please answer the 6 time value of money calculations.

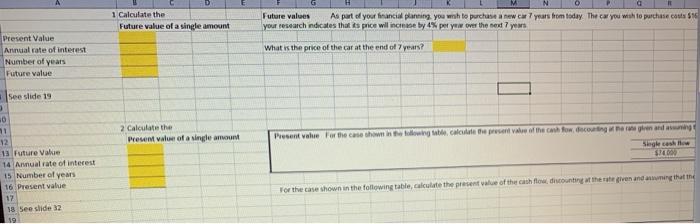

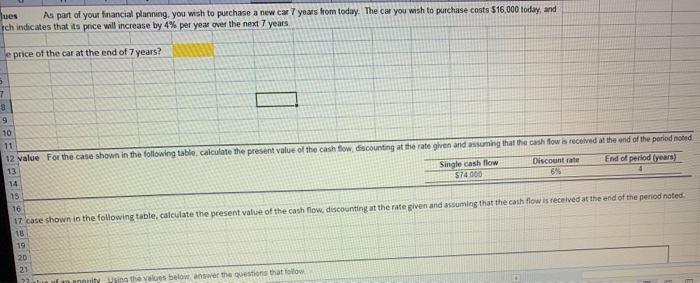

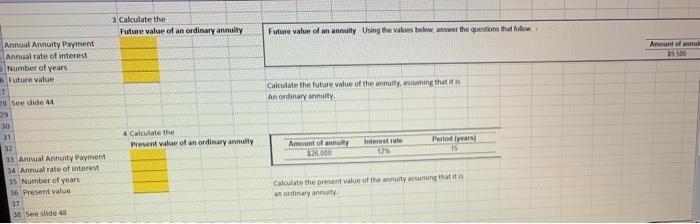

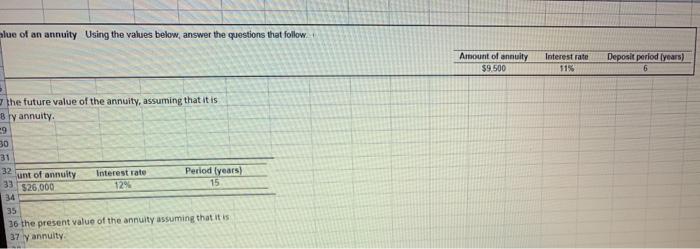

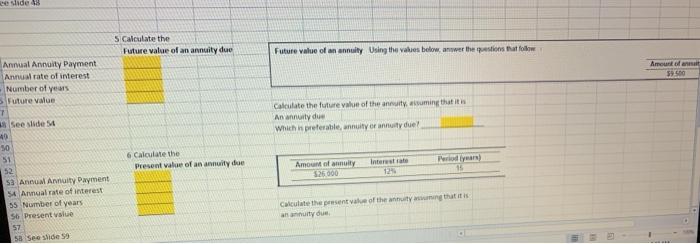

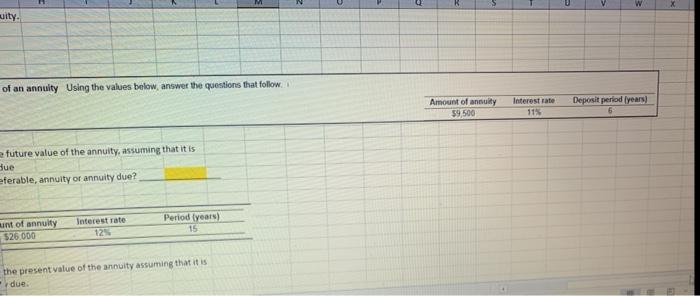

1 Calculate the Future value of a single amount Future values As part of your financial planning, you who purchase a new car 7 years from today. The car you wish to purchase cats $15 your research indicates that its price will inchise by 4% pety w over the end 7 years What is the price of the car at the end of 7 years? Present Value Annual rate of interest Number of years Future value 2 Calculate the Present value of a single amount See slide 19 3 0 71 12 13 Future Value 14 Annual rate of interest 15 Number of years 16 Present value 17 18 See slide 2 Present value for the case shown toowing the calculate the present of the cash fow coming more and Skok cash SHOP For the case shown in the following table, calculate the present value of the cash flow discounting at the rate given and women the Jues As part of your financial planning, you wish to purchase a new car 7 years from today. The car you wish to purchase costs $16,000 today, and Ich indicates that its price will increase by 4% per year over the next 7 years le price of the car at the end of 7 years? 5 7 9 9 10 11 12 value for the case shown in the following table calculate the present value of the cash flow discounting at the rate given and assuming that the cash flow is received at the end of the period noted 13 Single cash flow Discount rate End of period (years) 14 $74.000 6% 15 16 17 case shown in the following table calculate the present value of the cash flow, discounting at the rate given and assuming that the cash flow is received at the end of the period noted 18 19 20 21 mity Using the values below answer the questions that follow 3 Calculate the Future value of an ordinary annuity Future value of an annuity Using the values below, answer the questions that follow Amount 1900 Calculate the future value of the annuity, suming that it An ordinary annuity Annual Annuity Payment Annual rate of interest Number of years 5 Future value 1 se side 44 29 30 31 12 33 Anwal Annuity Payrrvent 34 Annual rate of interest 35 Number of years 36 Present value 37 30 See slide 48 4 Calculate the Present value of an ordinary annuity Interstate Amount of any 526.000 Period years 15 Calculate the present value of the annuity assuming that it is an ordinary annut alue of an annuity Using the values below, answer the questions that follow Interest rate Amount of annuity $9.500 Deposit period years) the future value of the annuity, assuming that it is Bryannuity. -9 30 unt of annuity Interest rate Period (years) $26.000 12% 15 34 35 36 the present value of the annuity assuming that it is 37 ly annuity slide 5 Calculate the Future value of an annuity due Future value of an annuity Using the values below, anwer the questions at follow Amount of an $9.500 Calculate the future value of the annualming that it is An annuity due which is preferable, annuity or annuity duel Annual Arvuity Payment Annual rate of interest Number of years Future Value 7 See slide 40 50 51 52 53 Ann Annuity Dayment 54 Amal rate of interest 55 Number of years 56 Present value 57 58 See side 59 6 Calculate the Present value of an annuity due Amount of sinuity 526000 Interstate 12% Calculate the present value of the annuity wing that it annuity due U w of an annuity Using the values below, answer the questions that follow Amount of annuity $9,500 Interest rate 11% Deposit period (years) 6 future value of the annuity, assuming that it is Hue eferable, annuity or annuity due? unt of annuity $26.000 Interest rate 12% Period (years) 15 the present value of the annuity assuming that it is due 1 Calculate the Future value of a single amount Future values As part of your financial planning, you who purchase a new car 7 years from today. The car you wish to purchase cats $15 your research indicates that its price will inchise by 4% pety w over the end 7 years What is the price of the car at the end of 7 years? Present Value Annual rate of interest Number of years Future value 2 Calculate the Present value of a single amount See slide 19 3 0 71 12 13 Future Value 14 Annual rate of interest 15 Number of years 16 Present value 17 18 See slide 2 Present value for the case shown toowing the calculate the present of the cash fow coming more and Skok cash SHOP For the case shown in the following table, calculate the present value of the cash flow discounting at the rate given and women the Jues As part of your financial planning, you wish to purchase a new car 7 years from today. The car you wish to purchase costs $16,000 today, and Ich indicates that its price will increase by 4% per year over the next 7 years le price of the car at the end of 7 years? 5 7 9 9 10 11 12 value for the case shown in the following table calculate the present value of the cash flow discounting at the rate given and assuming that the cash flow is received at the end of the period noted 13 Single cash flow Discount rate End of period (years) 14 $74.000 6% 15 16 17 case shown in the following table calculate the present value of the cash flow, discounting at the rate given and assuming that the cash flow is received at the end of the period noted 18 19 20 21 mity Using the values below answer the questions that follow 3 Calculate the Future value of an ordinary annuity Future value of an annuity Using the values below, answer the questions that follow Amount 1900 Calculate the future value of the annuity, suming that it An ordinary annuity Annual Annuity Payment Annual rate of interest Number of years 5 Future value 1 se side 44 29 30 31 12 33 Anwal Annuity Payrrvent 34 Annual rate of interest 35 Number of years 36 Present value 37 30 See slide 48 4 Calculate the Present value of an ordinary annuity Interstate Amount of any 526.000 Period years 15 Calculate the present value of the annuity assuming that it is an ordinary annut alue of an annuity Using the values below, answer the questions that follow Interest rate Amount of annuity $9.500 Deposit period years) the future value of the annuity, assuming that it is Bryannuity. -9 30 unt of annuity Interest rate Period (years) $26.000 12% 15 34 35 36 the present value of the annuity assuming that it is 37 ly annuity slide 5 Calculate the Future value of an annuity due Future value of an annuity Using the values below, anwer the questions at follow Amount of an $9.500 Calculate the future value of the annualming that it is An annuity due which is preferable, annuity or annuity duel Annual Arvuity Payment Annual rate of interest Number of years Future Value 7 See slide 40 50 51 52 53 Ann Annuity Dayment 54 Amal rate of interest 55 Number of years 56 Present value 57 58 See side 59 6 Calculate the Present value of an annuity due Amount of sinuity 526000 Interstate 12% Calculate the present value of the annuity wing that it annuity due U w of an annuity Using the values below, answer the questions that follow Amount of annuity $9,500 Interest rate 11% Deposit period (years) 6 future value of the annuity, assuming that it is Hue eferable, annuity or annuity due? unt of annuity $26.000 Interest rate 12% Period (years) 15 the present value of the annuity assuming that it is due