Answered step by step

Verified Expert Solution

Question

1 Approved Answer

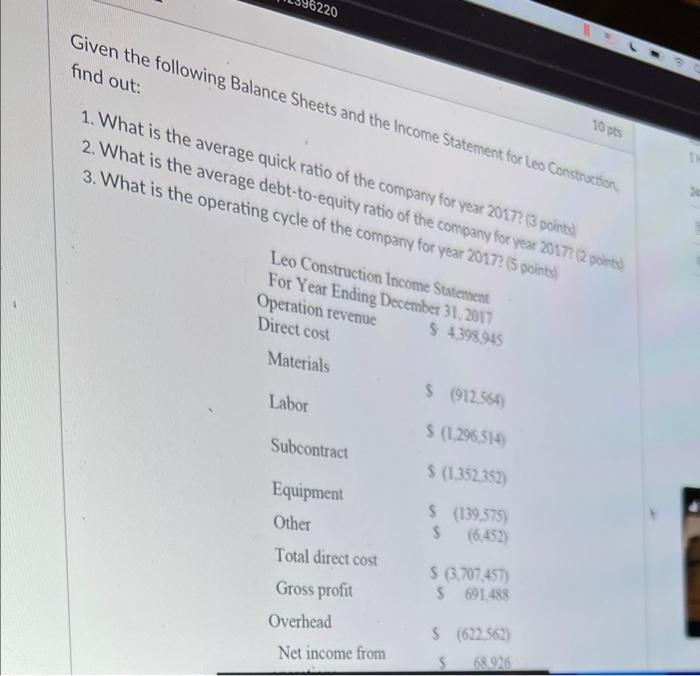

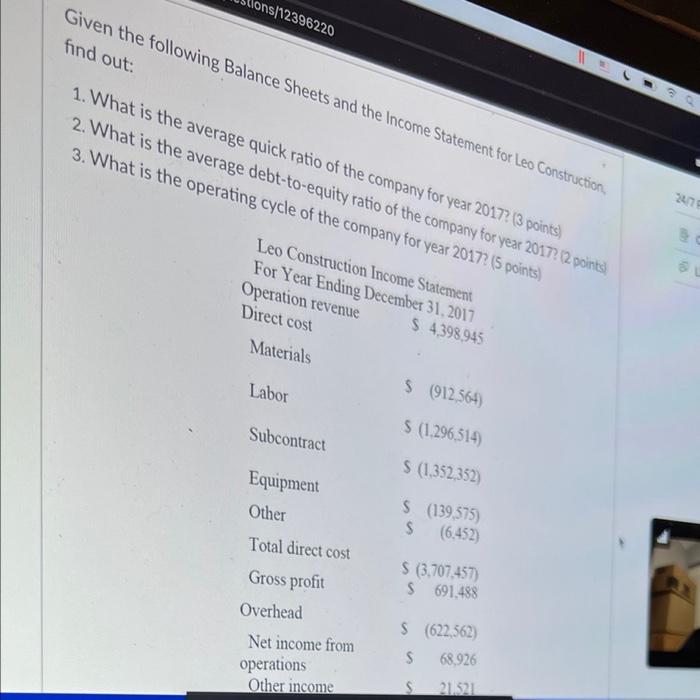

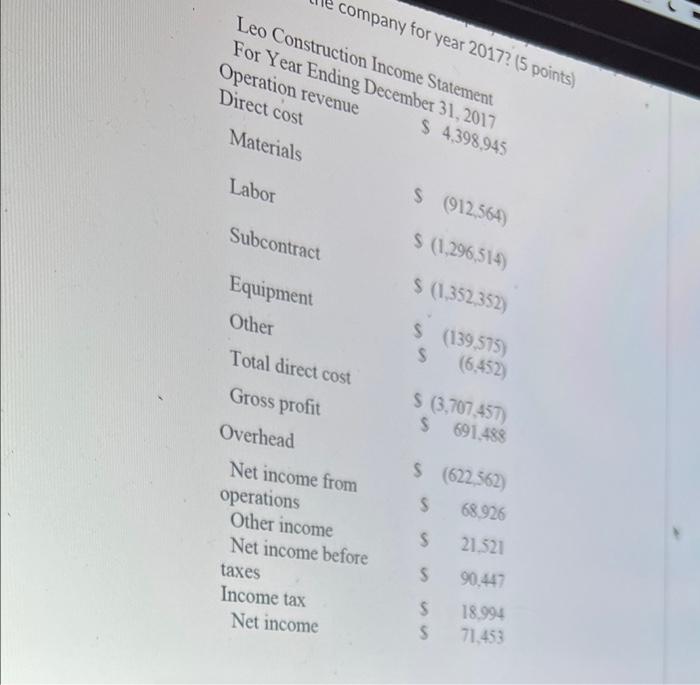

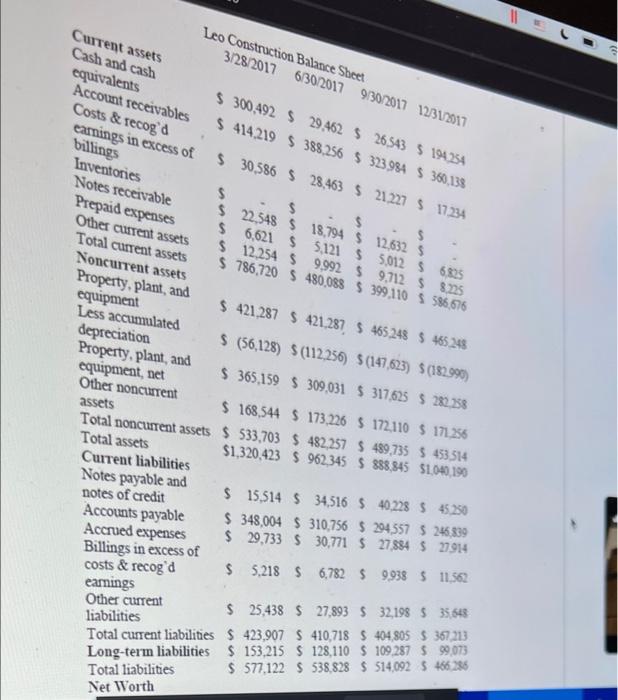

please answer thank you $220 Given the following Balance Sheets and the Income Statement for Leo Construction, find out: 10 pts 1. What is the

please answer thank you

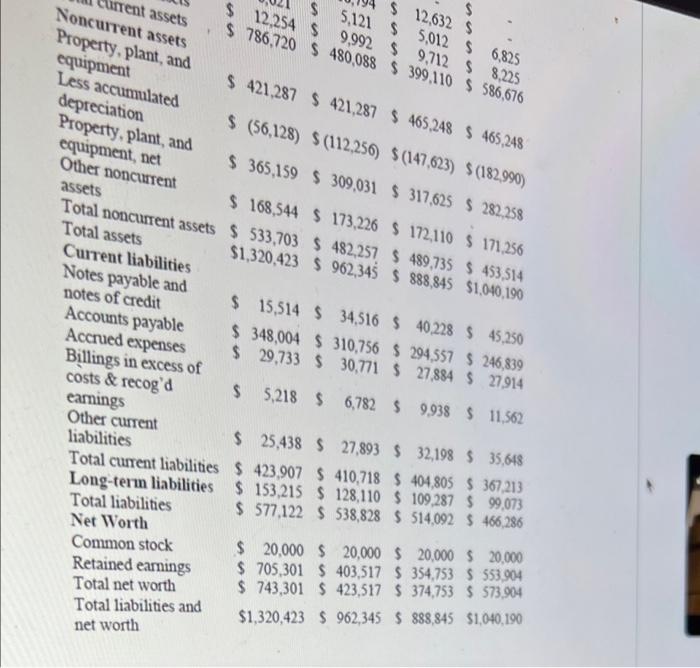

$220 Given the following Balance Sheets and the Income Statement for Leo Construction, find out: 10 pts 1. What is the average quick ratio of the company for year 2017? (3 points! 2. What is the average debt-to-equity ratio of the company for year 2017? (2 points 3. What is the operating cycle of the company for year 2017? (5 points) Leo Construction Income Statement For Year Ending December 31, 2017 Operation revenue $ 4.398.945 Direct cost Materials $ (912,564) Labor S (1,296,514) Subcontract S (1.352,352) Equipment $ (139,575) Other $ (6,452) Total direct cost $ (3,707,457) $ 691,488 Gross profit Overhead $ (622,562) 68.926 Net income from S 11 ons/12396220 Given the following Balance Sheets and the Income Statement for Leo Construction, find out: 1. What is the average quick ratio of the company for year 2017? (3 points) 2. What is the average debt-to-equity ratio of the company for year 2017? (2 points) 3. What is the operating cycle of the company for year 2017? (5 points) Leo Construction Income Statement For Year Ending December 31, 2017 Operation revenue $ 4,398,945 Direct cost Materials S (912,564) Labor S (1,296,514) Subcontract S (1,352,352) Equipment S (139,575) Other $ (6.452) Total direct cost $ (3,707,457) $ 691,488 Gross profit Overhead S (622,562) Net income from S 68,926 operations S 21.521 Other income 24/7 F company for year 2017? (5 points) Leo Construction Income Statement For Year Ending December 31, 2017 Operation revenue Direct cost $ 4,398,945 Materials $ (912,564) Labor $ (1,296,514) Subcontract $ (1,352,352) Equipment S (139,575) Other S (6.452) Total direct cost $ (3,707,457) Gross profit $ 691.488 Overhead S (622,562) S 68.926 21,521 90,447 18,994 71,453 Net income from operations Other income Net income before taxes Income tax Net income $ $ $ $ Leo Construction Balance Sheet Current assets Cash and cash equivalents Account receivables Costs & recog'd earnings in excess of billings Inventories Notes receivable Prepaid expenses Other current assets Total current assets Noncurrent assets Property, plant, and equipment Less accumulated depreciation Property, plant, and equipment, net Other noncurrent assets Total noncurrent assets Total assets Current liabilities Notes payable and notes of credit Accounts payable Accrued expenses Billings in excess of costs & recog'd earnings Other current liabilities Total current liabilities Long-term liabilities Total liabilities Net Worth 3/28/2017 6/30/2017 9/30/2017 12/31/2017 $ 300,492 $ 29,462 $26.543 $ 194,254 $ 414,219 $388,256 $323,984 $ 360,138 $ 30,586 $ 28,463 $ 21,227 S 17234 22,548 $ 18,794 S 12,632 $ - $ -S $ $ $ $ 6,621 $5,121 $ 5,012 $ 6.825 $ 12,254 $ 9,992 $ 9,712 $ 8,225 $ 786,720 $ 480,088 $ 399,110 $ 586,676 $ 421,287 S 421,287 $ 465.248 $ 465.248 S (56,128) $(112,256) $(147,623) $(182.990) $365,159 $309,031 $317,625 $ 282,258 $ 168,544 $173,226 $ 172,110 $ 171,256 $ 533,703 $ 482,257 $ 489,735 $ 453,514 $1,320,423 $962,345 $888,845 $1,040,190 $ 15,514 $ 34,516 $ 40,228 $ 45.250 $ 348,004 $310,756 $294557 $ 245,839 $ 29,733 $ 30,771 $ 27,884 $ 27,914 $ 5,218 S 6,782 $ 9,938 $ 11,562 $ 25,438 $ 27,893 $32,198 $ 35,648 $423,907 $ 410,718 $ 404,805 $367,213 $ 153,215 $ 128,110 $ 109,287 $ 99,073 $ 577,122 S538,828 $ 514,092 $ 466.286 $ $ 12,632 S $ 12,254 $ $ 9,992 $ 9,712 S 8,225 5,121 $ 5,012 $ 6,825 $ 786,720 $ 480,088 $399,110 $ 586,676 $ 421,287 $ 421,287 $ 465,248 $ 465,248 Less accumulated depreciation Property, plant, and equipment, net $ (56,128) $(112,256) $(147,623) $(182,990) $365,159 $ 309,031 $317,625 $ 282,258 Other noncurrent assets Total noncurrent assets $ 533,703 $482,257 $ 489,735 $ 453,514 $ 168,544 $173,226 $ 172,110 $ 171,256 Total assets $1,320,423 $962,345 $ 888,845 $1,040,190 Current liabilities $ 15,514 $ 34,516 $ 40,228 $ 45,250 Notes payable and notes of credit Accounts payable Accrued expenses Billings in excess of costs & recog'd $ 348,004 $310,756 $294,557 $ 246,839 $ 29,733 $ 30,771 $ 27,884 $ 27,914 $ 5,218 $ 6,782 $ 9,938 $ 11,562 $ 25,438 $ 27,893 $ 32,198 $ 35,648 $423,907 $ 410,718 $ 404,805 $ 367,213 $ 153,215 $ 128,110 $ 109,287 $ 99,073 $ 577,122 $538,828 $514,092 $ 466,286 $ 20,000 $20,000 $ 705,301 $ 403,517 $20,000 $ 20,000 $ 354,753 $ 553,904 $ 743,301 $423,517 $374,753 $ 573,904 $962,345 $888,845 $1,040,190 $1,320,423 rent assets Noncurrent assets Property, plant, and equipment earnings Other current liabilities Total current liabilities Long-term liabilities Total liabilities Net Worth Common stock Retained earnings Total net worth Total liabilities and net worth $220 Given the following Balance Sheets and the Income Statement for Leo Construction, find out: 10 pts 1. What is the average quick ratio of the company for year 2017? (3 points! 2. What is the average debt-to-equity ratio of the company for year 2017? (2 points 3. What is the operating cycle of the company for year 2017? (5 points) Leo Construction Income Statement For Year Ending December 31, 2017 Operation revenue $ 4.398.945 Direct cost Materials $ (912,564) Labor S (1,296,514) Subcontract S (1.352,352) Equipment $ (139,575) Other $ (6,452) Total direct cost $ (3,707,457) $ 691,488 Gross profit Overhead $ (622,562) 68.926 Net income from S 11 ons/12396220 Given the following Balance Sheets and the Income Statement for Leo Construction, find out: 1. What is the average quick ratio of the company for year 2017? (3 points) 2. What is the average debt-to-equity ratio of the company for year 2017? (2 points) 3. What is the operating cycle of the company for year 2017? (5 points) Leo Construction Income Statement For Year Ending December 31, 2017 Operation revenue $ 4,398,945 Direct cost Materials S (912,564) Labor S (1,296,514) Subcontract S (1,352,352) Equipment S (139,575) Other $ (6.452) Total direct cost $ (3,707,457) $ 691,488 Gross profit Overhead S (622,562) Net income from S 68,926 operations S 21.521 Other income 24/7 F company for year 2017? (5 points) Leo Construction Income Statement For Year Ending December 31, 2017 Operation revenue Direct cost $ 4,398,945 Materials $ (912,564) Labor $ (1,296,514) Subcontract $ (1,352,352) Equipment S (139,575) Other S (6.452) Total direct cost $ (3,707,457) Gross profit $ 691.488 Overhead S (622,562) S 68.926 21,521 90,447 18,994 71,453 Net income from operations Other income Net income before taxes Income tax Net income $ $ $ $ Leo Construction Balance Sheet Current assets Cash and cash equivalents Account receivables Costs & recog'd earnings in excess of billings Inventories Notes receivable Prepaid expenses Other current assets Total current assets Noncurrent assets Property, plant, and equipment Less accumulated depreciation Property, plant, and equipment, net Other noncurrent assets Total noncurrent assets Total assets Current liabilities Notes payable and notes of credit Accounts payable Accrued expenses Billings in excess of costs & recog'd earnings Other current liabilities Total current liabilities Long-term liabilities Total liabilities Net Worth 3/28/2017 6/30/2017 9/30/2017 12/31/2017 $ 300,492 $ 29,462 $26.543 $ 194,254 $ 414,219 $388,256 $323,984 $ 360,138 $ 30,586 $ 28,463 $ 21,227 S 17234 22,548 $ 18,794 S 12,632 $ - $ -S $ $ $ $ 6,621 $5,121 $ 5,012 $ 6.825 $ 12,254 $ 9,992 $ 9,712 $ 8,225 $ 786,720 $ 480,088 $ 399,110 $ 586,676 $ 421,287 S 421,287 $ 465.248 $ 465.248 S (56,128) $(112,256) $(147,623) $(182.990) $365,159 $309,031 $317,625 $ 282,258 $ 168,544 $173,226 $ 172,110 $ 171,256 $ 533,703 $ 482,257 $ 489,735 $ 453,514 $1,320,423 $962,345 $888,845 $1,040,190 $ 15,514 $ 34,516 $ 40,228 $ 45.250 $ 348,004 $310,756 $294557 $ 245,839 $ 29,733 $ 30,771 $ 27,884 $ 27,914 $ 5,218 S 6,782 $ 9,938 $ 11,562 $ 25,438 $ 27,893 $32,198 $ 35,648 $423,907 $ 410,718 $ 404,805 $367,213 $ 153,215 $ 128,110 $ 109,287 $ 99,073 $ 577,122 S538,828 $ 514,092 $ 466.286 $ $ 12,632 S $ 12,254 $ $ 9,992 $ 9,712 S 8,225 5,121 $ 5,012 $ 6,825 $ 786,720 $ 480,088 $399,110 $ 586,676 $ 421,287 $ 421,287 $ 465,248 $ 465,248 Less accumulated depreciation Property, plant, and equipment, net $ (56,128) $(112,256) $(147,623) $(182,990) $365,159 $ 309,031 $317,625 $ 282,258 Other noncurrent assets Total noncurrent assets $ 533,703 $482,257 $ 489,735 $ 453,514 $ 168,544 $173,226 $ 172,110 $ 171,256 Total assets $1,320,423 $962,345 $ 888,845 $1,040,190 Current liabilities $ 15,514 $ 34,516 $ 40,228 $ 45,250 Notes payable and notes of credit Accounts payable Accrued expenses Billings in excess of costs & recog'd $ 348,004 $310,756 $294,557 $ 246,839 $ 29,733 $ 30,771 $ 27,884 $ 27,914 $ 5,218 $ 6,782 $ 9,938 $ 11,562 $ 25,438 $ 27,893 $ 32,198 $ 35,648 $423,907 $ 410,718 $ 404,805 $ 367,213 $ 153,215 $ 128,110 $ 109,287 $ 99,073 $ 577,122 $538,828 $514,092 $ 466,286 $ 20,000 $20,000 $ 705,301 $ 403,517 $20,000 $ 20,000 $ 354,753 $ 553,904 $ 743,301 $423,517 $374,753 $ 573,904 $962,345 $888,845 $1,040,190 $1,320,423 rent assets Noncurrent assets Property, plant, and equipment earnings Other current liabilities Total current liabilities Long-term liabilities Total liabilities Net Worth Common stock Retained earnings Total net worth Total liabilities and net worth Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started