Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the 2 questions immediately thankyou 3 Assuming all balances in the accounts before liquidation are the same except for EM and P Partnership

please answer the 2 questions immediately thankyou

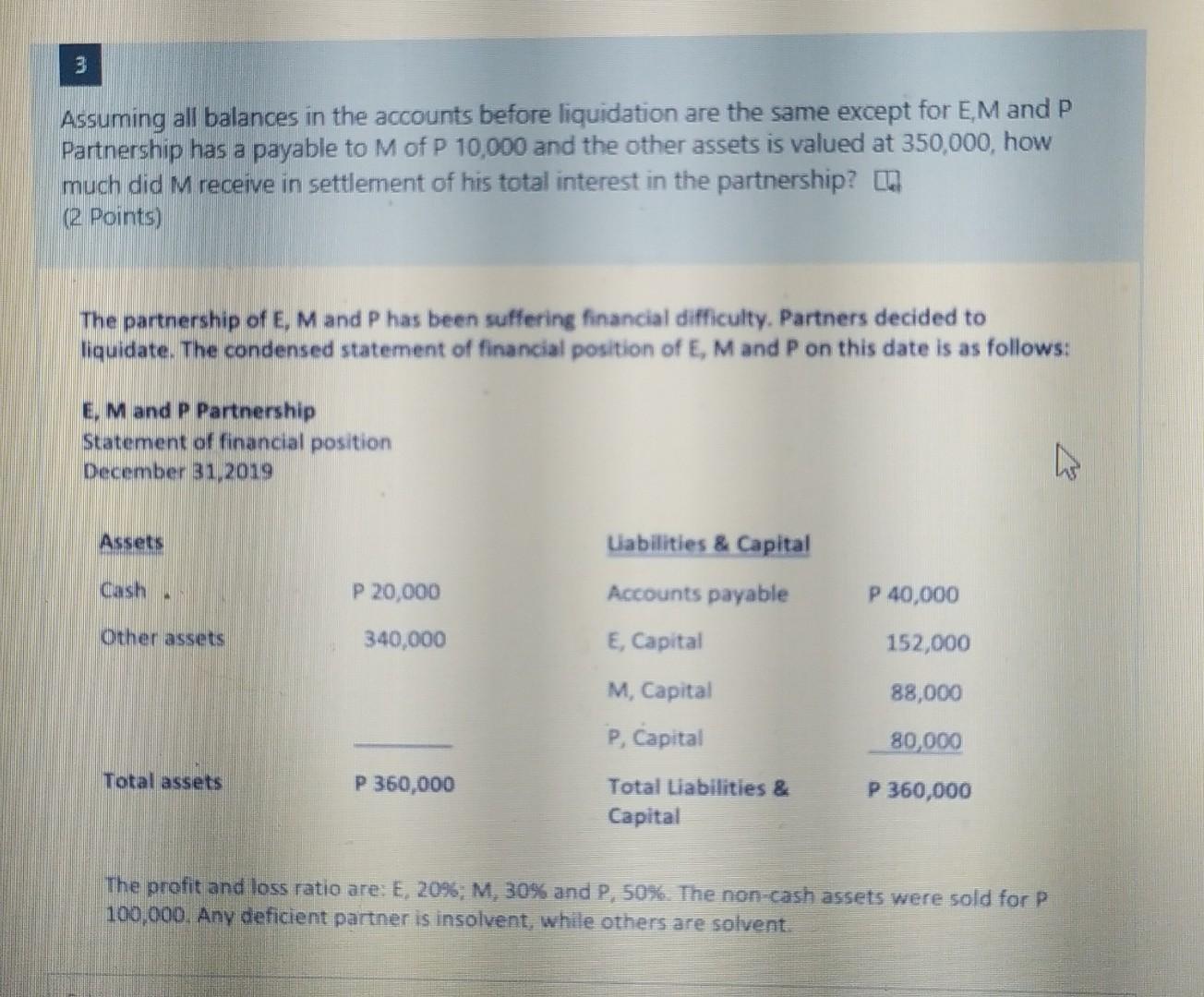

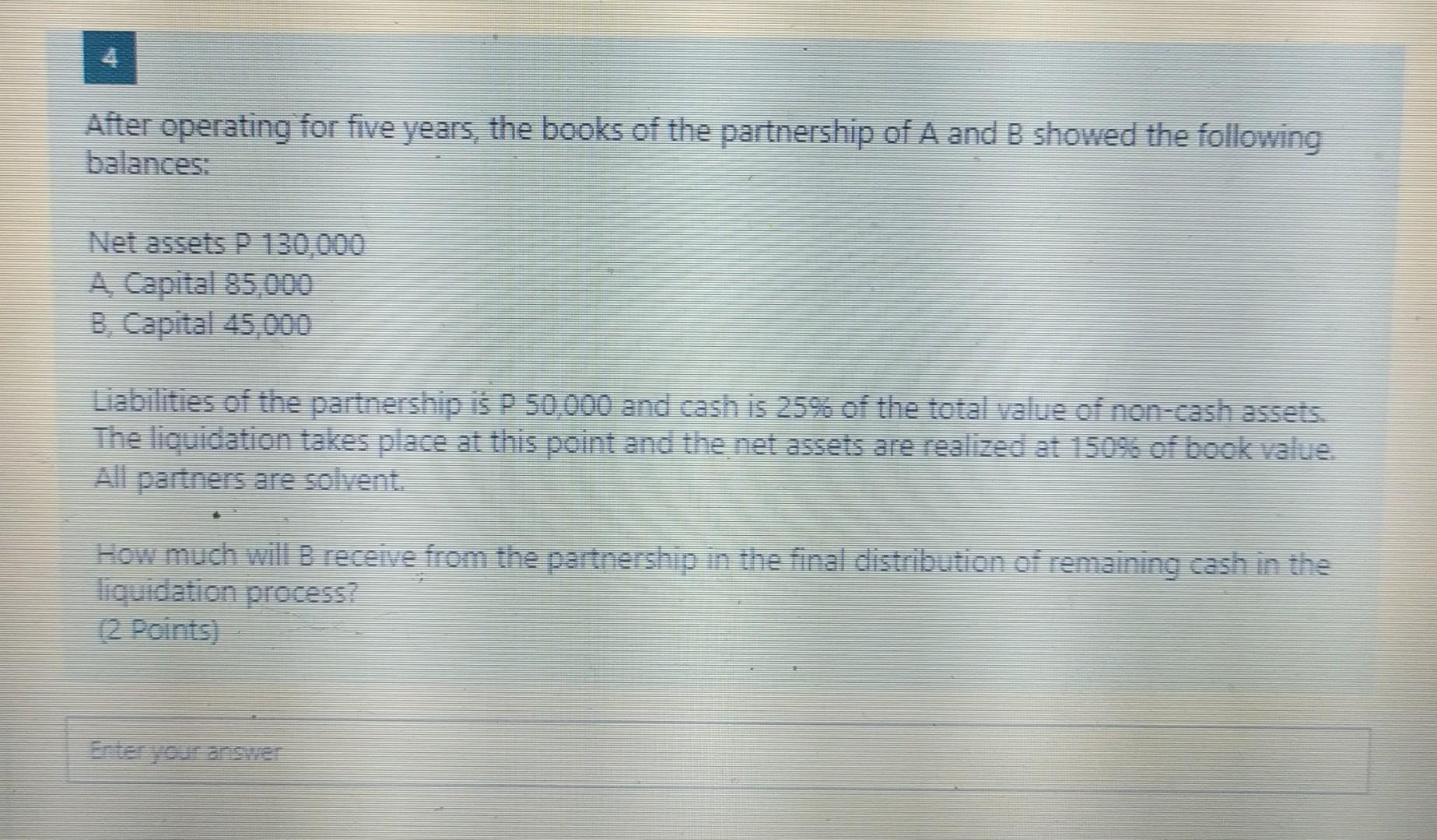

3 Assuming all balances in the accounts before liquidation are the same except for EM and P Partnership has a payable to M of P 10,000 and the other assets is valued at 350,000, how much did M receive in settlement of his total interest in the partnership? (2 Points) The partnership of E, Mand P has been suffering financial difficulty. Partners decided to liquidate. The condensed statement of financial position of E, M and P on this date is as follows: e. M and P Partnership Statement of financial position December 31, 2019 Assets cash Liabilities & Capital Accounts payable E, Capital P 20,000 340,000 P 40,000 Other assets 152,000 M, Capital 88,000 P, Capital 80,000 Total assets P 360,000 Total Liabilities & Capital P 360,000 The profit and loss ratio are: E, 20%; M, 30% and P. 50%. The non-cash assets were sold for p 100,000. Any deficient partner is insolvent, while others are solvent. After operating for five years, the books of the partnership of A and B showed the following balances: Net assets P 130.000 A Capital 85.000 B. Capital 45,000 Liabilities of the partnership is P 50,000 and cash is 25% of the total value of non-cash assets. The liquidation takes place at this point and the net assets are realized at 50% of book value Al partners are solvent How much will B receive from the partnership in the final distribution of remaining cash in the liquidation process? 2 points 3 Assuming all balances in the accounts before liquidation are the same except for EM and P Partnership has a payable to M of P 10,000 and the other assets is valued at 350,000, how much did M receive in settlement of his total interest in the partnership? (2 Points) The partnership of E, Mand P has been suffering financial difficulty. Partners decided to liquidate. The condensed statement of financial position of E, M and P on this date is as follows: e. M and P Partnership Statement of financial position December 31, 2019 Assets cash Liabilities & Capital Accounts payable E, Capital P 20,000 340,000 P 40,000 Other assets 152,000 M, Capital 88,000 P, Capital 80,000 Total assets P 360,000 Total Liabilities & Capital P 360,000 The profit and loss ratio are: E, 20%; M, 30% and P. 50%. The non-cash assets were sold for p 100,000. Any deficient partner is insolvent, while others are solvent. After operating for five years, the books of the partnership of A and B showed the following balances: Net assets P 130.000 A Capital 85.000 B. Capital 45,000 Liabilities of the partnership is P 50,000 and cash is 25% of the total value of non-cash assets. The liquidation takes place at this point and the net assets are realized at 50% of book value Al partners are solvent How much will B receive from the partnership in the final distribution of remaining cash in the liquidation process? 2 pointsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started