Answered step by step

Verified Expert Solution

Question

1 Approved Answer

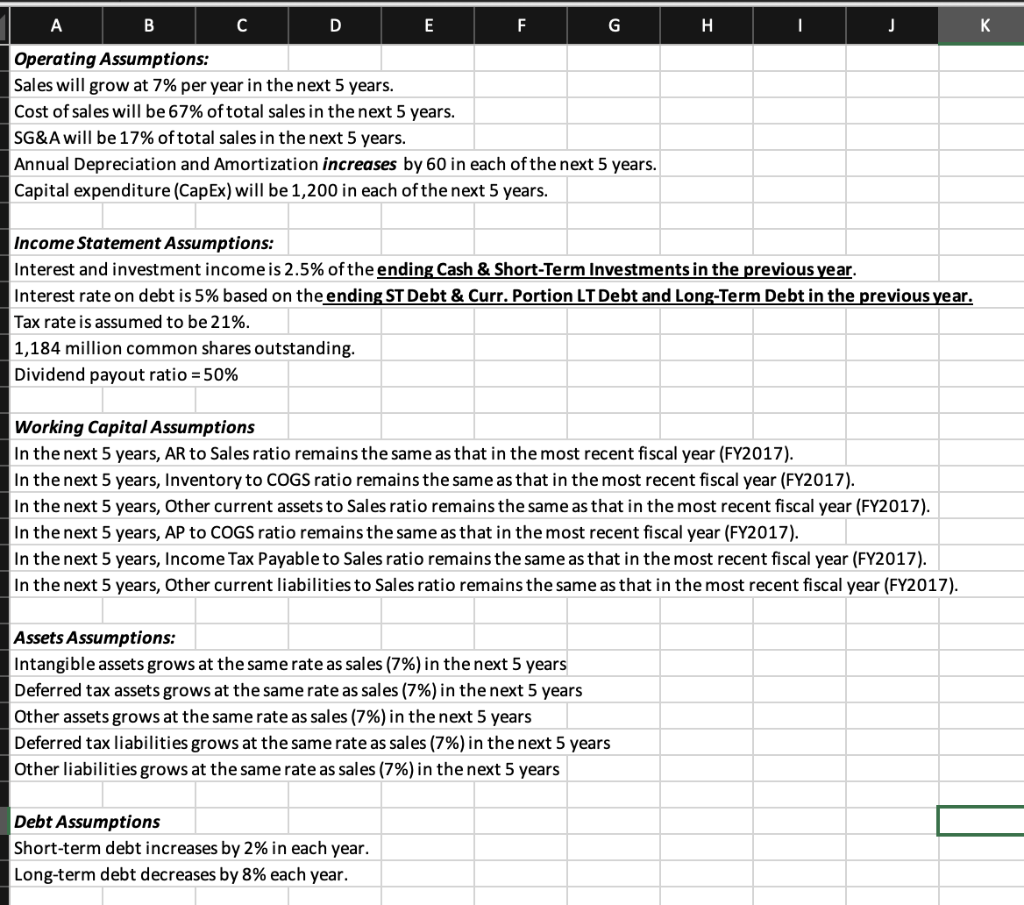

Please answer the #3 and pls show the calculation using excel. thank you A B D E F G H I J K Operating Assumptions:

Please answer the #3 and pls show the calculation using excel. thank you

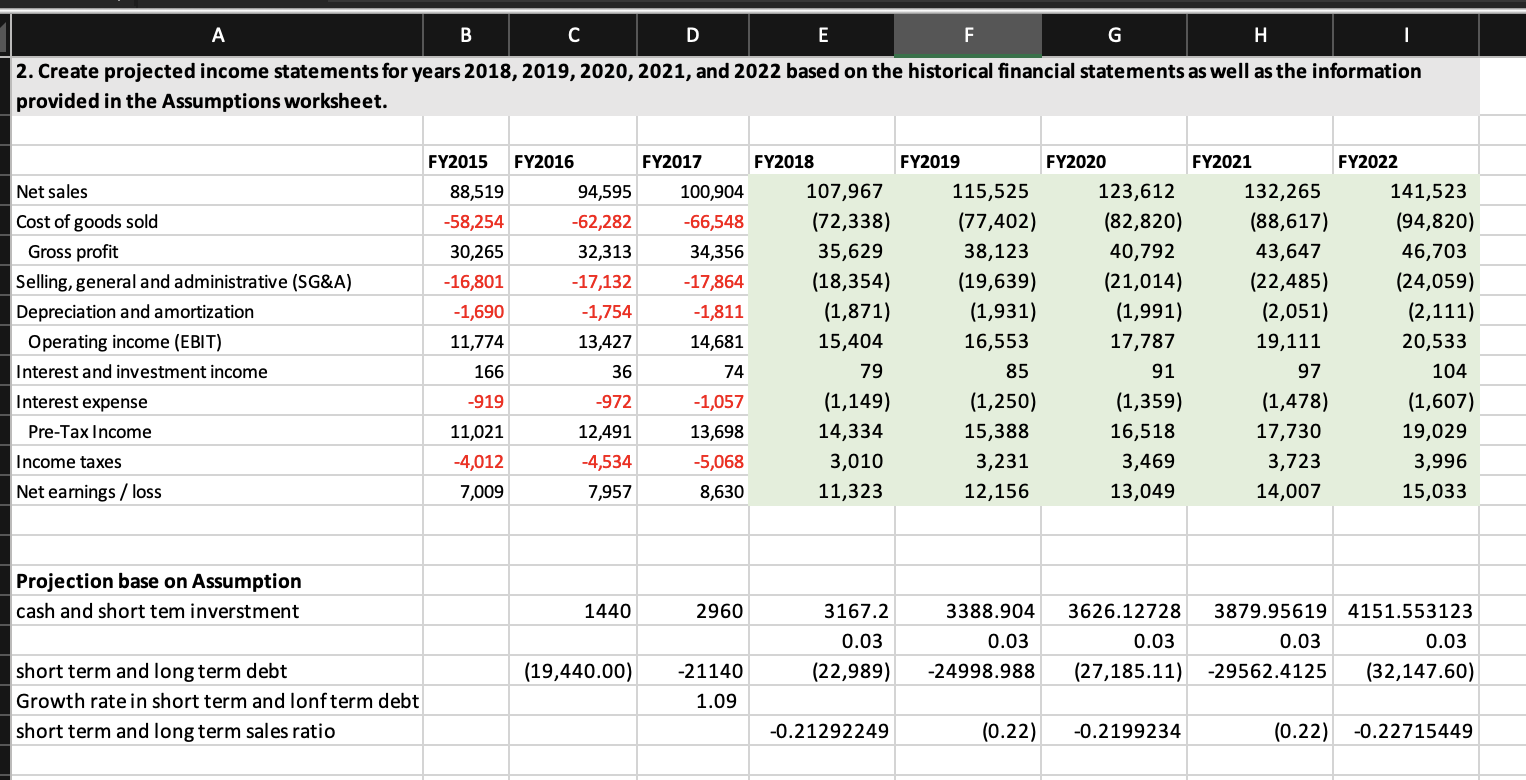

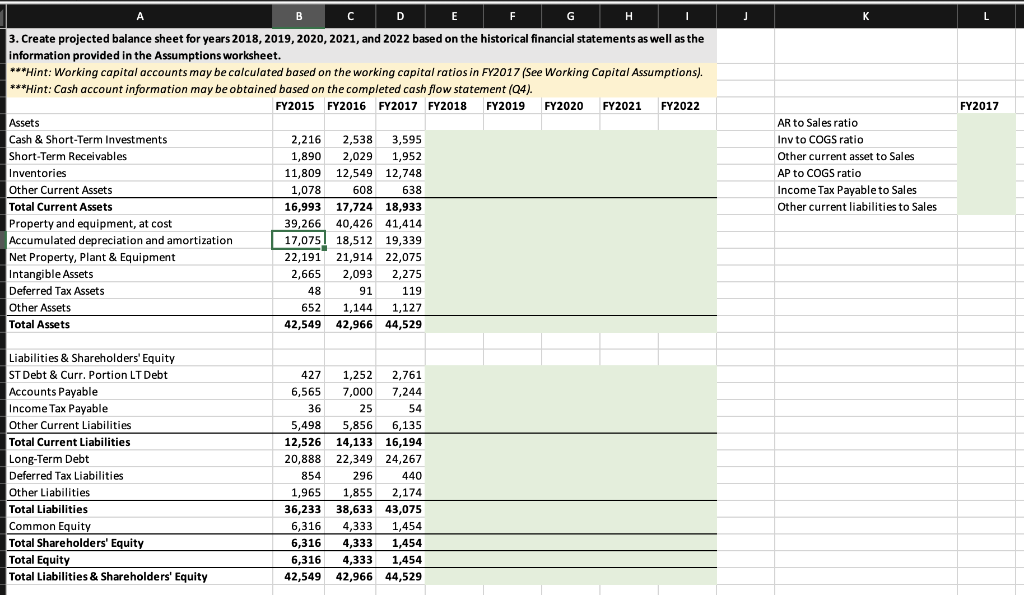

A B D E F G H I J K Operating Assumptions: Sales will grow at 7% per year in the next 5 years. Cost of sales will be 67% of total sales in the next 5 years. SG&A will be 17% of total sales in the next 5 years. Annual Depreciation and Amortization increases by 60 in each of the next 5 years. Capital expenditure (CapEx) will be 1,200 in each of the next 5 years. Income Statement Assumptions: Interest and investment income is 2.5% of the ending Cash & Short-Term Investments in the previous year. Interest rate on debt is 5% based on the ending ST Debt & Curr. Portion LT Debt and Long-Term Debt in the previous year. Tax rate is assumed to be 21%. 1,184 million common shares outstanding. Dividend payout ratio = 50% Working Capital Assumptions In the next 5 years, AR to Sales ratio remains the same as that in the most recent fiscal year (FY2017). In the next 5 years, Inventory to COGS ratio remains the same as that in the most recent fiscal year (FY2017). In the next 5 years, Other current assets to Sales ratio remains the same as that in the most recent fiscal year (FY2017). In the next 5 years, AP to COGS ratio remains the same as that in the most recent fiscal year (FY2017). In the next 5 years, Income Tax Payable to Sales ratio remains the same as that in the most recent fiscal year (FY2017). In the next 5 years, Other current liabilities to Sales ratio remains the same as that in the most recent fiscal year (FY2017). Assets Assumptions: Intangible assets grows at the same rate as sales (7%) in the next 5 years Deferred tax assets grows at the same rate as sales (7%) in the next 5 years Other assets grows at the same rate as sales (7%) in the next 5 years Deferred tax liabilities grows at the same rate as sales (7%) in the next 5 years Other liabilities grows at the same rate as sales (7%) in the next 5 years Debt Assumptions Short-term debt increases by 2% in each year. Long-term debt decreases by 8% each year. A A B D E F G H I 2. Create projected income statements for years 2018, 2019, 2020, 2021, and 2022 based on the historical financial statements as well as the information provided in the Assumptions worksheet. Net sales Cost of goods sold Gross profit Selling, general and administrative (SG&A) Depreciation and amortization Operating income (EBIT) Interest and investment income FY2015 FY2016 88,519 94,595 -58,254 -62,282 30,265 32,313 -16,801 -17,132 -1,690 -1,754 11,774 13,427 166 36 -919 -972 11,021 12,491 -4,012 -4,534 7,009 7,957 FY2017 FY2018 FY2019 FY2020 100,904 107,967 115,525 123,612 -66,548 (72,338) (77,402) (82,820) 34,356 35,629 38,123 40,792 -17,864 (18,354) (19,639) (21,014) -1,811 (1,871) (1,931) (1,991) 14,681 15,404 16,553 17,787 74 79 85 91 -1,057 (1,149) (1,250) (1,359) 13,698 14,334 15,388 16,518 -5,068 3,010 3,231 3,469 8,630 11,323 12,156 13,049 FY2021 FY2022 132,265 141,523 (88,617) (94,820) 43,647 46,703 (22,485) (24,059) (2,051) (2,111) 19,111 20,533 97 104 (1,478) (1,607) 17,730 19,029 3,723 3,996 14,007 15,033 Interest expense Pre-Tax Income Income taxes Net earnings / loss Projection base on Assumption cash and short tem inverstment 1440 2960 3167.2 0.03 (22,989) 3388.904 0.03 -24998.988 3626.12728 3879.95619 4151.553123 0.03 0.03 0.03 (27,185.11) -29562.4125 (32,147.60) (19,440.00) short term and long term debt Growth rate in short term and lonfterm debt short term and long term sales ratio -21140 1.09 -0.21292249 (0.22) -0.2199234 (0.22) -0.22715449 J K L FY2017 B C D F F G H 3. Create projected balance sheet for years 2018, 2019, 2020, 2021, and 2022 based on the historical financial statements as well as the information provided in the Assumptions worksheet. ***Hint: Working capital accounts may be calculated based on the working capital ratios in FY2017 (See Working Capital Assumptions). ***Hint: Cash account information may be obtained based on the completed cash flow statement (Q4). FY2015 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY2022 Assets Cash & Short-Term Investments & 2,216 2,538 3,595 Short-Term Receivables 1,890 2,029 1,952 Inventories 11,809 12,549 12,748 Other Current Assets 1,078 608 638 Total Current Assets 16.993 17,724 18,933 Property and equipment, at cost 39,266 40,426 41,414 Accumulated depreciation and amortization 17,075 18,512 19,339 Net Property, Plant & Equipment 22,191 21,914 22,075 Intangible Assets 2,665 2,093 2,275 Deferred Tax Assets 48 91 119 Other Assets 652 1.144 1,127 Total Assets 42,549 42,966 44,529 AR to Sales ratio Inv to COGS ratio Other current asset to Sales AP to COGS ratio Income Tax Payable to Sales Other current liabilities to Sales Liabilities & Shareholders' Equity ST Debt & Curr. Portion LT Debt Accounts Payable Income Tax Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Deferred Tax Liabilities Other Liabilities Total Liabilities Common Equity Total Shareholders' Equity Total Equity Total Liabilities & Shareholders' Equity 427 1,252 2,761 6,565 7,000 7,244 36 25 54 5,498 5,856 6,135 12,526 14,133 16,194 20,888 22,349 24,267 854 296 440 1,965 1,855 2,174 36,233 38,633 43,075 6,316 4,333 1,454 6,316 4,333 1,454 6,316 4,333 1,454 42,549 42,966 44,529 A B D E F G H I J K Operating Assumptions: Sales will grow at 7% per year in the next 5 years. Cost of sales will be 67% of total sales in the next 5 years. SG&A will be 17% of total sales in the next 5 years. Annual Depreciation and Amortization increases by 60 in each of the next 5 years. Capital expenditure (CapEx) will be 1,200 in each of the next 5 years. Income Statement Assumptions: Interest and investment income is 2.5% of the ending Cash & Short-Term Investments in the previous year. Interest rate on debt is 5% based on the ending ST Debt & Curr. Portion LT Debt and Long-Term Debt in the previous year. Tax rate is assumed to be 21%. 1,184 million common shares outstanding. Dividend payout ratio = 50% Working Capital Assumptions In the next 5 years, AR to Sales ratio remains the same as that in the most recent fiscal year (FY2017). In the next 5 years, Inventory to COGS ratio remains the same as that in the most recent fiscal year (FY2017). In the next 5 years, Other current assets to Sales ratio remains the same as that in the most recent fiscal year (FY2017). In the next 5 years, AP to COGS ratio remains the same as that in the most recent fiscal year (FY2017). In the next 5 years, Income Tax Payable to Sales ratio remains the same as that in the most recent fiscal year (FY2017). In the next 5 years, Other current liabilities to Sales ratio remains the same as that in the most recent fiscal year (FY2017). Assets Assumptions: Intangible assets grows at the same rate as sales (7%) in the next 5 years Deferred tax assets grows at the same rate as sales (7%) in the next 5 years Other assets grows at the same rate as sales (7%) in the next 5 years Deferred tax liabilities grows at the same rate as sales (7%) in the next 5 years Other liabilities grows at the same rate as sales (7%) in the next 5 years Debt Assumptions Short-term debt increases by 2% in each year. Long-term debt decreases by 8% each year. A A B D E F G H I 2. Create projected income statements for years 2018, 2019, 2020, 2021, and 2022 based on the historical financial statements as well as the information provided in the Assumptions worksheet. Net sales Cost of goods sold Gross profit Selling, general and administrative (SG&A) Depreciation and amortization Operating income (EBIT) Interest and investment income FY2015 FY2016 88,519 94,595 -58,254 -62,282 30,265 32,313 -16,801 -17,132 -1,690 -1,754 11,774 13,427 166 36 -919 -972 11,021 12,491 -4,012 -4,534 7,009 7,957 FY2017 FY2018 FY2019 FY2020 100,904 107,967 115,525 123,612 -66,548 (72,338) (77,402) (82,820) 34,356 35,629 38,123 40,792 -17,864 (18,354) (19,639) (21,014) -1,811 (1,871) (1,931) (1,991) 14,681 15,404 16,553 17,787 74 79 85 91 -1,057 (1,149) (1,250) (1,359) 13,698 14,334 15,388 16,518 -5,068 3,010 3,231 3,469 8,630 11,323 12,156 13,049 FY2021 FY2022 132,265 141,523 (88,617) (94,820) 43,647 46,703 (22,485) (24,059) (2,051) (2,111) 19,111 20,533 97 104 (1,478) (1,607) 17,730 19,029 3,723 3,996 14,007 15,033 Interest expense Pre-Tax Income Income taxes Net earnings / loss Projection base on Assumption cash and short tem inverstment 1440 2960 3167.2 0.03 (22,989) 3388.904 0.03 -24998.988 3626.12728 3879.95619 4151.553123 0.03 0.03 0.03 (27,185.11) -29562.4125 (32,147.60) (19,440.00) short term and long term debt Growth rate in short term and lonfterm debt short term and long term sales ratio -21140 1.09 -0.21292249 (0.22) -0.2199234 (0.22) -0.22715449 J K L FY2017 B C D F F G H 3. Create projected balance sheet for years 2018, 2019, 2020, 2021, and 2022 based on the historical financial statements as well as the information provided in the Assumptions worksheet. ***Hint: Working capital accounts may be calculated based on the working capital ratios in FY2017 (See Working Capital Assumptions). ***Hint: Cash account information may be obtained based on the completed cash flow statement (Q4). FY2015 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY2022 Assets Cash & Short-Term Investments & 2,216 2,538 3,595 Short-Term Receivables 1,890 2,029 1,952 Inventories 11,809 12,549 12,748 Other Current Assets 1,078 608 638 Total Current Assets 16.993 17,724 18,933 Property and equipment, at cost 39,266 40,426 41,414 Accumulated depreciation and amortization 17,075 18,512 19,339 Net Property, Plant & Equipment 22,191 21,914 22,075 Intangible Assets 2,665 2,093 2,275 Deferred Tax Assets 48 91 119 Other Assets 652 1.144 1,127 Total Assets 42,549 42,966 44,529 AR to Sales ratio Inv to COGS ratio Other current asset to Sales AP to COGS ratio Income Tax Payable to Sales Other current liabilities to Sales Liabilities & Shareholders' Equity ST Debt & Curr. Portion LT Debt Accounts Payable Income Tax Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Deferred Tax Liabilities Other Liabilities Total Liabilities Common Equity Total Shareholders' Equity Total Equity Total Liabilities & Shareholders' Equity 427 1,252 2,761 6,565 7,000 7,244 36 25 54 5,498 5,856 6,135 12,526 14,133 16,194 20,888 22,349 24,267 854 296 440 1,965 1,855 2,174 36,233 38,633 43,075 6,316 4,333 1,454 6,316 4,333 1,454 6,316 4,333 1,454 42,549 42,966 44,529Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started