please answer, thank you

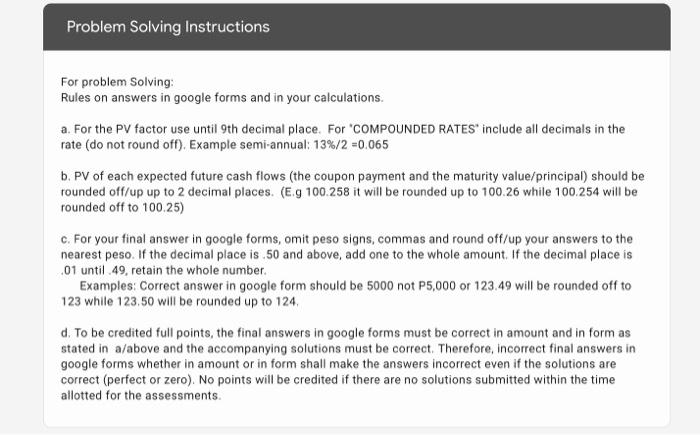

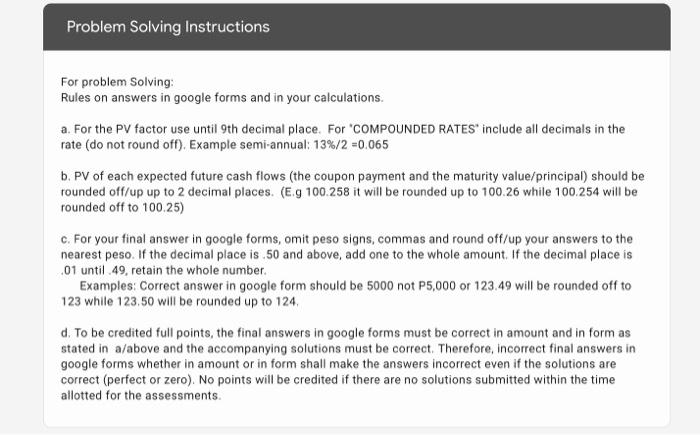

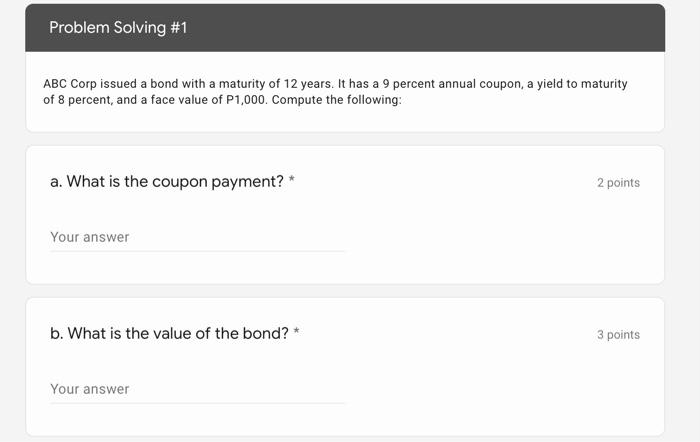

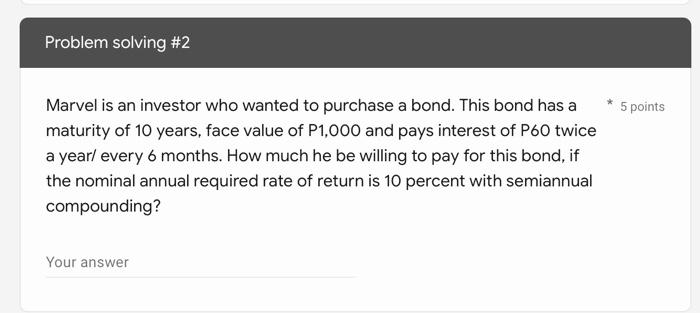

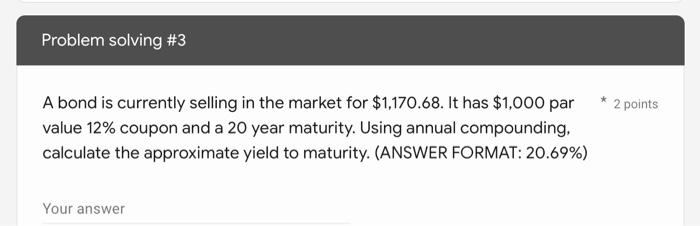

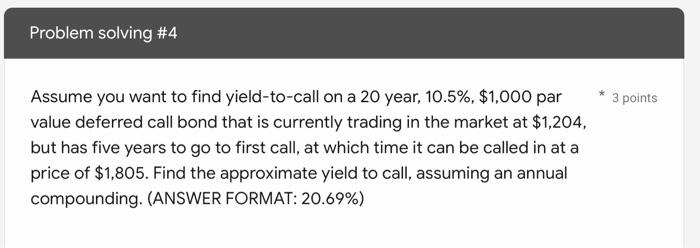

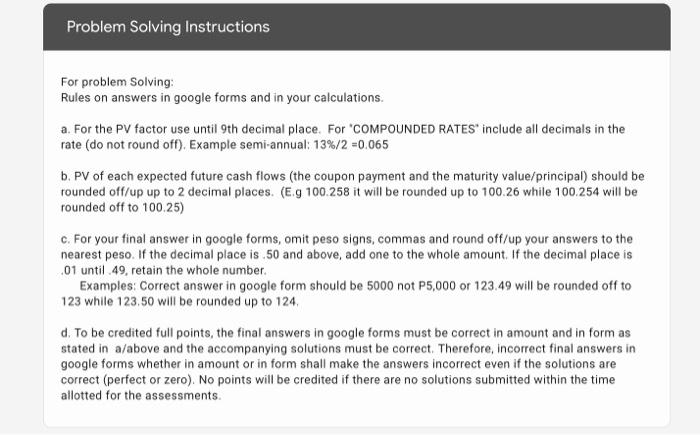

Problem Solving Instructions For problem Solving: Rules on answers in google forms and in your calculations. a. For the PV factor use until 9th decimal place. For "COMPOUNDED RATES include all decimals in the rate (do not round off). Example semi-annual: 13% / 2 =0.065 b. PV of each expected future cash flows (the coupon payment and the maturity value/principal) should be rounded off/up up to 2 decimal places. (E.g 100.258 it will be rounded up to 100.26 while 100.254 will be rounded off to 100.25) c. For your final answer in google forms, omit peso signs, commas and round off/up your answers to the nearest peso. If the decimal place is .50 and above, add one to the whole amount. If the decimal place is 01 until 49, retain the whole number. Examples: Correct answer in google form should be 5000 not P5,000 or 123.49 will be rounded off to 123 while 123.50 will be rounded up to 124. d. To be credited full points, the final answers in google forms must be correct in amount and in form as stated in a/above and the accompanying solutions must be correct. Therefore, incorrect final answers in google forms whether in amount or in form shall make the answers incorrect even if the solutions are correct (perfect or zero). No points will be credited if there are no solutions submitted within the time allotted for the assessments. Problem Solving #1 ABC Corp issued a bond with a maturity of 12 years. It has a 9 percent annual coupon, a yield to maturity of 8 percent, and a face value of P1,000. Compute the following: a. What is the coupon payment? * Your answer b. What is the value of the bond? * Your answer 2 points 3 points Problem solving #2 Marvel is an investor who wanted to purchase a bond. This bond has a maturity of 10 years, face value of P1,000 and pays interest of P60 twice a year/ every 6 months. How much he be willing to pay for this bond, if the nominal annual required rate of return is 10 percent with semiannual compounding? Your answer 5 points Problem solving #3 A bond is currently selling in the market for $1,170.68. It has $1,000 par value 12% coupon and a 20 year maturity. Using annual compounding, calculate the approximate yield to maturity. (ANSWER FORMAT: 20.69%) Your answer * 2 points Problem solving #4 Assume you want to find yield-to-call on a 20 year, 10.5%, $1,000 par value deferred call bond that is currently trading in the market at $1,204, but has five years to go to first call, at which time it can be called in at a price of $1,805. Find the approximate yield to call, assuming an annual compounding. (ANSWER FORMAT: 20.69%) * 3 points