Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the 4 questions 10) QBO considers all of the following to be a vendor except: (5pts) c. Employees providing specific services to the

please answer the 4 questions

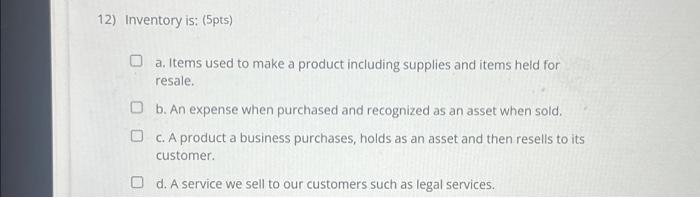

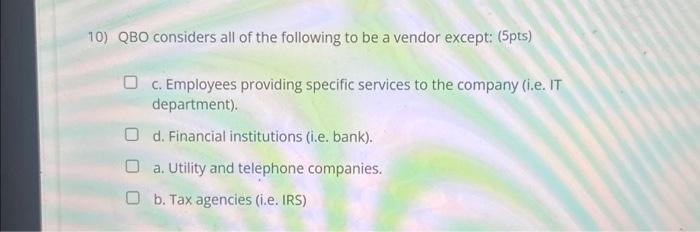

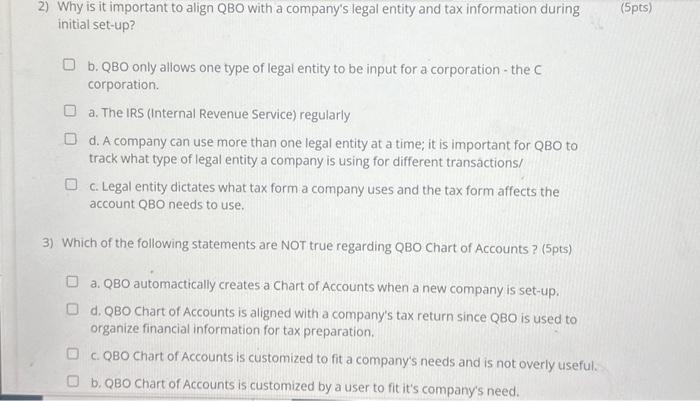

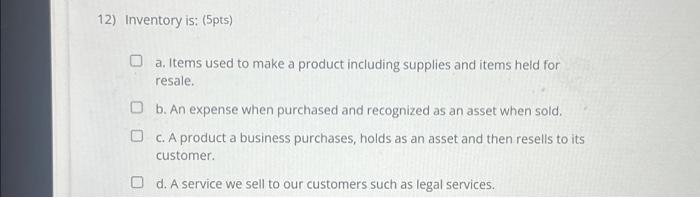

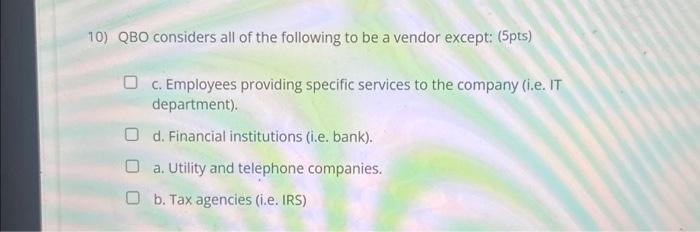

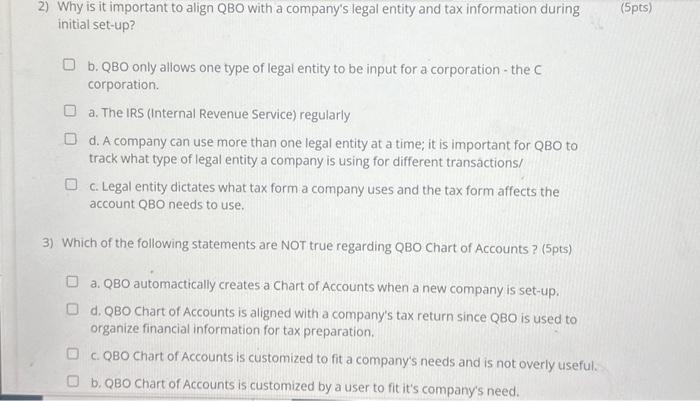

10) QBO considers all of the following to be a vendor except: (5pts) c. Employees providing specific services to the company (i.e. IT department). d. Financial institutions (i.e. bank). a. Utility and telephone companies. b. Tax agencies (i.e. IRS) 2) Why is it important to align QBO with a company's legal entity and tax information during initial set-up? b. QBO only allows one type of legal entity to be input for a corporation - the C corporation. a. The IRS (Internal Revenue Service) regularly d. A company can use more than one legal entity at a time; it is important for QBO to track what type of legal entity a company is using for different transactions/ c. Legal entity dictates what tax form a company uses and the tax form affects the account QBO needs to use. 3) Which of the following statements are NOT true regarding QBO Chart of Accounts ? (5pts) a. QBO automactically creates a Chart of Accounts when a new company is set-up. d. QBO Chart of Accounts is aligned with a company's tax return since QBO is used to organize financial information for tax preparation. c. QBO Chart of Accounts is customized to fit a company's needs and is not overly useful. b. QBO Chart of Accounts is customized by a user to fit it's company's need. 12) Inventory is: (5pts) a. Items used to make a product including supplies and items held for resale. b. An expense when purchased and recognized as an asset when sold. c. A product a business purchases, holds as an asset and then resells to its customer. d. A service we sell to our customers such as legal services

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started