Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the above question through formulas(calculations) and explain if possible. Refrain from using Excel functions. Thanks. Tell me what words are incorrect and i

Please answer the above question through formulas(calculations) and explain if possible. Refrain from using Excel functions. Thanks.

Tell me what words are incorrect and i will correct it.

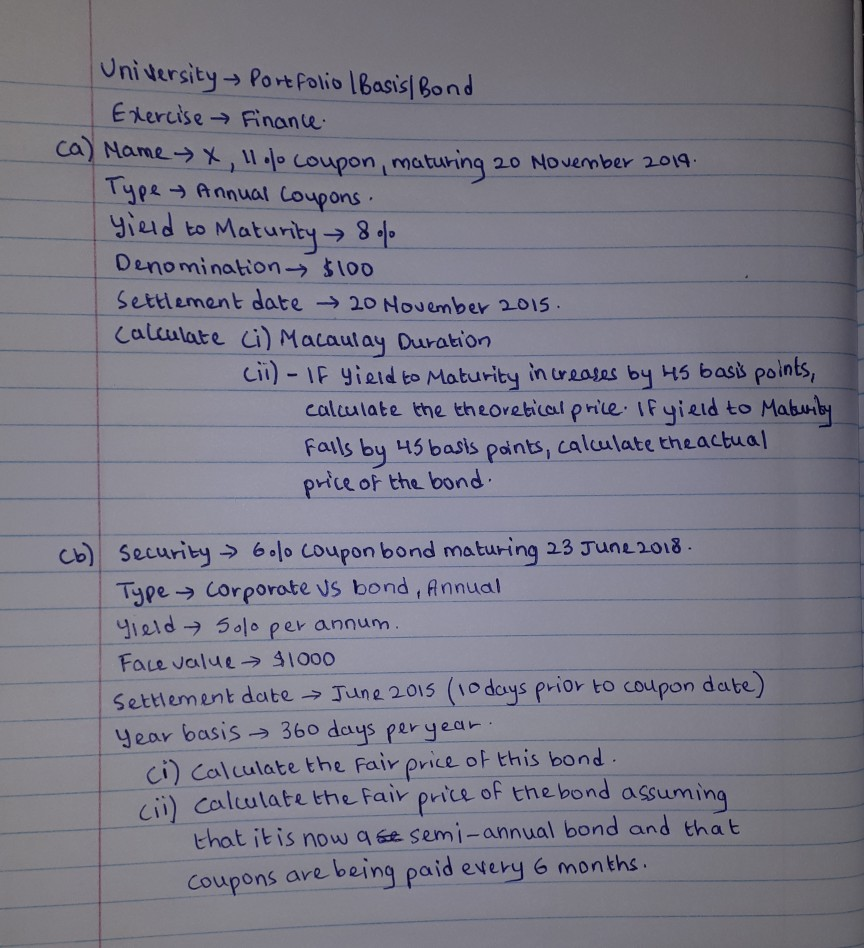

University Portfolio | Basis Bond Exercise Finance ca) Name x 11.o coupon, maturing 20 November 2014. Type Annual coupons. Yield to Maturity 8% Denomination $100 Settlement date 20 Hovember 2015 Calculate ci) Macaulay Duration cii) - If yield to Maturity increases by 45 basis points, calculate the theoretical price. If yield to Maturity falls by 45 basis points, calculate the actual price of the bond. Security - 6olo coupon bond maturing 23 June 2018 Type Corporate us bond, Annual Yield solo per annum. Face value 91000 Settlement date June 2015 (10days prior to coupon date) year basis 360 days per year. ci) Calculate the fair price of this bond. cii calculate the fair price of the bond assuming that it is now a se semi-annual bond and that coupons are being paid every 6 monthsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started