Please answer thank you

Please answer thank you

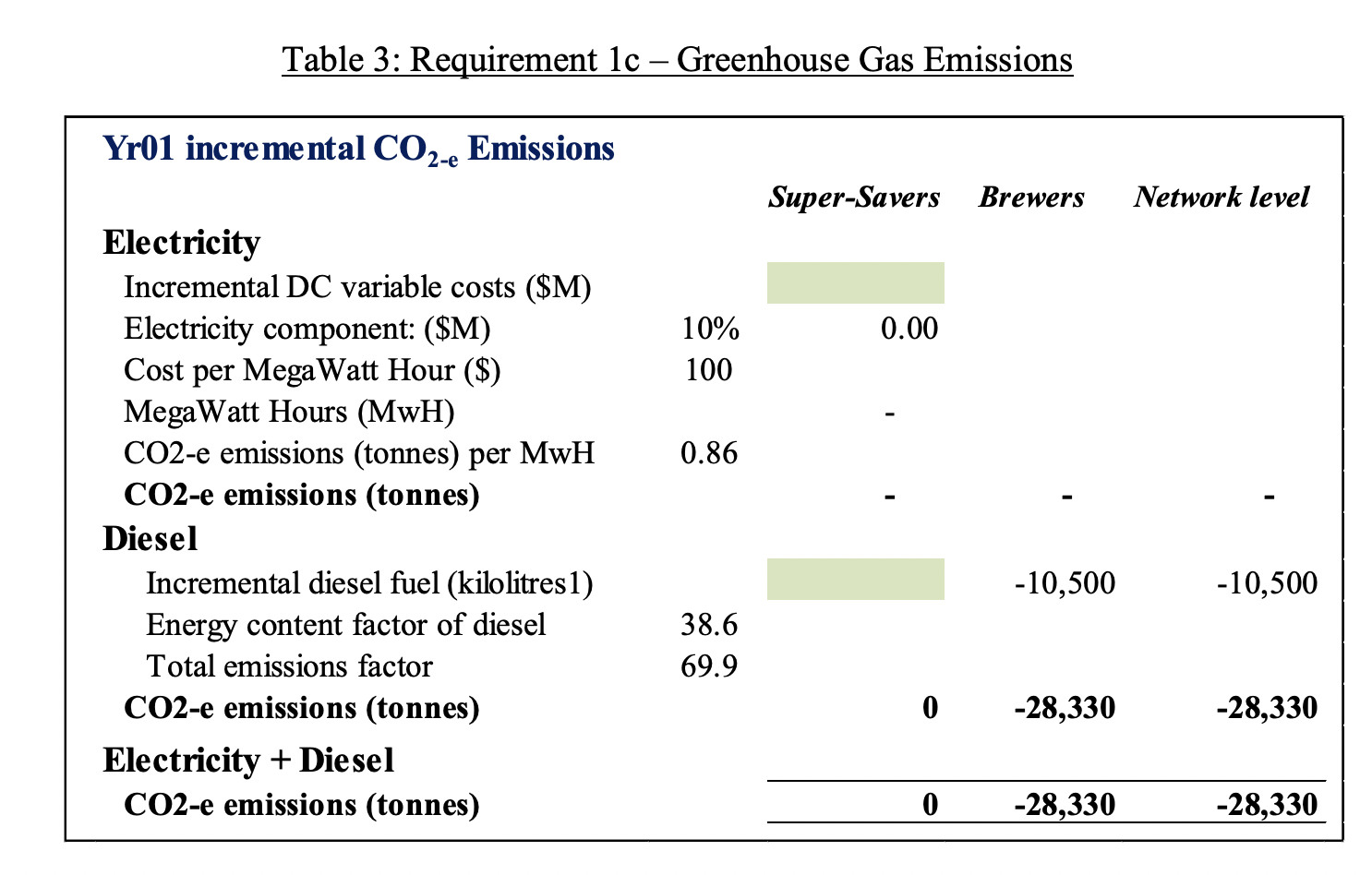

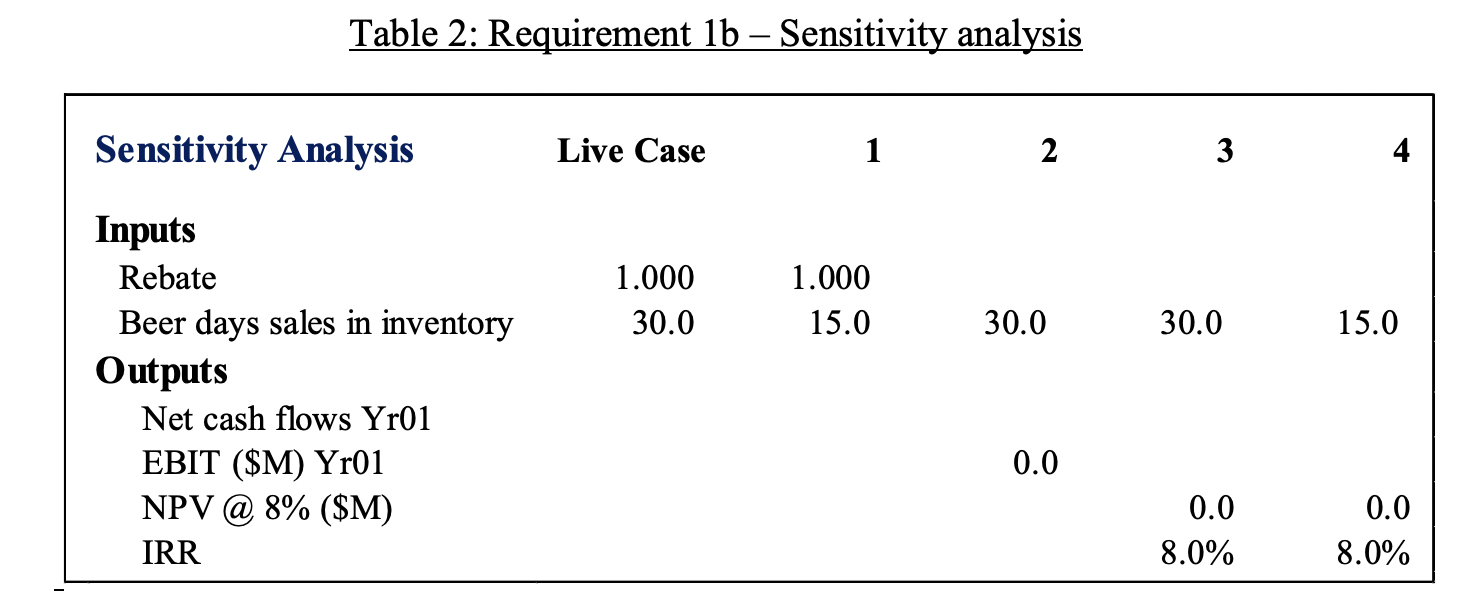

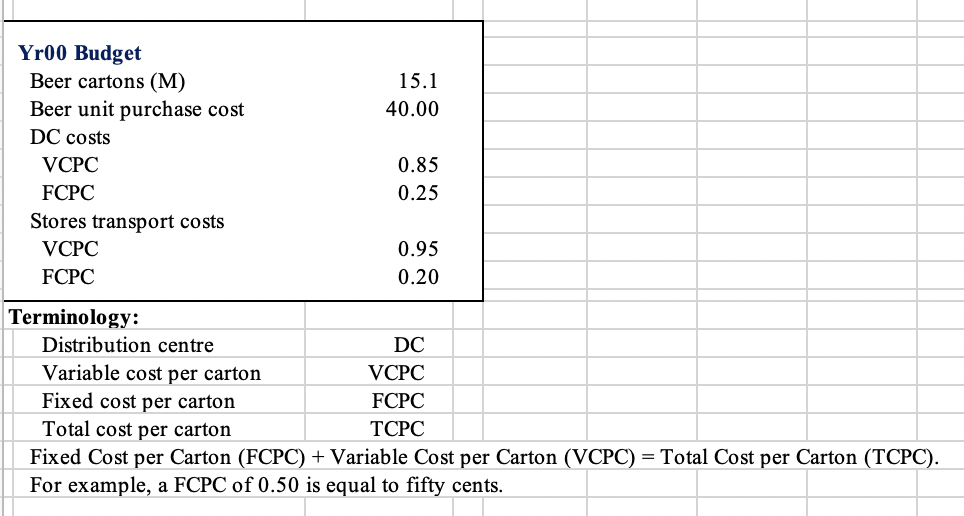

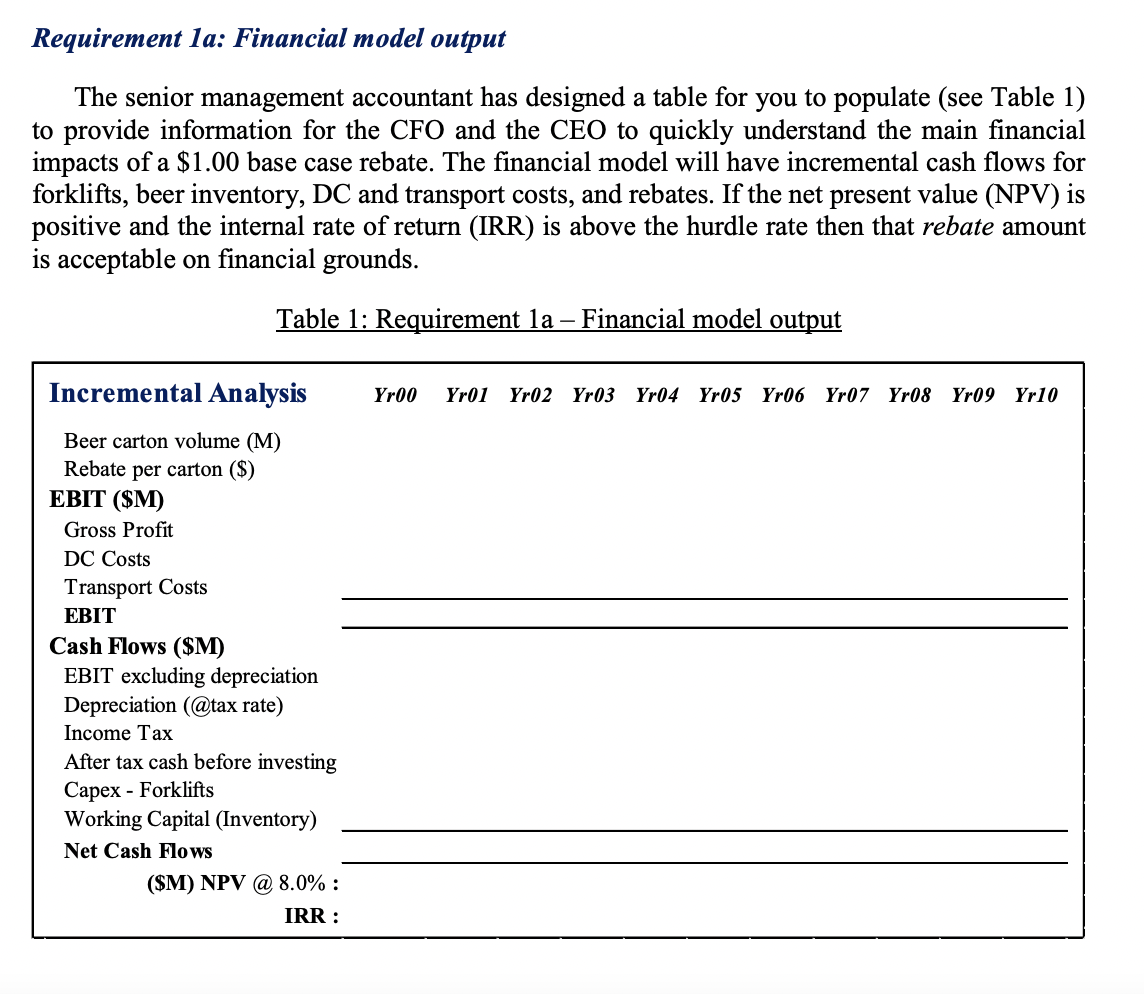

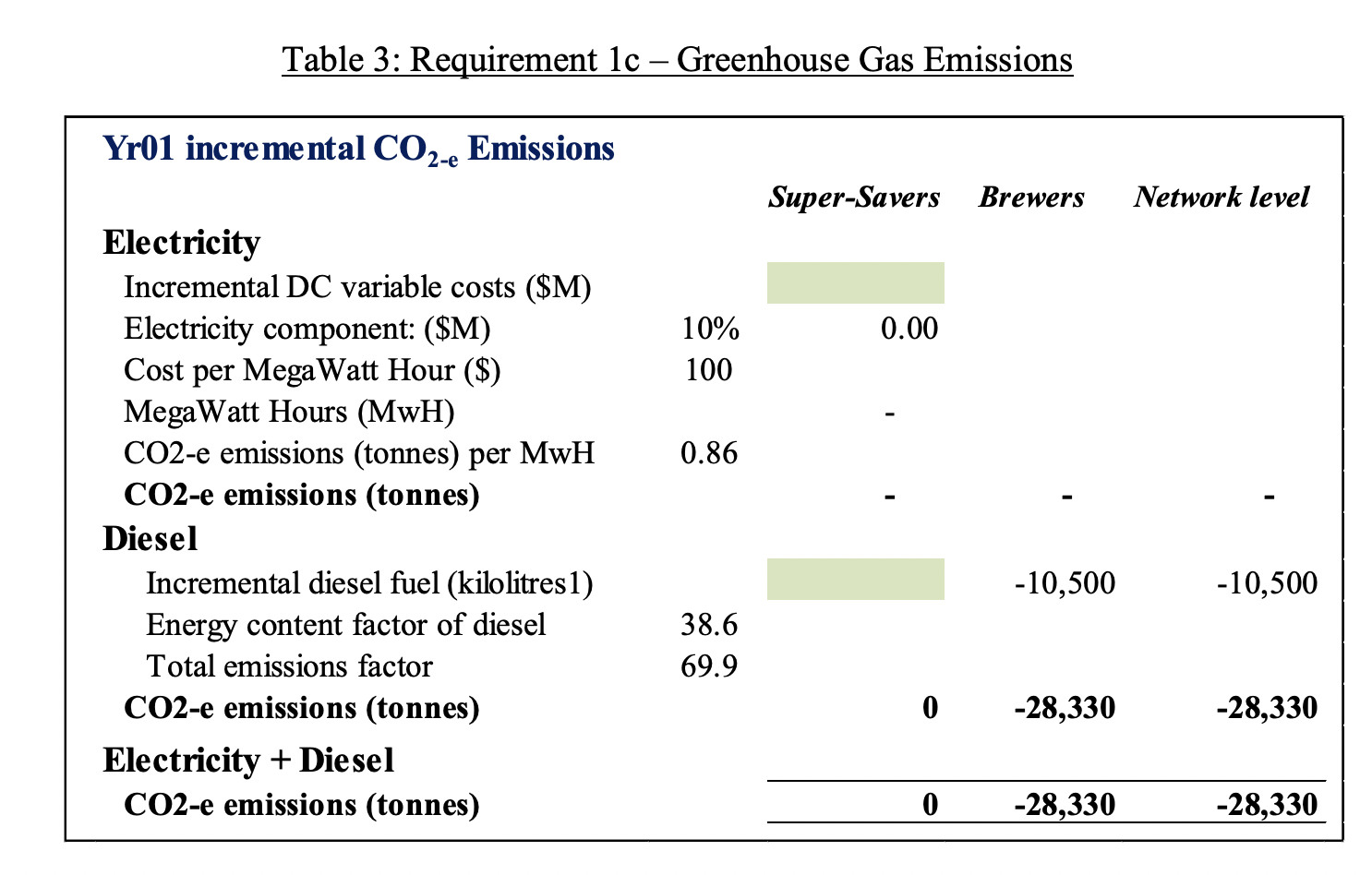

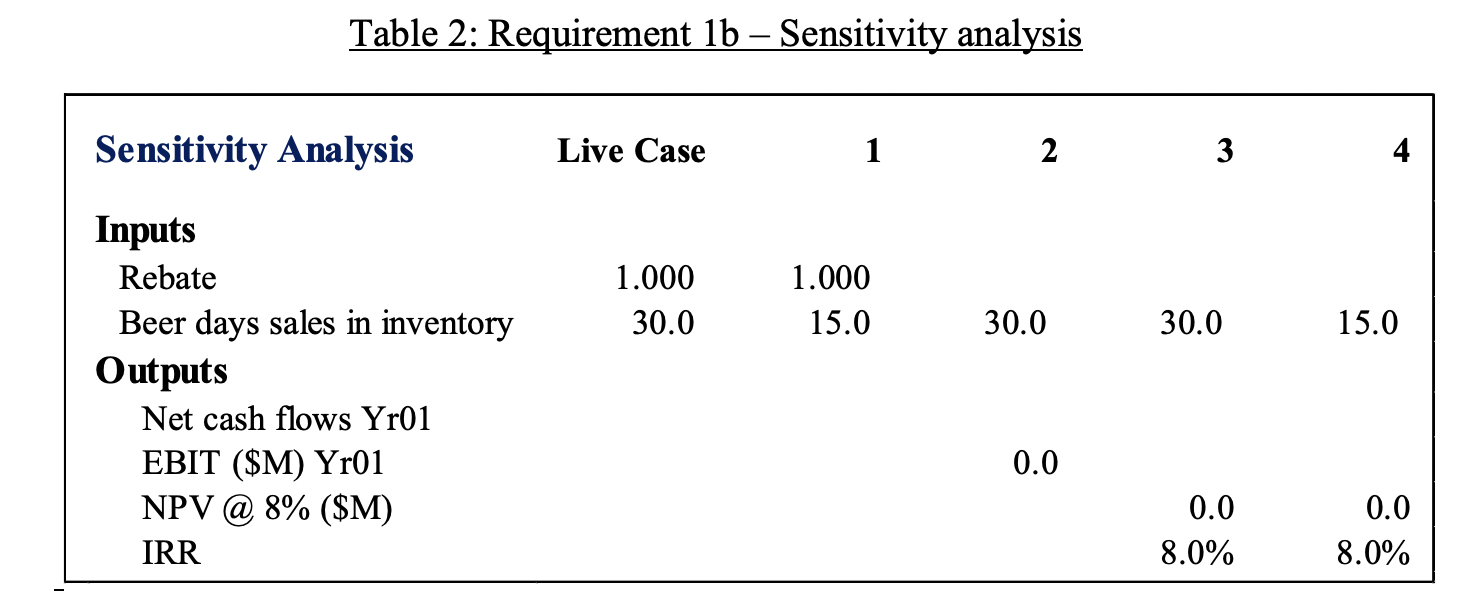

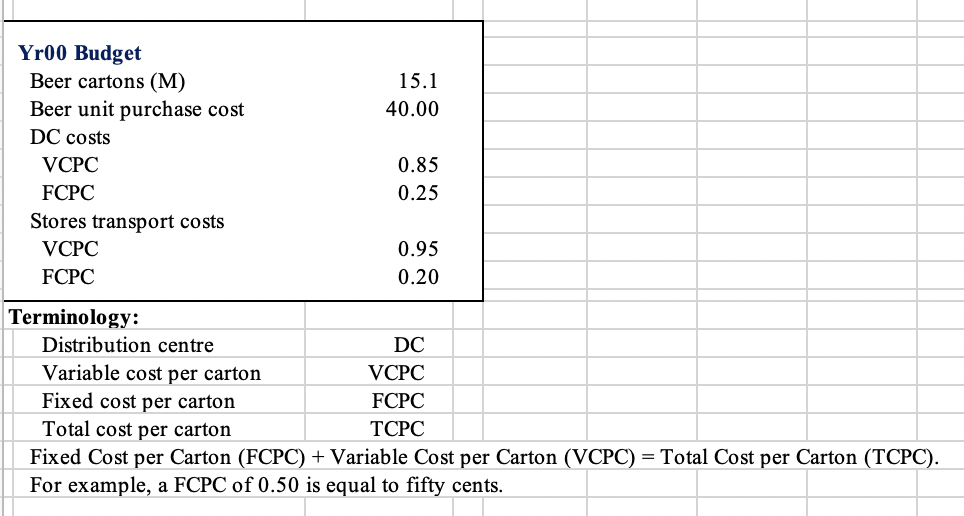

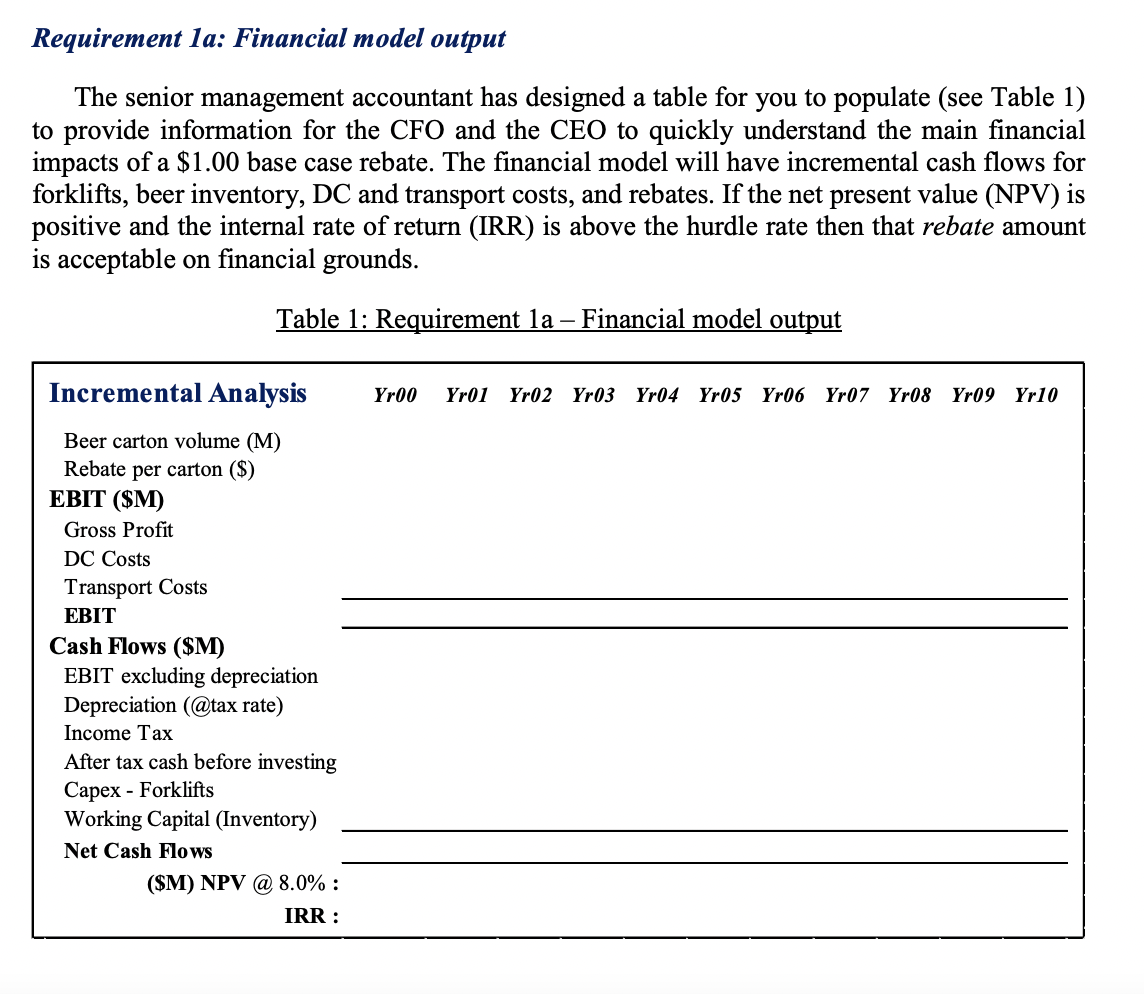

Table 3: Requirement 1c Greenhouse Gas Emissions Yr01 incremental CO2-e Emissions -e Super-Savers Brewers Network level 0.00 10% 100 0.86 Electricity Incremental DC variable costs ($M) Electricity component: ($M) Cost per MegaWatt Hour ($) MegaWatt Hours (MwH) CO2-e emissions (tonnes) per MwH CO2-e emissions (tonnes) Diesel Incremental diesel fuel (kilolitres 1) Energy content factor of diesel Total emissions factor CO2-e emissions (tonnes) Electricity + Diesel CO2-e emissions (tonnes) -10,500 -10,500 38.6 69.9 0 -28,330 -28,330 0 -28,330 -28,330 Table 2: Requirement 1b Sensitivity analysis Sensitivity Analysis Live Case 1 2 3 3 4 1.000 30.0 1.000 15.0 30.0 30.0 15.0 Inputs Rebate Beer days sales in inventory Outputs Net cash flows Yr01 EBIT ($M) Yr01 NPV @ 8% ($M) IRR 0.0 0.0 8.0% 0.0 8.0% 15.1 40.00 Yr00 Budget Beer cartons (M) Beer unit purchase cost DC costs VCPC FCPC Stores transport costs VCPC FCPC 0.85 0.25 0.95 0.20 Terminology: Distribution centre DC Variable cost per carton VCPC Fixed cost per carton FCPC Total cost per carton TCPC Fixed Cost per Carton (FCPC) + Variable Cost per Carton (VCPC) = Total Cost per Carton (TCPC). For example, a FCPC of 0.50 is equal to fifty cents. Requirement la: Financial model output The senior management accountant has designed a table for you to populate (see Table 1) to provide information for the CFO and the CEO to quickly understand the main financial impacts of a $1.00 base case rebate. The financial model will have incremental cash flows for forklifts, beer inventory, DC and transport costs, and rebates. If the net present value (NPV) is positive and the internal rate of return (IRR) is above the hurdle rate then that rebate amount is acceptable on financial grounds. Table 1: Requirement la Financial model output Incremental Analysis Yr00 Yr01 Yr02 Yr03 Yr04 Yr05 Yr06 Yr07 Yr08 Yr09 Yr10 Beer carton volume (M) Rebate per carton ($) EBIT ($M) Gross Profit DC Costs Transport Costs EBIT Cash Flows ($M) EBIT excluding depreciation Depreciation (@tax rate) Income Tax After tax cash before investing Capex - Forklifts Working Capital (Inventory) Net Cash Flows ($M) NPV @ 8.0%: IRR: Table 3: Requirement 1c Greenhouse Gas Emissions Yr01 incremental CO2-e Emissions -e Super-Savers Brewers Network level 0.00 10% 100 0.86 Electricity Incremental DC variable costs ($M) Electricity component: ($M) Cost per MegaWatt Hour ($) MegaWatt Hours (MwH) CO2-e emissions (tonnes) per MwH CO2-e emissions (tonnes) Diesel Incremental diesel fuel (kilolitres 1) Energy content factor of diesel Total emissions factor CO2-e emissions (tonnes) Electricity + Diesel CO2-e emissions (tonnes) -10,500 -10,500 38.6 69.9 0 -28,330 -28,330 0 -28,330 -28,330 Table 2: Requirement 1b Sensitivity analysis Sensitivity Analysis Live Case 1 2 3 3 4 1.000 30.0 1.000 15.0 30.0 30.0 15.0 Inputs Rebate Beer days sales in inventory Outputs Net cash flows Yr01 EBIT ($M) Yr01 NPV @ 8% ($M) IRR 0.0 0.0 8.0% 0.0 8.0% 15.1 40.00 Yr00 Budget Beer cartons (M) Beer unit purchase cost DC costs VCPC FCPC Stores transport costs VCPC FCPC 0.85 0.25 0.95 0.20 Terminology: Distribution centre DC Variable cost per carton VCPC Fixed cost per carton FCPC Total cost per carton TCPC Fixed Cost per Carton (FCPC) + Variable Cost per Carton (VCPC) = Total Cost per Carton (TCPC). For example, a FCPC of 0.50 is equal to fifty cents. Requirement la: Financial model output The senior management accountant has designed a table for you to populate (see Table 1) to provide information for the CFO and the CEO to quickly understand the main financial impacts of a $1.00 base case rebate. The financial model will have incremental cash flows for forklifts, beer inventory, DC and transport costs, and rebates. If the net present value (NPV) is positive and the internal rate of return (IRR) is above the hurdle rate then that rebate amount is acceptable on financial grounds. Table 1: Requirement la Financial model output Incremental Analysis Yr00 Yr01 Yr02 Yr03 Yr04 Yr05 Yr06 Yr07 Yr08 Yr09 Yr10 Beer carton volume (M) Rebate per carton ($) EBIT ($M) Gross Profit DC Costs Transport Costs EBIT Cash Flows ($M) EBIT excluding depreciation Depreciation (@tax rate) Income Tax After tax cash before investing Capex - Forklifts Working Capital (Inventory) Net Cash Flows ($M) NPV @ 8.0%: IRR

Please answer thank you

Please answer thank you