Answered step by step

Verified Expert Solution

Question

1 Approved Answer

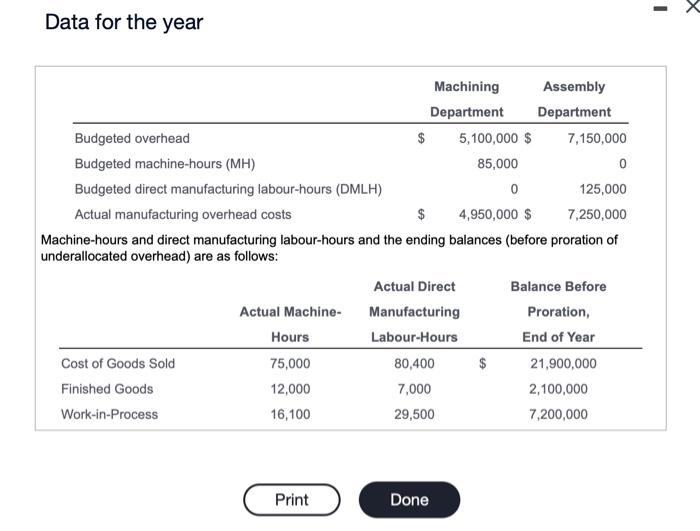

Please answer. Thank you. manufacturing labcur-hours using a budgeted direct manufacturing labour-hour rate. The following data are for the year: (Click the ioon to view

Please answer. Thank you.

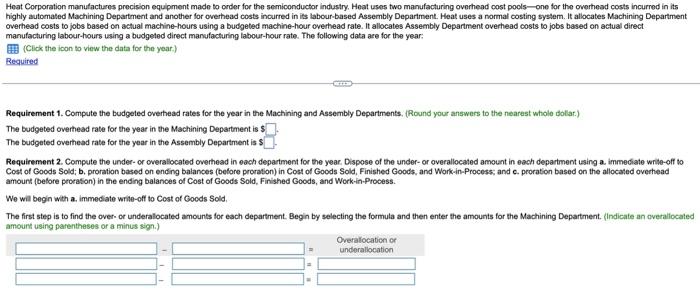

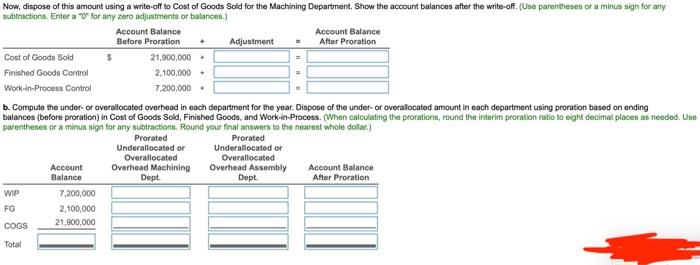

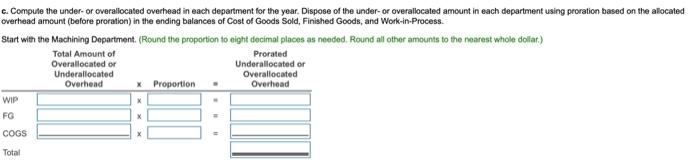

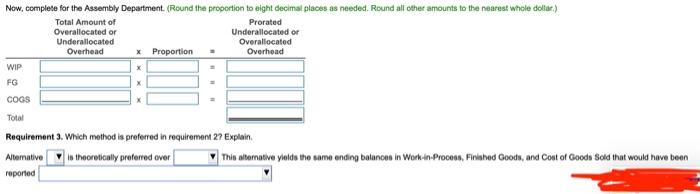

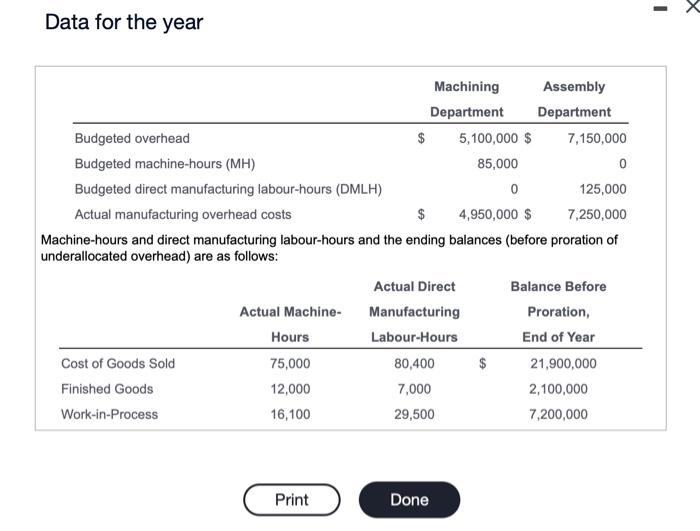

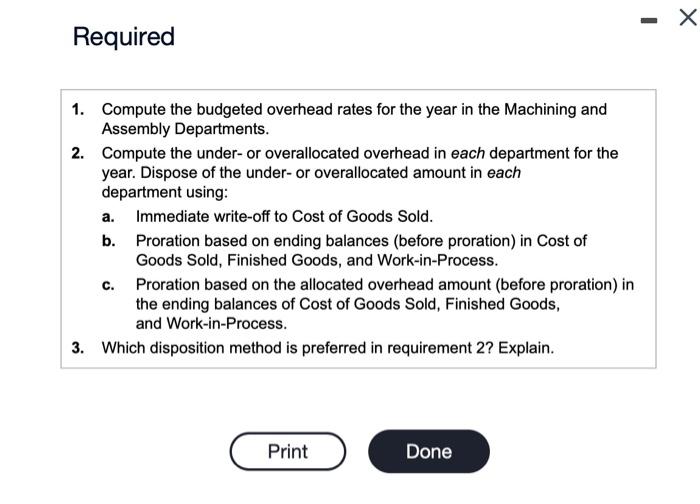

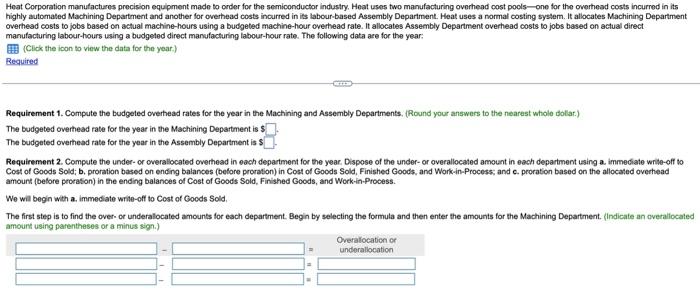

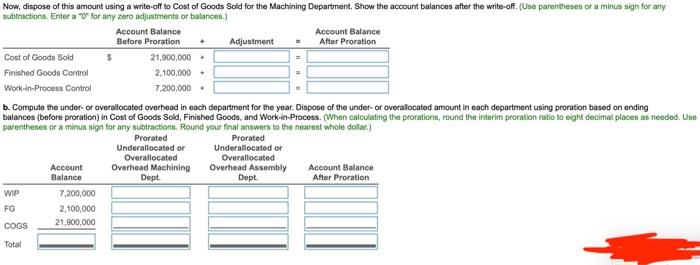

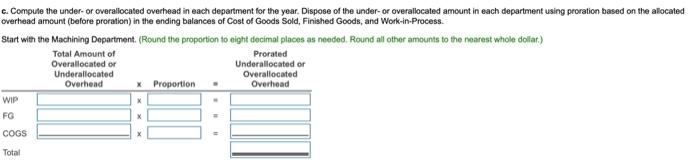

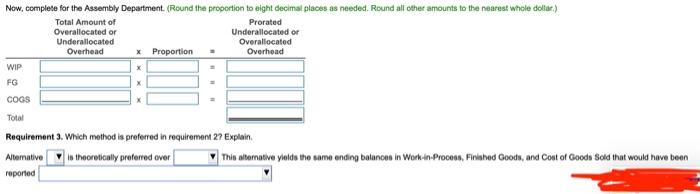

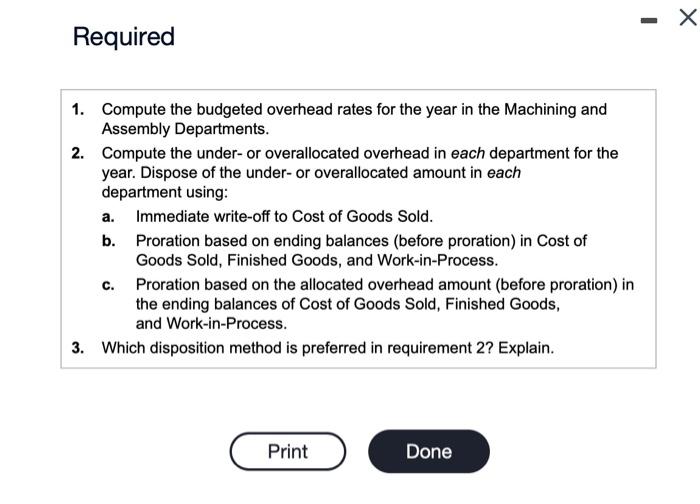

manufacturing labcur-hours using a budgeted direct manufacturing labour-hour rate. The following data are for the year: (Click the ioon to view the data for the year.) Requirement 1. Compute the budgeted overhead rates for the year in the Machining and Assembly Departments, (Round your answers to the nearest wholo dollar.) The budgeted overthead rate for the year in the Machining Department is $ The budgeted overhead rate for the year in the Assembly Department is sh amount (before procasion) in the ending balances of Cost of Goods Sold, Finished Goods, and Work-in.Process. We will begin with a. immediate write-off to Cost of Coods Sold. amourt using parentheses or a minus sign.) b. Compute the under-or overalocated overhead in each department for the year. Dispose of the under- or overalocated amount in each department using proration based on ending balances (before proration) in Cost of Goods Sold, Finished Goods, and Workin-Process. (When calculsting the prorations, round the interim proration ratio to eight decimal places as needed. Use parentheses or a minus sign for any subtractions. Round your final answers to the nearest whole dolar.) E. Compule the under-or overallocased overhead in each department for the year. Dispose of the under-or overallocated amount in each department using proration based on the alocated werhead ameunt (before proration) in the ending balances of Cost of Goods Sold, Finished Goods, and Work-in.Process. Start with the Machining Department, (Round the proportion to eight decimal places as needed. Round all other amounts to the nearest whole dollar.) Requirement 3. Which method is preferred in requirement 27 Explain. Ajemative is theoretically preferted over This alternative yields the same ending balances in Workin-Process, Finiahed Goods, and Cost of Goods Sold that would have been reported Data for the year Machine-hours and direct manufacturing labour-hours and the ending balances (before proration of underallocated overhead) are as follows: 1. Compute the budgeted overhead rates for the year in the Machining and Assembly Departments. 2. Compute the under- or overallocated overhead in each department for the year. Dispose of the under- or overallocated amount in each department using: a. Immediate write-off to Cost of Goods Sold. b. Proration based on ending balances (before prostion) in Cost of Goods Sold, Finished Goods, and Work-in-Process. c. Proration based on the allocated overhead amount (before proration) in the ending balances of Cost of Goods Sold, Finished Goods, and Work-in-Process. 3. Which disposition method is preferred in requirement 2? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started