please answer the above questions, noting that this is the 3rd post!

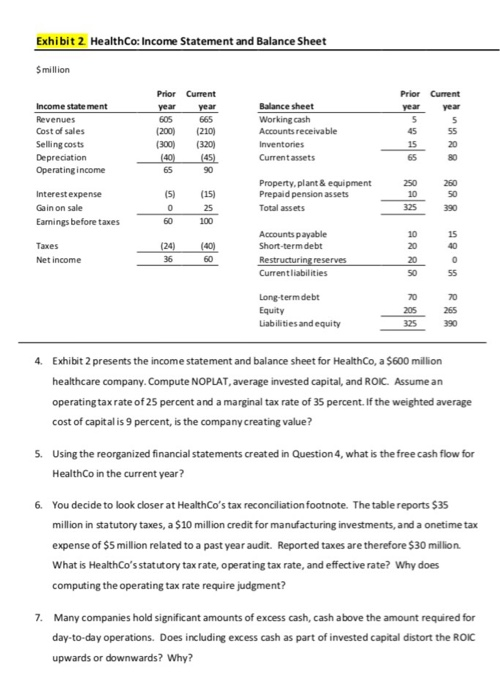

Exhibit 2 Health Co: Income Statement and Balance Sheet Smillion Prior Current 2003 Income statement Revenues Cost of sales Selling costs Depreciation Operating income Balance sheet Working cash Accounts receivable Inventories Current assets Interest expense Gain on sale Earnings before taxes Property.plant & equipment Prepaid pension assets Total assets Taxes Net income Accounts payable Short-term debt Restructuring reserves Current liabilities Long-term debt Equity Liabilities and equity 4. Exhibit 2 presents the income statement and balance sheet for HealthCo, a $600 million healthcare company. Compute NOPLAT, average invested capital, and ROIC. Assume an operating tax rate of 25 percent and a marginal tax rate of 35 percent. If the weighted average cost of capital is 9 percent, is the company creating value? 5. Using the reorganized financial statements created in Question 4, what is the free cash flow for Health Co in the current year? 6. You decide to look closer at HealthCo's tax reconciliation footnote. The table reports $35 million in statutory taxes, a $10 million credit for manufacturing investments, and a onetime tax expense of $5 million related to a past year audit. Reported taxes are therefore $30 million What is Health Co's statutory tax rate, operating tax rate, and effective rate? Why does computing the operating tax rate require judgment? 7. Many companies hold significant amounts of excess cash, cash above the amount required for day-to-day operations. Does including excess cash as part of invested capital distort the ROIC upwards or downwards? Why? Exhibit 2 Health Co: Income Statement and Balance Sheet Smillion Prior Current 2003 Income statement Revenues Cost of sales Selling costs Depreciation Operating income Balance sheet Working cash Accounts receivable Inventories Current assets Interest expense Gain on sale Earnings before taxes Property.plant & equipment Prepaid pension assets Total assets Taxes Net income Accounts payable Short-term debt Restructuring reserves Current liabilities Long-term debt Equity Liabilities and equity 4. Exhibit 2 presents the income statement and balance sheet for HealthCo, a $600 million healthcare company. Compute NOPLAT, average invested capital, and ROIC. Assume an operating tax rate of 25 percent and a marginal tax rate of 35 percent. If the weighted average cost of capital is 9 percent, is the company creating value? 5. Using the reorganized financial statements created in Question 4, what is the free cash flow for Health Co in the current year? 6. You decide to look closer at HealthCo's tax reconciliation footnote. The table reports $35 million in statutory taxes, a $10 million credit for manufacturing investments, and a onetime tax expense of $5 million related to a past year audit. Reported taxes are therefore $30 million What is Health Co's statutory tax rate, operating tax rate, and effective rate? Why does computing the operating tax rate require judgment? 7. Many companies hold significant amounts of excess cash, cash above the amount required for day-to-day operations. Does including excess cash as part of invested capital distort the ROIC upwards or downwards? Why