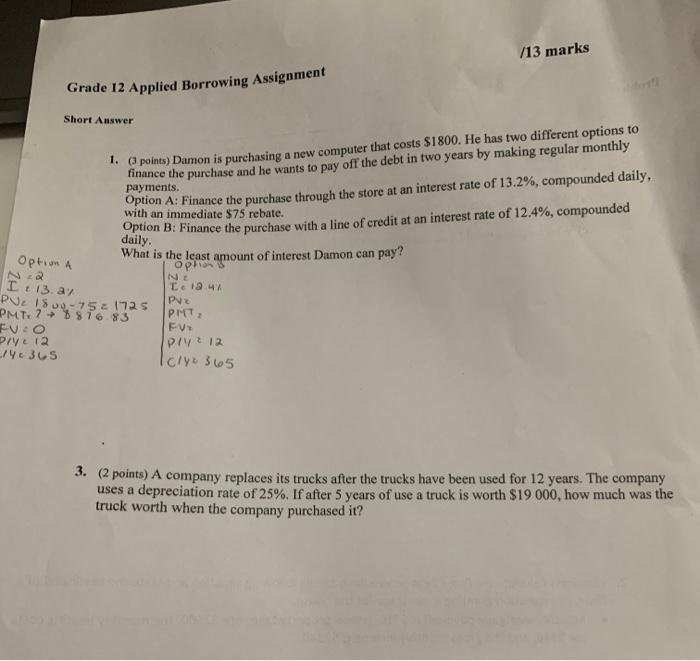

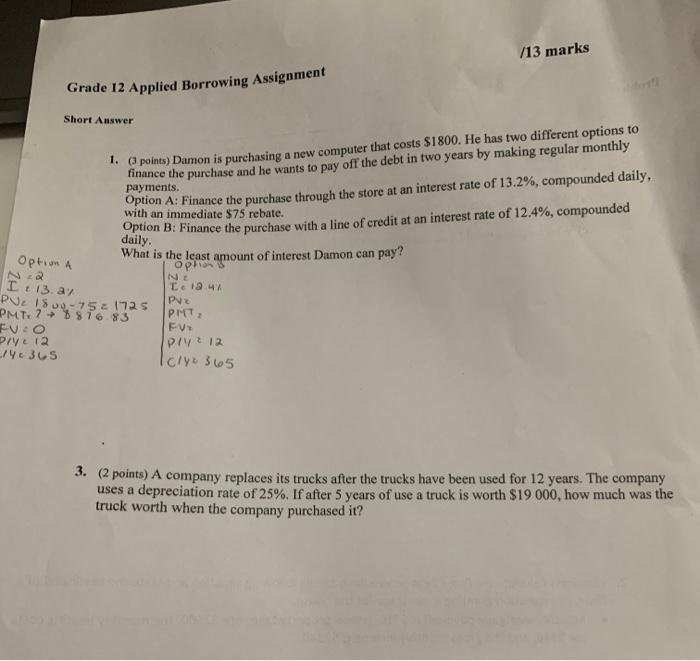

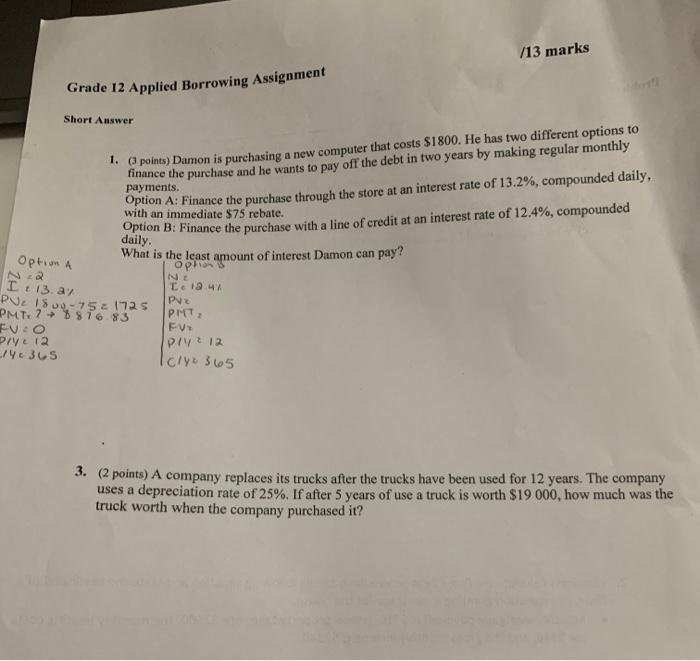

/13 marks Grade 12 Applied Borrowing Assignment Short Answer payments. 1. points) Damon is purchasing a new computer that costs $1800. He has two different options to finance the purchase and he wants to pay off the debt in two years by making regular monthly Option A: Finance the purchase through the store at an interest rate of 13.2%, compounded daily, Option B: Finance the purchase with a line of credit at an interest rate of 12.4%, compounded What is the least amount of interest Damon can pay? Option A I 13. ay PU: 18-7521725 PMT 7 8 816 83 Fuco Piye 12 140365 NE L.18.4% Pus PMT: FV Plye 12 Iclye 365 3. (2 points) A company replaces its trucks after the trucks have been used for 12 years. The company truck worth when the company purchased it? uses a depreciation rate of 25%. If after 5 years of use a truck is worth $19000, how much was the roblem 1. points Sasha got a job and now needs a place to live. She can rent an apartment for $500 per month. She can also buy a house for $240 000. She has negotiated a mortgage with the bank for 90% of the purchase price at an interest rate of 4,6%.compounded semi-annually. Sasha will pay of the mortgage by making regular monthly payments for 17 years. The house also apprecintes at 1.5% annually. a) What are the costs of renting an apartment over 17 years? Show your work b) What are the costs of purchasing a house over 17 years? Show your work. c) Which option would you recommend for Sasha? Explain. 2. (2 points) Calculate the Gross Debt Service Ratio for the following situation and state the likelihood of a financial institution granting a mortgage for the house. Monthly mortgage payment is $716, annual property taxes are $2500, the monthly heating costs are $116, and the gross monthly income is $2340 /13 marks Grade 12 Applied Borrowing Assignment Short Answer payments. 1. points) Damon is purchasing a new computer that costs $1800. He has two different options to finance the purchase and he wants to pay off the debt in two years by making regular monthly Option A: Finance the purchase through the store at an interest rate of 13.2%, compounded daily, Option B: Finance the purchase with a line of credit at an interest rate of 12.4%, compounded What is the least amount of interest Damon can pay? Option A I 13. ay PU: 18-7521725 PMT 7 8 816 83 Fuco Piye 12 140365 NE L.18.4% Pus PMT: FV Plye 12 Iclye 365 3. (2 points) A company replaces its trucks after the trucks have been used for 12 years. The company truck worth when the company purchased it? uses a depreciation rate of 25%. If after 5 years of use a truck is worth $19000, how much was the roblem 1. points Sasha got a job and now needs a place to live. She can rent an apartment for $500 per month. She can also buy a house for $240 000. She has negotiated a mortgage with the bank for 90% of the purchase price at an interest rate of 4,6%.compounded semi-annually. Sasha will pay of the mortgage by making regular monthly payments for 17 years. The house also apprecintes at 1.5% annually. a) What are the costs of renting an apartment over 17 years? Show your work b) What are the costs of purchasing a house over 17 years? Show your work. c) Which option would you recommend for Sasha? Explain. 2. (2 points) Calculate the Gross Debt Service Ratio for the following situation and state the likelihood of a financial institution granting a mortgage for the house. Monthly mortgage payment is $716, annual property taxes are $2500, the monthly heating costs are $116, and the gross monthly income is $2340