Answered step by step

Verified Expert Solution

Question

1 Approved Answer

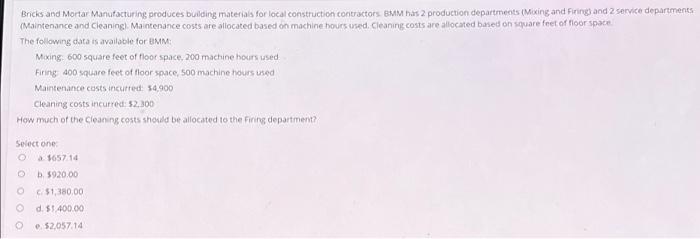

PLEASE answer the 5. Bricks and Mortar Manufacturing produces building materials for local construction contractors. 8mM hars 2 production departments iMcxing and Firing and 2

PLEASE answer the 5.

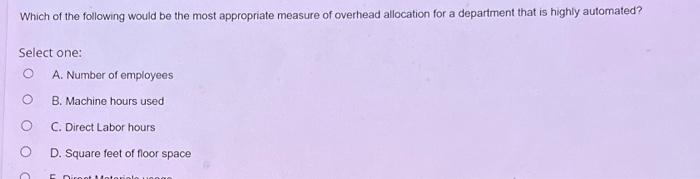

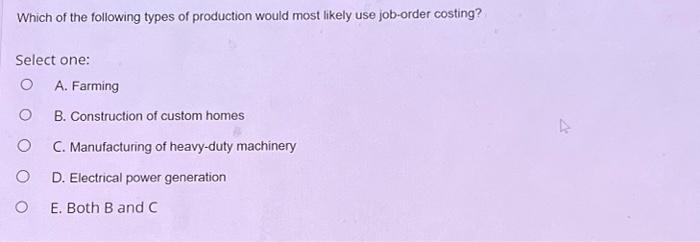

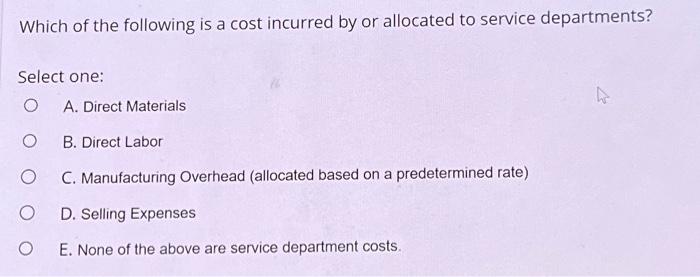

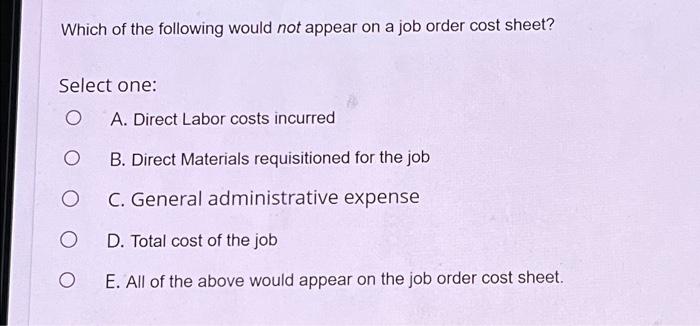

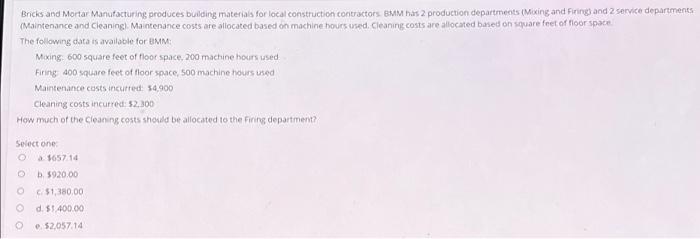

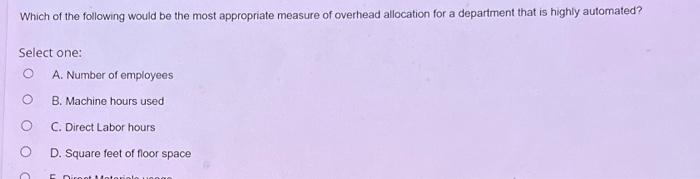

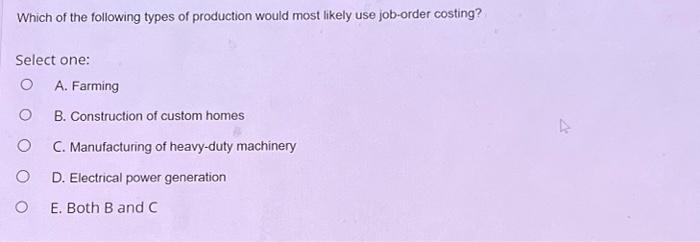

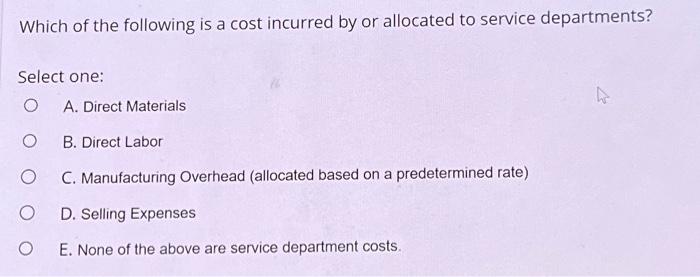

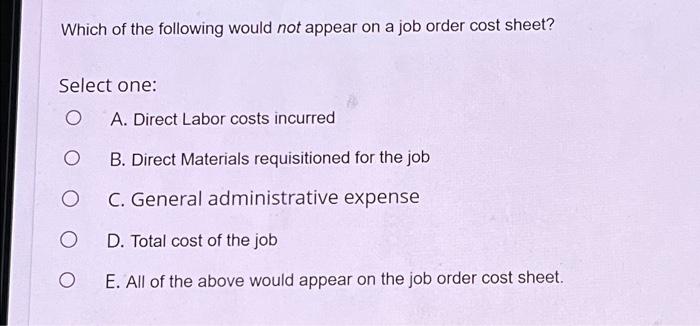

Bricks and Mortar Manufacturing produces building materials for local construction contractors. 8mM hars 2 production departments iMcxing and Firing and 2 service departments. (Maintenance and Cleaning): Maintenance costs are allocated based on machine hours used. Cleanung costs are allocated based on square fret of floor space. The following data is available for BMM: Maxing: 600 square feet of floor space, 200 machine hours used Firing 400 square feet of floor space, 500 machine hours used Maintenance costs incuitred: 84,900 Cleaning costs incurred: $2,300 How much of the cleaning costs showld be allocited to the firing department? Seiect one: a. $65714 b. 5920.00 ci. $1,380.00 d. 51.400.00 0. 52,057.14 Which of the following would be the most appropriate measure of overhead allocation for a department that is highly automated? Select one: A. Number of employees B. Machine hours used C. Direct Labor hours D. Square feet of floor space Which of the following types of production would most likely use job-order costing? Select one: A. Farming B. Construction of custom homes C. Manufacturing of heavy-duty machinery D. Electrical power generation E. Both B and C Which of the following is a cost incurred by or allocated to service departments? Select one: A. Direct Materials B. Direct Labor C. Manufacturing Overhead (allocated based on a predetermined rate) D. Selling Expenses E. None of the above are service department costs. Which of the following would not appear on a job order cost sheet? Select one: A. Direct Labor costs incurred B. Direct Materials requisitioned for the job C. General administrative expense D. Total cost of the job E. All of the above would appear on the job order cost sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started