Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the 2 problem! thankyou. PROBLEM 3: The equity accounts of Jane and Nelliza at the end of the 2019 are as follows: Jane

please answer the 2 problem! thankyou.

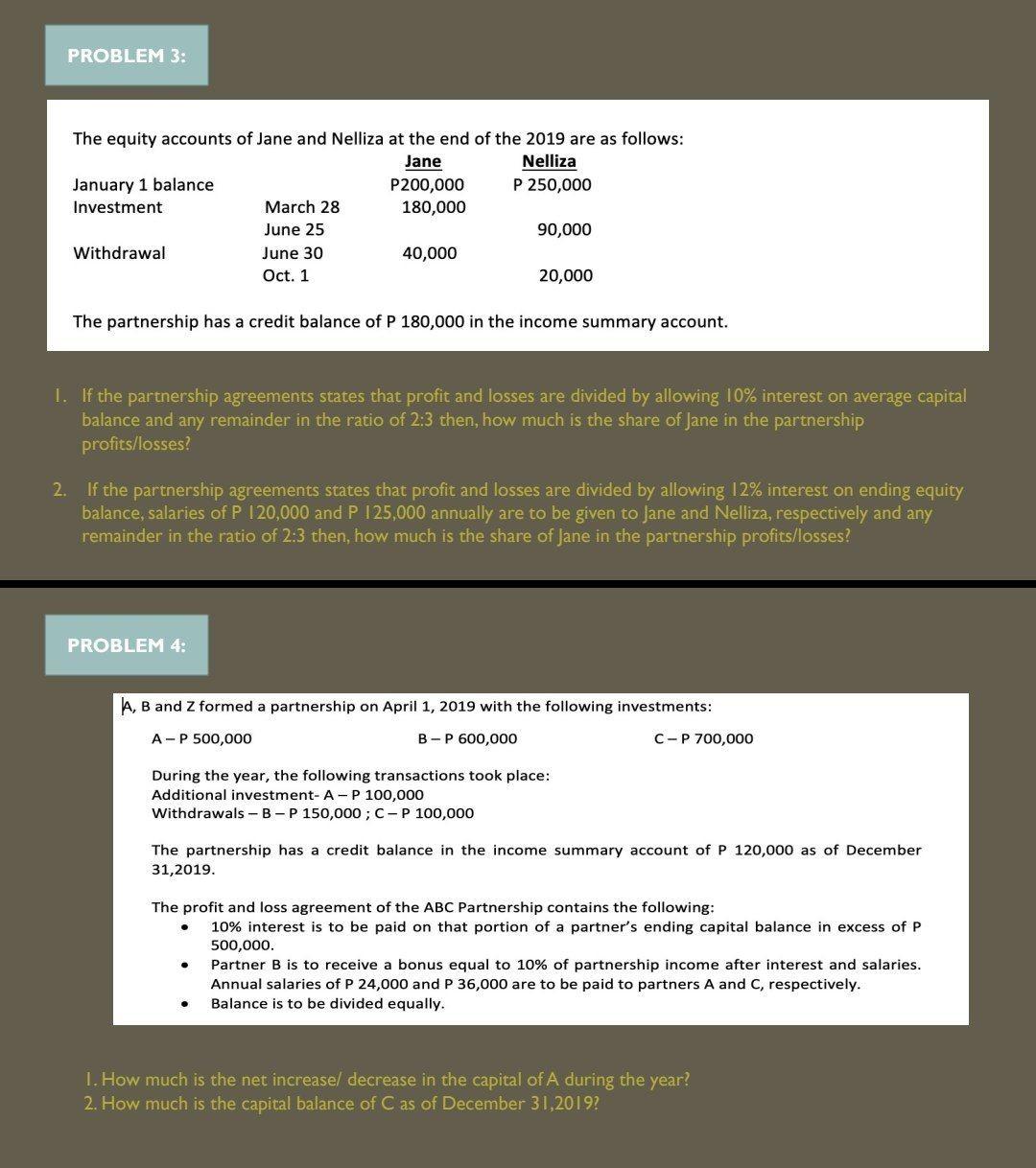

PROBLEM 3: The equity accounts of Jane and Nelliza at the end of the 2019 are as follows: Jane Nelliza January 1 balance P200,000 P 250,000 Investment March 28 180,000 June 25 90,000 Withdrawal June 30 40,000 Oct. 1 20,000 The partnership has a credit balance of P 180,000 in the income summary account. 1. If the partnership agreements states that profit and losses are divided by allowing 10% interest on average capital balance and any remainder in the ratio of 2:3 then, how much is the share of Jane in the partnership profits/losses? 2. If the partnership agreements states that profit and losses are divided by allowing 12% interest on ending equity balance, salaries of P 120,000 and P 125,000 annually are to be given to Jane and Nelliza, respectively and any remainder in the ratio of 2:3 then, how much is the share of Jane in the partnership profits/losses? PROBLEM 4: A, B and Z formed a partnership on April 1, 2019 with the following investments: A-P 500,000 B-P 600,000 C-P 700,000 During the year, the following transactions took place: Additional investment-A-P 100,000 Withdrawals -B-P 150,000 ; C-P 100,000 The partnership has a credit balance in the income summary account of P 120,000 as of December 31,2019. The profit and loss agreement of the ABC Partnership contains the following: 10% interest is to be paid on that portion of a partner's ending capital balance in excess of P 500,000. Partner B is to receive a bonus equal to 10% of partnership income after interest and salaries. Annual salaries of P 24,000 and P 36,000 are to be paid to partners A and C, respectively. Balance is to be divided equally. 1. How much is the net increase/ decrease in the capital of A during the year? 2. How much is the capital balance of C as of December 31,2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started